The 2023 TABInsights annual survey of global trade and supply chain finance (SCF) trends took place amid global decoupling, rising inflation and working capital costs and near shoring and onshoring of supply chains. These factors collectively affect global trade.

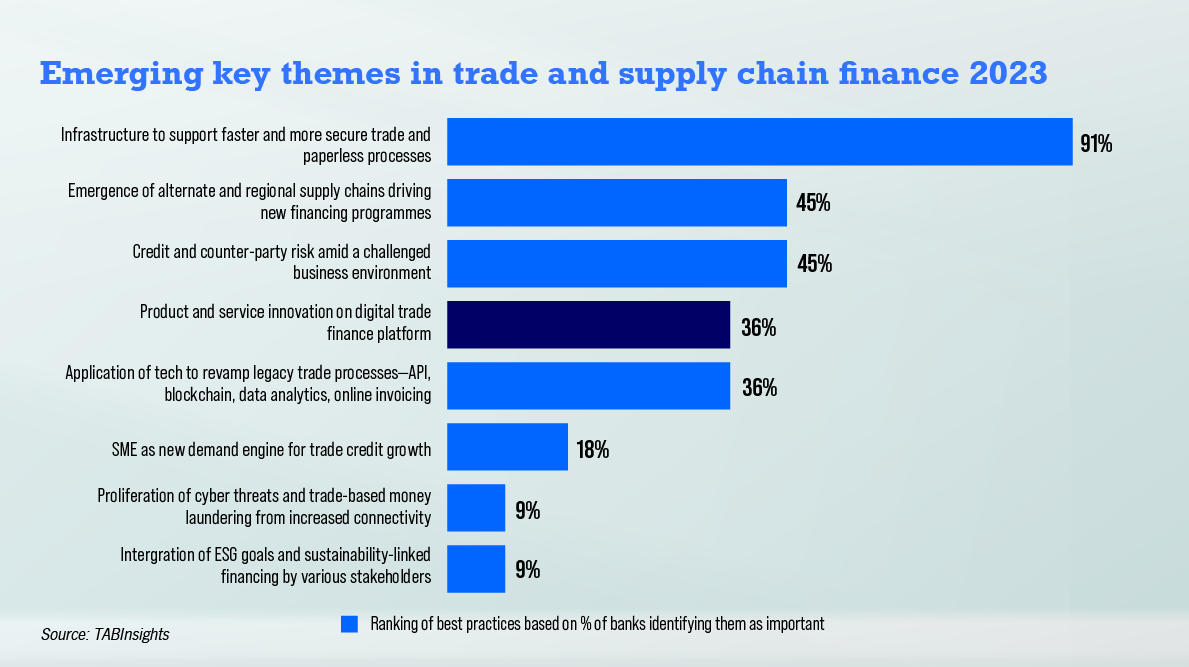

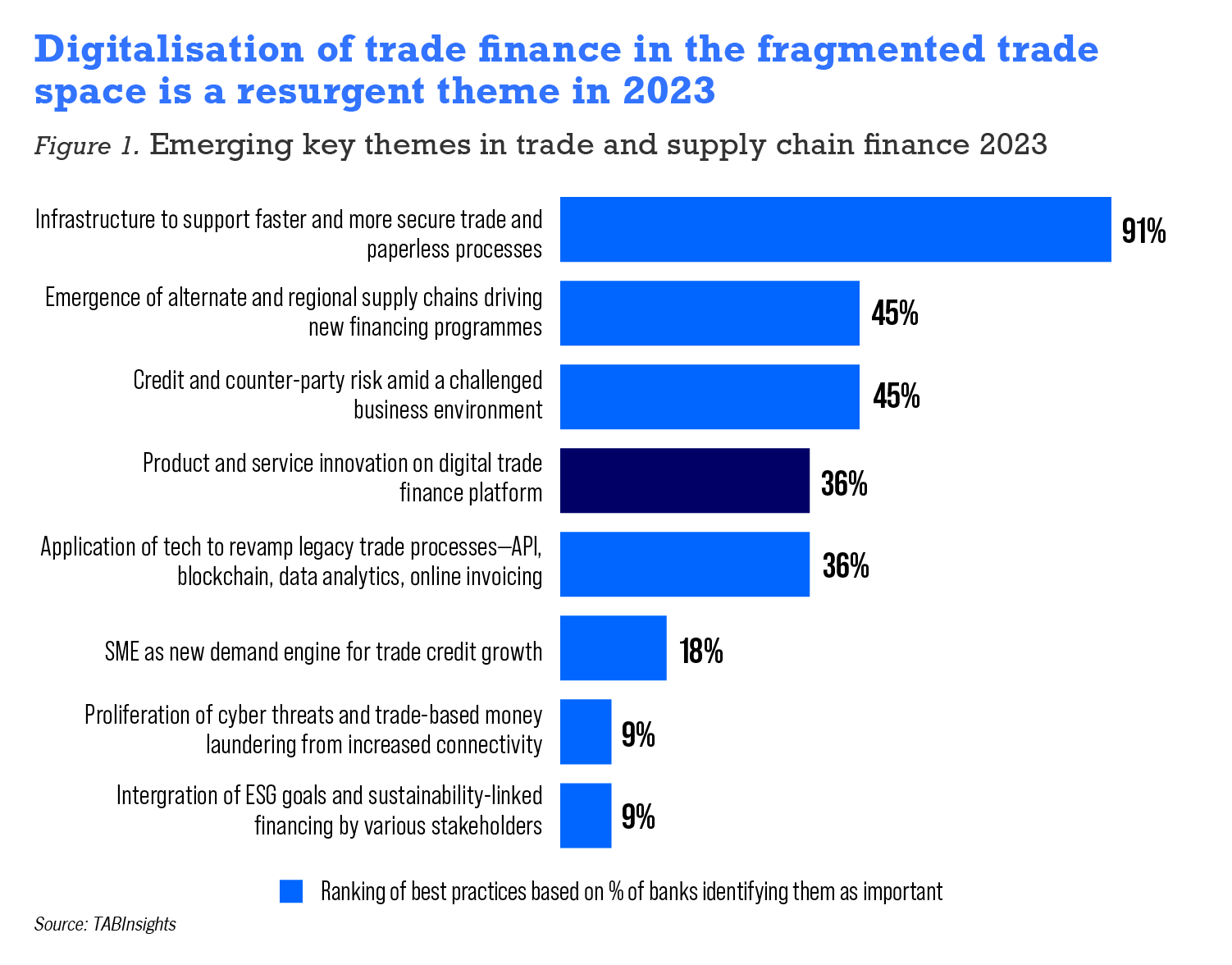

Last year’s survey outlined how the pandemic had exacerbated some of the trends that predated US-China frictions on trade, technology and investment. It also exposed the fragility of far-flung supply chains, which accelerated the process of bringing production closer to home. In Asia’s current landscape, the strategy is better known as China+1 where manufacturers have gravitated towards an additional sourcing partner to diversify concentrated risks. As a result of these developments and increased counterparty risk post-crisis, there is a growing demand for alternative SCF programmes as risk management tools. In the survey, 45% of respondents cited emergence of new supply chains and financing options as a key trend.

The digital transformation of trade finance, including innovations like electronic invoicing and e-document presentation, offers opportunities for greater efficiency in the trade process. Despite this, end-to-end financing that underpins it remains fragmented and lacks standardisation. There is a growing demand for common and interoperable infrastructure among various platforms using application programming interfaces (API). Banks are actively seeking collaboration opportunities with industry platforms to connect customers directly to the buyer-seller network. They are also deepening direct connectivity with customers, using API to integrate into customer ecosystems. According to reports, 91% of respondents support the idea of a common infrastructure to simplify customers’ trade journeys.

Echoing last year’s survey, digitalisation remains a top priority in trade transformation. Sixty-two percent of respondents are actively using advanced tools such as API, blockchain, data analytics and e-invoicing to enhance efficiency and user experience. Banks are leveraging these technologies to revamp their entire trade finance systems and modernise their trade platforms globally, often through partnerships with IT vendors, peers, or government-led initiatives. In the survey, 31% of respondents recognise the significance of collaborative trade finance as the way forward.

Rewiring global supply chains spurs growth in financing

The global economy is still facing disruptions due to economic decoupling, which has affected trade and supply chains. This has forced businesses to adjust their plans for how they source materials, produce goods, and handle sales invoicing. As a result, corporations are increasingly diversifying their sources, production sites and invoicing practices to minimise such risk and optimise cost and tax efficiency.

In the region, ASEAN has become an appealing alternative for global production compared to China. Strong regional banks with a willingness to take risks use their expertise in cash management, trade and financial supply chain management (FSCM), along with integrated transaction banking capabilities, to support customers with their trade and working capital needs across ASEAN and Greater China.

UOB, OCBC, Deutsche Bank rise to challenges

UOB has noticed that many Chinese companies are setting up new factories in its core markets in ASEAN to be either closer to the source of materials or to the markets where they sell their products. UOB’s global transaction banking team collaborates closely with its foreign direct investment and sector solution teams to assist customers who are looking for sourcing, selling and investment opportunities in the region. They provide transaction banking services and financing advice to help customers manage their working capital cycle from order stage to payment, production, sales and collection.

In supply chain finance, UOB has introduced solutions to help its primary customers either preserve cash flow through supplier financing solutions or accelerate cash collection with accounts receivable. For small and medium-sized enterprises (SME), the bank explores opportunities to shift financing to competitively-priced supplier financing or account receivable purchase options, which can help reduce their financing costs, especially when backed by stronger anchor companies.

As banks’ regional customers expanded across borders, so did their digital platform capabilities. In 2022, UOB launched a single sign-on platform that simplifies communication between the anchor and their suppliers, buyers and distributors for handling procurement, invoicing and financing. UOB Infinity FSCM includes workflows that streamline the exchange of purchase orders and invoices, validation, and financing requests. These automated processes eliminate manual tasks, speed up turnaround times, and enhance the value of money.

To address supply chain disruptions and enhance regional cooperation between ASEAN and Greater China, OCBC Bank is investing in digital capabilities and expanding banking solutions while simplifying processes to support business growth, particularly in China. As regional corporates pursue expansion, OCBC observes that businesses are increasingly mindful of costs in their investment strategies, mainly due to higher inflation and interest rates. They are inclined towards lower-cost locations and are considering onshoring and nearshoring their business operations closer to production or consumption centres.

Recognising this trend, OCBC took action in 2022 by setting up a middle office in China to assist customers with their domestic procurement requirements. In the trade finance division, they established an arrangement for renegotiating letters of credit (LC) between the Chinese and Singapore markets. This allows Chinese companies to secure financing from OCBC Singapore, with documents drawn under LC presented at OCBC China. To minimise disruptions and payment delays, OCBC also collaborated with digital platforms for electronic document presentation.

To meet the growing demands of cross-border trade and market intelligence, OCBC’s trade finance team works closely with its global network. The bank focuses on delivering tailored solutions for the import and export markets of various countries. Its regional trade hubs in Hong Kong and Singapore further enhance the integration of trade finance functions into customers’ cross-border trade flows.

To tap into the growing opportunities and trade between Asia’s developed and emerging markets, Deutsche Bank has expanded its presence by opening new offices in strategic locations, including Bangladesh. This move is expected to create fresh opportunities for the bank, especially in its trade finance for financial institutions and institutional cash management businesses. In response to uncertain economic conditions and rising interest rates, Deutsche Bank has also enhanced its ability to provide off-balance sheet solutions.

The bank advanced its capability in the reverse-factoring area to create a purchase order financing solution for suppliers. One of these solutions is purchase order financing with recourse to the buyer. This solution uses the buyer’s credit to provide a discount on the purchase order at an agreed-upon rate. The discounted amount is sent directly to the suppliers. Once the shipment is made, the buyer will convert the purchase order into an invoice and share the invoice details with Deutsche Bank. The bank will then provide a discount on the full invoice amount, and the resulting funds, after deducting interest, will be used to repay the pre-shipment financing, with the remainder going to the suppliers.

Demand for digital frameworks and platforms connecting players in global trade

The trade finance industry acknowledges the need for standardisation and fintech solutions, but various disconnected digital systems and alternative solutions have emerged. While there have been legislative developments and calls for standardisation, it is not realistic to expect a single dominant digital solution for connecting global trade players. Instead, the focus is shifting towards enabling interoperability between different platforms, whether they are led by governments or private consortia. Central to this effort is the promotion of common standards and open API. Open API facilitate faster and smoother data transfer and information sharing, which is crucial for improving trade process efficiency and combating trade-related financial crimes like money laundering.

Open API facilitate faster and smoother data transfer and information sharing

For example, the Trade Information Network (TIN) is a purchase order financing platform that currently has more than 12 banks and 10 corporations actively using it. TIN acts as a registry to support the digitalisation of global trade by allowing the exchange of essential trade information among buyers, suppliers and financiers globally. Its aim is to accelerate the transition of fully digital and paperless trade, offer access to different sources of lending, and enhance liquidity for supply chain customers.

To enhance its digital operations, Deutsche Bank has been focusing on a long-term API strategy that aims to promote interoperability, share information, and integrate across various networks and platforms. Internally, core service API break down business functions into individual services within different divisions. Externally, the bank has developed product API, that provide business functions to external users and markets. The API have allowed the trade business to scale and speed up its time-to-market through internal changes. External API, like the one used in TIN, have also made it possible for new business models to emerge.

Several banks in Southeast Asia are actively involved in industry initiatives that promote broader and collective ecosystem connectivity. These initiatives go beyond linking buyers and sellers; they include banks, logistics companies, customers and ports, among others. UOB, as a founding and core bank participant in the Singapore Trade Data Exchange, a digital infrastructure that ensures secure sharing of data among supply chain ecosystem partners, is leading the effort to launch use cases for digitalising the bunkering trade. Traditionally, bunker trade relies on paper-based, manual processes that are susceptible to errors and manipulation. This serves as a key example for digitalising trade finance, enabling the transformation of manual validation of sustainable qualifications into a digital format, thus making transaction-based finance more scalable.

In the area of open account and documentary trade, more players in the trade and supply chain industry are getting involved. This includes the creation of industry consortiums both within individual countries and on a global scale. Governments are also taking a more active role in promoting and supporting various initiatives in the trade ecosystem. These initiatives cover areas like e-invoicing, sustainable financing, digitalisation of industry sectors such as bunkering, and efforts to reduce fraud.

Banks like OCBC are strengthening direct ties with customers by using API to integrate into customers’ ecosystems. For instance, they have partnered with a supermarket procurement platform to offer seamless digital financing to its suppliers. OCBC leverages suppliers’ sales and transaction data from the platform to assess the credit limit and amount of financing they can receive. This credit process is smooth and efficient, as suppliers receive payments directly into their accounts from the buyers. Thanks to this initiative, OCBC’s financing for SME customers has grown by over 150%.

Banks are under increasing pressure to improve their credit assessment in commodity financing, and work together to fight fraud. For instance, in Singapore, the Association of Banks introduced the Trade Finance Registry, a secure, centralised record of trade finance transactions. This initiative, supported by major trade financing banks, aims to reduce the risk of duplicate financing for the same trade, and boost trust and confidence among banks and traders. It ultimately strengthens Singapore’s position as a central trading hub.

Bank of China (Hong Kong) has collaborated with various consortiums and fintech firms to help its customers digitalise their trade processes. The bank actively engaged in different electronic trade ecosystems, including Contour, Effitrade, IQAX, TradeGo, and e-B/L platforms essDOCS and Bolero..

CTBC Bank has become the first and only Taiwanese bank to offer a complete electronic bill of lading solution in Taiwan. It has partnered with blockchain-based LC service provider Contour, essDOCS and Bolero, and e-commerce companies Formosa Technologies and Universal Exchange. It has seamlessly integrated its solutions into its clients’ daily operations through various flexible electronic channels, such as email, internet banking, mobile banking, API and host-to-host solutions.

New solutions to digitalise trade finance

The trade finance industry is seeing a rise in technological innovation, with the pandemic giving it a boost toward digitalisation. While the emergence of new technologies presents challenges, such as lack of standardisation and fragmentation caused by numerous fintech solutions and blockchain platforms, it also offers opportunities as the industry embraces a more digital future.

Banks in Hong Kong are taking advantage of their strong connections with Mainland China to offer enhanced cross-border trade finance services to Chinese companies expanding internationally. For instance, Bank of China (Hong Kong) has upgraded its online platform to create an innovative, all-in-one and cross-regional solution for customers. They completed the first-ever blockchain-based invoice financing deal last year in partnership with six major Hong Kong banks, forming the eTradeConnect trade blockchain platform. Wider adoption of this platform is expected to promote standardisation and cut down processing times and costs associated with traditional paper documentation.

In response to the changing trade landscape in India, Kotak Mahindra Bank launched a trade portal to enhance customer convenience and flexibility. This portal offers user-friendly features such as paperless exports, RA financing through Gujarat International Finance Tec-City, INR Vostro settlements and Exim Bank Export Negotiation, among others. Currently, the bank has over 10,000 customers using the trade portal.

Bangkok Bank in Thailand upgraded its digital trade channel, iTrade, in early 2022. Most of its essential trade services and products have been available digitally since the launch. The upgrade included a major improvement to its trade finance processing engine, notably enhancing service level agreement management. The bank has experienced a 22% rise in subscribed clients, with over 96% of active customers using iTrade for their transactions.

As a unique differentiator from other banks in Vietnam, Techcombank is implementing end-to-end digital signatures in all of its trade finance operations. The bank has invested in a new highly secure system that uses remote digital signature technology, enabling faster application processing.

The trade industry is at a critical point, as the push for digitalisation is compelling banks and companies to rethink their traditional processes and systems. While the advantages of embracing digital change are evident, the obstacles and choices institutions face on this path are intricate and diverse.