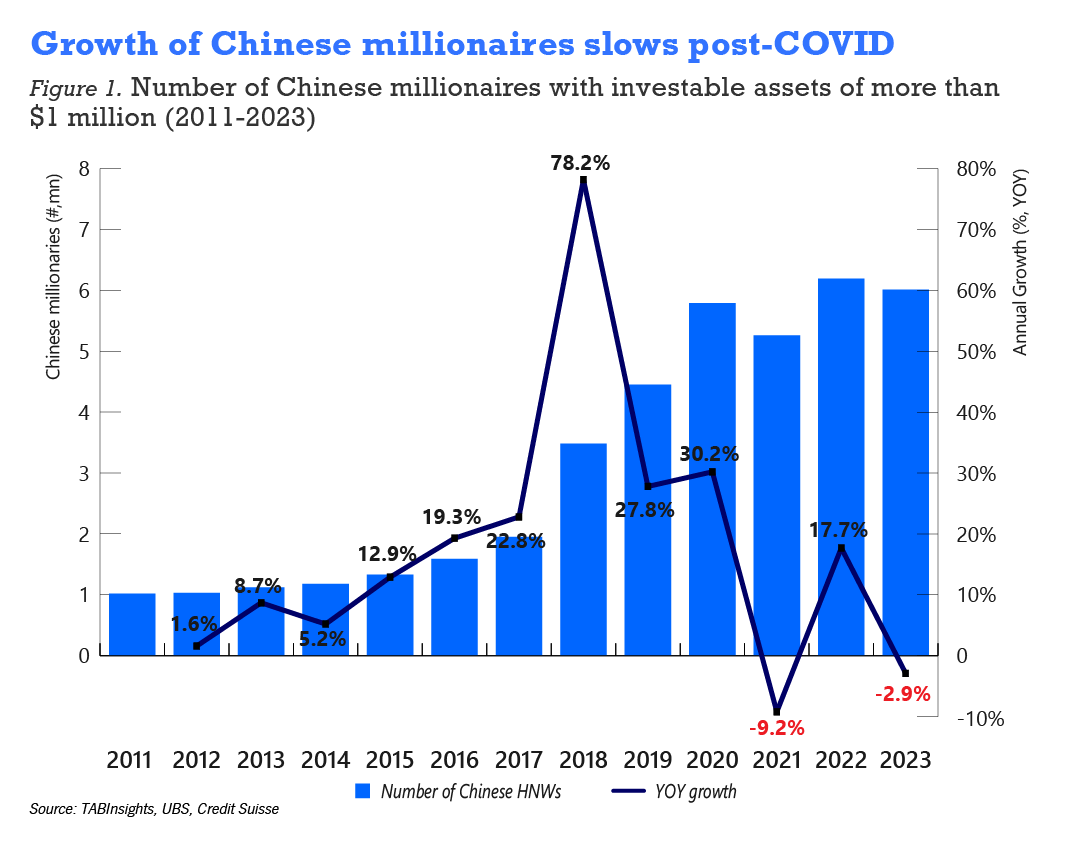

Chinese private banks are facing a fundamental shift in how they approach client relationships and service delivery in an increasingly complex market environment. The landscape for Chinese private banking and entrepreneur services has markedly changed since its golden era between 2011 and 2021, when China witnessed nearly fivefold growth in its millionaire population. Recent data indicates a concerning trend, with assets under management (AUM) declining by 2.7% in affluent wealth management and 4% in private banking and entrepreneur services segments while the millionaire populations shrunk by 2.9% in 2023.

The transformation is particularly striking considering China's private banking and entrepreneur services journey, which began in 2007 amid unprecedented wealth creation. This era saw the emergence of a new entrepreneurial class, driven by technological innovation, property development and investment, and robust economic growth. These business owners, who now constitute between 60% and 70% of private banking and entrepreneur services clients in China, were the primary engine of the sector's rapid expansion.

However, growing geopolitical tensions and economic uncertainties have fundamentally altered these entrepreneurs' priorities. Their focus has shifted from wealth accumulation to business preservation and sustainability - protecting the very enterprises that generated their wealth in the first place. This shift represents not just a change in investment strategy, but a broader reassessment of risk and opportunity in China's evolving business landscape.

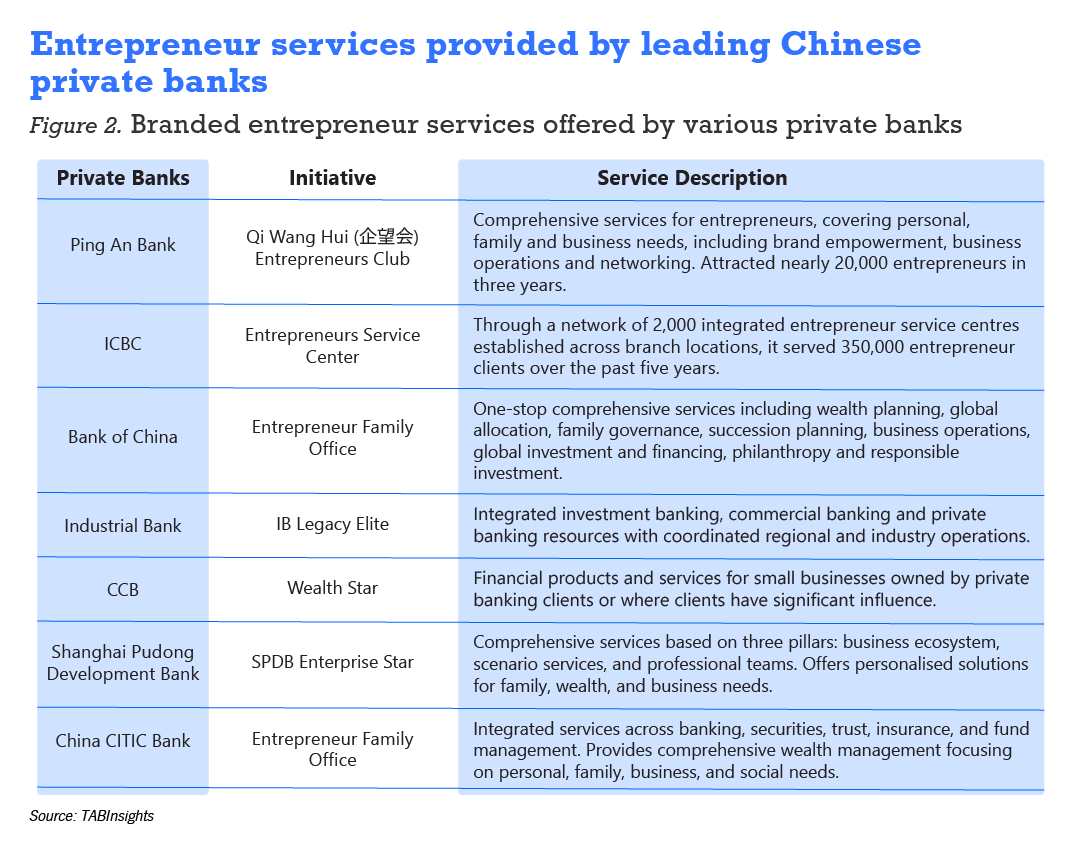

Against this backdrop, leading private banks have transformed their service model to address entrepreneurs' evolving needs. Beyond traditional wealth management, they now offer comprehensive solutions spanning business financing, strategic advisory, and operational support. This shift isn't merely strategic - it's fundamental to their survival and growth, given that entrepreneurs comprise the majority of their client base.

The new service model reflects a deeper understanding that in challenging economic conditions, an entrepreneur's primary concern is business sustainability rather than personal wealth accumulation. Private banks that successfully integrate business banking with wealth management services are better positioned to retain and grow their entrepreneurial client base. Some have established dedicated teams that combine industry expertise with financial advisory, while others have developed platforms connecting entrepreneurs with potential investors and business partners.

Entrepreneur-centric strategy emerges as key to future growth

The pivot towards entrepreneur services represents more than a mere diversification of revenue streams; it fundamentally reimagines the relationship between private banks and their business-owner clients. This approach addresses several critical challenges simultaneously, offering a compelling value proposition that combines personal wealth management with business growth support.

Private bankers need deep insights into their clients' businesses to provide relevant wealth management advice, while corporate banking teams require understanding of clients' personal financial objectives to structure appropriate business solutions. This interconnectedness explains why leading institutions are breaking down traditional departmental silos to create more integrated service models.

The strategic shift acknowledges the intricate connection between personal wealth and business success for entrepreneur clients. By providing integrated solutions that address both aspects, private banks are positioning themselves as essential partners in their clients' overall financial journey, rather than just wealth managers.

Notably, Industrial Bank's experience illustrates the potential of this strategy, particularly in leveraging the natural synergy between corporate and private banking and entrepreneur services services. Understanding that most of their private banking and entrepreneur services clients are entrepreneurs, the institution has successfully aligned its corporate and private banking and entrepreneur services divisions, achieving remarkable results in cross-selling and client acquisition.

In 2023, the bank reported gaining over 1,000 new corporate clients through its private banking and entrepreneur services relationships, representing a 53% year-on-year increase. This success has contributed to Industrial Bank maintaining the second-highest compound annual growth rate in private banking and entrepreneur services clients among joint-stock banks, averaging 18% over the past five years. The bank's success demonstrates how understanding and serving the dual nature of entrepreneur clients - as both business owners and high-net-worth individuals - can create a powerful growth engine for private banks.

The success of Industrial Bank's approach demonstrates how integrated services can create a virtuous cycle of growth. Business owners who receive effective support for their enterprises are more likely to entrust their personal wealth management to the same institution, while private banking and entrepreneur services clients are more inclined to leverage the bank's corporate services for their business needs.

ICBC Private Bank's nationwide approach demonstrates the power of scale in relationship banking. Through a network of 2,000 integrated entrepreneur service centres established across branch locations over the past five years, the bank has built deep relationships with more than 350,000 entrepreneur clients. The commitment to personal engagement is evident in their 2023 activity: over 260,000 enterprise visits and more than 390,000 face-to-face meetings with corporate executives. This intensive outreach strategy has yielded valuable insights into clients' evolving financial needs throughout their business lifecycle, driving measurable improvements in client loyalty and satisfaction.

The sheer scale of ICBC's engagement efforts underscores the commitment required to execute this strategic pivot effectively. These interactions go beyond traditional wealth management discussions, encompassing business strategy, industry trends, and operational challenges. This comprehensive approach helps build deeper relationships and creates multiple touchpoints between the bank and its entrepreneur clients.

Banks leverage operational transformation to serve entrepreneurs better

The execution of this strategic shift requires significant operational changes across Chinese private banks. Leading institutions are implementing comprehensive transformations of their service delivery models, focusing on three key areas: institutional framework redesign, service innovation, and execution capabilities.

The transformation begins with organisational structure. Banks are breaking down traditional silos between corporate and private banking and entrepreneur services divisions, creating integrated teams that can serve entrepreneur clients holistically. This requires new training programs, incentive structures, and communication channels to ensure effective collaboration across different business units.

ICBC has implemented large-scale changes at the branch level to support entrepreneur services, developing a digital service platform that now serves more than 350,000 entrepreneurs. This platform integration demonstrates how traditional private banking and entrepreneur services services can be enhanced through digital capabilities to meet the specific needs of business owner clients.

The digital platform represents more than just a technological upgrade; it serves as a fundamental reimagining of how private banking and entrepreneur services services are delivered. By combining traditional relationship management with digital capabilities, banks can provide more responsive, accessible and comprehensive services to their entrepreneur clients.

Industrial Bank has taken a different but complementary approach, focusing on building strong investment banking and capital market services for entrepreneurs. This specialisation has enabled the bank to offer sophisticated solutions that address both personal wealth management and business financing needs. The bank's success in this area demonstrates how specialised expertise can create significant competitive advantages in serving entrepreneur clients.

The creation of bank-wide synergies has emerged as a crucial success factor in serving entrepreneur clients effectively. This involves not only aligning corporate and private banking and entrepreneur services services but also building exclusive entrepreneur platforms that provide specialised advisory services. These platforms typically combine traditional wealth management offerings with business advisory services, creating a comprehensive ecosystem for entrepreneur clients.

The transformation underway represents a fundamental reimagining of private banking and entrepreneur services's role in China's financial landscape, with banks positioning themselves as key enablers of business growth and innovation in the broader economy. This strategic pivot could significantly influence how private wealth is deployed and managed in the years ahead.

The ability to seamlessly integrate personal wealth management with business support services will likely become the defining characteristic of successful institutions in China's private banking and entrepreneur services sector, determining which banks emerge as leaders in the next phase of development. Those that can effectively execute this comprehensive transformation while preserving their core strengths in relationship management will be best positioned to thrive in China's changing private banking and entrepreneur services landscape.