Digital banks continue to experience rapid growth in users, assets and revenue, with Brazil’s Nubank, the retail arm of ING…

Over the past decade, since the onset of the fintech boom, the financial services sector has witnessed the emergence of hundreds of stand-alone digital banks globally. These banks have revolutionised how digitally inclined consumers save, borrow, transact and invest.

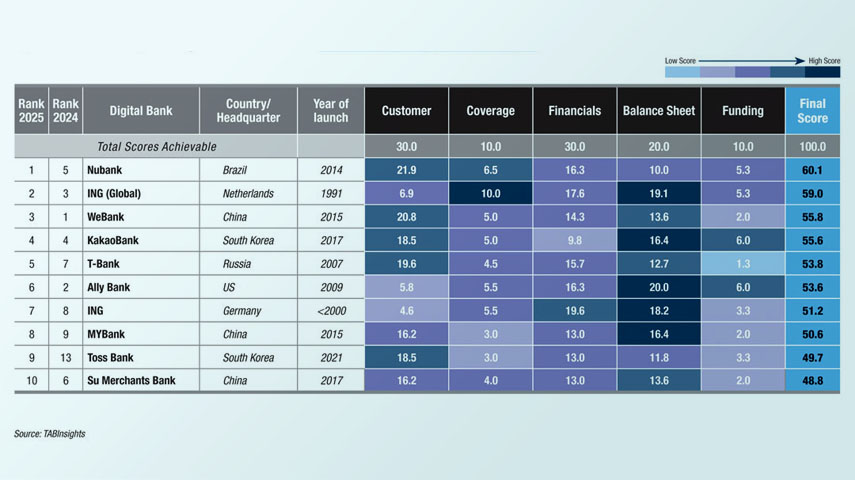

To monitor this growing array of digital contenders, TABInsights has been assessing the performance of more than 160 leading digital banks from 42 markets since 2021, ranking them based on a balanced scorecard that evaluates capabilities across five key dimensions: customers, market/product coverage, profitability, asset and deposit growth, and funding. Scale and size are not the primary determinants; instead, factors such as profitability, operational efficiencies, the ability to secure funding, and the maintenance of a robust loan book and balance sheet are considered. This year’s ranking introduces a new indicator, "funding as a percentage of total assets," alongside "funding value," to better reflect the actual funding level in relation to a digital bank’s total assets.

The assessment covered over 160 leading players from 42 markets to identify the World’s Top 100 Digital Banks. The Top 100 are distributed across various regions: 47 from Asia Pacific, 30 from Europe, 10 from North America, seven from South America, and three each from the Middle East and Africa.

| Rank | Digital Bank | Country/Headquarter | Region | Year of launch | Customer | Coverage | Financials | Balance Sheet | Funding | Final Score | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| # of users | Growth /month | Users /staff | Total Score | # of markets | # of products | Total Score | ROE | Gross revenue | Revenue growth | Revenue/ user | CIR | Total Score | Assets | Deposits | LDR | Total Score | Funding | Funding /assets | Total Score | ||||||

| Score | Score | Score | 30% | Score | Score | 10% | Score | Score | Score | Score | Score | 30% | Score | Score | Score | 20% | Score | Score | 10% | ||||||

| 6 | 10 | 10 | 30.0 | 10 | 10 | 10.0 | 10 | 6 | 10 | 10 | 10 | 30.0 | 6 | 6 | 10 | 20.0 | 10 | 5 | 10.0 | 100.0 | |||||

| 1 | Nubank | Brazil | Latin and South America | 2014 | 6 | 9 | 4 | 21.9 | 3 | 10 | 6.5 | 8 | 4 | 3 | 3 | 7 | 16.3 | 4 | 3 | 4 | 10.0 | 6 | 2 | 5.3 | 60.1 |

| 2 | ING (Global) | Netherlands | Europe | 1991 | 4 | 1 | 1 | 6.9 | 10 | 10 | 10.0 | 8 | 5 | 1 | 8 | 5 | 17.6 | 6 | 6 | 9 | 19.1 | 7 | 1 | 5.3 | 59.0 |

| 3 | WeBank | China | Asia Pacific | 2015 | 6 | 5 | 7 | 20.8 | 1 | 9 | 5.0 | 8 | 4 | 1 | 1 | 8 | 14.3 | 5 | 4 | 6 | 13.6 | 2 | 1 | 2.0 | 55.8 |

| 4 | KakaoBank | South Korea | Asia Pacific | 2017 | 4 | 8 | 4 | 18.5 | 1 | 9 | 5.0 | 3 | 2 | 1 | 2 | 7 | 9.8 | 4 | 4 | 10 | 16.4 | 6 | 3 | 6.0 | 55.6 |

| 5 | T-Bank | Russia | Europe | 2007 | 4 | 10 | 3 | 19.6 | 1 | 8 | 4.5 | 10 | 3 | 2 | 5 | 4 | 15.7 | 3 | 3 | 8 | 12.7 | 1 | 1 | 1.3 | 53.8 |

| 6 | Ally Bank | US | North America | 2009 | 3 | 1 | 1 | 5.8 | 1 | 10 | 5.5 | 6 | 4 | 0 | 10 | 5 | 16.3 | 6 | 6 | 10 | 20.0 | 7 | 2 | 6.0 | 53.6 |

| 7 | ING | Germany | Europe | <2000 | 2 | 1 | 1 | 4.6 | 1 | 10 | 5.5 | 10 | 3 | 2 | 8 | 7 | 19.6 | 6 | 6 | 8 | 18.2 | 4 | 1 | 3.3 | 51.2 |

| 8 | MYBank | China | Asia Pacific | 2015 | 5 | 4 | 5 | 16.2 | 1 | 5 | 3.0 | 5 | 3 | 1 | 2 | 9 | 13.0 | 5 | 4 | 9 | 16.4 | 2 | 1 | 2.0 | 50.6 |

| 9 | Toss Bank | South Korea | Asia Pacific | 2021 | 2 | 10 | 4 | 18.5 | 1 | 5 | 3.0 | 0 | 1 | 10 | 2 | 7 | 13.0 | 3 | 3 | 7 | 11.8 | 3 | 2 | 3.3 | 49.7 |

| 10 | Su Merchants Bank | China | Asia Pacific | 2017 | 5 | 2 | 7 | 16.2 | 1 | 7 | 4.0 | 6 | 2 | 1 | 1 | 10 | 13.0 | 3 | 3 | 9 | 13.6 | 2 | 1 | 2.0 | 48.8 |

| 11 | Klarna | Sweden | Europe | 2017 | 6 | 1 | 5 | 13.8 | 10 | 4 | 7.0 | 0 | 3 | 1 | 1 | 0 | 3.3 | 3 | 2 | 9 | 12.7 | 6 | 5 | 7.3 | 44.2 |

| 12 | Z-Bank | China | Asia Pacific | 2017 | 5 | 3 | 7 | 17.3 | 1 | 4 | 2.5 | 5 | 1 | 1 | 1 | 8 | 10.4 | 3 | 3 | 7 | 11.8 | 2 | 1 | 2.0 | 44.1 |

| 13 | Banco Inter | Brazil | Latin and South America | 2015 | 4 | 2 | 3 | 10.4 | 2 | 11 | 6.5 | 4 | 2 | 2 | 2 | 4 | 9.1 | 3 | 2 | 9 | 12.7 | 4 | 3 | 4.7 | 43.4 |

| 14 | K Bank | South Korea | Asia Pacific | 2017 | 2 | 4 | 4 | 11.5 | 1 | 10 | 5.5 | 1 | 1 | 1 | 2 | 8 | 8.5 | 3 | 3 | 10 | 14.5 | 3 | 2 | 3.3 | 43.4 |

| 15 | SBI Sumishin Net Bank | Japan | Asia Pacific | 2007 | 2 | 2 | 3 | 8.1 | 1 | 10 | 5.5 | 7 | 1 | 1 | 3 | 5 | 11.1 | 5 | 4 | 10 | 17.3 | 1 | 1 | 1.3 | 43.3 |

| 16 | Rakuten Bank | Japan | Asia Pacific | 2001 | 3 | 2 | 4 | 10.4 | 1 | 10 | 5.5 | 6 | 2 | 1 | 2 | 6 | 11.1 | 6 | 5 | 5 | 14.5 | 1 | 1 | 1.3 | 42.9 |

| 17 | Revolut | UK | Europe | 2015 | 4 | 1 | 2 | 8.1 | 10 | 9 | 9.5 | 9 | 3 | 4 | 2 | 3 | 13.7 | 3 | 3 | 1 | 6.4 | 4 | 2 | 4.0 | 41.6 |

| 18 | OakNorth Bank | UK | Europe | 2015 | 1 | 2 | 1 | 4.6 | 1 | 5 | 3.0 | 7 | 1 | 2 | 10 | 9 | 18.9 | 2 | 2 | 10 | 12.7 | 1 | 2 | 2.0 | 41.3 |

| 19 | C6 | Brazil | Latin and South America | 2019 | 4 | 6 | 3 | 15.0 | 1 | 10 | 5.5 | 0 | 1 | 1 | 1 | 0 | 2.0 | 3 | 2 | 9 | 12.7 | 4 | 5 | 6.0 | 41.2 |

| 20 | knab | Netherlands | Europe | 2012 | 1 | 1 | 1 | 3.5 | 1 | 10 | 5.5 | 7 | 1 | 3 | 10 | 5 | 17.0 | 3 | 3 | 7 | 11.8 | 2 | 1 | 2.0 | 39.7 |

| 21 | Tangerine | Canada | North America | 2012 | 1 | 1 | 1 | 3.5 | 1 | 7 | 4.0 | 9 | 3 | 2 | 9 | 8 | 20.2 | 4 | 4 | 3 | 10.0 | 1 | 1 | 1.3 | 39.0 |

| 22 | SeaBank | Indonesia | Asia Pacific | 2021 | 2 | 4 | 3 | 10.4 | 1 | 4 | 2.5 | 2 | 1 | 2 | 2 | 10 | 11.1 | 1 | 1 | 10 | 10.9 | 1 | 5 | 4.0 | 38.9 |

| 23 | aiBank | China | Asia Pacific | 2017 | 6 | 2 | 6 | 16.2 | 1 | 6 | 3.5 | 5 | 2 | 1 | 1 | 8 | 11.1 | 3 | 2 | 1 | 5.5 | 2 | 2 | 2.7 | 38.9 |

| 24 | KCB Bank | China | Asia Pacific | 2015 | 4 | 1 | 6 | 12.7 | 1 | 4 | 2.5 | 4 | 1 | 1 | 1 | 9 | 10.4 | 3 | 2 | 8 | 11.8 | 1 | 1 | 1.3 | 38.8 |

| 25 | XW Bank | China | Asia Pacific | 2016 | 5 | 1 | 6 | 13.8 | 1 | 4 | 2.5 | 6 | 2 | 2 | 1 | 10 | 13.7 | 3 | 2 | 3 | 7.3 | 1 | 1 | 1.3 | 38.6 |

| 26 | Starling Bank | UK | Europe | 2015 | 1 | 2 | 1 | 4.6 | 1 | 7 | 4.0 | 10 | 2 | 2 | 6 | 5 | 16.3 | 3 | 3 | 5 | 10.0 | 3 | 2 | 3.3 | 38.3 |

| 27 | au Jibun Bank | Japan | Asia Pacific | 2008 | 2 | 1 | 3 | 6.9 | 1 | 10 | 5.5 | 5 | 1 | 2 | 3 | 3 | 9.1 | 4 | 3 | 9 | 14.5 | 2 | 1 | 2.0 | 38.1 |

| 28 | Sony Bank | Japan | Asia Pacific | 2001 | 1 | 1 | 2 | 4.6 | 1 | 10 | 5.5 | 6 | 1 | 1 | 6 | 3 | 11.1 | 4 | 3 | 10 | 15.5 | 1 | 1 | 1.3 | 38.0 |

| 29 | Axos Bank | US | North America | 2000 | 1 | 1 | 1 | 3.5 | 1 | 8 | 4.5 | 8 | 2 | 1 | 6 | 6 | 15.0 | 3 | 3 | 9 | 13.6 | 1 | 1 | 1.3 | 37.9 |

| 30 | bunq | Netherlands | Europe | 2015 | 3 | 1 | 5 | 10.4 | 10 | 7 | 8.5 | 7 | 1 | 5 | 1 | 3 | 11.1 | 2 | 2 | 3 | 6.4 | 1 | 1 | 1.3 | 37.7 |

| 31 | TymeBank | South Africa | Middle East and Africa | 2019 | 2 | 7 | 4 | 15.0 | 2 | 7 | 4.5 | 0 | 1 | 8 | 1 | 0 | 6.5 | 1 | 1 | 6 | 7.3 | 1 | 5 | 4.0 | 37.3 |

| 32 | SoFi | US | North America | 2011 | 2 | 2 | 1 | 5.8 | 2 | 10 | 6.0 | 0 | 3 | 2 | 7 | 0 | 7.8 | 4 | 3 | 4 | 10.0 | 7 | 4 | 7.3 | 36.9 |

| 33 | Air Bank | Czech Republic | Europe | 2011 | 1 | 2 | 1 | 4.6 | 2 | 8 | 5.0 | 8 | 1 | 1 | 7 | 6 | 15.0 | 2 | 2 | 8 | 10.9 | 1 | 1 | 1.3 | 36.9 |

| 34 | PicPay Bank | Brazil | Latin and South America | 2021 | 4 | 2 | 3 | 10.4 | 1 | 9 | 5.0 | 10 | 1 | 10 | 1 | 3 | 16.3 | 1 | 1 | 2 | 3.6 | 1 | 1 | 1.3 | 36.7 |

| 35 | Banca Widiba | Italy | Europe | 2014 | 1 | 0 | 1 | 2.3 | 1 | 10 | 5.5 | 10 | 1 | 3 | 10 | 6 | 19.6 | 3 | 3 | 2 | 7.3 | 1 | 2 | 2.0 | 36.6 |

| 36 | ING | Australia | Asia Pacific | 1999 | 1 | 1 | 1 | 3.5 | 1 | 8 | 4.5 | 6 | 2 | 1 | 7 | 6 | 14.3 | 4 | 4 | 5 | 11.8 | 2 | 1 | 2.0 | 36.1 |

| 37 | Boursobank | France | Europe | 1995 | 2 | 4 | 3 | 10.4 | 1 | 10 | 5.5 | 0 | 2 | 1 | 5 | 0 | 5.2 | 5 | 4 | 5 | 12.7 | 2 | 1 | 2.0 | 35.8 |

| 38 | Yillion Bank | China | Asia Pacific | 2017 | 4 | 1 | 7 | 13.8 | 1 | 5 | 3.0 | 1 | 1 | 0 | 1 | 6 | 5.9 | 2 | 1 | 9 | 10.9 | 1 | 2 | 2.0 | 35.6 |

| 39 | O-Bank | Taiwan | Asia Pacific | 2017 | 1 | 1 | 1 | 3.5 | 1 | 9 | 5.0 | 3 | 1 | 0 | 10 | 5 | 12.4 | 3 | 2 | 8 | 11.8 | 2 | 2 | 2.7 | 35.3 |

| 40 | Openbank | Spain | Europe | 1995 | 1 | 1 | 1 | 3.5 | 4 | 10 | 7.0 | 5 | 1 | 5 | 6 | 5 | 14.3 | 3 | 3 | 2 | 7.3 | 2 | 2 | 2.7 | 34.7 |

| 41 | CIMB Bank | Philippines | Asia Pacific | 2018 | 2 | 2 | 5 | 10.4 | 1 | 7 | 4.0 | 1 | 1 | 5 | 1 | 5 | 8.5 | 1 | 1 | 8 | 9.1 | 1 | 3 | 2.7 | 34.6 |

| 42 | Zopa Bank | UK | Europe | 2020 | 1 | 1 | 1 | 3.5 | 1 | 5 | 3.0 | 2 | 1 | 2 | 7 | 7 | 12.4 | 2 | 1 | 9 | 10.9 | 2 | 4 | 4.0 | 33.8 |

| 43 | Northmill Bank | Sweden | Europe | 2006 | 1 | 1 | 2 | 4.6 | 4 | 6 | 5.0 | 7 | 1 | 1 | 5 | 7 | 13.7 | 1 | 1 | 8 | 9.1 | 1 | 1 | 1.3 | 33.7 |

| 44 | imaginBank | Spain | Europe | 2016 | 1 | 2 | 5 | 9.2 | 1 | 8 | 4.5 | 7 | 1 | 1 | 3 | 7 | 11.1 | 1 | 1 | 5 | 6.4 | 1 | 2 | 2.0 | 33.2 |

| 45 | ANEXT Bank | Singapore | Asia Pacific | 2022 | 1 | 1 | 1 | 3.5 | 1 | 3 | 2.0 | 0 | 1 | 10 | 10 | 0 | 13.7 | 1 | 1 | 9 | 10.0 | 1 | 5 | 4.0 | 33.2 |

| 46 | Kompasbank | Denmark | Europe | 2021 | 1 | 2 | 1 | 4.6 | 1 | 3 | 2.0 | 0 | 1 | 10 | 10 | 0 | 13.7 | 1 | 1 | 8 | 9.1 | 1 | 4 | 3.3 | 32.7 |

| 47 | UnionDigital Bank | Philippines | Asia Pacific | 2022 | 1 | 1 | 4 | 6.9 | 1 | 3 | 2.0 | 3 | 1 | 10 | 2 | 7 | 15.0 | 1 | 1 | 4 | 5.5 | 1 | 4 | 3.3 | 32.7 |

| 48 | illimity | Italy | Europe | 2019 | 1 | 1 | 1 | 3.5 | 1 | 7 | 4.0 | 6 | 1 | 1 | 10 | 3 | 13.7 | 2 | 1 | 8 | 10.0 | 1 | 1 | 1.3 | 32.5 |

| 49 | N26 | Germany | Europe | 2015 | 2 | 1 | 3 | 6.9 | 10 | 8 | 9.0 | 0 | 1 | 2 | 2 | 0 | 3.3 | 2 | 2 | 4 | 7.3 | 4 | 5 | 6.0 | 32.5 |

| 50 | Trust Bank | Singapore | Asia Pacific | 2022 | 1 | 8 | 2 | 12.7 | 1 | 6 | 3.5 | 0 | 1 | 10 | 2 | 0 | 8.5 | 1 | 1 | 2 | 3.6 | 1 | 5 | 4.0 | 32.3 |

| 51 | PayPay Bank | Japan | Asia Pacific | 2018 | 2 | 2 | 4 | 9.2 | 1 | 8 | 4.5 | 3 | 1 | 1 | 2 | 2 | 5.9 | 3 | 3 | 5 | 10.0 | 2 | 2 | 2.7 | 32.3 |

| 52 | Bank Jago | Indonesia | Asia Pacific | 2020 | 3 | 2 | 5 | 11.5 | 1 | 6 | 3.5 | 1 | 1 | 1 | 1 | 2 | 3.9 | 1 | 1 | 7 | 8.2 | 2 | 5 | 4.7 | 31.8 |

| 53 | WEX Bank | US | North America | 2000 | 1 | 1 | 1 | 3.5 | 1 | 3 | 2.0 | 10 | 3 | 0 | 5 | 4 | 14.3 | 2 | 2 | 7 | 10.0 | 1 | 1 | 1.3 | 31.1 |

| 54 | Allica Bank | UK | Europe | 2020 | 1 | 1 | 1 | 3.5 | 1 | 4 | 2.5 | 3 | 1 | 3 | 10 | 3 | 13.0 | 1 | 1 | 9 | 10.0 | 1 | 2 | 2.0 | 31.0 |

| 55 | Bank Aladin | Indonesia | Asia Pacific | 2022 | 1 | 1 | 4 | 6.9 | 1 | 6 | 3.5 | 0 | 1 | 8 | 1 | 0 | 6.5 | 1 | 1 | 9 | 10.0 | 1 | 5 | 4.0 | 30.9 |

| 56 | Green Link Digital Bank | Singapore | Asia Pacific | 2022 | 1 | 1 | 1 | 3.5 | 1 | 4 | 2.5 | 0 | 1 | 10 | 10 | 0 | 13.7 | 1 | 1 | 6 | 7.3 | 1 | 5 | 4.0 | 30.9 |

| 57 | Aprila Bank | Norway | Europe | 2018 | 1 | 1 | 1 | 3.5 | 1 | 2 | 1.5 | 4 | 1 | 3 | 10 | 4 | 14.3 | 1 | 1 | 6 | 7.3 | 1 | 5 | 4.0 | 30.6 |

| 58 | LendingClub Bank | US | North America | 2021 | 1 | 1 | 2 | 4.6 | 1 | 5 | 3.0 | 2 | 2 | 0 | 6 | 3 | 8.5 | 2 | 2 | 9 | 11.8 | 2 | 2 | 2.7 | 30.6 |

| 59 | Mox Bank | Hong Kong | Asia Pacific | 2020 | 1 | 3 | 1 | 5.8 | 1 | 7 | 4.0 | 0 | 1 | 6 | 5 | 0 | 7.8 | 1 | 1 | 7 | 8.2 | 2 | 5 | 4.7 | 30.4 |

| 60 | livi Bank | Hong Kong | Asia Pacific | 2020 | 1 | 1 | 1 | 3.5 | 1 | 6 | 3.5 | 0 | 1 | 10 | 3 | 0 | 9.1 | 1 | 1 | 9 | 10.0 | 1 | 5 | 4.0 | 30.1 |

| 61 | Alex Bank | Australia | Asia Pacific | 2021 | 1 | 1 | 1 | 3.5 | 1 | 4 | 2.5 | 0 | 1 | 3 | 10 | 0 | 9.1 | 1 | 1 | 10 | 10.9 | 1 | 5 | 4.0 | 30.0 |

| 62 | Monzo | UK | Europe | 2015 | 2 | 1 | 2 | 5.8 | 2 | 8 | 5.0 | 1 | 2 | 4 | 3 | 2 | 7.8 | 3 | 3 | 2 | 7.3 | 3 | 3 | 4.0 | 29.9 |

| 63 | Judo Bank | Australia | Asia Pacific | 2018 | 1 | 2 | 1 | 4.6 | 1 | 4 | 2.5 | 2 | 1 | 2 | 10 | 5 | 13.0 | 2 | 1 | 1 | 3.6 | 4 | 5 | 6.0 | 29.8 |

| 64 | Atom Bank | UK | Europe | 2015 | 1 | 1 | 1 | 3.5 | 1 | 4 | 2.5 | 1 | 1 | 1 | 9 | 3 | 9.8 | 2 | 2 | 8 | 10.9 | 2 | 2 | 2.7 | 29.3 |

| 65 | Maya Bank | Philippines | Asia Pacific | 2022 | 1 | 3 | 6 | 11.5 | 1 | 5 | 3.0 | 0 | 1 | 10 | 1 | 1 | 8.5 | 1 | 1 | 2 | 3.6 | 1 | 3 | 2.7 | 29.3 |

| 66 | Wio Bank | UAE | Middle East and Africa | 2022 | 1 | 2 | 1 | 4.6 | 1 | 6 | 3.5 | 1 | 1 | 10 | 10 | 0 | 14.3 | 1 | 1 | 1 | 2.7 | 2 | 4 | 4.0 | 29.2 |

| 67 | Neon | Brazil | Latin and South America | 2016 | 4 | 4 | 4 | 13.8 | 1 | 7 | 4.0 | 0 | 1 | 4 | 1 | 0 | 3.9 | 1 | 1 | 1 | 2.7 | 2 | 5 | 4.7 | 29.2 |

| 68 | Airtel Payments Bank | India | Asia Pacific | 2017 | 6 | 0 | 6 | 13.8 | 1 | 6 | 3.5 | 3 | 1 | 2 | 1 | 0 | 4.6 | 1 | 1 | 1 | 2.7 | 1 | 5 | 4.0 | 28.6 |

| 69 | LINE Bank | Taiwan | Asia Pacific | 2021 | 1 | 3 | 2 | 6.9 | 1 | 7 | 4.0 | 0 | 1 | 5 | 1 | 0 | 4.6 | 1 | 1 | 8 | 9.1 | 1 | 5 | 4.0 | 28.6 |

| 70 | Fjord Bank | Lithuania | Europe | 2019 | 1 | 1 | 1 | 3.5 | 5 | 5 | 5.0 | 0 | 1 | 4 | 6 | 0 | 7.2 | 1 | 1 | 7 | 8.2 | 1 | 5 | 4.0 | 27.8 |

| 71 | Seven Bank | Japan | Asia Pacific | 2001 | 1 | 1 | 2 | 4.6 | 4 | 5 | 4.5 | 6 | 2 | 1 | 7 | 2 | 11.7 | 3 | 2 | 1 | 5.5 | 1 | 1 | 1.3 | 27.6 |

| 72 | NBKC | US | North America | 1999 | 1 | 1 | 1 | 3.5 | 1 | 9 | 5.0 | 6 | 1 | 0 | 3 | 2 | 7.8 | 1 | 1 | 9 | 10.0 | 1 | 1 | 1.3 | 27.6 |

| 73 | PAObank | Hong Kong | Asia Pacific | 2020 | 1 | 1 | 1 | 3.5 | 1 | 3 | 2.0 | 0 | 1 | 0 | 10 | 0 | 7.2 | 1 | 1 | 10 | 10.9 | 1 | 5 | 4.0 | 27.5 |

| 74 | WeLab Bank | Hong Kong | Asia Pacific | 2020 | 1 | 5 | 1 | 8.1 | 1 | 6 | 3.5 | 0 | 1 | 2 | 1 | 0 | 2.6 | 1 | 1 | 8 | 9.1 | 1 | 5 | 4.0 | 27.3 |

| 75 | Fortuneo | France | Europe | 2000 | 1 | 1 | 2 | 4.6 | 2 | 10 | 6.0 | 3 | 1 | 1 | 6 | 1 | 7.8 | 3 | 3 | 2 | 7.3 | 1 | 1 | 1.3 | 27.0 |

| 76 | Allo Bank | Indonesia | Asia Pacific | 2021 | 2 | 2 | 4 | 9.2 | 1 | 4 | 2.5 | 3 | 1 | 2 | 1 | 6 | 8.5 | 1 | 1 | 1 | 2.7 | 1 | 5 | 4.0 | 26.9 |

| 77 | blu | Indonesia | Asia Pacific | 2021 | 1 | 1 | 2 | 4.6 | 1 | 8 | 4.5 | 1 | 1 | 4 | 1 | 2 | 5.9 | 1 | 1 | 6 | 7.3 | 1 | 5 | 4.0 | 26.3 |

| 78 | Cake | Vietnam | Asia Pacific | 2021 | 1 | 3 | 4 | 9.2 | 1 | 6 | 3.5 | 0 | 1 | 10 | 1 | 0 | 7.8 | 1 | 1 | 2 | 3.6 | 1 | 2 | 2.0 | 26.2 |

| 79 | ZA Bank | Hong Kong | Asia Pacific | 2020 | 1 | 3 | 1 | 5.8 | 1 | 8 | 4.5 | 0 | 1 | 2 | 3 | 0 | 3.9 | 1 | 1 | 6 | 7.3 | 2 | 5 | 4.7 | 26.1 |

| 80 | Hello Bank! | France | Europe | 2013 | 1 | 1 | 2 | 4.6 | 5 | 10 | 7.5 | 0 | 1 | 1 | 5 | 0 | 4.6 | 4 | 3 | 1 | 7.3 | 2 | 1 | 2.0 | 26.0 |

| 81 | Carbon | Nigeria | Middle East and Africa | 2012 | 1 | 1 | 5 | 8.1 | 3 | 3 | 3.0 | 2 | 1 | 1 | 1 | 8 | 8.5 | 1 | 1 | 2 | 3.6 | 1 | 2 | 2.0 | 25.2 |

| 82 | Marcus | US | North America | 2016 | 1 | 0 | 1 | 2.3 | 1 | 4 | 2.5 | 0 | 3 | 0 | 7 | 0 | 6.5 | 6 | 6 | 1 | 11.8 | 2 | 1 | 2.0 | 25.1 |

| 83 | MariBank | Singapore | Asia Pacific | 2022 | 1 | 5 | 1 | 8.1 | 1 | 4 | 2.5 | 0 | 1 | 10 | 1 | 0 | 7.8 | 1 | 1 | 1 | 2.7 | 1 | 5 | 4.0 | 25.1 |

| 84 | Rakuten Bank | Taiwan | Asia Pacific | 2021 | 1 | 1 | 1 | 3.5 | 1 | 7 | 4.0 | 0 | 1 | 10 | 1 | 0 | 7.8 | 1 | 1 | 4 | 5.5 | 1 | 5 | 4.0 | 24.7 |

| 85 | SweepBank | Malta | Europe | 2021 | 1 | 1 | 1 | 3.5 | 3 | 6 | 4.5 | 0 | 1 | 2 | 7 | 0 | 6.5 | 1 | 1 | 7 | 8.2 | 1 | 2 | 2.0 | 24.7 |

| 86 | Ant Bank | Hong Kong | Asia Pacific | 2020 | 1 | 1 | 1 | 3.5 | 1 | 3 | 2.0 | 0 | 1 | 9 | 2 | 0 | 7.8 | 1 | 1 | 6 | 7.3 | 1 | 5 | 4.0 | 24.6 |

| 87 | Next Bank | Taiwan | Asia Pacific | 2022 | 1 | 1 | 1 | 3.5 | 1 | 9 | 5.0 | 0 | 1 | 5 | 1 | 0 | 4.6 | 1 | 1 | 6 | 7.3 | 1 | 5 | 4.0 | 24.3 |

| 88 | Tandem | UK | Europe | 2014 | 1 | 1 | 1 | 3.5 | 1 | 5 | 3.0 | 0 | 1 | 1 | 10 | 2 | 9.1 | 2 | 1 | 5 | 7.3 | 1 | 1 | 1.3 | 24.2 |

| 89 | Mashreq Neo | UAE | Middle East and Africa | 2017 | 1 | 5 | 3 | 10.4 | 2 | 9 | 5.5 | 0 | 1 | 1 | 2 | 0 | 2.6 | 1 | 1 | 2 | 3.6 | 1 | 2 | 2.0 | 24.1 |

| 90 | EQ Bank | Canada | North America | 2016 | 1 | 1 | 1 | 3.5 | 1 | 5 | 3.0 | 4 | 1 | 1 | 7 | 4 | 11.1 | 2 | 2 | 1 | 4.5 | 1 | 2 | 2.0 | 24.1 |

| 91 | GXS Bank | Singapore | Asia Pacific | 2022 | 1 | 3 | 1 | 5.8 | 2 | 4 | 3.0 | 0 | 1 | 7 | 1 | 0 | 5.9 | 1 | 1 | 3 | 4.5 | 2 | 5 | 4.7 | 23.9 |

| 92 | First Internet Bank | US | North America | 1999 | 1 | 1 | 1 | 3.5 | 1 | 7 | 4.0 | 2 | 1 | 0 | 2 | 2 | 4.6 | 1 | 1 | 9 | 10.0 | 1 | 1 | 1.3 | 23.4 |

| 93 | Liv. | UAE | Middle East and Africa | 2017 | 1 | 1 | 2 | 4.6 | 1 | 8 | 4.5 | 2 | 1 | 1 | 4 | 5 | 8.5 | 1 | 1 | 2 | 3.6 | 1 | 2 | 2.0 | 23.2 |

| 94 | Kuda | Nigeria | Middle East and Africa | 2019 | 2 | 2 | 4 | 9.2 | 3 | 6 | 4.5 | 0 | 1 | 2 | 1 | 0 | 2.6 | 1 | 1 | 1 | 2.7 | 1 | 5 | 2.0 | 23.1 |

| 95 | LINE BK | Thailand | Asia Pacific | 2020 | 2 | 3 | 5 | 11.5 | 1 | 5 | 3.0 | 0 | 1 | 1 | 1 | 0 | 2.0 | 1 | 1 | 3 | 4.5 | 1 | 2 | 2.0 | 23.0 |

| 96 | BruBank | Argentina | Latin and South America | 2019 | 1 | 2 | 4 | 8.1 | 1 | 9 | 5.0 | 0 | 1 | 2 | 2 | 2 | 4.6 | 1 | 1 | 1 | 2.7 | 1 | 3 | 2.7 | 23.0 |

| 97 | Lunar | Denmark | Europe | 2015 | 1 | 1 | 1 | 3.5 | 3 | 9 | 6.0 | 0 | 1 | 3 | 4 | 0 | 5.2 | 1 | 1 | 2 | 3.6 | 2 | 5 | 4.7 | 23.0 |

| 98 | Uala | Argentina | Latin and South America | 2017 | 2 | 1 | 2 | 5.8 | 3 | 9 | 6.0 | 0 | 1 | 2 | 3 | 0 | 3.9 | 2 | 1 | 2 | 4.5 | 2 | 2 | 2.7 | 22.9 |

| 99 | Paytm Payments Bank | India | Asia Pacific | 2017 | 6 | 1 | 5 | 13.8 | 1 | 6 | 3.5 | 0 | 1 | 0 | 1 | 0 | 1.3 | 1 | 1 | 1 | 2.7 | 1 | 1 | 1.3 | 22.7 |

| 100 | Zempler Bank | UK | Europe | 2005 | 1 | 2 | 4 | 8.1 | 1 | 5 | 3.0 | 5 | 1 | 2 | 2 | 1 | 7.2 | 1 | 1 | 1 | 2.7 | 1 | 1 | 1.3 | 22.3 |

Notes:

Source: TABInsights

Digital banks continue to experience rapid growth in users, assets and revenue, with Brazil’s Nubank, the retail arm of ING…

Over the past decade, since the start of the fintech boom, the financial services sector has witnessed the emergence of hundreds of stand-alone digital banks globally. These banks have revolutionised how digitally inclined consumers save, borrow, transact and invest.

To monitor this growing array of digital contenders, TABInsights has been assessing the performance of more than 150 leading digital banks globally since 2021, ranking them based on a balanced scorecard. This scorecard evaluates capabilities across five key dimensions: customers, market/product coverage, profitability, asset and deposit growth, and funding. Scale and size aren't the primary determinants; instead, they're weighed against factors like profitability, operational efficiencies, the ability to secure funding, and the manner in which these digital banks maintain a robust loan book and balance sheet.

The assessment encompassed over 150 leading players from 39 markets to identify the Global Top 100 Digital banks. The Top 100 are distributed across various regions: 41 from Asia Pacific, 38 from Europe, 10 from North America, five from South America, and three each from the Middle East and Africa.

| Rank | Digital Bank | Country/Headquarter | Year of launch | Customer | Coverage | Financials | Balance Sheet | Funding | Final Score | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| # of users | Growth /month | Users /staff | Total Score | # of markets | # of products | Total Score | ROE | Gross revenue | Revenue growth | Revenue/ user | CIR | Total Score | Assets | Deposits | LDR | Total Score | Funding | Total Score | |||||

| Score | Score | Score | 30% | Score | Score | 10% | Score | Score | Score | Score | Score | 30% | Score | Score | Score | 20% | Score | 10% | |||||

| 6 | 10 | 10 | 30.0 | 10 | 10 | 10.0 | 10 | 6 | 10 | 10 | 10 | 30.0 | 6 | 6 | 10 | 20.0 | 10 | 10.0 | 100.0 | ||||

| 1 | WeBank | China | 2015 | 6 | 5 | 7 | 20.8 | 1 | 9 | 5.0 | 9 | 4 | 2 | 1 | 8 | 15.7 | 5 | 4 | 9 | 16.4 | 2 | 2.0 | 59.8 |

| 2 | Ally Bank | US | 2009 | 3 | 1 | 1 | 5.8 | 1 | 10 | 5.5 | 8 | 4 | 1 | 10 | 6 | 18.9 | 6 | 6 | 10 | 20.0 | 8 | 8.0 | 58.2 |

| 3 | ING (Global) | Netherlands | 1991 | 4 | 0 | 1 | 5.8 | 10 | 10 | 10.0 | 6 | 5 | 0 | 7 | 3 | 13.7 | 6 | 6 | 9 | 19.1 | 8 | 8.0 | 56.6 |

| 4 | KakaoBank | South Korea | 2017 | 4 | 9 | 4 | 19.6 | 1 | 8 | 4.5 | 3 | 2 | 2 | 2 | 6 | 9.8 | 4 | 3 | 10 | 15.5 | 6 | 6.0 | 55.4 |

| 5 | Nubank | Brazil | 2014 | 5 | 9 | 4 | 20.8 | 3 | 9 | 6.0 | 0 | 3 | 5 | 2 | 3 | 8.5 | 3 | 3 | 3 | 8.2 | 6 | 6.0 | 49.4 |

| 6 | Suning Bank | China | 2017 | 5 | 2 | 7 | 16.2 | 1 | 6 | 3.5 | 7 | 2 | 1 | 1 | 10 | 13.7 | 3 | 3 | 9 | 13.6 | 2 | 2.0 | 49.0 |

| 7 | Tinkoff Bank | Russia | 2007 | 4 | 9 | 3 | 18.5 | 1 | 8 | 4.5 | 6 | 3 | 1 | 5 | 4 | 12.4 | 3 | 3 | 7 | 11.8 | 1 | 1.0 | 48.2 |

| 8 | ING | Germany | 2000 | 2 | 0 | 1 | 3.5 | 1 | 10 | 5.5 | 7 | 3 | 1 | 6 | 5 | 14.3 | 6 | 6 | 9 | 19.1 | 5 | 5.0 | 47.4 |

| 9 | MYBank | China | 2015 | 4 | 1 | 5 | 11.5 | 1 | 4 | 2.5 | 6 | 3 | 1 | 2 | 9 | 13.7 | 5 | 4 | 10 | 17.3 | 2 | 2.0 | 47.0 |

| 10 | K-Bank | South Korea | 2017 | 2 | 5 | 4 | 12.7 | 1 | 9 | 5.0 | 2 | 1 | 3 | 2 | 7 | 9.8 | 3 | 3 | 9 | 13.6 | 4 | 4.0 | 45.1 |

| 11 | SBI Sumishin Net Bank | Japan | 2007 | 2 | 2 | 3 | 8.1 | 1 | 10 | 5.5 | 6 | 1 | 1 | 4 | 5 | 11.1 | 5 | 4 | 10 | 17.3 | 1 | 1.0 | 42.9 |

| 12 | Klarna | Sweden | 2017 | 6 | 1 | 5 | 13.8 | 10 | 4 | 7.0 | 0 | 3 | 1 | 1 | 0 | 3.3 | 3 | 2 | 9 | 12.7 | 6 | 6.0 | 42.8 |

| 13 | Toss Bank | South Korea | 2021 | 2 | 10 | 4 | 18.5 | 1 | 4 | 2.5 | 0 | 1 | 10 | 1 | 0 | 7.8 | 3 | 3 | 5 | 10.0 | 3 | 3.0 | 41.8 |

| 14 | Rakuten Bank | Japan | 2001 | 3 | 2 | 4 | 10.4 | 1 | 10 | 5.5 | 6 | 2 | 1 | 2 | 5 | 10.4 | 5 | 5 | 5 | 13.6 | 1 | 1.0 | 41.0 |

| 15 | Sony Bank | Japan | 2001 | 1 | 1 | 2 | 4.6 | 1 | 10 | 5.5 | 6 | 1 | 1 | 6 | 4 | 11.7 | 4 | 3 | 10 | 15.5 | 2 | 2.0 | 39.3 |

| 16 | KCB Bank | China | 2015 | 3 | 1 | 5 | 10.4 | 1 | 4 | 2.5 | 5 | 1 | 5 | 2 | 9 | 14.3 | 2 | 2 | 8 | 10.9 | 1 | 1.0 | 39.1 |

| 17 | aiBank | China | 2017 | 6 | 2 | 6 | 16.2 | 1 | 6 | 3.5 | 4 | 2 | 2 | 1 | 8 | 11.1 | 3 | 2 | 1 | 5.5 | 2 | 2.0 | 38.2 |

| 18 | Starling Bank | UK | 2015 | 1 | 3 | 1 | 5.8 | 1 | 5 | 3.0 | 9 | 1 | 5 | 5 | 5 | 16.3 | 3 | 3 | 5 | 10.0 | 3 | 3.0 | 38.1 |

| 19 | OakNorth Bank | UK | 2015 | 1 | 1 | 1 | 3.5 | 1 | 5 | 3.0 | 7 | 1 | 1 | 10 | 9 | 18.3 | 2 | 1 | 10 | 11.8 | 1 | 1.0 | 37.5 |

| 20 | XW Bank | China | 2016 | 5 | 1 | 6 | 13.8 | 1 | 4 | 2.5 | 5 | 2 | 2 | 1 | 9 | 12.4 | 3 | 2 | 3 | 7.3 | 1 | 1.0 | 37.0 |

| 21 | Z-Bank | China | 2017 | 4 | 1 | 6 | 12.7 | 1 | 4 | 2.5 | 2 | 1 | 1 | 1 | 7 | 7.8 | 3 | 3 | 7 | 11.8 | 2 | 2.0 | 36.8 |

| 22 | C6 | Brazil | 2019 | 3 | 5 | 2 | 11.5 | 1 | 9 | 5.0 | 0 | 1 | 6 | 1 | 0 | 5.2 | 2 | 1 | 9 | 10.9 | 4 | 4.0 | 36.7 |

| 23 | Wise | UK | 2011 | 3 | 1 | 2 | 6.9 | 10 | 3 | 6.5 | 8 | 3 | 3 | 3 | 5 | 14.3 | 3 | 1 | 1 | 4.5 | 4 | 4.0 | 36.3 |

| 24 | Air Bank | Czech Republic | 2011 | 1 | 2 | 1 | 4.6 | 2 | 8 | 5.0 | 8 | 1 | 2 | 6 | 7 | 15.7 | 2 | 2 | 7 | 10.0 | 1 | 1.0 | 36.3 |

| 25 | LendingClub Bank | US | 2021 | 1 | 1 | 2 | 4.6 | 1 | 3 | 2.0 | 7 | 3 | 2 | 7 | 3 | 14.3 | 2 | 2 | 10 | 12.7 | 2 | 2.0 | 35.7 |

| 26 | ING | Australia | 1999 | 1 | 1 | 1 | 3.5 | 1 | 8 | 4.5 | 5 | 2 | 1 | 7 | 6 | 13.7 | 4 | 4 | 5 | 11.8 | 2 | 2.0 | 35.5 |

| 27 | Tangerine | Canada | 2012 | 1 | 1 | 1 | 3.5 | 1 | 7 | 4.0 | 7 | 2 | 3 | 7 | 6 | 16.3 | 4 | 4 | 3 | 10.0 | 1 | 1.0 | 34.8 |

| 28 | Axos Bank | US | 2000 | 1 | 1 | 1 | 3.5 | 1 | 8 | 4.5 | 7 | 2 | 1 | 1 | 6 | 11.1 | 3 | 3 | 9 | 13.6 | 1 | 1.0 | 33.7 |

| 29 | illimity | Italy | 2019 | 1 | 1 | 1 | 3.5 | 1 | 7 | 4.0 | 5 | 1 | 1 | 10 | 4 | 13.7 | 2 | 1 | 9 | 10.9 | 1 | 1.0 | 33.1 |

| 30 | knab | Netherlands | 2012 | 1 | 1 | 1 | 3.5 | 1 | 10 | 5.5 | 2 | 1 | 0 | 10 | 1 | 9.1 | 3 | 3 | 8 | 12.7 | 2 | 2.0 | 32.8 |

| 31 | au Jibun Bank | Japan | 2008 | 1 | 1 | 4 | 6.9 | 1 | 9 | 5.0 | 2 | 1 | 1 | 3 | 1 | 5.2 | 3 | 3 | 9 | 13.6 | 2 | 2.0 | 32.8 |

| 32 | Revolut | UK | 2015 | 4 | 1 | 2 | 8.1 | 10 | 9 | 9.5 | 2 | 3 | 2 | 2 | 1 | 6.5 | 3 | 1 | 1 | 4.5 | 4 | 4.0 | 32.6 |

| 33 | imaginBank | Spain | 2016 | 1 | 2 | 6 | 10.4 | 1 | 8 | 4.5 | 7 | 1 | 1 | 1 | 7 | 11.1 | 1 | 1 | 4 | 5.5 | 1 | 1.0 | 32.4 |

| 34 | Northmill Bank | Sweden | 2006 | 1 | 1 | 2 | 4.6 | 4 | 6 | 5.0 | 5 | 1 | 2 | 4 | 7 | 12.4 | 1 | 1 | 8 | 9.1 | 1 | 1.0 | 32.1 |

| 35 | Boursorama | France | 1995 | 1 | 4 | 3 | 9.2 | 1 | 10 | 5.5 | 0 | 1 | 1 | 2 | 0 | 2.6 | 5 | 4 | 6 | 13.6 | 1 | 1.0 | 32.0 |

| 36 | Allo Bank | Indonesia | 2021 | 2 | 6 | 4 | 13.8 | 1 | 4 | 2.5 | 4 | 1 | 6 | 1 | 6 | 11.7 | 1 | 1 | 1 | 2.7 | 1 | 1.0 | 31.8 |

| 37 | Yillion Bank | China | 2017 | 4 | 1 | 7 | 13.8 | 1 | 5 | 3.0 | 2 | 1 | 0 | 1 | 6 | 6.5 | 2 | 1 | 5 | 7.3 | 1 | 1.0 | 31.6 |

| 38 | Marcus | US | 2016 | 3 | 3 | 3 | 10.4 | 1 | 4 | 2.5 | 0 | 3 | 1 | 5 | 0 | 5.9 | 6 | 6 | 1 | 11.8 | 1 | 1.0 | 31.6 |

| 39 | Tandem | UK | 2014 | 1 | 1 | 1 | 3.5 | 1 | 6 | 3.5 | 0 | 1 | 10 | 10 | 1 | 14.3 | 1 | 1 | 8 | 9.1 | 1 | 1.0 | 31.4 |

| 40 | SeaBank | Indonesia | 2021 | 1 | 1 | 1 | 3.5 | 1 | 4 | 2.5 | 1 | 1 | 10 | 1 | 9 | 14.3 | 1 | 1 | 9 | 10.0 | 1 | 1.0 | 31.3 |

| 41 | bunq | Netherlands | 2015 | 2 | 1 | 4 | 8.1 | 10 | 7 | 8.5 | 0 | 1 | 6 | 1 | 0 | 5.2 | 1 | 1 | 7 | 8.2 | 1 | 1.0 | 31.0 |

| 42 | Airtel P Bank | India | 2017 | 6 | 5 | 7 | 20.8 | 1 | 5 | 3.0 | 1 | 1 | 2 | 1 | 0 | 3.3 | 1 | 1 | 1 | 2.7 | 1 | 1.0 | 30.8 |

| 43 | TymeBank | South Africa | 2019 | 2 | 6 | 4 | 13.8 | 1 | 5 | 3.0 | 0 | 1 | 8 | 1 | 0 | 6.5 | 1 | 1 | 5 | 6.4 | 1 | 1.0 | 30.7 |

| 44 | PayPay Bank | Japan | 2018 | 2 | 2 | 4 | 9.2 | 1 | 7 | 4.0 | 3 | 1 | 1 | 2 | 2 | 5.9 | 3 | 3 | 4 | 9.1 | 2 | 2.0 | 30.2 |

| 45 | Fortuneo | France | 2000 | 1 | 1 | 1 | 3.5 | 1 | 10 | 5.5 | 1 | 2 | 1 | 6 | 0 | 6.5 | 3 | 3 | 9 | 13.6 | 1 | 1.0 | 30.1 |

| 46 | N26 | Germany | 2015 | 2 | 1 | 3 | 6.9 | 10 | 7 | 8.5 | 0 | 1 | 3 | 1 | 0 | 3.3 | 2 | 2 | 4 | 7.3 | 4 | 4.0 | 30.0 |

| 47 | Bank Jago | Indonesia | 2020 | 2 | 3 | 4 | 10.4 | 1 | 6 | 3.5 | 1 | 1 | 5 | 1 | 2 | 6.5 | 1 | 1 | 6 | 7.3 | 2 | 2.0 | 29.7 |

| 48 | WEX Bank | US | 2000 | 1 | 1 | 1 | 3.5 | 1 | 3 | 2.0 | 9 | 3 | 1 | 5 | 2 | 13 | 2 | 1 | 8 | 10.0 | 1 | 1.0 | 29.5 |

| 49 | Trust Bank | Singapore | 2022 | 1 | 10 | 1 | 13.8 | 1 | 5 | 3.0 | 0 | 1 | 10 | 1 | 0 | 7.8 | 1 | 1 | 2 | 3.6 | 1 | 1.0 | 29.3 |

| 50 | Fjord Bank | Lithuania | 2019 | 1 | 1 | 1 | 3.5 | 4 | 5 | 4.5 | 0 | 1 | 10 | 6 | 0 | 11.1 | 1 | 1 | 8 | 9.1 | 1 | 1.0 | 29.1 |

| 51 | SoFi | US | 2011 | 2 | 1 | 1 | 4.6 | 2 | 10 | 6.0 | 0 | 3 | 2 | 7 | 0 | 7.8 | 3 | 2 | 1 | 5.5 | 5 | 5.0 | 28.9 |

| 52 | Zopa Bank | UK | 2020 | 1 | 1 | 1 | 3.5 | 1 | 5 | 3.0 | 0 | 1 | 4 | 6 | 6 | 11.1 | 1 | 1 | 8 | 9.1 | 2 | 2.0 | 28.6 |

| 53 | MOX Bank | Hong Kong | 2020 | 1 | 4 | 1 | 6.9 | 1 | 5 | 3.0 | 0 | 1 | 10 | 3 | 0 | 9.1 | 1 | 1 | 7 | 8.2 | 1 | 1.0 | 28.2 |

| 54 | NBKC | US | 1999 | 1 | 1 | 1 | 3.5 | 1 | 9 | 5.0 | 6 | 1 | 0 | 7 | 2 | 10.4 | 1 | 1 | 7 | 8.2 | 1 | 1.0 | 28.1 |

| 55 | Neon | Brazil | 2016 | 4 | 5 | 3 | 13.8 | 1 | 6 | 3.5 | 0 | 1 | 7 | 1 | 0 | 5.9 | 1 | 1 | 1 | 2.7 | 2 | 2.0 | 27.9 |

| 56 | GXS Bank | Singapore | 2022 | 1 | 10 | 1 | 13.8 | 1 | 4 | 2.5 | 0 | 1 | 10 | 1 | 0 | 7.8 | 1 | 1 | 1 | 2.7 | 1 | 1.0 | 27.9 |

| 57 | UnionDigital Bank | Philippines | 2022 | 1 | 6 | 4 | 12.7 | 1 | 3 | 2.0 | 0 | 1 | 2 | 1 | 0 | 2.6 | 1 | 1 | 8 | 9.1 | 1 | 1.0 | 27.4 |

| 58 | SweepBank | Malta | 2021 | 1 | 1 | 1 | 3.5 | 5 | 6 | 5.5 | 0 | 1 | 4 | 6 | 0 | 7.2 | 1 | 1 | 9 | 10.0 | 1 | 1.0 | 27.1 |

| 59 | Judo Bank | Australia | 2018 | 1 | 1 | 1 | 3.5 | 1 | 4 | 2.5 | 2 | 1 | 4 | 10 | 3 | 13 | 2 | 1 | 1 | 3.6 | 4 | 4.0 | 26.6 |

| 60 | Monobank | Ukraine | 2017 | 2 | 9 | 3 | 16.2 | 1 | 8 | 4.5 | 0 | 1 | 1 | 1 | 0 | 2 | 1 | 1 | 1 | 2.7 | 1 | 1.0 | 26.3 |

| 61 | Seven Bank | Japan | 2001 | 1 | 1 | 2 | 4.6 | 4 | 5 | 4.5 | 4 | 2 | 1 | 7 | 2 | 10.4 | 3 | 2 | 1 | 5.5 | 1 | 1.0 | 26.0 |

| 62 | Anext Bank | Singapore | 2022 | 1 | 1 | 1 | 3.5 | 1 | 3 | 2.0 | 0 | 1 | 10 | 5 | 0 | 10.4 | 1 | 1 | 8 | 9.1 | 1 | 1.0 | 26.0 |

| 63 | Allica Bank | UK | 2020 | 1 | 1 | 1 | 3.5 | 1 | 3 | 2.0 | 0 | 1 | 10 | 1 | 1 | 8.5 | 1 | 1 | 10 | 10.9 | 1 | 1.0 | 25.8 |

| 64 | Atom Bank | UK | 2015 | 1 | 1 | 1 | 3.5 | 1 | 4 | 2.5 | 0 | 1 | 2 | 10 | 0 | 8.5 | 2 | 2 | 6 | 9.1 | 2 | 2.0 | 25.5 |

| 65 | WeLab Bank | Hong Kong | 2020 | 1 | 1 | 1 | 3.5 | 1 | 5 | 3.0 | 0 | 1 | 10 | 1 | 0 | 7.8 | 1 | 1 | 9 | 10.0 | 1 | 1.0 | 25.3 |

| 66 | ZA Bank | Hong Kong | 2020 | 1 | 4 | 1 | 6.9 | 1 | 8 | 4.5 | 0 | 1 | 3 | 3 | 0 | 4.6 | 1 | 1 | 6 | 7.3 | 2 | 2.0 | 25.3 |

| 67 | Carbon | Nigeria | 2012 | 1 | 1 | 5 | 8.1 | 3 | 3 | 3.0 | 5 | 1 | 1 | 1 | 8 | 10.4 | 1 | 1 | 1 | 2.7 | 1 | 1.0 | 25.2 |

| 68 | Paytm P Bank | India | 2017 | 6 | 1 | 5 | 13.8 | 1 | 6 | 3.5 | 3 | 1 | 1 | 1 | 0 | 3.9 | 1 | 1 | 1 | 2.7 | 1 | 1.0 | 25.0 |

| 69 | CIMB | Philippines | 2018 | 2 | 2 | 4 | 9.2 | 1 | 6 | 3.5 | 0 | 1 | 4 | 1 | 0 | 3.9 | 1 | 1 | 6 | 7.3 | 1 | 1.0 | 24.9 |

| 70 | PAObank | Hong Kong | 2020 | 1 | 1 | 1 | 3.5 | 1 | 3 | 2.0 | 0 | 1 | 7 | 3 | 0 | 7.2 | 1 | 1 | 10 | 10.9 | 1 | 1.0 | 24.5 |

| 71 | Openbank | Spain | 1995 | 1 | 1 | 1 | 3.5 | 5 | 10 | 7.5 | 1 | 1 | 1 | 4 | 1 | 5.2 | 3 | 3 | 2 | 7.3 | 1 | 1.0 | 24.5 |

| 72 | Monzo | UK | 2015 | 2 | 1 | 2 | 5.8 | 2 | 8 | 5.0 | 0 | 1 | 5 | 2 | 0 | 5.2 | 2 | 2 | 2 | 5.5 | 3 | 3.0 | 24.4 |

| 73 | First Internet Bank | US | 1999 | 1 | 1 | 1 | 3.5 | 1 | 6 | 3.5 | 4 | 1 | 1 | 1 | 4 | 7.2 | 1 | 1 | 8 | 9.1 | 1 | 1.0 | 24.2 |

| 74 | Lunar | Denmark | 2015 | 1 | 2 | 1 | 4.6 | 3 | 8 | 5.5 | 0 | 1 | 10 | 2 | 0 | 8.5 | 1 | 1 | 3 | 4.5 | 1 | 1.0 | 24.1 |

| 75 | Chime | US | 2014 | 3 | 2 | 3 | 9.2 | 2 | 5 | 3.5 | 0 | 2 | 2 | 3 | 0 | 4.6 | 1 | 1 | 1 | 2.7 | 4 | 4.0 | 24.0 |

| 76 | Kompasbank | Denmark | 2021 | 1 | 1 | 1 | 3.5 | 1 | 2 | 1.5 | 0 | 1 | 10 | 5 | 0 | 10.4 | 1 | 1 | 6 | 7.3 | 1 | 1.0 | 23.7 |

| 77 | Aprila Bank | Norway | 2018 | 1 | 1 | 1 | 3.5 | 1 | 2 | 1.5 | 0 | 1 | 4 | 10 | 2 | 11.1 | 1 | 1 | 5 | 6.4 | 1 | 1.0 | 23.4 |

| 78 | Alex Bank | Australia | 2021 | 1 | 1 | 1 | 3.5 | 1 | 4 | 2.5 | 0 | 1 | 10 | 10 | 0 | 13.7 | 1 | 1 | 1 | 2.7 | 1 | 1.0 | 23.4 |

| 79 | livi Bank | Hong Kong | 2020 | 1 | 2 | 1 | 4.6 | 1 | 6 | 3.5 | 0 | 1 | 10 | 1 | 0 | 7.8 | 1 | 1 | 5 | 6.4 | 1 | 1.0 | 23.3 |

| 80 | Hello Bank! | France | 2013 | 1 | 1 | 2 | 4.6 | 5 | 10 | 7.5 | 0 | 1 | 1 | 2 | 0 | 2.6 | 4 | 3 | 1 | 7.3 | 1 | 1.0 | 23.0 |

| 81 | LINE BK | Thailand | 2020 | 2 | 4 | 4 | 11.5 | 1 | 5 | 3.0 | 0 | 1 | 2 | 1 | 0 | 2.6 | 1 | 1 | 3 | 4.5 | 1 | 1.0 | 22.7 |

| 82 | Curve | UK | 2018 | 1 | 1 | 4 | 6.9 | 10 | 4 | 7.0 | 0 | 1 | 2 | 1 | 0 | 2.6 | 1 | 1 | 1 | 2.7 | 3 | 3.0 | 22.3 |

| 83 | Green Link Digital Bank | Singapore | 2022 | 1 | 1 | 1 | 3.5 | 1 | 4 | 2.5 | 0 | 1 | 10 | 1 | 0 | 7.8 | 1 | 1 | 6 | 7.3 | 1 | 1.0 | 22.1 |

| 84 | Mach | Chile | 2017 | 1 | 4 | 4 | 10.4 | 1 | 7 | 4.0 | 0 | 1 | 3 | 1 | 0 | 3.3 | 1 | 1 | 1 | 2.7 | 1 | 1.0 | 21.4 |

| 85 | Orange Bank | France | 2017 | 1 | 2 | 2 | 5.8 | 2 | 5 | 3.5 | 0 | 1 | 1 | 1 | 0 | 2 | 1 | 1 | 8 | 9.1 | 1 | 1.0 | 21.3 |

| 86 | Maya Bank | Philippines | 2022 | 1 | 4 | 5 | 11.5 | 1 | 4 | 2.5 | 0 | 1 | 2 | 1 | 0 | 2.6 | 1 | 1 | 2 | 3.6 | 1 | 1.0 | 21.3 |

| 87 | NSDL P Bank | India | 2017 | 1 | 1 | 2 | 4.6 | 1 | 4 | 2.5 | 0 | 1 | 10 | 5 | 0 | 10.4 | 1 | 1 | 1 | 2.7 | 1 | 1.0 | 21.3 |

| 88 | Lydia | France | 2013 | 2 | 3 | 5 | 11.5 | 3 | 5 | 4.0 | 0 | 1 | 1 | 1 | 0 | 2 | 1 | 1 | 1 | 2.7 | 1 | 1.0 | 21.2 |

| 89 | Monabanq | France | 2006 | 1 | 1 | 1 | 3.5 | 1 | 9 | 5.0 | 0 | 1 | 1 | 2 | 0 | 2.6 | 1 | 1 | 8 | 9.1 | 1 | 1.0 | 21.2 |

| 90 | Papara | Turkey | 2016 | 3 | 1 | 5 | 10.4 | 1 | 5 | 3.0 | 1 | 1 | 2 | 1 | 1 | 3.9 | 1 | 1 | 1 | 2.7 | 1 | 1.0 | 21.0 |

| 91 | Holvi | Finland | 2011 | 1 | 1 | 1 | 3.5 | 9 | 4 | 6.5 | 0 | 1 | 4 | 6 | 0 | 7.2 | 1 | 1 | 1 | 2.7 | 1 | 1.0 | 20.9 |

| 92 | Mashreq Neo | UAE | 2017 | 1 | 1 | 5 | 8.1 | 1 | 9 | 5.0 | 0 | 1 | 2 | 3 | 0 | 3.9 | 1 | 1 | 1 | 2.7 | 1 | 1.0 | 20.7 |

| 93 | LINE Bank | Taiwan | 2021 | 1 | 5 | 2 | 9.2 | 1 | 5 | 3.0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 6 | 7.3 | 1 | 1.0 | 20.5 |

| 94 | Liv. | UAE | 2017 | 1 | 1 | 3 | 5.8 | 2 | 8 | 5.0 | 1 | 1 | 1 | 3 | 3 | 5.9 | 1 | 1 | 1 | 2.7 | 1 | 1.0 | 20.4 |

| 95 | Uala | Argentina | 2017 | 2 | 2 | 2 | 6.9 | 3 | 5 | 4.0 | 0 | 1 | 3 | 3 | 0 | 4.6 | 1 | 1 | 1 | 2.7 | 2 | 2.0 | 20.2 |

| 96 | blu | Indonesia | 2021 | 1 | 1 | 2 | 4.6 | 1 | 5 | 3.0 | 0 | 1 | 4 | 1 | 0 | 3.9 | 1 | 1 | 6 | 7.3 | 1 | 1.0 | 19.8 |

| 97 | Kuda | Nigeria | 2019 | 1 | 3 | 5 | 10.4 | 2 | 5 | 3.5 | 0 | 1 | 1 | 1 | 0 | 2 | 1 | 1 | 1 | 2.7 | 1 | 1.0 | 19.6 |

| 98 | ila | Bahrain | 2020 | 1 | 4 | 2 | 8.1 | 2 | 7 | 4.5 | 0 | 1 | 2 | 2 | 0 | 3.3 | 1 | 1 | 1 | 2.7 | 1 | 1.0 | 19.6 |

| 99 | Monese | UK | 2015 | 1 | 1 | 3 | 5.8 | 10 | 6 | 8.0 | 0 | 1 | 1 | 1 | 0 | 2 | 1 | 1 | 1 | 2.7 | 1 | 1.0 | 19.5 |

| 100 | Qonto | France | 2017 | 1 | 1 | 1 | 3.5 | 4 | 5 | 4.5 | 0 | 1 | 1 | 8 | 0 | 6.5 | 1 | 1 | 1 | 2.7 | 2 | 2.0 | 19.2 |

Notes:

Source: TABInsights

Over the last decade since the start of the fintech boom, the financial services sector has seen the rise of more than a hundred stand-alone digital banks globally. They have transformed the way digitally inclined consumers save, borrow, transact and invest.

To track this increasing array of mobile based virtual contenders, TABInsights has launched the world’s first comprehensive assessment of global digital banks that ranks them according to a balanced scorecard derived from an objective and transparent set of evaluation criteria. The scorecard assessment covers capabilities mapped across five key dimensions: customer, market/product coverage, profitability, asset and deposit growth and funding. Scale and size are not the main determinant, and are balanced with profitability, operational efficiencies, the ability to raise funds and the way these digital banks grow a healthy loan book and balance sheet. The global top 100 digital bank ranking covers digital banks from 36 countries across all major world regions.

| Rank | Digital Bank | Country/Headquarter | Year of launch | Customer | Coverage | Financials | Balance Sheet | Funding | Final score | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| # of users | Growth /month | Users /staff | Total Score | # of markets | # of products | Total Score | ROE | Gross revenue | Revenue growth | Revenue/ user | CIR | Total Score | Assets | Deposits | LDR | Total Score | Funding | Total Score | |||||

| Score | Score | Score | 30% | Score | Score | 10% | Score | Score | Score | Score | Score | 30% | Score | Score | Score | 20% | Score | 10% | |||||

| 10 | 10 | 10 | 30.0 | 10 | 10 | 10.0 | 10 | 10 | 10 | 10 | 10 | 30.0 | 10 | 10 | 10 | 20.0 | 10 | 10.0 | 100.0 | ||||

| 1 | WeBank | China | 2015 | 10 | 10 | 7 | 27.0 | 1 | 9 | 5.0 | 8 | 5 | 2 | 1 | 8 | 14.4 | 9 | 6 | 10 | 16.7 | 2 | 2.0 | 65.1 |

| 2 | ING (Global) | Netherland | 1991 | 7 | 0 | 1 | 8.0 | 10 | 9 | 9.5 | 6 | 7 | 1 | 8 | 3 | 15.0 | 10 | 10 | 9 | 19.3 | 9 | 9.0 | 60.8 |

| 3 | Ally Bank | US | 2009 | 4 | 4 | 1 | 9.0 | 1 | 10 | 5.5 | 7 | 6 | 1 | 10 | 6 | 18.0 | 10 | 10 | 10 | 20.0 | 8 | 8.0 | 60.5 |

| 4 | MYBank | China | 2015 | 8 | 7 | 5 | 20.0 | 1 | 3 | 2.0 | 4 | 5 | 3 | 2 | 8 | 13.2 | 9 | 5 | 10 | 16.0 | 3 | 3.0 | 54.2 |

| 5 | Klarna | Sweden | 2017 | 10 | 10 | 5 | 25.0 | 10 | 2 | 6.0 | 0 | 5 | 2 | 1 | 0 | 4.8 | 4 | 2 | 7 | 8.7 | 6 | 6.0 | 50.5 |

| 6 | Tinkoff Bank | Russia | 2007 | 5 | 7 | 3 | 15.0 | 1 | 8 | 4.5 | 10 | 5 | 2 | 5 | 9 | 18.6 | 4 | 3 | 10 | 11.3 | 1 | 1.0 | 50.4 |

| 7 | Suning Bank | China | 2017 | 8 | 8 | 7 | 23.0 | 1 | 4 | 2.5 | 5 | 4 | 1 | 1 | 10 | 12.6 | 4 | 3 | 8 | 10.0 | 2 | 2.0 | 50.1 |

| 8 | KakaoBank | South Korea | 2017 | 5 | 6 | 4 | 15.0 | 1 | 8 | 4.5 | 2 | 4 | 3 | 2 | 6 | 10.2 | 5 | 4 | 10 | 12.7 | 6 | 6.0 | 48.4 |

| 9 | ING | Germany | <2000 | 3 | 1 | 1 | 5.0 | 1 | 6 | 3.5 | 6 | 5 | 0 | 6 | 4 | 12.6 | 10 | 10 | 9 | 19.3 | 6 | 6.0 | 46.4 |

| 10 | Nubank | Brazil | 2014 | 8 | 9 | 3 | 20.0 | 3 | 6 | 4.5 | 0 | 5 | 4 | 1 | 3 | 7.8 | 4 | 3 | 2 | 6.0 | 6 | 6.0 | 44.3 |

| 11 | Rakuten Bank | Japan | 2001 | 4 | 5 | 4 | 13.0 | 3 | 10 | 6.5 | 4 | 4 | 1 | 2 | 4 | 9.0 | 10 | 8 | 4 | 14.7 | 1 | 1.0 | 44.2 |

| 12 | aiBank | China | 2017 | 10 | 9 | 6 | 25.0 | 1 | 5 | 3.0 | 1 | 3 | 3 | 1 | 7 | 9.0 | 4 | 2 | 1 | 4.7 | 2 | 2.0 | 43.7 |

| 13 | K-Bank | South Korea | 2017 | 3 | 6 | 4 | 13.0 | 1 | 9 | 5.0 | 1 | 3 | 10 | 1 | 3 | 10.8 | 4 | 3 | 9 | 10.7 | 4 | 4.0 | 43.5 |

| 14 | XW Bank | China | 2016 | 9 | 9 | 6 | 24.0 | 1 | 4 | 2.5 | 5 | 3 | 1 | 1 | 8 | 10.8 | 3 | 2 | 1 | 4.0 | 1 | 1.0 | 42.3 |

| 15 | SBI Sumishin | Japan | 2007 | 2 | 3 | 3 | 8.0 | 1 | 10 | 5.5 | 5 | 3 | 1 | 5 | 4 | 10.8 | 9 | 7 | 9 | 16.7 | 1 | 1.0 | 42.0 |

| 16 | NBKC | US | 1999 | 1 | 1 | 1 | 3.0 | 1 | 9 | 5.0 | 8 | 3 | 0 | 8 | 2 | 12.6 | 1 | 1 | 8 | 6.7 | 10 | 10.0 | 37.3 |

| 17 | Marcus | US | 2016 | 4 | 5 | 2 | 11.0 | 1 | 5 | 3.0 | 0 | 5 | 1 | 5 | 0 | 6.6 | 10 | 10 | 2 | 14.7 | 1 | 1.0 | 36.3 |

| 18 | Sony Bank | Japan | 2001 | 2 | 1 | 2 | 5.0 | 1 | 10 | 5.5 | 4 | 3 | 1 | 6 | 3 | 10.2 | 6 | 4 | 10 | 13.3 | 2 | 2.0 | 36.0 |

| 19 | Wise | UK | 2011 | 4 | 5 | 2 | 11.0 | 10 | 2 | 6.0 | 5 | 4 | 2 | 3 | 6 | 12.0 | 3 | 1 | 1 | 3.3 | 3 | 3.0 | 35.3 |

| 20 | C6 | Brazil | 2019 | 3 | 5 | 2 | 10.0 | 1 | 7 | 4.0 | 0 | 3 | 10 | 1 | 0 | 8.4 | 2 | 2 | 8 | 8.0 | 4 | 4.0 | 34.4 |

| 21 | au Jibun Bank | Japan | 2008 | 2 | 3 | 4 | 9.0 | 1 | 9 | 5.0 | 1 | 3 | 1 | 3 | 1 | 5.4 | 5 | 4 | 10 | 12.7 | 2 | 2.0 | 34.1 |

| 22 | Revolut | UK | 2015 | 5 | 5 | 3 | 13.0 | 10 | 9 | 9.5 | 0 | 3 | 2 | 1 | 0 | 3.6 | 3 | 1 | 1 | 3.3 | 4 | 4.0 | 33.4 |

| 23 | SoFi | US | 2011 | 2 | 5 | 1 | 8.0 | 2 | 10 | 6.0 | 0 | 4 | 3 | 7 | 0 | 8.4 | 3 | 1 | 1 | 3.3 | 5 | 5.0 | 30.7 |

| 24 | Air Bank | Czech Republic | 2011 | 1 | 2 | 1 | 4.0 | 2 | 8 | 5.0 | 5 | 3 | 1 | 6 | 6 | 12.6 | 3 | 2 | 7 | 8.0 | 1 | 1.0 | 30.6 |

| 25 | N26 | Germany | 2015 | 3 | 4 | 2 | 9.0 | 10 | 8 | 9.0 | 0 | 2 | 1 | 1 | 0 | 2.4 | 3 | 2 | 4 | 6.0 | 4 | 4.0 | 30.4 |

| 26 | ING | Australia | 1999 | 2 | 1 | 1 | 4.0 | 1 | 7 | 4.0 | 4 | 4 | 1 | 7 | 4 | 12.0 | 6 | 5 | 3 | 9.3 | 1 | 1.0 | 30.3 |

| 27 | UBank | Australia | 2008 | 1 | 1 | 1 | 3.0 | 1 | 6 | 3.5 | 4 | 3 | 1 | 8 | 5 | 12.6 | 4 | 3 | 8 | 10.0 | 1 | 1.0 | 30.1 |

| 28 | Chime | US | 2014 | 4 | 5 | 3 | 12.0 | 2 | 5 | 3.5 | 0 | 4 | 7 | 3 | 0 | 8.4 | 1 | 1 | 1 | 2.0 | 4 | 4.0 | 29.9 |

| 29 | Paytm P Bank | India | 2017 | 9 | 6 | 5 | 20.0 | 1 | 6 | 3.5 | 1 | 3 | 0 | 1 | 0 | 3.0 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 29.5 |

| 30 | imaginBank | Spain | 2016 | 2 | 4 | 6 | 12.0 | 1 | 5 | 3.0 | 6 | 1 | 1 | 1 | 7 | 9.6 | 1 | 1 | 3 | 3.3 | 1 | 1.0 | 28.9 |

| 31 | Tangerine | Canada | 2012 | 2 | 1 | 1 | 4.0 | 1 | 6 | 3.5 | 4 | 3 | 1 | 6 | 3 | 10.2 | 6 | 5 | 3 | 9.3 | 1 | 1.0 | 28.0 |

| 32 | PayPay Bank | Japan | 2018 | 3 | 3 | 4 | 10.0 | 1 | 6 | 3.5 | 3 | 3 | 1 | 2 | 2 | 6.6 | 4 | 3 | 3 | 6.7 | 1 | 1.0 | 27.8 |

| 33 | OakNorth | UK | 2015 | 1 | 0 | 1 | 2.0 | 1 | 5 | 3.0 | 6 | 3 | 1 | 10 | 9 | 17.4 | 2 | 2 | 1 | 3.3 | 2 | 2.0 | 27.7 |

| 34 | Seven Bank | Japan | 2001 | 2 | 2 | 2 | 6.0 | 1 | 4 | 2.5 | 5 | 4 | 0 | 8 | 3 | 12.0 | 4 | 2 | 1 | 4.7 | 2 | 2.0 | 27.2 |

| 35 | Boursorama | France | 1995 | 2 | 4 | 2 | 8.0 | 1 | 10 | 5.5 | 0 | 3 | 1 | 2 | 0 | 3.6 | 8 | 4 | 1 | 8.7 | 1 | 1.0 | 26.8 |

| 36 | knab | Netherland | 2012 | 1 | 0 | 1 | 2.0 | 1 | 10 | 5.5 | 0 | 3 | 1 | 8 | 1 | 7.8 | 4 | 3 | 7 | 9.3 | 2 | 2.0 | 26.6 |

| 37 | Hello Bank! | France | 2013 | 2 | 3 | 2 | 7.0 | 5 | 10 | 7.5 | 0 | 2 | 1 | 2 | 0 | 3.0 | 6 | 5 | 1 | 8.0 | 1 | 1.0 | 26.5 |

| 38 | Airtel P Bank | India | 2017 | 6 | 5 | 6 | 17.0 | 1 | 5 | 3.0 | 0 | 2 | 2 | 1 | 0 | 3.0 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 26.0 |

| 39 | Judo Bank | Australia | 2018 | 1 | 1 | 1 | 3.0 | 1 | 4 | 2.5 | 0 | 2 | 8 | 10 | 0 | 12.0 | 3 | 1 | 1 | 3.3 | 4 | 4.0 | 24.8 |

| 40 | bunq | Netherland | 2015 | 2 | 1 | 3 | 6.0 | 10 | 7 | 8.5 | 0 | 1 | 10 | 1 | 0 | 7.2 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 24.7 |

| 41 | Neon | Brazil | 2016 | 5 | 6 | 3 | 14.0 | 1 | 6 | 3.5 | 0 | 1 | 5 | 1 | 0 | 4.2 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 24.7 |

| 42 | Papara | Turkey | 2016 | 4 | 6 | 5 | 15.0 | 1 | 4 | 2.5 | 1 | 1 | 2 | 1 | 1 | 3.6 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 24.1 |

| 43 | Starling | UK | 2015 | 2 | 4 | 1 | 7.0 | 1 | 5 | 3.0 | 0 | 3 | 1 | 3 | 0 | 4.2 | 3 | 3 | 5 | 7.3 | 2 | 2.0 | 23.5 |

| 44 | LINE BK | Thailand | 2020 | 2 | 5 | 4 | 11.0 | 1 | 4 | 2.5 | 0 | 2 | 5 | 1 | 0 | 4.8 | 1 | 2 | 2 | 3.3 | 1 | 1.0 | 22.6 |

| 45 | PAObank | Hong Kong | 2020 | 1 | 1 | 1 | 3.0 | 1 | 3 | 2.0 | 0 | 1 | 10 | 3 | 0 | 8.4 | 1 | 1 | 10 | 8.0 | 1 | 1.0 | 22.4 |

| 46 | Curve | UK | 2018 | 2 | 4 | 3 | 9.0 | 10 | 4 | 7.0 | 0 | 1 | 3 | 1 | 0 | 3.0 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 22.0 |

| 47 | Monzo | UK | 2015 | 2 | 4 | 2 | 8.0 | 2 | 7 | 4.5 | 0 | 2 | 1 | 1 | 0 | 2.4 | 3 | 2 | 1 | 4.0 | 3 | 3.0 | 21.9 |

| 48 | Monese | UK | 2015 | 2 | 3 | 3 | 8.0 | 10 | 6 | 8.0 | 0 | 1 | 2 | 1 | 0 | 2.4 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 21.4 |

| 49 | TymeBank | South Africa | 2019 | 2 | 5 | 3 | 10.0 | 2 | 4 | 3.0 | 0 | 1 | 6 | 1 | 0 | 4.8 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 20.8 |

| 50 | Neo | UAE | 2017 | 1 | 2 | 6 | 9.0 | 1 | 7 | 4.0 | 0 | 1 | 3 | 3 | 0 | 4.2 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 20.2 |

| 51 | Liv. | UAE | 2017 | 1 | 1 | 4 | 6.0 | 2 | 7 | 4.5 | 1 | 1 | 2 | 2 | 5 | 6.6 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 20.1 |

| 52 | ZA Bank | Hong Kong | 2020 | 1 | 2 | 1 | 4.0 | 1 | 8 | 4.5 | 0 | 1 | 8 | 2 | 0 | 6.6 | 1 | 1 | 4 | 4.0 | 1 | 1.0 | 20.1 |

| 53 | Uala | Argentina | 2017 | 2 | 4 | 2 | 8.0 | 3 | 3 | 3.0 | 0 | 1 | 6 | 1 | 0 | 4.8 | 1 | 1 | 1 | 2.0 | 2 | 2.0 | 19.8 |

| 54 | Carbon | Kenya | 2012 | 2 | 5 | 5 | 12.0 | 3 | 3 | 3.0 | 0 | 1 | 1 | 1 | 0 | 1.8 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 19.8 |

| 55 | Fino P Bank | India | 2017 | 2 | 4 | 1 | 7.0 | 1 | 5 | 3.0 | 5 | 3 | 1 | 2 | 0 | 6.6 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 19.6 |

| 56 | Simplii | Canada | 2017 | 2 | 2 | 5 | 9.0 | 1 | 6 | 3.5 | 0 | 2 | 1 | 1 | 0 | 2.4 | 2 | 2 | 1 | 3.3 | 1 | 1.0 | 19.2 |

| 57 | CIMB | Philippines | 2018 | 2 | 5 | 4 | 11.0 | 1 | 4 | 2.5 | 0 | 1 | 1 | 1 | 0 | 1.8 | 1 | 1 | 2 | 2.7 | 1 | 1.0 | 19.0 |

| 58 | Varo | US | 2017 | 2 | 5 | 2 | 9.0 | 1 | 5 | 3.0 | 0 | 2 | 1 | 2 | 0 | 3.0 | 1 | 1 | 1 | 2.0 | 2 | 2.0 | 19.0 |

| 59 | Toss Bank | South Korea | 2021 | 1 | 4 | 3 | 8.0 | 1 | 4 | 2.5 | 0 | 0 | 0 | 0 | 0 | 0.0 | 4 | 3 | 4 | 7.3 | 1 | 1.0 | 18.8 |

| 60 | Kuda | Nigeria | 2019 | 2 | 5 | 4 | 11.0 | 1 | 3 | 2.0 | 0 | 1 | 2 | 1 | 0 | 2.4 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 18.4 |

| 61 | Monobank | Ukraine | 2017 | 2 | 5 | 2 | 9.0 | 1 | 8 | 4.5 | 0 | 1 | 1 | 1 | 0 | 1.8 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 18.3 |

| 62 | Mach | Chile | 2017 | 2 | 3 | 4 | 9.0 | 1 | 3 | 2.0 | 0 | 1 | 5 | 1 | 0 | 4.2 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 18.2 |

| 63 | Atom Bank | UK | 2015 | 1 | 1 | 1 | 3.0 | 1 | 4 | 2.5 | 0 | 1 | 1 | 1 | 0 | 1.8 | 2 | 2 | 9 | 8.7 | 2 | 2.0 | 18.0 |

| 64 | Zopa Bank | UK | 2020 | 1 | 2 | 1 | 4.0 | 1 | 5 | 3.0 | 0 | 2 | 5 | 3 | 0 | 6.0 | 2 | 1 | 1 | 2.7 | 2 | 2.0 | 17.7 |

| 65 | blu | Indonesia | 2021 | 1 | 4 | 2 | 7.0 | 1 | 4 | 2.5 | 0 | 1 | 0 | 1 | 0 | 1.2 | 1 | 1 | 7 | 6.0 | 1 | 1.0 | 17.7 |

| 66 | Airstar Bank | Hong Kong | 2020 | 1 | 1 | 1 | 3.0 | 1 | 4 | 2.5 | 0 | 1 | 6 | 2 | 0 | 5.4 | 1 | 1 | 5 | 4.7 | 1 | 1.0 | 16.6 |

| 67 | ING Bank | Philippines | 2018 | 2 | 4 | 3 | 9.0 | 1 | 4 | 2.5 | 0 | 1 | 1 | 1 | 0 | 1.8 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 16.3 |

| 68 | NSDL P Bank | India | 2017 | 1 | 1 | 1 | 3.0 | 1 | 4 | 2.5 | 0 | 1 | 10 | 1 | 0 | 7.2 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 15.7 |

| 69 | EQ Bank | Canada | 2016 | 1 | 1 | 3 | 5.0 | 1 | 5 | 3.0 | 0 | 2 | 1 | 1 | 0 | 2.4 | 3 | 2 | 1 | 4.0 | 1 | 1.0 | 15.4 |

| 70 | Discovery Bank | South Africa | 2018 | 1 | 1 | 2 | 4.0 | 1 | 4 | 2.5 | 0 | 1 | 2 | 1 | 0 | 2.4 | 1 | 1 | 6 | 5.3 | 1 | 1.0 | 15.2 |

| 71 | Allica Bank | UK | 2020 | 1 | 1 | 1 | 3.0 | 1 | 3 | 2.0 | 0 | 1 | 1 | 1 | 0 | 1.8 | 1 | 1 | 9 | 7.3 | 1 | 1.0 | 15.1 |

| 72 | Lunar | Denmark | 2015 | 1 | 2 | 1 | 4.0 | 3 | 8 | 5.5 | 0 | 1 | 1 | 1 | 0 | 1.8 | 1 | 1 | 2 | 2.7 | 1 | 1.0 | 15.0 |

| 73 | LINE Bank | Taiwan | 2021 | 1 | 4 | 1 | 6.0 | 3 | 4 | 3.5 | 0 | 1 | 1 | 1 | 0 | 1.8 | 1 | 1 | 2 | 2.7 | 1 | 1.0 | 15.0 |

| 74 | Jenius | Indonesia | 2016 | 2 | 4 | 1 | 7.0 | 1 | 5 | 3.0 | 0 | 1 | 1 | 1 | 0 | 1.8 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 14.8 |

| 75 | Flowe | Italy | 2020 | 1 | 3 | 3 | 7.0 | 1 | 5 | 3.0 | 0 | 1 | 1 | 1 | 0 | 1.8 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 14.8 |

| 76 | Marcus | UK | 2018 | 1 | 3 | 1 | 5.0 | 1 | 2 | 1.5 | 0 | 2 | 1 | 1 | 0 | 2.4 | 1 | 4 | 1 | 4.0 | 1 | 1.0 | 13.9 |

| 77 | Up | Australia | 2018 | 1 | 1 | 4 | 6.0 | 1 | 4 | 2.5 | 0 | 1 | 1 | 1 | 0 | 1.8 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 13.3 |

| 78 | TNEX | Vietnam | 2020 | 1 | 3 | 2 | 6.0 | 1 | 4 | 2.5 | 0 | 1 | 1 | 1 | 0 | 1.8 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 13.3 |

| 79 | Ligo | Peru | 2019 | 1 | 3 | 2 | 6.0 | 1 | 3 | 2.0 | 0 | 1 | 1 | 1 | 0 | 1.8 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 12.8 |

| 80 | TMRW | Indonesia | 2020 | 1 | 3 | 1 | 5.0 | 1 | 4 | 2.5 | 0 | 1 | 1 | 1 | 0 | 1.8 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 12.3 |

| 81 | TIMO | Vietnam | 2016 | 1 | 1 | 2 | 4.0 | 1 | 6 | 3.5 | 0 | 1 | 1 | 1 | 0 | 1.8 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 12.3 |

| 82 | TMRW | Thailand | 2019 | 1 | 1 | 2 | 4.0 | 1 | 4 | 2.5 | 0 | 1 | 2 | 1 | 0 | 2.4 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 11.9 |

| 83 | meem | KSA | 2014 | 1 | 1 | 1 | 3.0 | 2 | 6 | 4.0 | 0 | 1 | 1 | 1 | 0 | 1.8 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 11.8 |

| 84 | KEPT | Thailand | 2020 | 1 | 1 | 2 | 4.0 | 1 | 3 | 2.0 | 0 | 1 | 2 | 1 | 0 | 2.4 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 11.4 |

| 85 | Rakuten Bank | Taiwan | 2021 | 1 | 1 | 1 | 3.0 | 3 | 4 | 3.5 | 0 | 1 | 1 | 1 | 0 | 1.8 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 11.3 |

| 86 | LINE Bank | Indonesia | 2021 | 1 | 3 | 1 | 5.0 | 1 | 3 | 2.0 | 0 | 0 | 1 | 1 | 0 | 1.2 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 11.2 |

| 87 | ila | Bahrain | 2019 | 1 | 1 | 1 | 3.0 | 1 | 3 | 2.0 | 0 | 1 | 2 | 2 | 0 | 3.0 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 11.0 |

| 88 | Hala | KSA | 2018 | 1 | 1 | 1 | 3.0 | 1 | 4 | 2.5 | 0 | 1 | 2 | 1 | 0 | 2.4 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 10.9 |

| 89 | Pepper | Israel | 2017 | 1 | 1 | 1 | 3.0 | 1 | 5 | 3.0 | 0 | 1 | 1 | 1 | 0 | 1.8 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 10.8 |

| 90 | MOX Bank | Hong Kong | 2020 | 1 | 2 | 1 | 4.0 | 1 | 5 | 3.0 | 0 | 0 | 0 | 0 | 0 | 0.0 | 1 | 1 | 2 | 2.7 | 1 | 1.0 | 10.7 |

| 91 | KOHO | Canada | 2015 | 1 | 2 | 1 | 4.0 | 1 | 2 | 1.5 | 0 | 1 | 1 | 1 | 0 | 1.8 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 10.3 |

| 92 | WeLab Bank | Hong Kong | 2020 | 1 | 1 | 1 | 3.0 | 1 | 5 | 3.0 | 0 | 0 | 0 | 0 | 0 | 0.0 | 1 | 1 | 3 | 3.3 | 1 | 1.0 | 10.3 |

| 93 | YAP | UAE | 2021 | 1 | 1 | 1 | 3.0 | 1 | 5 | 3.0 | 0 | 0 | 1 | 1 | 0 | 1.2 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 10.2 |

| 94 | Tonik Bank | Philippines | 2021 | 1 | 2 | 1 | 4.0 | 1 | 4 | 2.5 | 0 | 0 | 1 | 0 | 0 | 0.6 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 10.1 |

| 95 | Alex Bank | Australia | 2021 | 1 | 1 | 1 | 3.0 | 1 | 3 | 2.0 | 0 | 1 | 1 | 1 | 0 | 1.8 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 9.8 |

| 96 | BruBank | Argentina | 2019 | 1 | 1 | 1 | 3.0 | 1 | 4 | 2.5 | 0 | 0 | 1 | 1 | 0 | 1.2 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 9.7 |

| 97 | livi Bank | Hong Kong | 2020 | 1 | 2 | 1 | 4.0 | 1 | 4 | 2.5 | 0 | 0 | 0 | 0 | 0 | 0.0 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 9.5 |

| 98 | Bank Zero | South Africa | 2021 | 1 | 1 | 1 | 3.0 | 1 | 3 | 2.0 | 0 | 0 | 1 | 1 | 0 | 1.2 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 9.2 |

| 99 | Fusion Bank | Hong Kong | 2020 | 1 | 1 | 1 | 3.0 | 1 | 5 | 3.0 | 0 | 0 | 0 | 0 | 0 | 0.0 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 9.0 |

| 100 | Bankiom | UAE | 2020 | 1 | 1 | 1 | 3.0 | 1 | 2 | 1.5 | 0 | 1 | 0 | 1 | 0 | 1.2 | 1 | 1 | 1 | 2.0 | 1 | 1.0 | 8.7 |

Notes: Scores for ING Global are based on group retail banking.

Source: TABInsights

Brian Lo is a seasoned risk professional with nearly 30 years of experience across global financial institutions. Based in Hong Kong and Singapore, he has led teams in managing market and liquidity risk, counterparty risk, and asset and liability management. His expertise encompasses quantitative modelling, risk governance, stress testing, and regulatory compliance. Brian has also played a critical role in developing internal risk models, driving strategic initiatives, and advising on cutting-edge risk solutions, including AI and machine learning applications. Throughout his career, he has served on multiple risk committees, providing strategic insights to senior management and boards, and has been instrumental in implementing Basel reforms and risk management innovations. Brian’s approach integrates deep technical knowledge with practical leadership, making him a valuable contributor to banking risk management education and practice.

Urs Bolt is a seasoned professional with over 35 years of expertise in wealth management, investment banking, and technology. He helps individuals achieve financial well-being and advises senior leaders in financial services and technology on refining business strategies, developing markets, and forging impactful partnerships. Recognised as a global thought leader in digital banking, WealthTech, and decentralised finance, Urs is an active speaker, author, and jury member for esteemed awards and panels. A passionate advocate for sustainable progress, he champions energy policies that balance economic growth and ecological preservation through scientific solutions.

Sina is Chief Data Officer at Unique AG – a rising European startup providing a GenAI-driven platform called Unique.AI to better understand customers and build more meaningful client relationships. Unique.AI is a tailored solution for the financial industry that aims to increase productivity by automating manual workload through AI and ChatGPT solutions.

Sina is a proven GenAI and data transformation specialist for financial applications with over 20 years of experience. Before Unique AG, Sina led data strategy projects at Credit Suisse AG and worked as a consultant at Accenture AG. She lectures on GenAI, AI Governance, and Data Protection at top universities like HSG St. Gallen and HEC Paris, inspiring future tech leaders. Sina also mentors startups on GenAI applications and serves on the ISO expert council in Switzerland. She was recently honored with the “Women in Banking and Fintech 2024” award for her Thought Leadership on Data Protection and AI Governance for GenAI applications for Financial Services by Handelsblatt (#1 business newspaper in Germany). Sina holds a PhD in Financial Modeling from the University of St. Gallen (HSG, Switzerland) and a Diploma in Economics from the University of Mannheim (Germany).

John Januszczak is a seasoned fintech leader and the President & CEO of UBX Philippines, the fintech venture studio and fund of Union Bank of the Philippines. He was appointed to this role after joining UnionBank as a Consultant in 2018. Prior to this, he served as the Chief Operating Officer of Manulife Philippines and held leadership roles such as Head of Global Business Process Management at Manulife Financial and Vice President of Product Management at Meta Software Corporation. His extensive experience in operations, technology, and financial services has positioned him as a key driver of digital transformation in the fintech space.

Under John’s leadership, UBX has grown into Southeast Asia’s fastest-growing fintech, building a robust ecosystem that helps startups and fintech founders access expertise, funding, and customers. He has spearheaded the incubation of award-winning ventures such as i2i, SeekCap, and BUX, while also managing a corporate venture fund that successfully invests in and scales fintech startups. By leveraging corporate ecosystems, open finance, and embedded finance, John continues to drive financial inclusion, innovation, and strategic growth in the Philippine fintech landscape.

Jonny Fry led initiatives around blockchain and digital assets within the regulated banking environment at ClearBank. With over three decades of experience in financial services, Jonny is widely recognised as a thought leader in digital innovation. He is currently the CEO of TeamBlockchain, Chairman of Gemini Capital UK, and author of Digital Bytes, a weekly publication analysing blockchain developments. At ClearBank, he focused on integrating digital asset strategies to support institutional-grade infrastructure for next-generation financial services. In 2022, he was named CryptoAM’s “Influencer of the Year.”.

David Parsons is an accomplished technology executive with over 25 years of experience leading digital financial infrastructure initiatives across the US and Europe. As Chief Technology Officer at NiftyOne, he drives innovation, technology strategy, and platform development. His expertise spans go-to-market strategies, business development, and regulatory frameworks, underpinned by a strong track record of working with global technology providers, hardware manufacturers, and software developers. David’s strategic vision and hands-on leadership have consistently enabled the successful deployment of scalable, secure, and compliant digital solutions in the financial sector.

Helen Child is the Founder and CEO of Open Banking Excellence (OBE), the world’s leading community of Open Banking and Open Finance pioneers. With a legacy of innovation rooted in her family’s 400-year history in banking, Helen’s journey includes founding the UK’s first e-Money Licence Issuer to be awarded licences by Mastercard and Visa. She has played a pivotal role in the development of the UK’s Open Banking ecosystem and has become a global ambassador for the movement, advising governments and regulators in emerging markets like Brazil and Saudi Arabia.

Sandeep Deobhakta is a veteran financial services leader and design innovator with over 35 years of experience spanning banking, wealth management, and bancassurance across ten countries. He has held senior roles at major institutions including Citibank, Shinsei Bank in Japan where he helped transform it into an award-winning digital retail bank using Human-Centered Design and VP Bank in Vietnam, where he drove significant retail banking growth. Most recently, he served as President & CEO of Manulife China Bank Life Assurance Corporation in the Philippines, steering innovation in bancassurance and strategic partnerships.

A champion of innovation at the intersection of finance and design, Sandeep is currently pursuing PhD research focused on AI and Design Thinking in financial services. He is the author of Banking by Design (2024) and teaches fintech at Dai Nam University in Vietnam.

With over 25 years of experience in strategy, finance, banking, and innovation, Rafiza Ghazali currently serves as the CEO of KAF Digital Bank, where she is responsible for the development and operationalisation of the retail/consumer digital bank. She brings deep expertise in corporate finance, Islamic finance, and fintech to her leadership role.

Previously, she was the Group CEO of Cradle Fund, where she played a key role in transforming Malaysia’s early-stage funding and venture capital ecosystem. Her extensive C-suite experience spans across various sectors including consumer products and services, energy, property, and media—where she has contributed to enhancing performance, governance, and sustainability. Rafiza is a Chartered Accountant with the Australian Institute of Chartered Accountants. She also holds a Postgraduate Diploma in Strategy and Innovation from the University of Oxford and a BSc in Economics from the London School of Economics. She is passionate about creating meaningful impact through digital innovation in banking and advancing financial inclusion. She is also deeply committed to fostering a culture of collaboration, diversity, and excellence across her teams and stakeholders.

Tiravat Assavapokee is currently the Executive Vice President and Head of Data Intelligent and IT Integration Division at KASIKORNBANK Public Company Limited, one of Thailand’s leading financial institutions. He is recognized as a pioneer in data science and AI transformation in the Thai banking sector, with more than two decades of international and domestic experience in data strategy, analytics, and operations research.

Prior to joining KASIKORNBANK, Dr. Assavapokee held several key leadership positions, including Executive Vice President for Data Innovation at Krung Thai Bank, and Executive Vice President for Business Intelligence at SCB. He also served in various leadership and senior analytics & data science roles at Capital One Bank ,Walmart and Manhattan Associates in the United States.

Dr. Assavapokee began his career in the U.S., where he also served as Assistant Professor in the Department of Industrial Engineering at the University of Houston. With over 21 years of studying and working in the United States and 8 years in Thailand, his career reflects a deep integration of global best practices with local business innovation.

He holds a Ph.D. and M.Sc. in Industrial and Systems Engineering from the Georgia Institute of Technology, another M.Sc. in Industrial and Manufacturing Engineering from Oregon State University, and a B.Sc. in Computer Science from King Mongkut’s Institute of Technology Ladkrabang (KMITL), Thailand.

Dr. Assavapokee is passionate about building data-AI driven organizations, fostering data-AI talent, and advancing responsible AI adoption in financial services.

John Januszczak is the former President and CEO of UBX, the fintech company originally established by UnionBank of the Philippines. Since assuming leadership in 2018, he has transformed UBX into a leading force in open and embedded finance across Southeast Asia. Under his guidance, UBX has processed billions in transactions, empowered more than 250,000 businesses, and forged strategic partnerships with global leaders such as SBI Holdings.

With a career spanning over three decades, John brings a wealth of experience in financial services, technology, and operations. Prior to UBX, he served as Chief Operating Officer at Manulife Philippines and held senior roles at Manulife Financial, MAXIMUS, and Meta Software Corporation. His expertise encompasses global business process management, product development, and digital transformation.

John is also a prominent advocate for financial inclusion and open finance. He chairs the European Chamber of Commerce of the Philippines' Special Committee on Open Finance and Financial Inclusion and has served on the boards of leading fintech and energy firms including PETNET, FinScore, Dragonpay and Solviva.

A native of Canada, John holds a degree in Astrophysics from the University of Toronto. His unique blend of scientific rigor and business acumen positions him at the forefront of fintech innovation in the region. John is a sought-after speaker at major industry events such as InsureTech Connect Asia and the Future Bank Working Group, where he shares insights on digital transformation, embedded finance, and the evolving fintech landscape.

With over 22 years of experience in transaction banking, treasury, and finance across Asia and the USA, Ankur Kanwar drives strategic growth and innovation in his dual leadership roles. As Head of Transaction Banking for Singapore and ASEAN, he oversees business growth and operational excellence in one of the region's most dynamic markets. In his global role as Head of Structured Solutions Development for Cash Management, he leads a team of experts in creating advanced cash management solutions for clients worldwide.

Ankur has helped large corporates optimise cash and treasury operations and spearheaded the adoption of transformative digital solutions to meet evolving industry needs. Before joining Standard Chartered, he held senior roles at JP Morgan Chase in Singapore and New York, leading transaction banking regulatory products and enhancing liquidity structures for corporate clients. His expertise in regulatory insights, treasury management, and balance sheet optimisation makes him a key influencer in transaction banking across ASEAN and beyond.

Allen Ng is Group Head and Principal Economist at the ASEAN+3 Macroeconomic Research Office (AMRO). He leads the Regional Surveillance group, which is responsible for the annual flagship ASEAN+3 Regional Economic Outlook and related updates.

He was previously the Chief Economist of Securities Commission Malaysia (SCM), where he was also a member of the International Organization of Securities Commissions’ Committee on Emerging Risks and a board member of the Institute for Capital Market Research Malaysia. Prior to SCM, Allen was Director of Research at Khazanah Research Institute, and before that he spent more than a decade in the Central Bank of Malaysia.

Sebastien joined Deutsche Bank in 2010 and currently leads Institutional Cash & Trade for APAC, based in Singapore. He oversees cash and trade businesses for institutional clients across the region, supported by a team of 50. Previously, he headed Trade Finance Distribution for APAC and led the Distribution franchise for the Middle East & Africa. With experience spanning Europe, Russia & CIS, and MEA, he has managed syndications and trade finance across major markets. Before Deutsche Bank, he spent nine years at BNP Paribas, focusing on loan syndications in the oil, gas, and commodities sectors.

Christo Georgiev is a seasoned financial technology executive with a strong track record in driving business growth and operational excellence across Southeast Asia. He is the founder and CEO of LenderLink, a company focused on advancing credit and lending innovation.

From 2019 to 2024, Christo served as Group COO and Country Manager (Philippines) at FinScore, a leading alternative credit scoring company. Under his leadership, the firm achieved 100% year-on-year revenue growth, forged strategic partnerships with over 30 top-tier financial institutions, and significantly broadened its market footprint and data capabilities. He led initiatives that processed millions of alternative data points monthly, advancing financial inclusion for the underbanked and unbanked.

Christo played a key role in raising $1.9 million from investors, including UBX Ventures (UnionBank of the Philippines’ CVC arm), and co-led FinScore’s successful exit to CTOS Digital of Malaysia in 2023. Following the acquisition, he remained with the company through its transition before stepping down in 2024 to launch LenderLink. Since 2012, Christo has held leadership roles across Operations and Business Development in Southeast Asia, building a reputation for strategic impact and execution in emerging fintech markets.

Frankie Shuai is the APAC Chief Information Security Officer (CISO) at DWS, Deutsche Bank Asset Management, with over two decades of experience in Financial and IT industries. As a seasoned leader, he previously directed cyber and technology risk at UBS for Singapore, Australia, and New Zealand, and has held positions at Citibank, Microsoft, and HP. Frankie is renowned for bridging the gap between cybersecurity and business agendas, evidenced by his frequent speaking engagements at industry events. His commitment to digital transformation and innovation is underscored by a patent for next-generation wireless networking filed with the United States Patent and Trademark Office, where he serves as the sole inventor. In his current role at Deutsche Bank Asset Management, he leads regional Information Security, contributing significantly to the institution's cybersecurity resilience.

David Gee is a distinguished former Global Head of Technology, Cyber, and Data Risk at Macquarie Group, celebrated for his transformative leadership across multiple industries and geographies. With over 25 years at the helm as CIO and CISO, including pivotal roles at HSBC Asia Pacific and MetLife, David has been instrumental in driving major digital transformations. He is notably recognized as the CIO of the Year 2014 for his strategic overhaul at Credit Union Australia, significantly enhancing their core and digital banking platforms. His latest book, The Aspiring CIO & CISO, published in July 2024, is a comprehensive guide for emerging leaders aiming to excel in top IT roles, offering strategies to develop leadership skills, build personal brands, and navigate executive challenges effectively.

Stephen Tjokro is a Business Development Director, Global Fraud Solutions at GBG. He has a keen interest in fraud management, cybersecurity, digital risk protection and enterprise software. With deep expertise in fraud management, he helps businesses navigate fraud risk challenges in an evolving digital landscape. Beyond his professional expertise, Stephen prioritises fitness and stays informed on emerging technology advancements, ensuring he remains at the forefront of innovation.

Patrick Schueffel is an adjunct professor at the School of Management Fribourg (HEG) in Switzerland, where he specialises in fintech, entrepreneurship in banking and finance, and innovation. His academic work is complemented by extensive professional experience in the financial services industry, having held senior and C-level roles at institutions in Switzerland and Liechtenstein, including Chief Operating Officer positions at Sora Bank and Saxo Bank (Switzerland). Earlier in his career, he served as a senior manager at Credit Suisse’s headquarters in Zurich, where he led a global innovation team.

Dr Schueffel also represented HEG Fribourg internationally during a three-year assignment in Singapore. His research has been widely published in leading academic journals and practitioner outlets, making a significant contribution to the fields of financial innovation and international business. He holds a doctorate from the University of Reading/Henley Business School, and postgraduate degrees from the Norwegian School of Economics (NHH), the University of Mannheim, and Henley Business School.

Kelvin Teo is the co-founder and Group CEO of Funding Societies | Modalku. He has been a key member of the Singapore FinTech Association’s Digital Finance Subcomm since 2018 and recently named by the Association as among the Top 12 Fintech Leaders in Singapore in 2020. As one of the Top 200 FinTech Influencers in Asia, Teo has spoken at major conferences such as LendIt Shanghai, Boao Hainan and Money20/20. He has also been featured on Bloomberg, BBC and Business Times. Prior to this, Teo served as a consulting professional at KKR, McKinsey and Accenture.

You're just one step away from unlocking this content.

Become a Member today for full access.