- Non-bank payment players have overtaken banks in terms of scale and usage

- Threats brought by non-bank players to commercial banks may extend to valuable transaction data

- In the long term, non-bank players aim to grow into full scale financial service providers

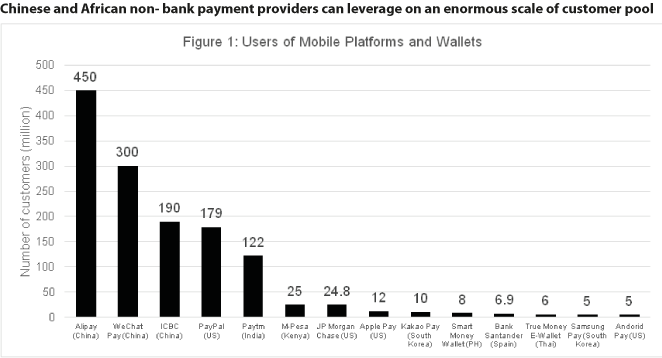

Increasing adoption of digital payments has resulted in stiff competition within the industry, where global and regional players vie for greater control of the payments ecosystem. However, most platforms still lack the critical scale to establish their market positions. The payment services of PayPal, Alibaba and Tencent – initially considered as mere payments processors or messaging services – have carved out huge international and national payment markets. They have also begun articulating a much more ambitious route that will help them grow beyond their current scope of businesses (Figure 1).

On the other hand, Apple, Google, and Samsung have launched their own payment wallets, but these moves often lack traction in emerging markets that require underlying payment instrument such as credit cards. Apple Pay, for example, has faced stiff competition from local banks in Australia who promote their own costly proprietary digital payment systems.

Non-bank players are aggressively expanding

WeChat Pay

In Asia, the convergence of messaging platforms with micropayments proved to be a powerful combination. This is best demonstrated by the success of China’s WeChat e-payment services, which offers integrated wallet that is compatible with all phone operating systems. It has a staggering 300 million users as of May 2016 and has processed $550 billion worth of payments annually.

Since its inception in August 2013, WeChat Pay, a mobile payments feature integrated into the WeChat messaging app, has been able to compete with leading payments player Alipay which was launched in 2004.

WeChat’s social media and messaging platform proved to be more beneficial than Alipay. WeChat Pay tapped on the large network of users of WeChat’s messaging app, which latest statistics show at 700 billion – a number more than half of China’s total population. WeChat Pay has also taken advantage of various celebrations such as the Chinese New Year in 2014, pioneering digital red envelopes to boost its traction in the local market and attracting new customers. In 2015, Alipay and Baidu followed the same trend and released their own versions of WeChat Pay.

WeChat Pay also developed a public account whereby merchants can run promotional campaigns, undertake branding activities, and engage existing customers, who in turn help them reach potential customers through referrals.

PayPal

PayPal, whose payment ecosystem offers remittances, bill payments and reload, grew its overall revenue from $3.51 billion in 2010 to $9.25 billion in 2015 or a CAGR of 18%. The company aims to grow its PayPal wallet and offer consumer credit and payments services related to tax, education and health. The company has strengthened its relevance to both consumers and merchants by providing digital payment services using devices such as mobile phones, tablets, computers, and wearables gadgets. In 2015, PayPal launched One Touch payments, acquired remittance platform, Xoom, and entered into strategic partnerships with Facebook, Vodaphone, Alibaba, and other payment networks.

Paytm

Paytm, one of India’s largest e-commerce companies, has mirrored Alibaba’s business model. The company will raise close to $1 billion in funding, mainly from Alibaba by end of 2016. Paytm will likely benefit from the country’s mobile payments growth. It has also received the approval of the Reserve Bank of India to launch its payment bank.

Facebook

Facebook has reportedly been expanding its payment services in Asia, which will allow users to pay for products listed on Facebook pages in a similar fashion as Wechat. According to reports, trials are being run in Thailand through Cash & Credit Card Payment Processor (2C2P).

Banks boost their digital services amidst strong competition

On the other hand, banks have bolstered customer acquisitions in their respective digital services. ICBC has over 30 million registered customers in its e-commerce platform, ICBC Mall, as of end 2015. Bank of America, meanwhile, has 31 million digital banking users, comprising 61% of their total users, which generated $3.6 billion worth of payments in 2015.

However, commercial banks still lag behind their non-bank counterparts in terms of on-boarding new users to their mobile platforms, particularly in Asia and Africa. Non-bank payment providers offer payments services, which do not require deposit accounts. They have also focused on improving micropayments and providing relevant services to enhance user experience.

Another threat to commercial banks is the inability to access customer-merchant data. Banks generally leverage on the data obtained from the platform where customers and merchant interact. However, some banks fail to get customer-merchant data from these platforms. For example, banks in China and state-owned settlement network UnionPay, are being crippled by their inability to access transactional payments and lifestyle usage from WeChat and Alipay. Their parent companies, Tencent and Alibaba, sanitise the data slice and only report whether a payment has been completed by the customer through the two platforms. They withhold other important information such as the purpose of the payment and the merchant who received it.

To boost adoption, some banks have explored offering their payment services using online and messaging platforms. These platforms provide a variety of social networking and peer-to-peer products and services to customers who feel more comfortable using these channels for payment functions.

In September 2016, Citibank partnered with Grab, a Singapore-based ride-hailing app, in integrating its credit cards to the start-up’s mobile application. The move will help Citibank tap into the customer base that the transportation service has in the region. Citibank is also planning to expand its network by embedding its payment service with online messaging platform Line. On the other hand, Grab’s competitor, Uber, has already caught the attention of American Express in the US and Blom Bank in Lebanon. On the retail side, JP Morgan’s Chase Pay has been actively signing up merchants such as Starbucks to boost usage.

Banks and incumbent payment providers have a lot to fear within the digital payments industry. The largest non-bank payments players have articulated the ambition to grow into full-fledged “payment banks” even if they still do not have the ability to distribute loans or formally take in deposits. However, recent moves to build closed-loop payments systems show that a funding base among these players is being formed. It is only a matter of time and regulatory changes before these non-bank players will offer products and services other than bill payments and reloading facilities. This development will force banks to come up with better offerings to catch up with the increasing competition within the payments industry.