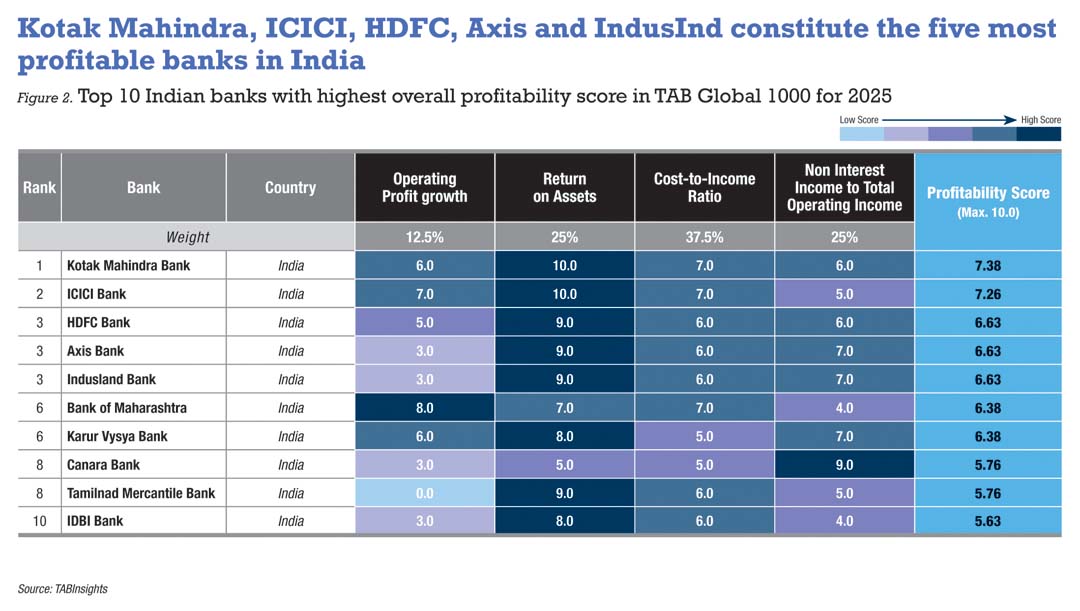

Kotak Mahindra Bank and ICICI Bank secured the top two positions, while Axis Bank, HDFC Bank and IndusInd Bank are tied for third among the most profitable banks in India in the financial year (FY) ending 31 March 2024, according to the TAB Global 1000 World’s Strongest Banks Ranking 2025. Bank profitability is assessed through four key indicators: operating profit growth, return on assets (ROA), cost-to-income ratio (CIR) and non-interest income to total operating income ratio.

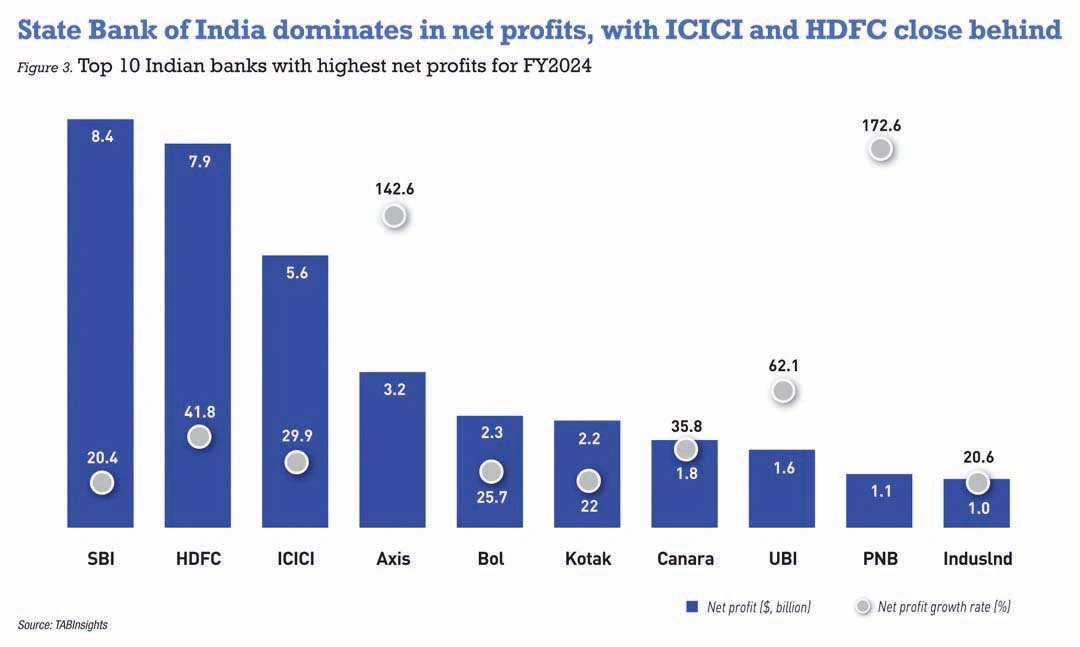

Among the top 10 banks in India by net profit, five are state-owned, and five are from the private sector. State Bank of India (SBI) recorded the highest earnings among Indian banks at $8.4 billion in FY2024, with HDFC Bank close behind at $7.9 billion, and ICICI Bank rounding up the top three with $5.5 billion.

Indian banks have risen in the global rankings of net profit share

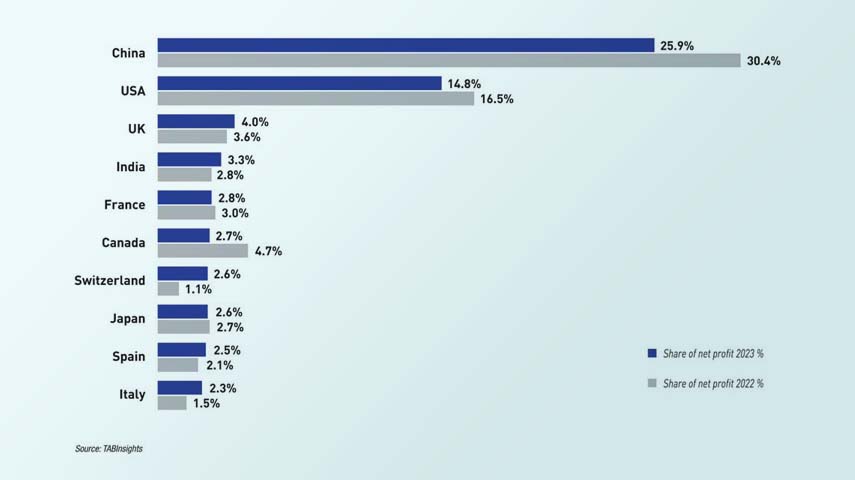

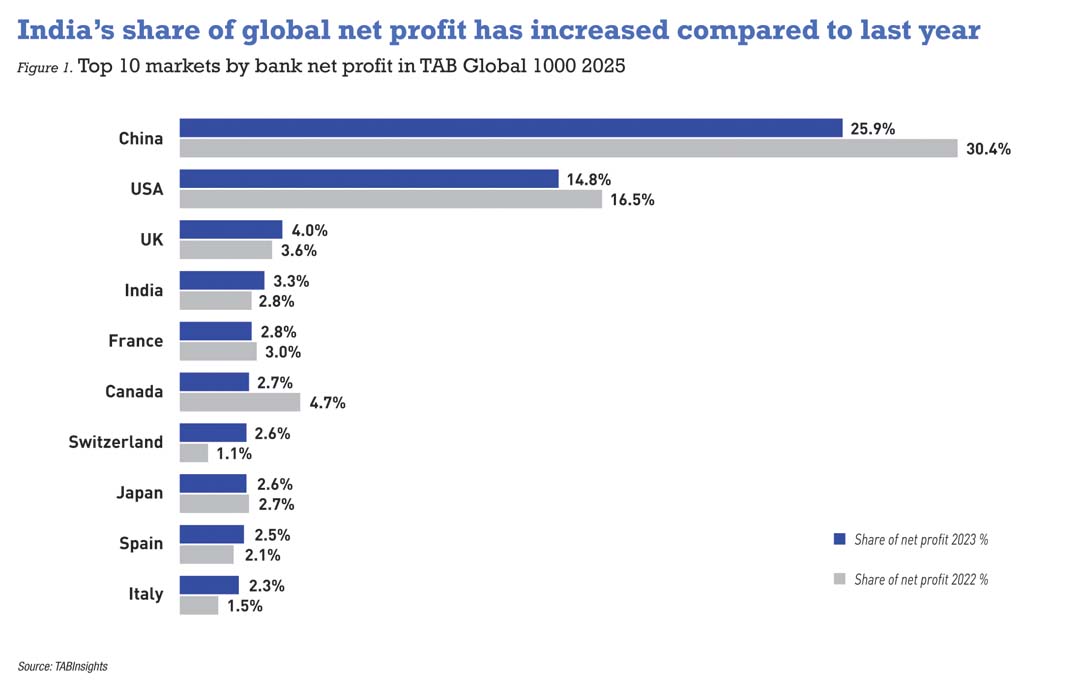

India is among the three Asian countries in the global ranking of banking sectors’ net profits, holding a 3.3% share of the total profits generated by banks globally. India has advanced from sixth to fourth place in net profit share, overtaking France, which has moved to fifth place. This improvement reflects the strong performance and strategic initiatives of Indian banks, driving higher profitability on the global stage.

A key factor behind this growth is credit expansion, which has boosted interest income. This trend is supported by a stable economic environment and rising demand for loans. The Reserve Bank of India has played a critical role in maintaining financial stability through effective regulatory oversight. Additionally, investments in technology have enhanced operational efficiency and customer service, resulting in cost reductions and higher profitability.

Chinese banks continue to dominate global net profit, accounting for nearly 26% of the total, compared with 14.8% for the United States and 4% for the United Kingdom. However, China’s share had declined to 26% from 30.4% in the previous year.

Meanwhile, Canadian banks have slipped from third to sixth place, reflecting the impact of an economic slowdown, higher inflation, and rising interest rates. These factors have weakened consumer spending and borrowing, constraining bank revenue growth.

Kotak Mahindra Bank’s strategic growth and financial performance

Kotak Mahindra Bank secured the highest score for profitability among the Indian banks in the TAB Global 1000 World’s Strongest Banks Ranking 2025, reflecting its strategic initiatives and strong financial performance. In FY2024, the bank achieved a 22% increase in net profit, reaching $2.2 billion, primarily driven by higher lending income. Net interest income (NII) rose by 21.4% to $4 billion, with loans and deposits expanding by 19.8% and 21.5%, respectively.

To strengthen its market position, Kotak Mahindra Bank acquired a 100% stake in Sonata Finance and the personal loan portfolio of Standard Chartered India. These acquisitions aimed to strengthen its retail lending business by incorporating a high-quality loan book and extending its reach among affluent customers.

Kotak Mahindra Bank reports the highest return on assets (ROA) at 2.7%, surpassing ICICI Bank’s 2.2% and HDFC Bank’s 1.9%. However, ICICI Bank demonstrates superior operational efficiency with the lowest CIR at 43%, compared with Kotak Mahindra’s 45% and HDFC Bank’s 48%. This efficiency is largely driven by its significant investments in technology and digital banking solutions, which enhance operational performance. Additionally, the bank benefits from economies of scale and effective cost management strategies, further strengthening its profitability.

SBI leads the Indian banking sector with the highest net profit

The SBI reported the highest net profit among Indian banks, amounting to $8.4 billion in FY2024. This performance places SBI sixth in the Asia-Pacific region and 28th globally. The bank’s success is attributed to its status as a state-owned institution, which provides government support and stability.

SBI’s performance is reflected in its ROA of 1.1% and net profit growth rate of 20.4%. The bank has improved operational efficiency, reducing its CIR from 56.3% in FY2023 to 55.8% in FY2024. SBI’s performance highlights its role in the Indian banking industry and its position in the global financial sector.

HDFC Bank, the leading private sector bank with the largest market capitalisation among Indian banks, reported net profits of $7.9 billion and a net profit growth of 41.8%. With a ROA of 1.9%, the bank reflects efficient use of assets. Following its merger with its parent company in 2023, HDFC Bank’s asset base expanded significantly. The merger enhanced the bank’s product offerings, expanded its customer base and improved operational efficiency. It also strengthened the bank’s financial position, providing access to low-cost funds and enabling geographic expansion.

The merger helped position HDFC Bank as a stronger and more competitive player in the financial sector, driving sustainable growth and serving a broader range of customers. However, the bank’s CIR rose from 40.5% to 48%, highlighting the need for better cost control.

Punjab National Bank (PNB) secured the fifth position in the ranking of banks based on net profit. Its net profit growth was primarily driven by recoveries of written-off accounts and a rise in net interest income. PNB’s net profit growth of 172.6% can be attributed to its lower provisioning for bad loans, gains from treasury activities and improved asset quality. Nonetheless, the decline in core operating profit highlights areas the bank needs to address to ensure sustainable growth.