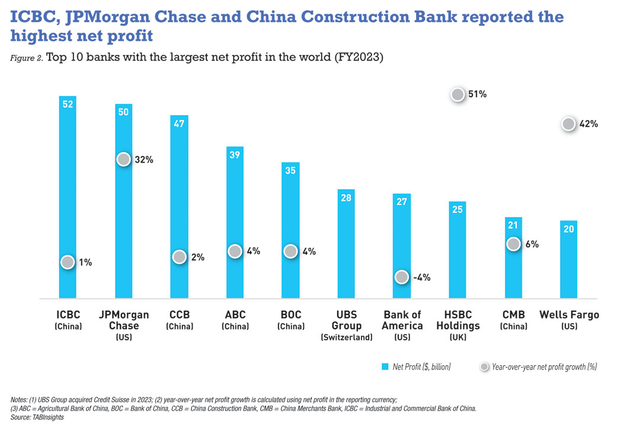

Industrial and Commercial Bank of China (ICBC) remained the bank with the largest net profit in the financial year (FY) 2023, while JPMorgan Chase of the United States (US) surpassed China Construction Bank (CCB) and Agricultural Bank of China (ABC) to claim the runner-up spot of banks with the largest net profits, according to the TAB Global 1000 World’s Largest Banks Ranking 2024.

The top 10 banks by net profit in FY2023 comprise five Chinese banks, three American banks and one each from Switzerland and the United Kingdom (UK). ICBC leads with a net profit of $52 billion, followed by JPMorgan Chase at $50 billion and CCB at $47 billion. UBS Group entered the top 10 with a net profit of $28 billion, following its acquisition of Credit Suisse. Bank of America and HSBC Holdings also made the top 10, with net profits of $27 billion and $25 billion, respectively. Citigroup and Industrial Bank, which saw profit decline 37% and 16%, respectively in FY2023, have fallen out of the top 10.

Asia Pacific banks lead in net profit

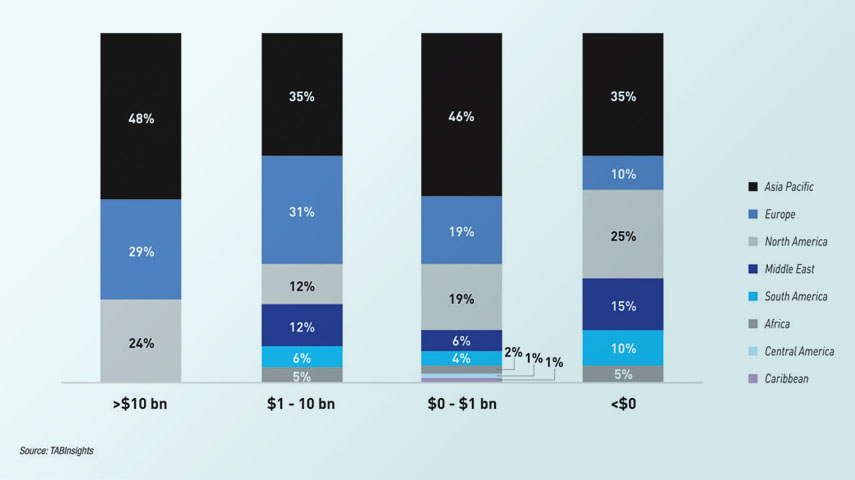

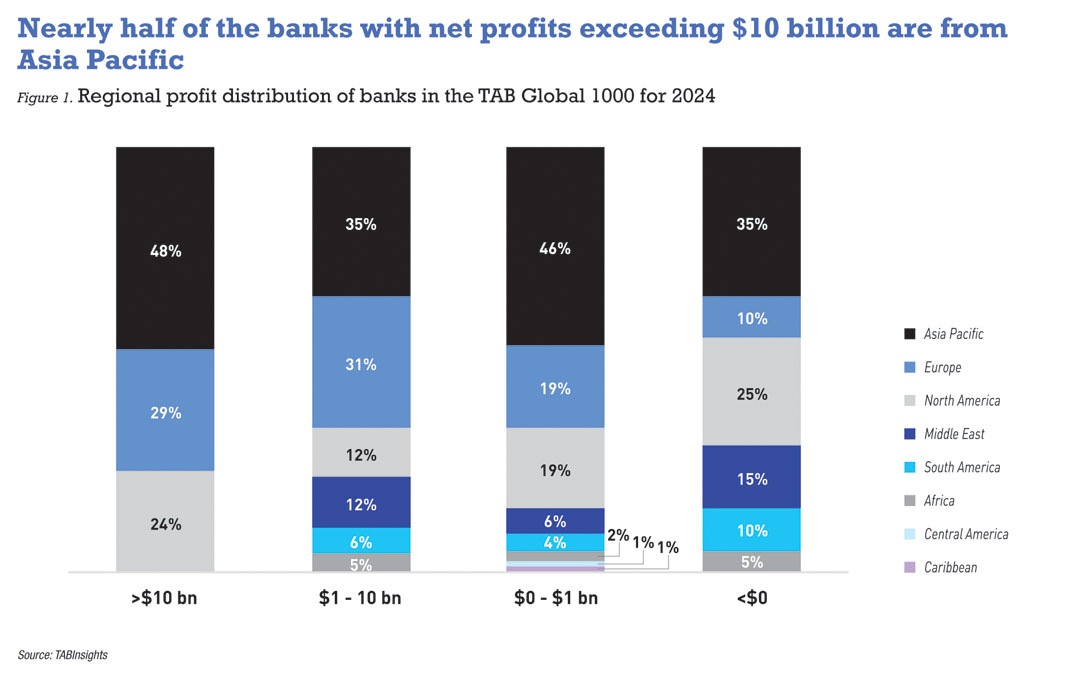

Among the world’s 1,000 largest banks, 21 reported net profit exceeding $10 billion in FY2023, including 10 banks from Asia Pacific, six from Europe, and five from North America. Notably, eight of the 10 Asia Pacific banks in this group are from China, highlighting the dominance of Chinese banks in the global banking sector. Additionally, 197 banks posted net profit between $1 billion and $10 billion, with 35% from Asia Pacific, 31% from Europe and 12 from North America.

In the Middle East, the banks with the largest net profits are Emirates NBD Bank at $5.9 billion, Saudi National Bank at $5.4 billion, and First Abu Dhabi Bank at $4.5 billion. United Arab Emirates (UAE) banks saw strong profit growth in FY2023, with Emirates NBD Bank and First Abu Dhabi Bank overtaking Al Rajhi Bank and Qatar National Bank to enter the top three banks by net profit in the region. In Latin and South America, the leading banks are Itaú Unibanco with $6.8 billion and Banco do Brasil with $6.6 billion. In Africa, Standard Bank Group reported the largest net profit of $2.7 billion.

Chinese banks retained the highest net profits despite subdued growth

Half of the world’s top 10 banks by net profit are based in China, including ICBC, CCB, ABC, Bank of China (BOC) and China Merchants Bank (CMB). However, Chinese banks saw subdued profit growth, facing challenges from weak loan demand and reductions in the five-year loan prime rate, amid a slowing economy and an ongoing property sector crisis.

The rate cuts, part of policy efforts to support strategic sectors with cheaper financing, and the repricing of existing mortgages resulted in a decline in the average net interest margin (NIM) for Chinese banks, from 1.91% in 2022 to 1.69% in 2023. ICBC reported a 6% drop in pre-impairment operating profit for FY2023, although its net profit grew by 0.8% due to lower loan loss provisions. CCB, ABC and BOC posted modest net profit increases of 2.3%, 4.2% and 4.1%, respectively. The large banks were more significantly affected due to their larger exposure to mortgages and infrastructure loans.

In FY2024, Chinese banks continued to face challenges with narrowing NIMs and declining profitability. The big four banks remained under pressure, as Beijing works to support the struggling property sector and stimulate economic growth.

US and UK banks showed mixed results

Among the world’s top 10 banks by net profit, JPMorgan Chase and Wells Fargo reported notable profit growth in FY2023, reversing decline from the previous year. JPMorgan Chase achieved a 32% increase in net profit, driven by higher margins, the strategic acquisition of First Republic Bank and its diversified operation, which offset weaker segments like investment banking. Wells Fargo reported a 42% profit growth, reaching $19 billion, primarily due to higher net interest income and lower operating expenses, resulting from operational streamlining and cost-cutting initiatives.

HSBC also posted significant profit growth, with a 51% rise in net profit. This increase was supported by higher net interest income across its global businesses, amid the rising interest rate environment, as well as gains from the sale of its retail banking operations in France and the acquisition of Silicon Valley Bank UK.

Bank of America was the only top 10 bank to report a decline in net profit in 2023, which fell by 4%. The bank faced challenges due to its significant exposure to fixed-income securities, which saw valuation decline as interest rates rose. Sluggish loan demand and narrowing margins in certain sectors further limited its ability to fully capitalise on higher interest rates. Additionally, increased operating expenses and higher credit loss provisions weighed on performance. However, when adjusted for special charges, net profit rose by 7% compared to 2022.

To view the TAB Global Largest and Strongest Islamic Banks Rankings, please visit https://tabinsights.com/ab100/strongest-islamic-banks