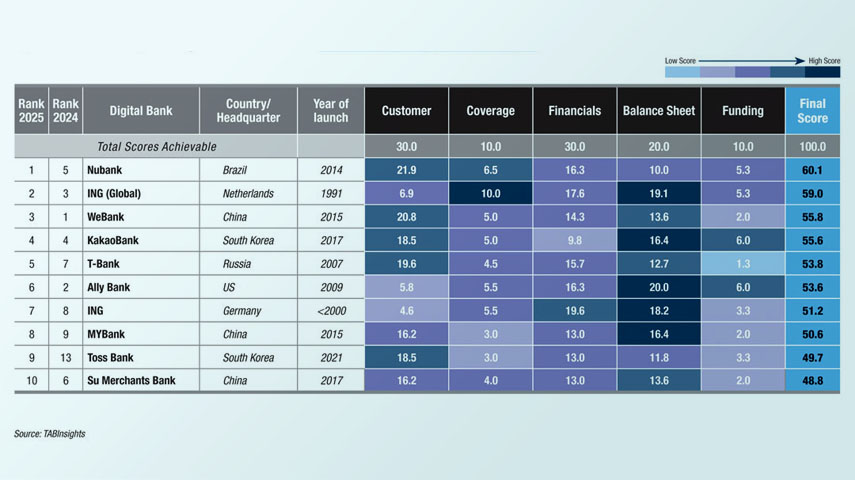

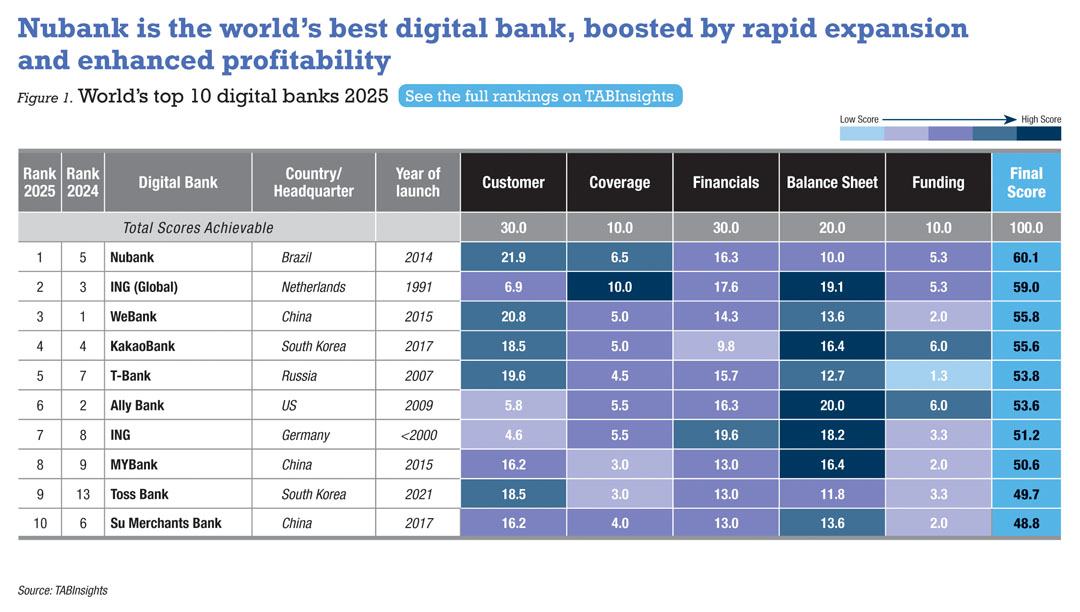

Brazil’s Nubank, the retail arm of ING Group and China’s WeBank lead the TABInsights World’s Top 100 Digital Banks Ranking 2025. This annual ranking highlights the most successful first- and second-generation digital banks out of more than 400 worldwide that operate independently of traditional commercial banks, providing a unique virtual customer experience.

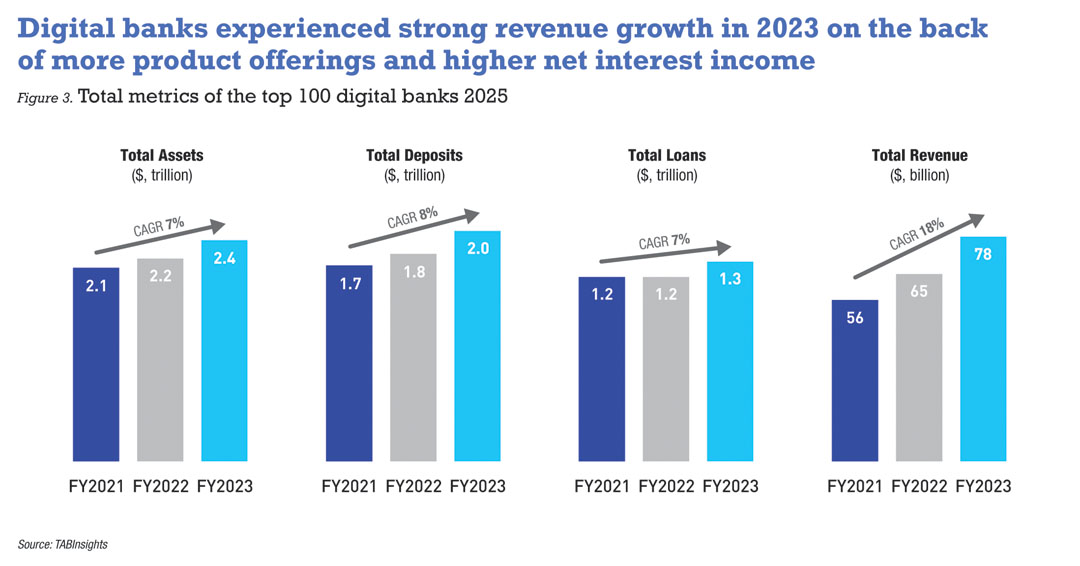

Collectively, these 100 banks held $2.4 trillion in total assets, $2 trillion in deposits, $1.4 trillion in loans and generated $78 billion in total revenue at the end of financial year (FY) 2023. The combined assets, loans, deposits and revenue of these banks grew at a compound annual growth rate (CAGR) of 7%, 8%, 7% and 18%, respectively, between FY2021 and FY2023, underscoring ongoing appeal and growth potential.

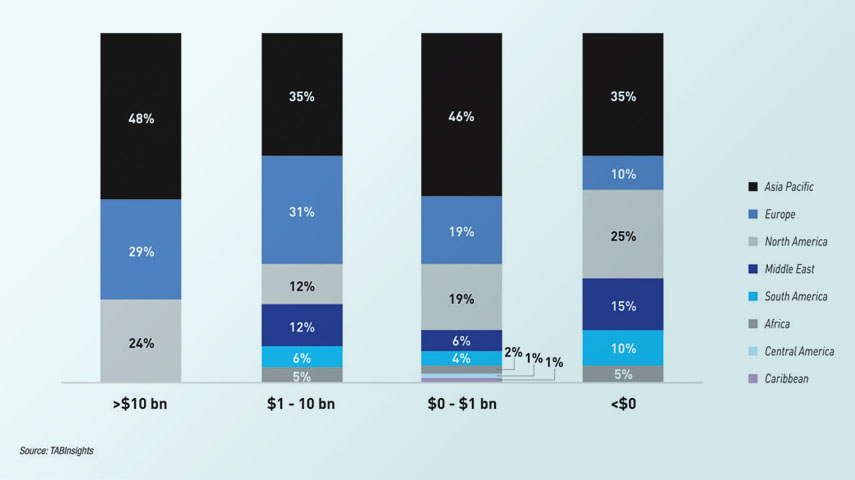

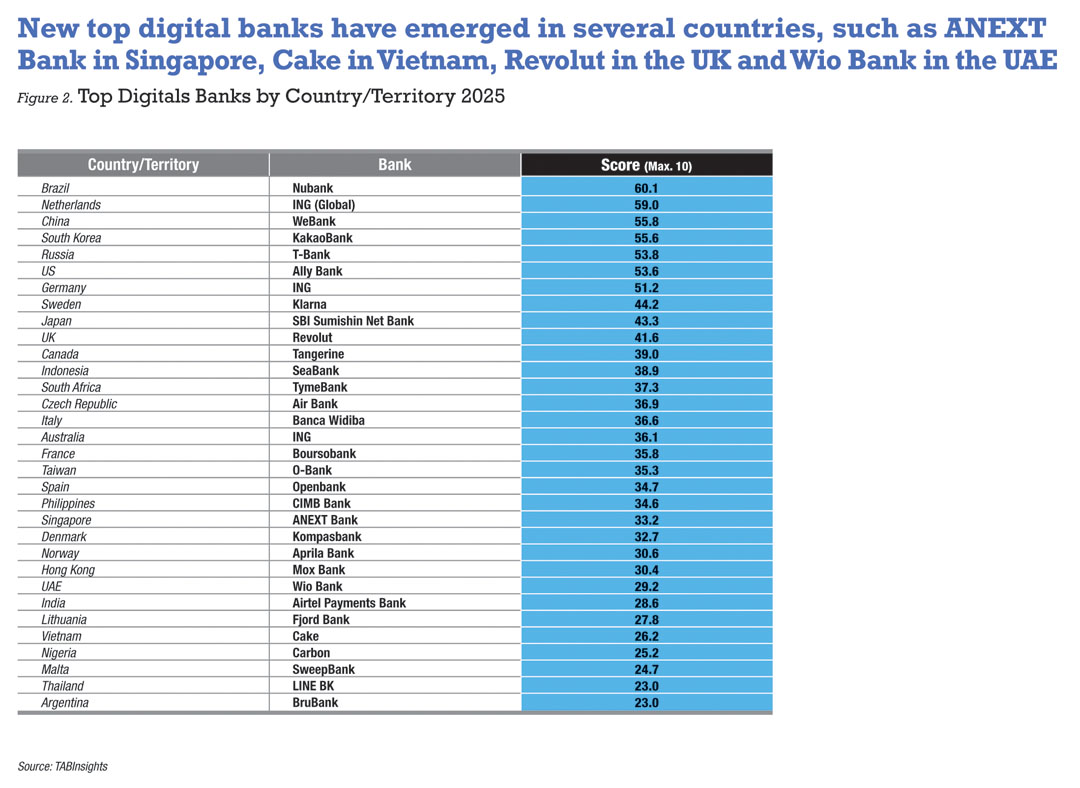

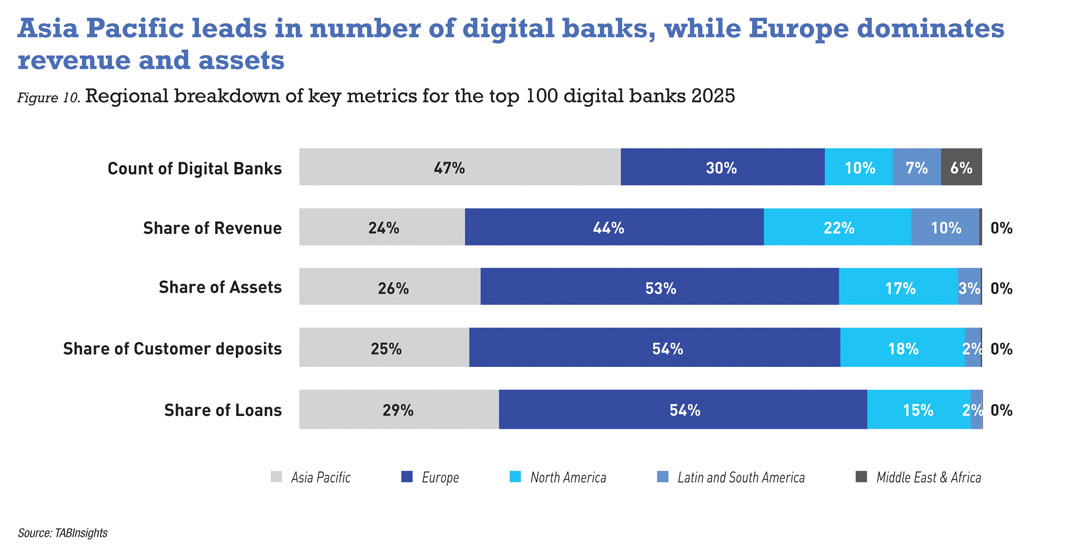

Of the top 100 digital banks, 47% are headquartered in Asia Pacific, 30% in Europe and 10% in North America. Despite their dominance in numbers, Asia Pacific digital banks have significantly lesser assets and revenue as compared to their European and American counterparts.

In the 2025 ranking, 61% of the top 100 reported full-year profitability, up from 48% in the 2024 ranking. However, the break-even ratio across all digital banks globally remains below 25%. The time taken for digital banks to reach break-even has shortened, with leading digital banks doing so in an average of two years. Meanwhile, interest income remains the primary source of revenue for most digital banks, although average loan-to-deposit ratio (LDR) declined slightly from 71% in FY2022 to 69% in FY2023, reflecting a more cautious approach to lending due to concerns over credit risks and costs.

More digital banks are expected to break even. Several digital banks, including Toss Bank of South Korea, South Africa’s TymeBank, the Philippines’ Maya Bank, Brazil’s C6, Sweden’s Klarna and Hong Kong’s ZA Bank, are anticipated to achieve profitability by end of 2024.

Top-ranked banks by country and region include TymeBank for Africa, WeBank for Asia Pacific, ING (Global) for Europe, Wio Bank from the United Arab Emirates (UAE) for the Middle East, Ally Bank from the United States (US) for North America, Nubank for Latin and South America, SeaBank from Indonesia for Southeast Asia and Revolut for the United Kingdom (UK).

World’s top 10 digital banks have an average pre-tax return on equity (ROE) of 22%

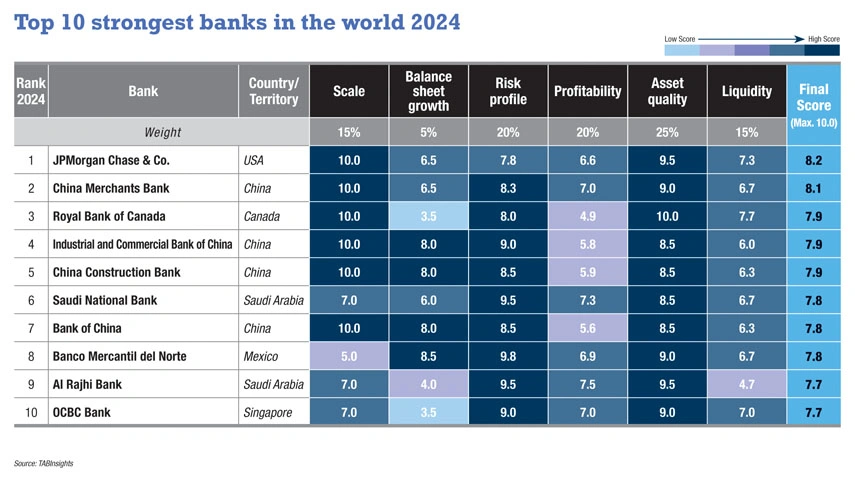

Nine of the top 10 digital banks in the 2024 ranking remain in the top 10 in 2025, with Toss Bank entering in ninth place and K Bank from South Korea dropping out. Overall, the top 10 digital banks have built substantial asset sizes and customer bases, ranging from $16 billion in asset and nine million customers, at the end of FY2023. On average, these top 10 banks offered 8.3 top-line products, compared to 6.6 for the top 100 digital banks. The top 10 digital banks show strong overall profitability, with an average pre-tax return on equity (ROE) of 22% and an average cost-to-income ratio (CIR) of 40%. All of these banks reported full-year profitability for FY2023, except for Toss Bank, which reached break-even by the third quarter of 2023.

Nubank climbed from fifth place in the 2024 ranking to first place in 2025, marking a significant milestone by achieving profitability in 2023 with a pre-tax ROE of 27%. The shift to a multi-product and service strategy since 2020 has driven notable user growth, nearly tripling its customer base from 33.3 million in FY2020 to 93.9 million in FY2023.

Its revenue surged by 85% in FY2023, driven by a 119% increase in net interest income and a 28% rise in fee and commission income. Additionally, its CIR improved from 66% in FY2022 to 36% in FY2023. Despite higher non-performing loans, Nubank demonstrated strong credit risk management, resulting in a record 10.2% risk-adjusted net interest margin in the fourth quarter of 2023, up from 5.3% in the same period in 2022.

Nubank allocates only a small percentage of its total operating expenses to marketing, averaging 8% of total operating expenses since FY2020, equivalent to less than $200,000 per year. Yet, it has emerged as one of Brazil’s most valuable brands, underscoring that brand value is shaped more by customer interaction, experience and empowerment than by traditional marketing efforts.

ING (Global), a first-generation digital bank with the largest asset size among digital banks, surpassed Ally Bank to secure the second position, outpacing both Nubank and WeBank in coverage, profitability and balance sheet dimensions. In FY2023, ING (Global) improved its profitability, achieving a 24% revenue growth driven by higher interest rates, following a 1% decline in FY2022 due to the discontinuation of retail operations in France and the Philippines. Its CIR improved from 62% in FY2022 to 51% in FY 2023.

WeBank has maintained the largest user base among digital banks worldwide, with over 399 million individual customers and more than 4.5 million micro, small and medium-sized enterprises (MSMEs), experiencing a monthly growth of 3.2 million customers in 2023. Despite a slowdown in income growth, the bank demonstrated financial resilience through strong operational efficiency, achieving a CIR of 32% and an impressive pre-tax ROE of 30% in FY2023. Its ongoing investment in research and development, with annual technology spending consistently exceeding 9% of revenue, enhances its technological capabilities and market competitiveness.

Steady growth in customer base, assets and revenue

Digital banks continue to expand their customer bases, although growth has moderated from the COVID-19 pandemic peak levels. The top 100 digital banks saw approximately 15% growth in their customer base in FY2023, demonstrating their strong appeal and potential for continued growth.

Several digital banks experienced strong customer acquisition, with growth surpassing 50% in FY2023. Notable performers include Z-Bank from China, Bank Aladin, Allo Bank and blu from Indonesia, bunq from the Netherlands, Maya Bank, Trust Bank from Singapore, Toss Bank and Cake from Vietnam.

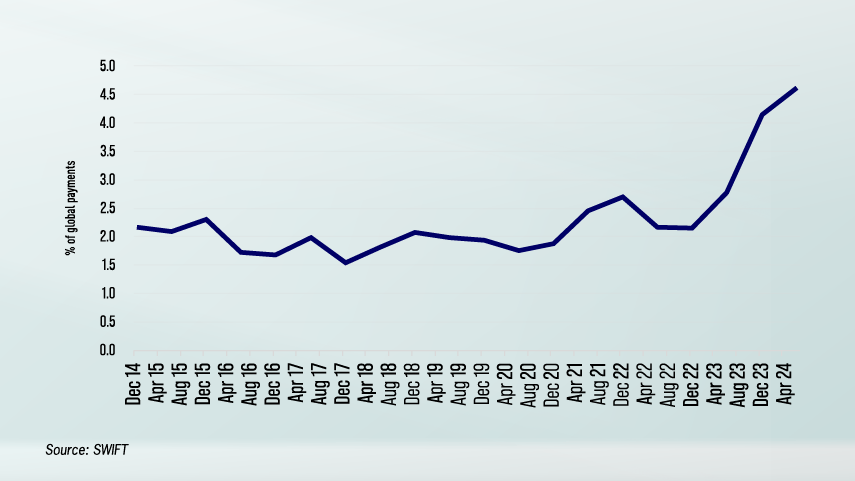

The world’s top 100 digital banks saw their assets reach $2.4 trillion by the end of FY2023, growing at an average annual rate of 7% from $2.1 trillion in FY2021. In comparison, the 100 largest traditional commercial banks worldwide held $117 trillion in assets, with an average annual growth rate of 2% from $112 trillion in FY2021. Despite the faster growth rate of digital bank assets, these accounted for just 2% of the total assets held by the 100 largest traditional commercial banks.

Combined deposits at the 100 digital banks increased by 8% annually, rising from $1.7 trillion in FY2021 to $2 trillion in FY2023, while loan growth averaged 7% annually, reaching $1.3 trillion over the same period. The average LDR among digital banks declined slightly from 71% in FY2022 to 69% in FY2023, reflecting a more cautious approach to lending due to concerns over credit risk and costs. Digital banks are more exposed to credit risk than traditional commercial banks, as most focus on serving underserved retail customers and SMEs.

The combined annual gross revenue of the top 100 digital banks reached approximately $78 billion in FY2023, up from $65 billion in FY2022 and $56 billion in FY2021. Growth in FY2023 was primarily driven by banks such as ING (Global), Nubank, Revolut and T-Bank. The 10 highest revenue-generating digital banks accounted for 68% of the total revenue in 2023, emphasising the relatively modest revenue among most digital banks.

Improved profitability of digital banks, with a shorter time to reach profitability

In the 2025 ranking, 61 of the top 100 digital banks reported profitability, a notable increase from 48 in 2024 and 29 in 2023. These banks benefited from higher interest rates, alongside their efforts to improve profitability. The profitable banks achieved an average ROE of around 16% in FY2023, up from 14% the previous year.

Asia Pacific accounted for 43%, followed by Europe at 34% and North America at 13%. Europe saw an increase in the number of profitable digital banks, with institutions such as bunq, Norway’s Aprila Bank and UK-based banks such as Allica Bank, Atom Bank, Monzo and Zopa Bank achieving full-year profit. Several digital banks in other regions attained full-year profitability in FY2023, including Nubank, Banco Inter, PicPay Bank, blu, UnionDigital Bank from the Philippines and Wio Bank. However, the overall break-even ratio across all digital banks globally remains low. Of the more than 400 digital banks worldwide, fewer than 25% are profitable.

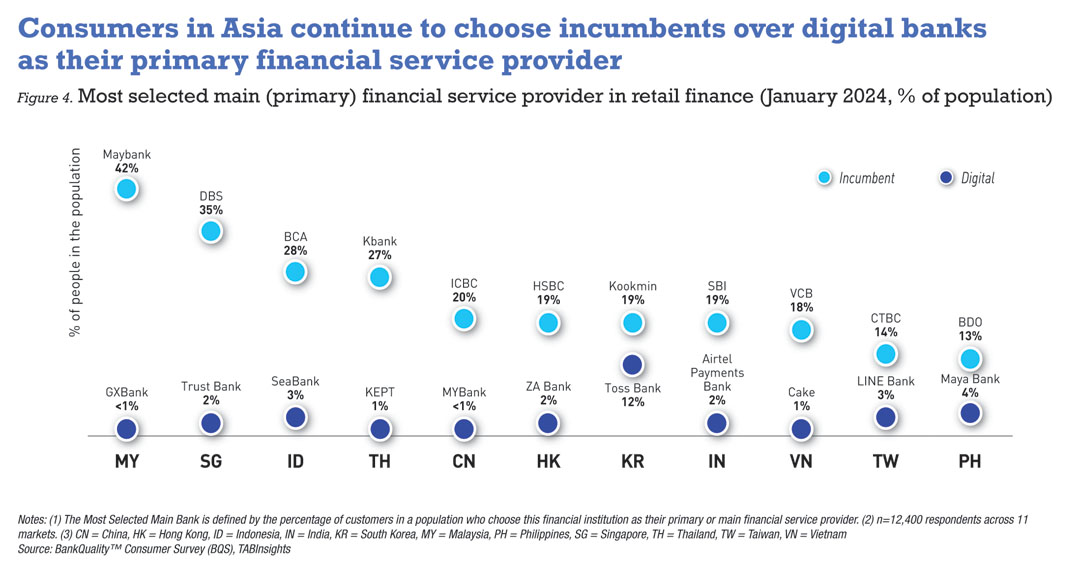

Meanwhile, most digital banks are still in the early stages of establishing primary banking relationships with their customers. However, in the US and South Korea, digital banks have made significant inroads. Digital banks and fintechs in the US accounted for nearly 50% of new chequing accounts opened in FY2023. In South Korea, the three digital banks had a combined deposit share of 4% at the end of 2023.

Nubank claims that as of September 2024, out of its 98.8 million registered users, about 60% are primary bank customers. In Asia, Mox Bank in Hong Kong claims that 28% of its 0.6 million user base are primary bank customers, which it defines as those using four products or more.

2024 and 2025 are expected to be pivotal years for more digital banks to reach break-even. Several digital banks, including Toss Bank, TymeBank, C6, Klarna and ZA Bank are anticipated to achieve full-year profitability. By the 2026 ranking of the world’s top 100 digital banks, the proportion of profitable digital banks is projected to exceed 70%.

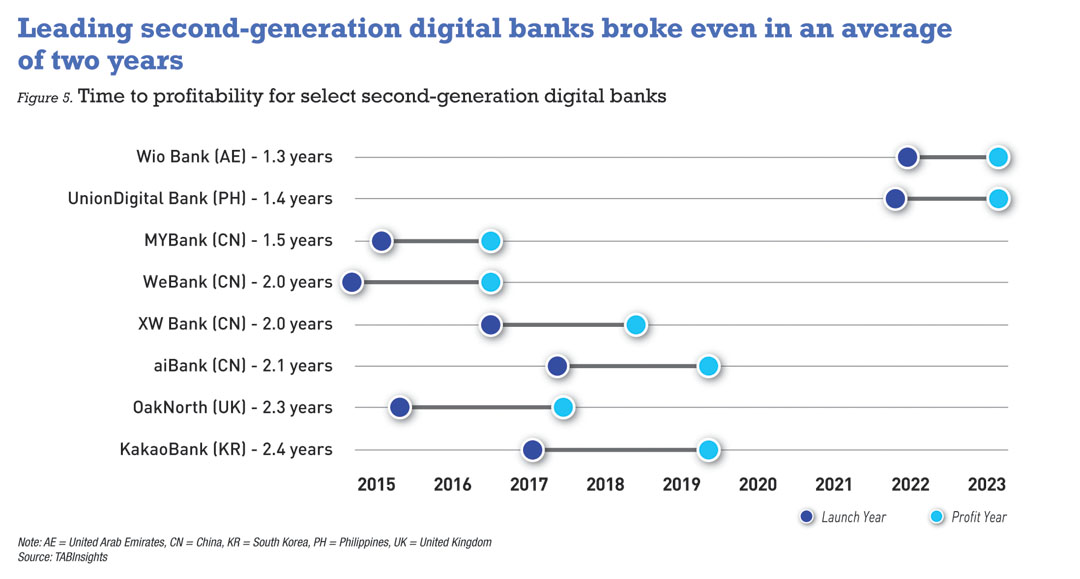

The timeline for digital banks to achieve their first full-year profitability has shortened over the years, decreasing from an average of five to six years to just two years for leading second-generation digital banks. Platform-based digital banks typically reach break-even even more quickly.

WeBank, MYBank, KakaoBank, OakNorth Bank, UnionDigital Bank and Wio Bank are among those that have reached this milestone in a relatively short time. Tencent-backed WeBank and Alibaba-backed MYBank, both launched in 2015, achieved profitability by 2016. KakaoBank, benefitting from its parent, Kakao, reached profitability in 2.4 years. SME-focused OakNorth Bank, launched in 2015, became the first UK digital bank to fully operate its core systems in the cloud and the first to break even in 2017. UnionDigital Bank, launched in 2022, became profitable in 2023, benefitting from substantial loan portfolio transfers from its parent, UnionBank of the Philippines, which expedited its path to profitability. Wio Bank, also launched in 2022, reached profitability in FY2023, driven by the rapid adoption of its platform banking solutions, Wio Business and Wio Personal.

Diversified revenue, with interest income remaining the primary source

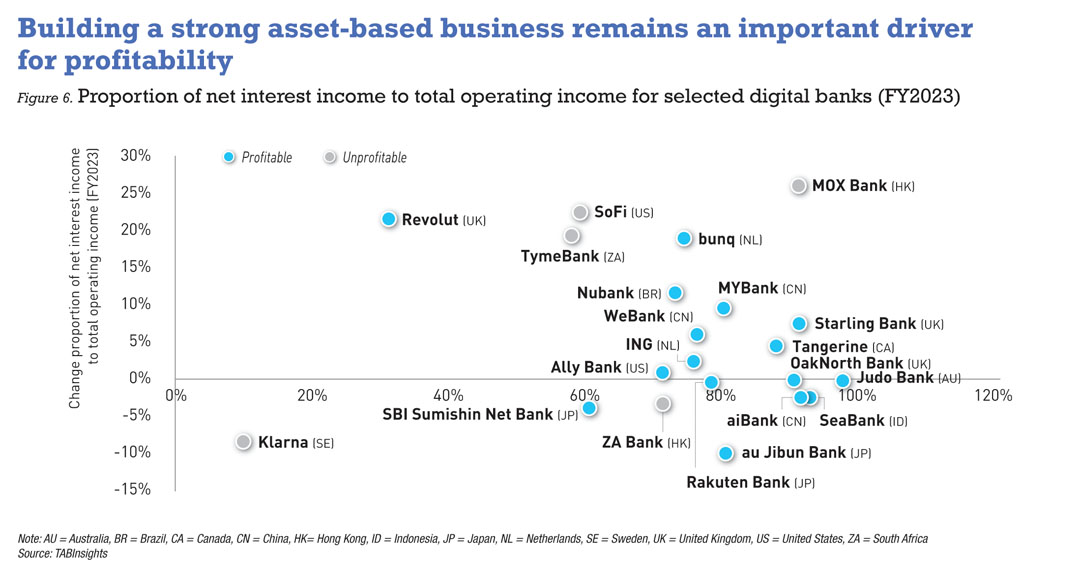

On average, the top 100 digital banks in the 2025 ranking offer 6.8 core products, up from 6.2 in 2024 and 5.4 in 2023. While digital banks are broadening their product offerings and diversifying revenue streams, interest income remains the primary driver. For instance, in FY2023, Nubank, ING Group’s retail arm and WeBank generated 73%, 76% and 77% of their revenue, respectively, from net interest income. Fee-based services, such as payments, help expand the customer base, but these typically yield lower margins. A well-developed lending business plays a significant role in enabling digital banks to achieve profitability.

In contrast, some digital banks, such as Revolut, place more emphasis on non-interest income and have also achieved strong profitability. In FY2023, Revolut’s net interest income accounted for just 32% of its operating income, up from 10% in FY2022. With a LDR of only 3.5% in FY2023, Revolut had a low reliance on lending. Its strong profitability in FY2023 was supported by robust performance across other revenue streams, such as payments, subscriptions, foreign exchange and wealth management.

In FY2023, the proportion of net interest income to total operating income for digital banks increased on average, partly driven by higher interest rates. Alongside Revolut, digital banks such as MOX Bank, TymeBank, bunq, Nubank, WeBank and MYBank also saw a significant rise in this ratio. While narrower net interest margins led to a decline in the share of net interest income for traditional commercial banks in China, WeBank and MYBank experienced an increase. In Japan, digital banks like au Jibun Bank and SBI Sumishin Net Bank saw a reduction in net interest income’s contribution to total operating income, due to margin compression from the country’s negative interest rate policy.

Most profitable and most cost-efficient digital banks

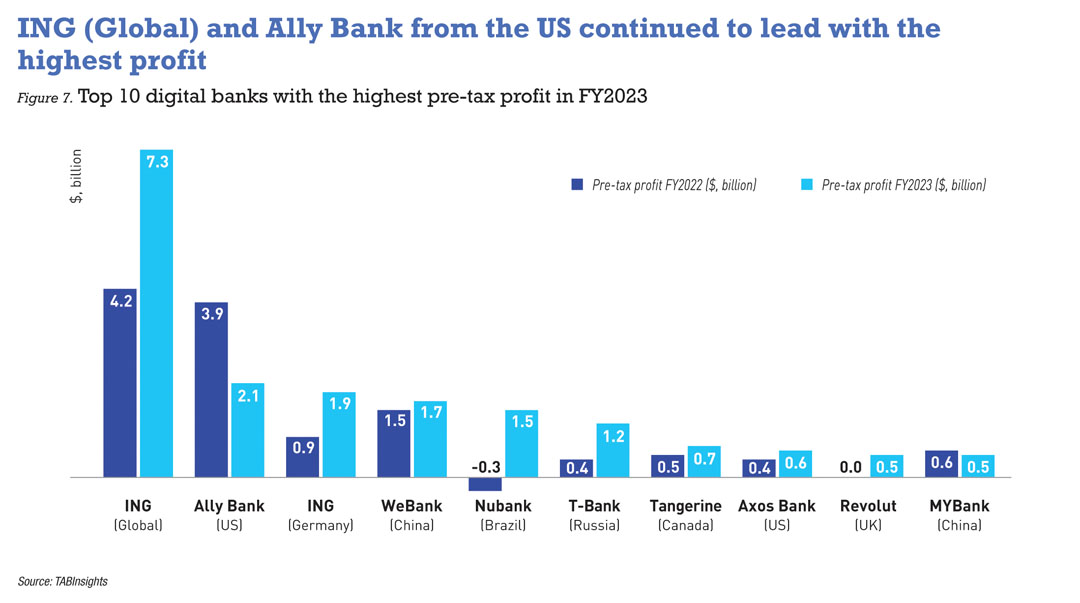

In FY2023, only nine digital banks reported pre-tax profit exceeding $500 million. ING (Global) and Ally Bank generated the highest pre-tax profit among digital banks, while ING Germany surpassed WeBank, ranking as the bank with the third-highest pre-tax profit. Additionally, Nubank and T-Bank experienced significant growth in pre-tax profit in FY2023, joining the small group of six digital banks with pre-tax profit over $1 billion.

ING (Global) achieved a 70% rise in pre-tax profit, reaching $7.3 billion, fuelled by higher interest rates and reduced provisions for credit losses. In contrast, Ally Bank saw a 46% decline in pre-tax profit, totalling $2.1 billion, as higher interest rates caused funding costs to outpace asset yields, while provisions for credit losses also increased.

C6 and Klarna recorded the largest losses in FY2023. C6’s pre-tax loss rose from $406 million in 2022 to $502 million in 2023, primarily due to increased provisions for credit losses. Klarna’s pre-tax loss narrowed significantly from $1 billion in 2022 to $308 million in 2023, driven by higher revenue, reduced operating expenses and lower consumer credit losses. Both digital banks experienced improved profitability in 2024.

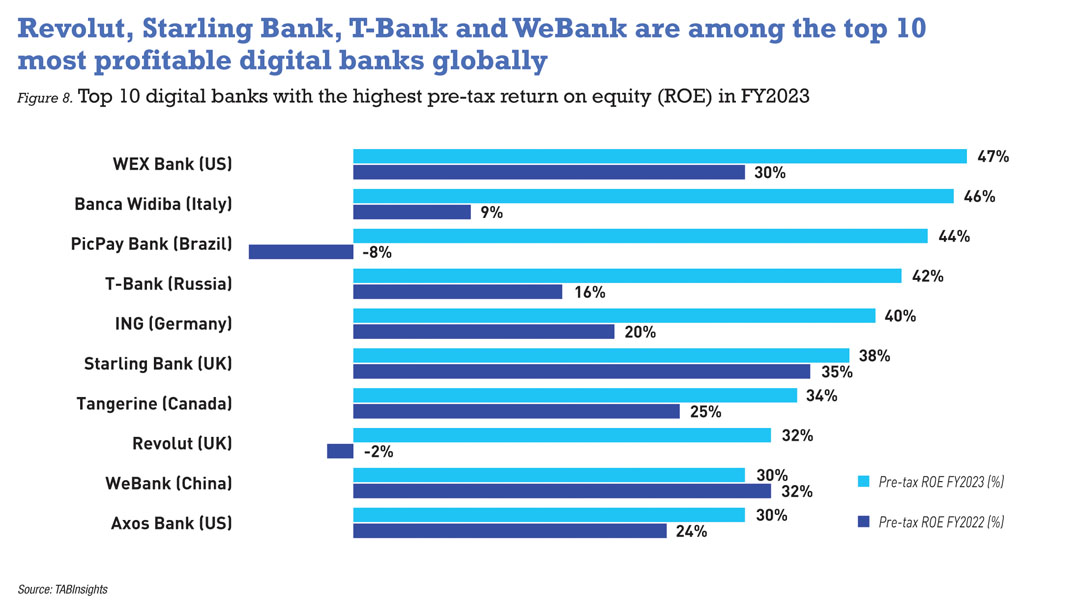

WEX Bank was the most profitable digital bank based on pre-tax ROE, achieving 47% in FY2023, up from 30% the previous year. A subsidiary of WEX, the bank specialises in high-margin business-to-business services, focusing on payment processing and corporate financing. Among the top 10 most profitable digital banks globally, Starling Bank and WeBank continued to report high pre-tax ROE, while Banca Widiba, PicPay Bank, Revolut, and T-Bank saw significant increases in pre-tax ROE in FY2023. Both Revolut and PicPay Bank achieved their first full year of profitability in FY2023. PicPay, based in Brazil, was granted a banking licence in 2022, allowing it to officially operate as a digital bank in the country.

Other digital banks such as bunq and UnionDigital Bank also reported notable increases in pre-tax ROE. In FY2023, bunq achieved a pre-tax ROE of 20%, marking a significant turnaround from negative 10% in 2022. UnionDigital Bank recorded a pre-tax ROE of 7% in 2023, improving from -34% in the previous year.

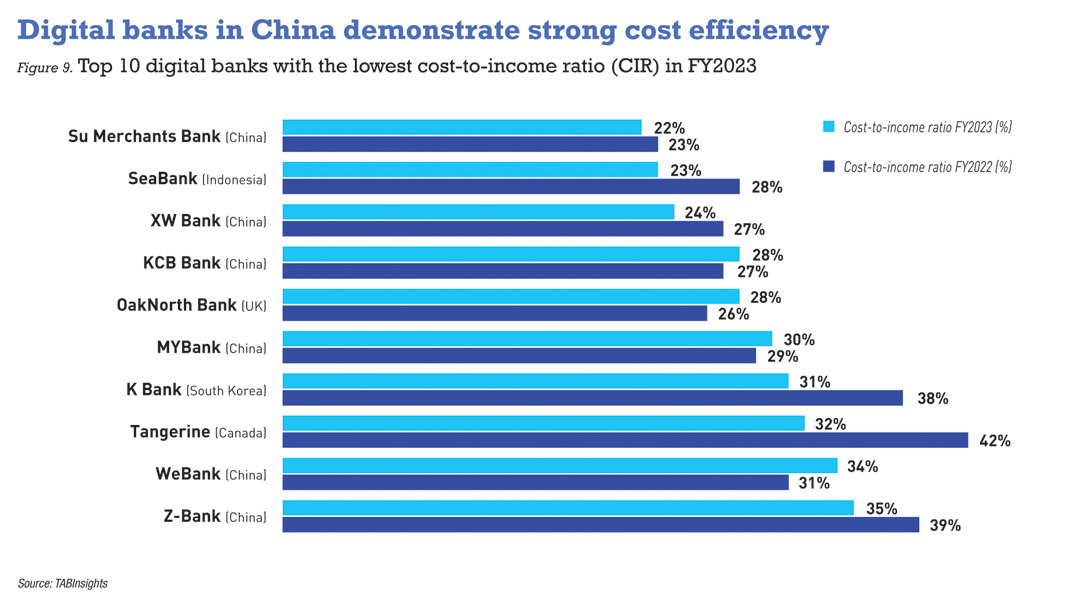

Overall, the cost efficiency of digital banks showed notable improvement in FY2023. Among the 2025 ranking of top 100 digital banks, 18 reported a CIR below 40%, an increase from 12 in 2024. In contrast, the number of digital banks with a CIR exceeding 100% fell to 33, down from 45 the previous year.

The top 10 digital banks with the lowest CIR in FY2023 include six from China, along with one each from Canada, Indonesia, South Korea and the UK. Among these 10 banks, Tangerine from Canada and K Bank recorded the largest enhancements in their ratios. Meanwhile, Su Merchants Bank from China maintained its position as the most efficient digital bank, achieving the lowest ratio at 22% in FY2023.

Regional analysis

Asia Pacific leads in the number of digital banks in the 2025 ranking, with 47 banks, followed by Europe with 30 and North America with 10. Latin and South America, along with the Middle East and Africa, contributed seven and six digital banks, respectively, to the ranking.

Europe stands out in terms of asset dominance, representing around 53% of the combined total assets of the top 100 digital banks. This is attributed to several well-established digital banks in Europe that have considerable asset bases. Although Asia Pacific has a higher number of digital banks, its shares of assets, deposits, loans and revenue are lower as compared to Europe. North America, despite having fewer digital banks, has a revenue share of 22%, slightly below Asia Pacific’s 24%. The Middle East and Africa hold the smallest share in terms of assets and revenue.

Asia Pacific

The top 10 digital banks in Asia Pacific include four from China, three from South Korea, two from Japan and one from Indonesia. Leading banks by market include ING of Australia, WeBank of China, Mox Bank of Hong Kong, Airtel Payments Bank of India, SeaBank of Indonesia, SBI Sumishin Net Bank of Japan, CIMB Bank Philippines, ANEXT Bank of Singapore, KakaoBank of South Korea, O-Bank of Taiwan, LINE BK of Thailand and Cake for Vietnam.

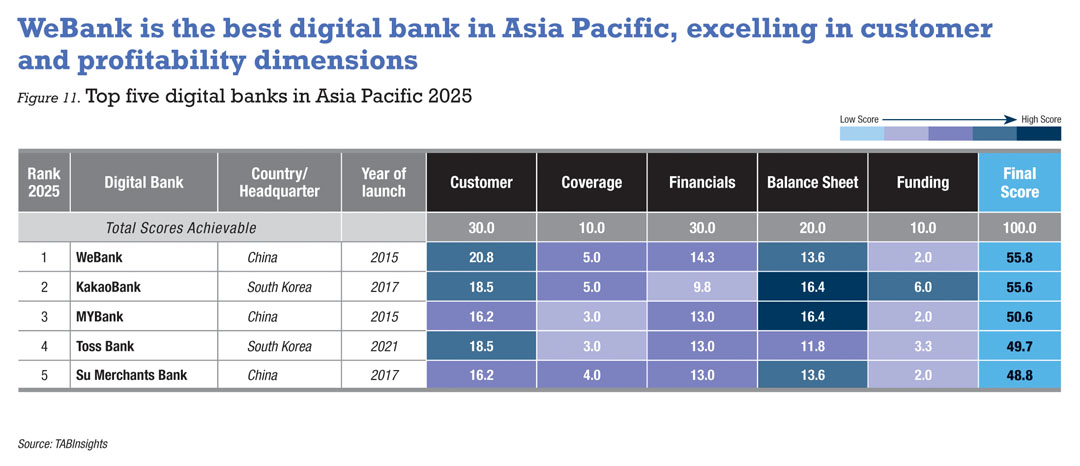

MYBank and Su Merchants Bank occupy the second and third spots in China and are included among the top five digital banks in the region. WeBank excels in the customer and profitability dimensions, while

MYBank leads in the balance sheet dimension with a LDR of 93% and aiBank outperforms in funding. Additionally, XW Bank demonstrates stronger profitability than MYBank and Su Merchants Bank, achieving a 51% revenue growth and an 18% pre-tax ROE in FY2023.

Toss Bank ranks fourth in the region and enters the global top 10 for the first time. Since its launch in October 2021, it reached break-even in the third quarter of 2023. Toss has launched highly competitive products, significantly expanding its customer base from 1.1 million in FY2021 to 8.9 million in FY2023. From FY2022 to FY2023, its LDR rose from 42% to 56%, revenue surged from $58 million to $371 million, and it achieved a low CIR of 37% in FY2023.

SeaBank is the leading digital bank in Southeast Asia and ranks 10th in Asia Pacific. After rebranding from Bank BKE to SeaBank Indonesia in FY2021, it achieved full-year profitability in FY2022, posting a pre-tax ROE of 1.5%, which improved to 5.3% in FY2023. The bank’s collaboration with Sea’s e-commerce platform, Shopee, has played a key role in promoting its services during peak shopping periods, significantly expanding its user base to 10 million customers by the end of FY2023. SeaBank’s LDR rose from 74% in 2022 to 86% in 2023. Its revenue grew by 57% in FY2023, leading to an improvement in its CIR from 28% in FY2022 to 23% in FY2023.

Europe

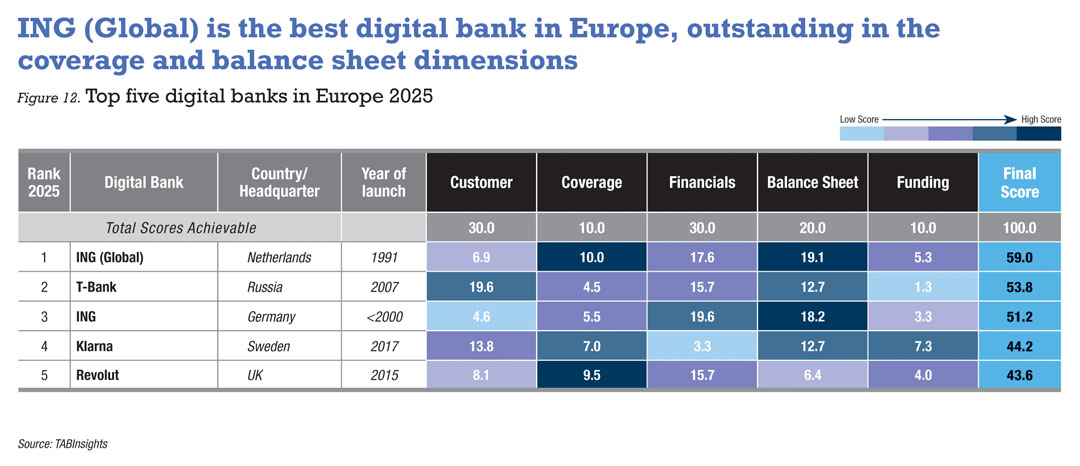

The top 10 digital banks in Europe include three from the UK, three from the Netherlands and one each from Czech Republic, Germany, Russia and Sweden. ING (Global) ranks as the leading digital bank in Europe, followed by T-Bank, ING Germany Klarna and Revolut.

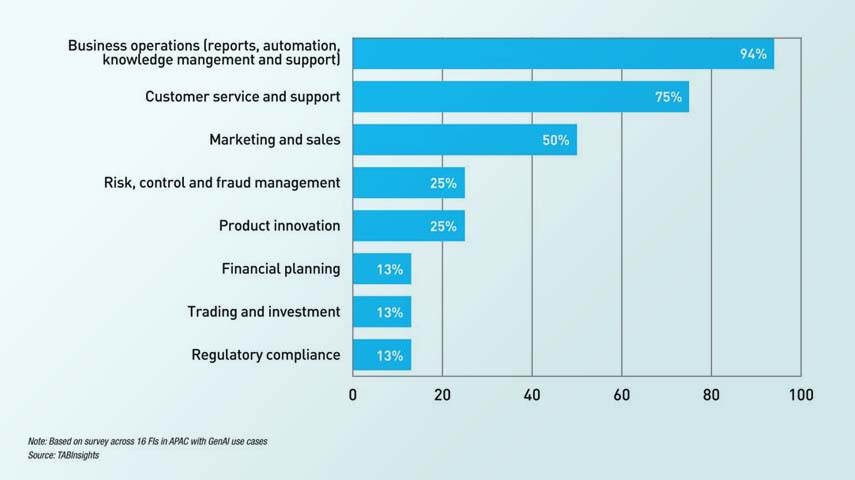

Klarna performs well in the customer, coverage and funding dimensions. While profitability remained weak, there were signs of improvement, with a 23% revenue increase in FY2023, reaching $1.9 billion, and a 7% reduction in operating expenses to $1.8 billion. Klarna has prioritised cost management through investments in artificial intelligence. The average number of users per employee rose from about 28,000 in 2022 to 36,000 in FY2023, as the workforce decreased from 5,400 to 4,200. Looking ahead, Klarna plans to limit hiring, potentially reducing the total headcount to 2,000.

Revolut has surpassed Starling Bank, OakNorth Bank and Wise to become the top digital bank in the UK, ranking fifth overall in Europe. It outperformed other UK digital banks in customer and coverage dimensions but lags in the balance sheet dimension, with a LDR of only 3.5% in FY2023, compared to 83% for OakNorth Bank and 43% for Starling Bank. By the end of FY2023, Revolut held full banking licences in 30 of the 38 countries it serves and secured its UK banking licence in July 2024.

Revolut’s strong growth stems from a diversified revenue model, entry into new markets and enhanced customer engagement. Its customer base grew from 26 million in FY2022 to 38 million in FY2023. Additionally, it posted a 95% increase in revenue and a pre-tax ROE of 32% in FY2023.

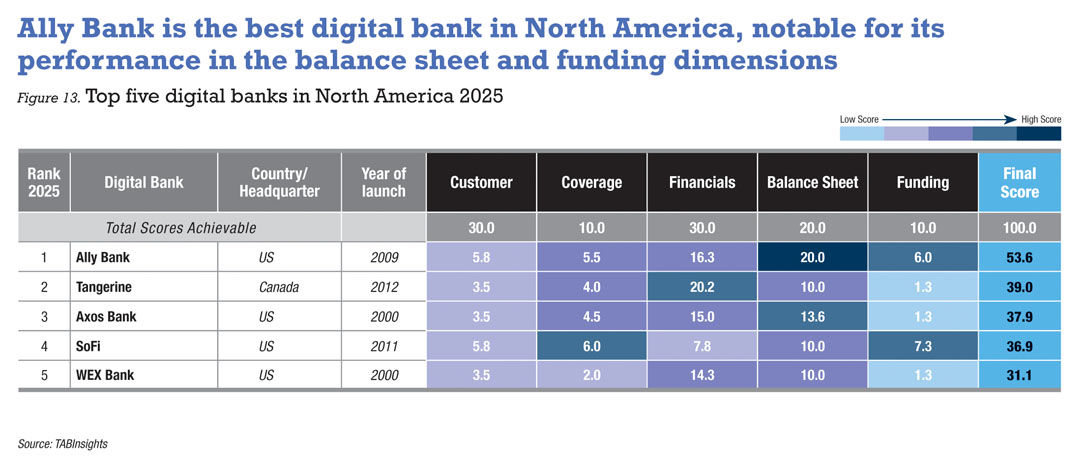

North America

Among the 10 digital banks ranked in North America, two are from Canada and the rest are based in the US. Ally Bank, Tangerine and Axos Bank are the top three digital banks in the region. Ally Bank and Axos Bank excel in balance sheet and coverage metrics, while Tangerine, a subsidiary of Scotiabank, showcases superior profitability.

The LDR for Ally Bank stood at 89% at the end of FY2023, while Tangerine’s LDR decreased from 24% in FY2021 to 21% in FY2023. However, Tangerine demonstrated better profitability, with revenue increasing by 44% in FY2023, improving its CIR from 42% in FY2022 to 32% in FY2023. Tangerine’s pre-tax ROE rose from 25% in FY2022 to 34% in FY2023, whereas Ally Bank’s ROE fell from 26% in FY2022 to 16% in FY2023. Ally Bank’s pre-tax profit declined by 46% in FY2023 due to reduced revenue and increased provisions for credit losses. Its revenue dropped by 9% to $8.9 billion, largely driven by higher funding costs. Despite this, Ally Bank achieved a higher revenue per user, at $809 as compared to $456 for Tangerine.

Latin and South America

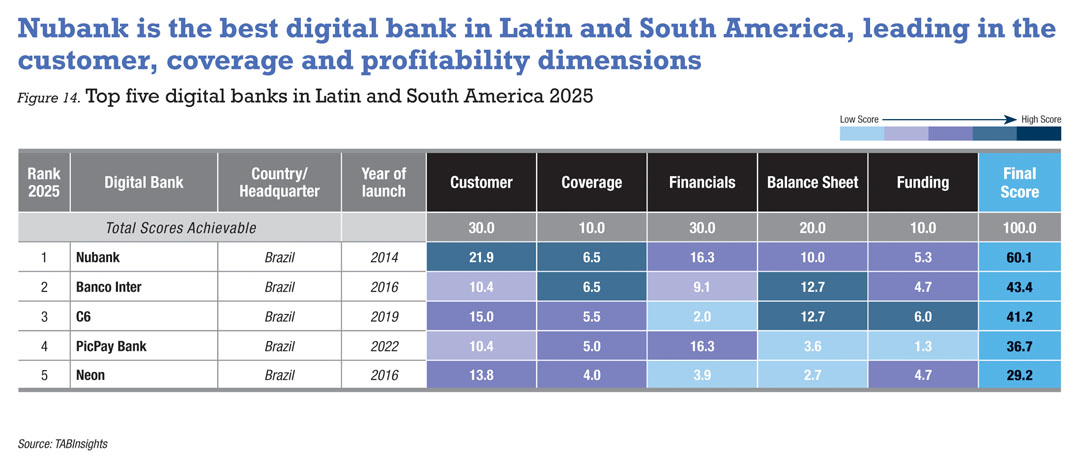

The top five digital banks in Latin and South America are all from Brazil, with Nubank leading the region. Banco Inter ranks second, while JPMorgan-backed C6 takes third place. Despite Nubank’s larger customer base and higher profitability, Banco Inter and C6 outperformed Nubank in the balance sheet dimension, with higher LDRs of 91% and 92% at the end of FY2023. PicPay Bank and Neon rank fourth and fifth, respectively.

Banco Inter, a traditional bank initially focused on payroll, real estate and corporate loans, transformed into a fully digital bank in 2015. Since then, it has experienced rapid growth, increasing its customer base from 0.4 million in FY2017 to 30.4 million in FY2023 through diversified services and its SuperApp strategy. The bank expanded into unsecured credit, and its dual approach of secured and unsecured lending balances risk while fostering long-term customer retention. Banco Inter achieved profitability in FY2023, with a pre-tax ROE of 11%.

However, C6 and Neon suffered from weak profitability, posting negative pre-tax ROEs of -121% and -110%, respectively, in FY2023. C6’s customer base doubled between 2021 and 2023, and the bank shifted towards less risky secured loans, including payroll and auto loans, which made up 78% of its total loans. This strategy proved effective, with C6 recording its first-ever profit in Q1 2024, driven by increased revenue and reduced credit losses.

Middle East and Africa

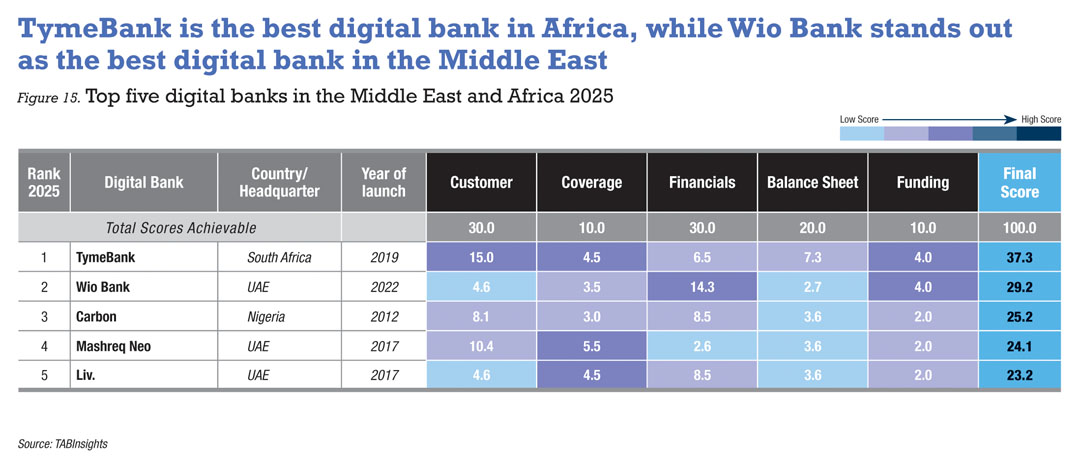

In the Middle East, Wio Bank is the leading digital bank, followed by Mashreq Neo and Liv. Launched in September 2022, Wio Bank attracted over 50,000 business customers and more than 40,000 personal customers by the end of FY2023, although its LDR was only 0.1%. The bank achieved an annual pre-tax profit of $0.5 million in 2023, making it one of the fastest digital banks to reach break-even.

In Africa, TymeBank continues to lead as the top digital bank, followed by Nigeria’s Carbon. The acquisition of the fintech loan company Retail Capital in FY2022 has significantly strengthened TymeBank’s SME lending capabilities. In FY2023, the bank’s LDR jumped to 48%, and its revenue more than tripled. In December 2023, TymeBank achieved its first month of profitability.

TymeBank has expanded into consumer lending while extending its footprint in Southeast Asia. Following the successful launch of GoTyme Bank in the Philippines in FY2022 and its entry into Vietnam in January 2024, Tyme Group plans to introduce an innovative merchant cash advance solution for SMEs in Indonesia.

View the World’s Best Digital Banks Ranking report here.