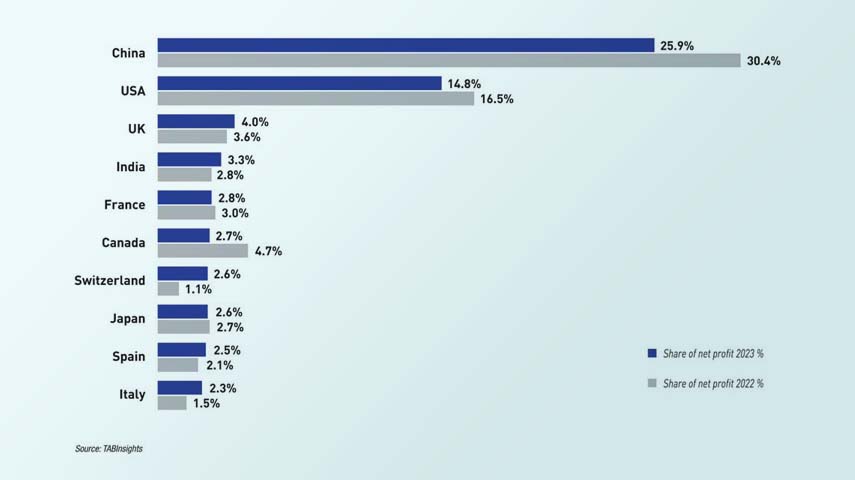

Kotak Mahindra Bank is the most profitable bank in India, while State Bank of India reports the largest net profit. Indian banks place fourth globally in net profit share, surpassing France.

Our latest insights

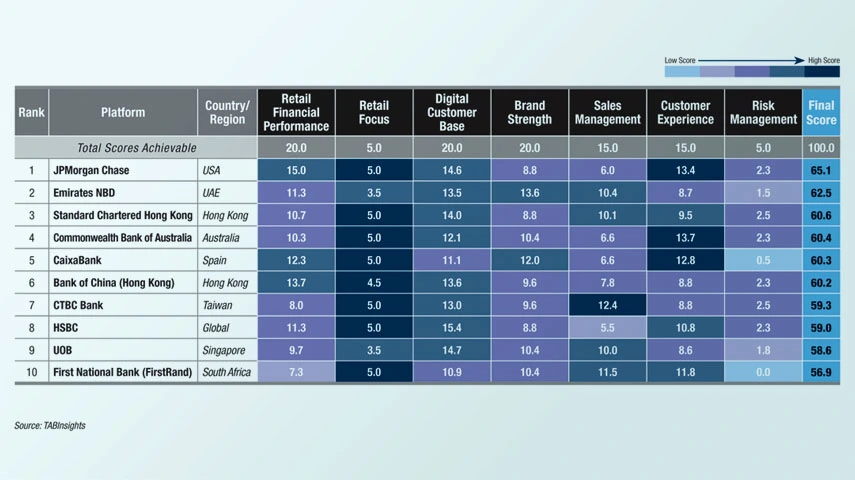

JPMorgan Chase, Emirates NBD and Standard Chartered Hong Kong top TABInsights World’s Best Retail Banks Ranking, with the top 50 banks showing modest improvements in retail profitability.

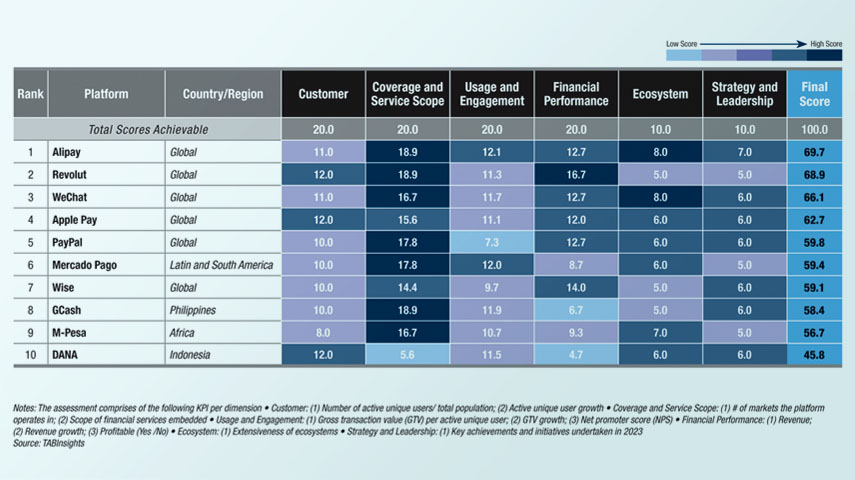

Asia is leading in financial platform development and adoption, with Alipay building a vast ecosystem and global reach, while Revolut excels in user acquisition and financial performance.

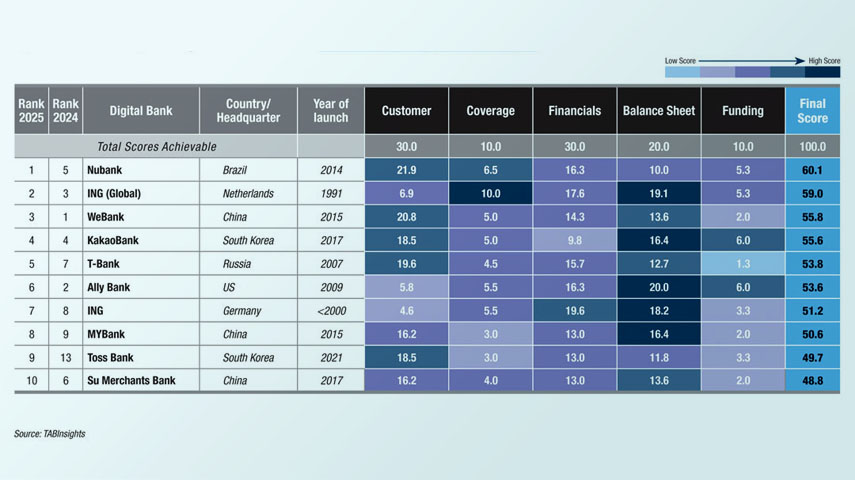

Digital banks continue to experience rapid growth in users, assets and revenue, with Brazil’s Nubank, the retail arm of ING Group and China’s WeBank leading the sector. Profitability among digital banks has improved, with a shorter time to break even.

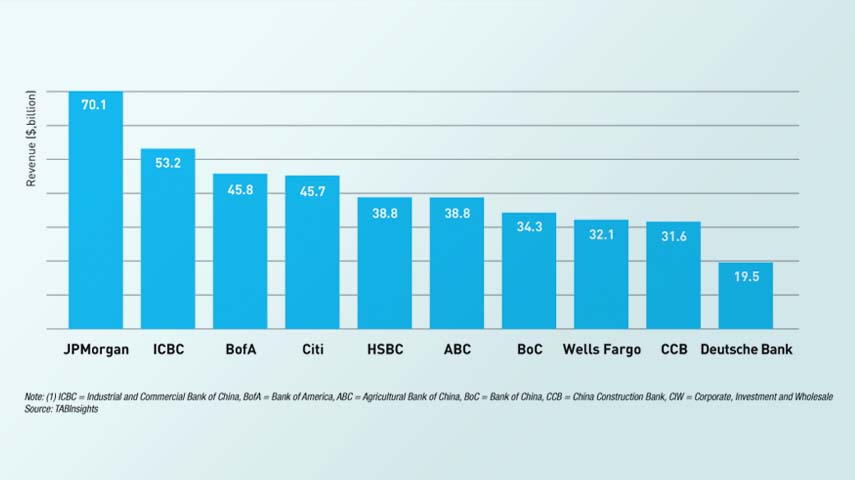

Chinese banks dominate the world’s top 10 banks by net profit, but their profit growth lagged behind US and UK banks, mainly due to rate cuts, narrowing profit margins.

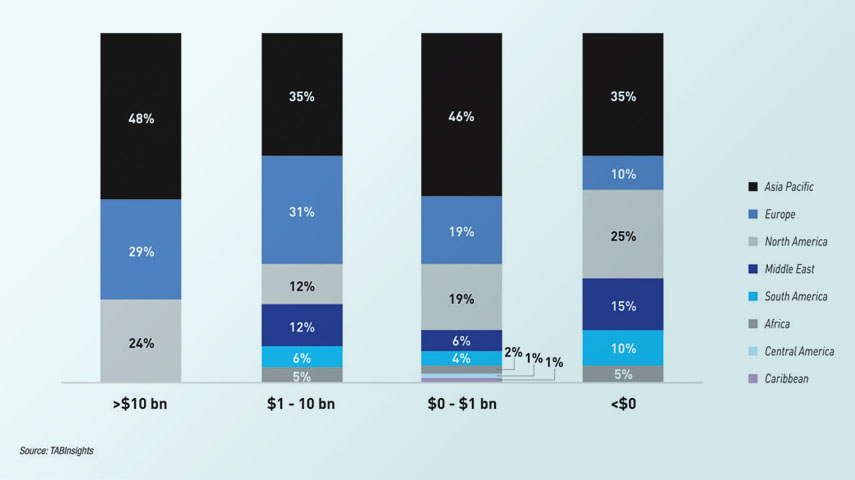

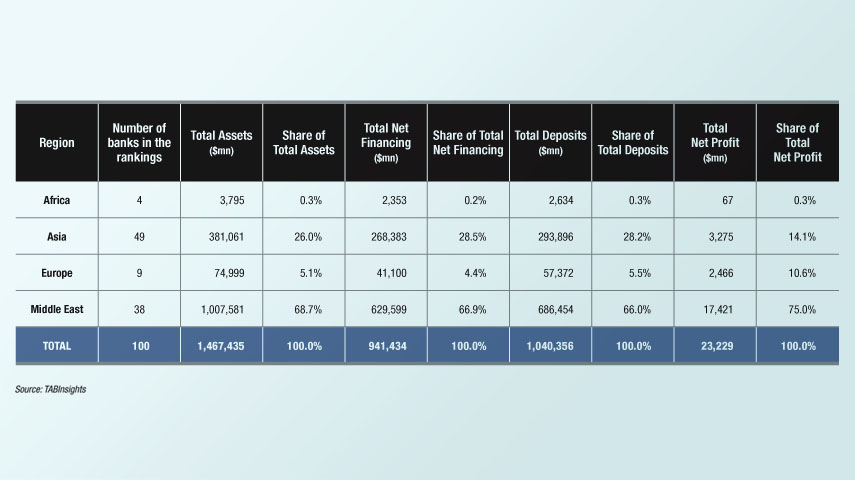

Islamic banks in Saudi Arabia display exceptional financial strength, with Al Rajhi Bank maintaining its position as the largest and strongest Islamic bank worldwide.

Purchase our reports

China Construction Bank, in cooperation with The Asian Banker, conducted a survey on the international use of the RMB in cross-border trade, payments, investment, and financing.

The Philippines BankQuality™️ Consumer Survey (BQS) and Rankings rely on responses from a representative online survey of 1005 customers in Philippines, conducted between January and February 2024.

The Indonesia BankQuality™️ Consumer Survey (BQS) and Rankings rely on responses from a representative online survey of 2095 customers in Indonesia, conducted between January and February 2024.

The recent global outage of Microsoft systems, affecting various sectors, including several financial institutions,

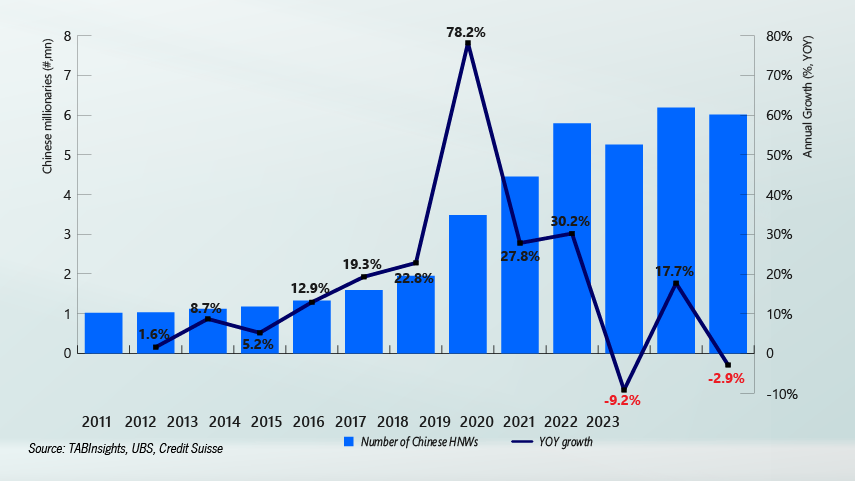

China’s wealth market has quickly grown to become the world’s second largest. It is expected to return to its growth trajectory in 2024, with a total value of $100 trillion by 2025.

The China BankQuality™️ Consumer Survey (BQS) and Rankings rely on responses from a representative online survey of 2095 customers in China, conducted between January and February 2024.

Case Studies

Rapid regional growth and evolving consumer demands have spurred banks like UOB to redefine their operational frameworks. With challenges in ensuring cost-efficiency, scalability and adaptability within the integration process is crucial.

Rapid industry shifts and growing customer demands drive banks like Axis to enhance their technological frameworks.

In the digital banking sector, leading institutions are reshaping digital finance through innovation, customer experience, and financial inclusion. Nubank, a leading entity in Latin America's digital banking sector, is in the early stages of d