Payments are entering an era of transformation, where technological innovation, evolving customer expectations, new market players and shifting economic landscapes are redefining how money moves globally. Emerging technologies — from cloud computing and application programming interfaces (APIs) to distributed ledger technology (DLT) and artificial intelligence (AI) are enabling faster, more efficient, secure and tailored payment solutions.

At the same time, customer demands, and regulatory requirements are rising sharply. Instant, low-cost, and secure payments are no longer optional as regulators worldwide, including the G20 and Financial Stability Board, are raising the bar for speed, security, transparency and resilience in cross-border flows. Yet, this push comes at a time when overall speed of wholesale cross-border payments was declining. According to the G20 Roadmap for Enhancing Cross-border Payments progress report, the share of Swift payments credited within one hour and one business day fell by 3.2% to 50.6% and by 0.7% to 92%, respectively, in 2024.

Complexities and opportunities define Asia’s payments market

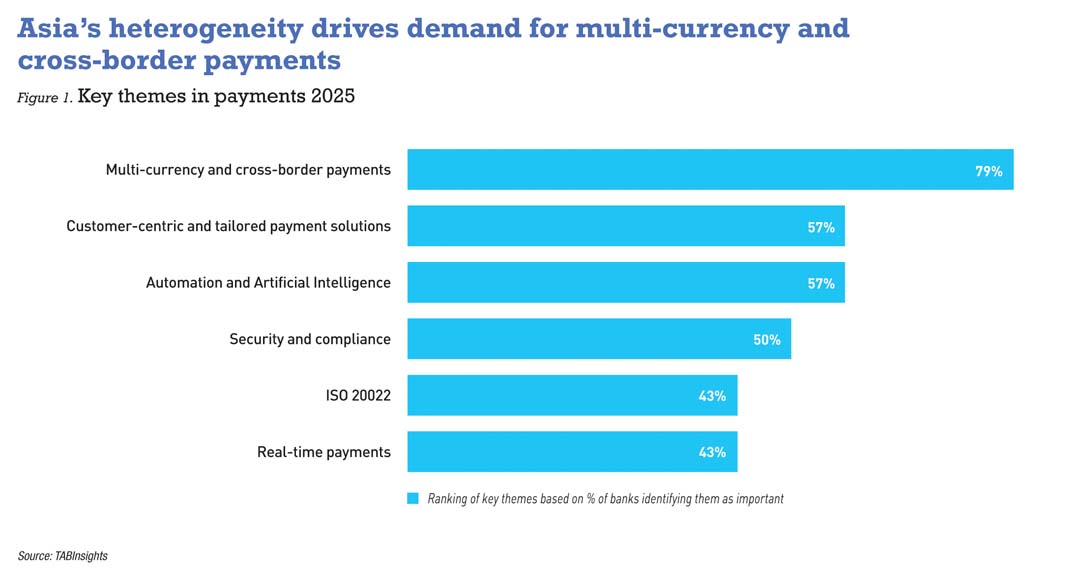

For corporates increasingly operating in a 24/7 environment, managing financial operations across multiple currencies and jurisdictions remains a key challenge. Treasury teams expect real-time visibility and seamless cross-border transfers. Yet, despite more payment channels, friction persists unless these systems can integrate smoothly. Asia Pacific’s (APAC) payments landscape remains fragmented, with diverse regulations, multiple currencies, and varied settlement practices. The TABInsights APAC Payments 2025 Survey underscores this challenge, as 79% of respondents ranked multi-currency and cross-border payments as the top theme.

For payment providers such as banks, this signals that delivering real-time, cross-border liquidity solutions is no longer optional — it is a critical enabler of corporate treasury efficiency. Banks that can simplify integration, optimise foreign exchange (FX) management and provide seamless multi-currency capabilities will reduce operational friction while strengthening corporate client relationships.

Competition is also intensifying, with fintechs, neobanks, big tech, and new DLT-based networks entering cross-border account-to-account payments, while central banks and industry consortia are driving interoperability initiatives such as Project Nexus and Immediate Cross Border Payments (IXB). Project Nexus — driven by the Bank for International Settlement Innovation Hub with central banks and payment operators from Indonesia, Malaysia, Singapore, the Philippines and Thailand — aims to standardise faster payment system (FPS) connectivity. In the West, IXB links The Clearing House in the US, EBA Clearing in Europe and Swift to create a 24/7 USD-EUR payments corridor.

Within ASEAN’s six largest economies, digital payments reached $806?billion in 2022 and are projected by the Asian Development Bank to surpass $1.2?trillion by 2025. To support this rapid growth and enable smoother cross-border flows, several jurisdictions have established bilateral and multilateral links through Project Nexus. Notable examples include the PayNow-PromptPay initiative, linking Singapore and Thailand, and UPI-PayNow, which facilitates remittances between Singapore and India.

As FPS are linked across borders, data exchange and common messaging standards will be critical to achieving straight-through processing (STP), automated reconciliation and stronger anti-money laundering (AML), countering the financing of terrorism (CFT) and sanctions controls. Harmonisation of standards will further enhance interoperability.

Global efforts are already underway to implement ISO 20022 for richer, more structured data. Ahead of the November 2025 deadline for the transition to ISO 20022 in cross-border payments (CBPR+), the coexistence period with Swift’s legacy MT standard — in place since March 2023 — has seen steady adoption. According to Swift, more than 40% of daily payment traffic now uses ISO 20022, with over 1.8 million payment messages exchanged daily. The new format already accounts for over 75% of traffic across Swift’s market infrastructure. In the TABInsights APAC Payments 2025 Survey, 43% of respondents highlighted ISO 20022 as central to automating payment journeys and improving STP.

Overlaying these market and technology shifts is a more fragmented geopolitical landscape. Regionalisation of supply chains, macroeconomic uncertainty and political change are influencing global trade flows and prompting discussions around alternative regional payment systems. Today’s payments ecosystem is defined by both opportunity and complexity — rising expectations, new entrants and shifting global relationships that banks must navigate to stay ahead.

Multi-currency and cross-border payment solutions gain momentum in the region

Advances in payment technology have made domestic transfers nearly instantaneous, often completed within seconds with pre-validation checks and delivery notifications. Corporates and multinationals now expect the same seamless experience for cross-border transactions. Yet, these remain more complex, involving currency conversion, multiple regulatory frameworks and stricter compliance requirements.

With intra-regional trade, cross-border e-commerce and digital banking accelerating, and corporates seeking faster settlement and improved liquidity, banks across APAC are investing heavily in multi-currency and cross-border solutions for corporate and institutional clients.

Bank of America, for instance, leveraged its cross-currency capabilities in Asia to secure a mandate from a North Asian virtual bank seeking US dollar (USD) clearing and global remittance services for its app-only retail base. The solution centred on a single account structure covering both USD and cross-currency transactions, supported by APIs and Swift connectivity. A multi-period guaranteed FX rate API enhanced transparency and pricing certainty, enabling the virtual bank to extend reliable cross-border services to its retail and SME customers.

Banks are also combining payments, FX and APIs to help corporates centralise treasury management while adapting to local clearing regimes, a critical advantage in fragmented Asian markets. Deutsche Bank enhanced multi-currency virtual accounts in Singapore and Hong Kong, added instant payments through BI-FAST API in Indonesia, and rolled out QR-based acceptance solutions in India and Thailand leveraging instant payments schemes, alongside multi-channel online acceptance in Australia, Korea and Indonesia, leveraging FPS in each market. The bank’s FX4Cash platform (for cross-currency payments) and Autobahn FX (for trading) support rules-based FX hedging and automated intercompany settlements across six APAC markets, reducing an eight-step process to one. FX4Cash also allows payments in over 130 currencies without clients holding multiple foreign accounts, as transactions are funded in a single chosen currency and converted by Deutsche Bank for the beneficiary.

UOB has expanded cross-border payment and multi-currency solutions across ASEAN and Greater China, leveraging local expertise to align flows with market rules. Its UOBSend solution enables low-value transfers from Singapore to more than 45 markets in 13 currencies, built on its New Payment Platform infrastructure. The solution provides cost savings, transparent pricing and full-value payments to beneficiaries.

Together, these initiatives show banks moving from fragmented models to integrated, digital-first platforms that simplify multi-currency flows, reduce operational burdens and align with regulatory expectations. Momentum is being driven by both global players with scale and regional banks with deep local connectivity, reflecting a market-wide shift in how cross-border payment solutions are delivered in APAC.

Banks pivot to tailored payment solutions to win mandates

Banks in APAC are sharpening their focus on tailored, customer-centric payment solutions, reflecting a broader industry shift towards flexibility, transparency and speed. As client needs diversify across markets, leading institutions are designing solutions around customer priorities rather than standardised products. The TABInsights APAC Payments 2025 Survey found that 57% of respondents view customisation as critical to winning mandates.

BNY delivered a customised solution for a Chinese joint-stock commercial bank seeking greater efficiency in cross-border payments. Through its Fullpay smart routing for cross-border payments solution, BNY guaranteed that beneficiary clients of the commercial bank received the full principal amount without deductions along the payment chain, by leveraging its extensive relationship management application (RMA) network. The solution also ensured predictable costs and improved reconciliation through proactive monitoring and customised reporting. The initiative reflects how tailored solutions can enhance transparency and client satisfaction while addressing the operational complexities of correspondent banking.

Barclays pursued a similar strategy with a large Chinese regional bank facing rising cross-border e-commerce volumes. It provided pound sterling (GBP) clearing, competitive FX conversion to the Chinese yuan and API-based access to the UK Faster Payments Scheme. This package reduced costs, accelerated settlement times, and improved transparency for merchants, directly supporting their business models.

Mizuho Bank expanded its transaction banking proposition in India by partnering with a local fintech to offer collection solutions tailored to sector needs. Food and beverage clients adopted integrated point-of-sale terminals; consumer goods companies used online gateways; and high-volume retailers benefited from payment soundbox devices that provide instant audio confirmation of QR payments. Mizuho also enabled education providers to collect fees remotely through QR code payment links, reducing paperwork and reconciliation errors.

As focus shifts from infrastructure-driven offerings to bespoke solutions that enhance customer experience, operational efficiency and competitiveness, banks are reshaping payments by putting clients at the centre of design.

Advancing payment innovation while managing risk and security

AI and automation are emerging as key enablers of better customer experience, lower costs and higher productivity in payments. In the TABInsights APAC Payments 2025 Survey, 57% of respondents cited AI as a key driver of innovation.

Deutsche Bank has partnered with Ant International to enhance payment solutions across Europe and Asia, combining its banking expertise with Ant’s tokenisation and AI-based FX technologies. The collaboration also extends to merchant acquiring via Antom, Ant’s merchant payment and digitisation arm, and to SME-focused cross-border services through WorldFirst, a digital payment and financial services platform under Ant International. Mizuho introduced a Client Insights Platform to analyse transaction flows, detect anomalies and anticipate client needs. Using AI analytics, it identifies borrowing and repayment patterns in group loans, allowing Mizuho to offer timely FX or payment solutions.

As adoption expands, security, compliance, inclusion and integration remain key areas of concern. Many organisations are still in the early stages of applying AI to payments, with the most traction seen in compliance and fraud prevention. In the TABInsights APAC Payments 2025 Survey, 50% of respondents cited security and compliance as their biggest challenge when managing cross-border payments for clients.

In October 2024, Swift launched an AI-enhanced fraud detection tool following pilots with financial institutions across Europe, North America, Asia and the Middle East. The feature builds on Swift’s existing Payment Controls Service, already widely used by smaller banks. By analysing anonymised data from the billions of transactions handled on the Swift network each year, the system identifies unusual activity, enabling suspicious payments to be flagged and acted on immediately, reducing fraud risk in real time.

J.P. Morgan has used AI-powered language models in payment validation screening for over two years, reducing false positives, improving queue management and cutting rejection rates by 15–20%. This has lowered fraud levels while improving client experience through faster, less disruptive processing.

Leading banks and infrastructure providers are thus applying AI not only to improve speed and efficiency but also to strengthen trust. The next phase of innovation will depend on striking the right balance between advanced technology and robust safeguards, ensuring that progress is matched by resilience, security and client confidence.

.jpg)