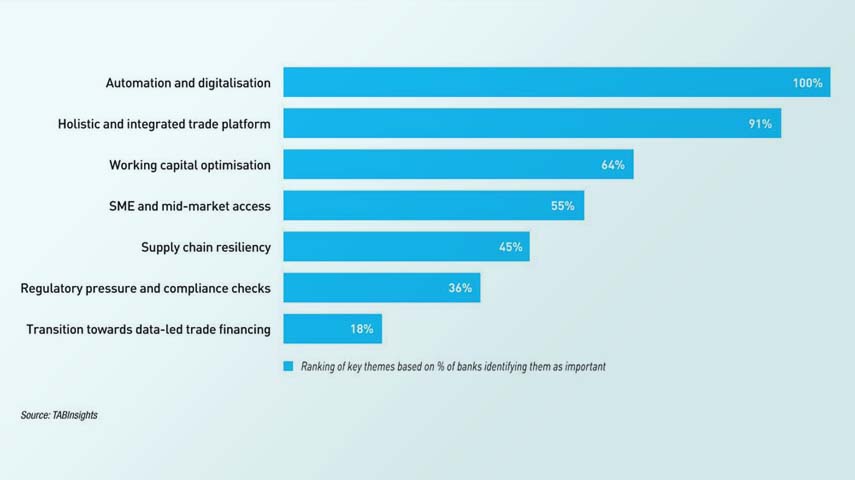

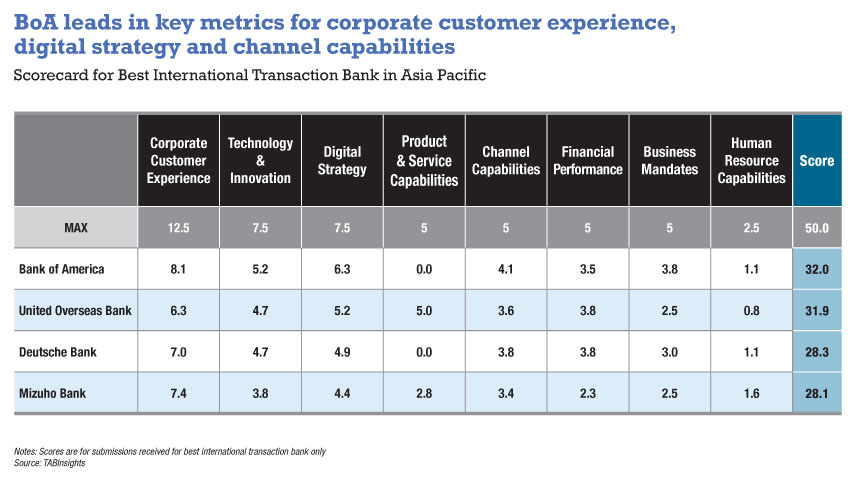

In Asia Pacific’s fragmented payments landscape, demand for faster and more transparent multi-currency payment solutions is rising as corporates expand businesses regionally. Banks are shifting from standardised offerings to integrated, AI-enabled solutions that balance security and compliance.

.jpg)