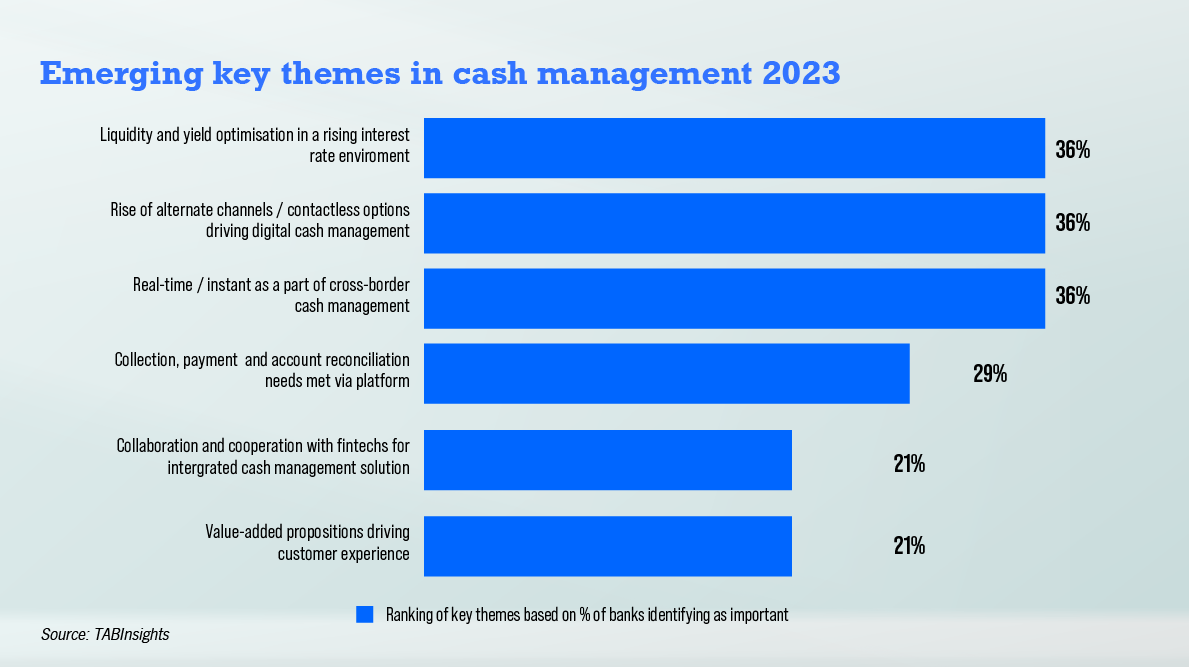

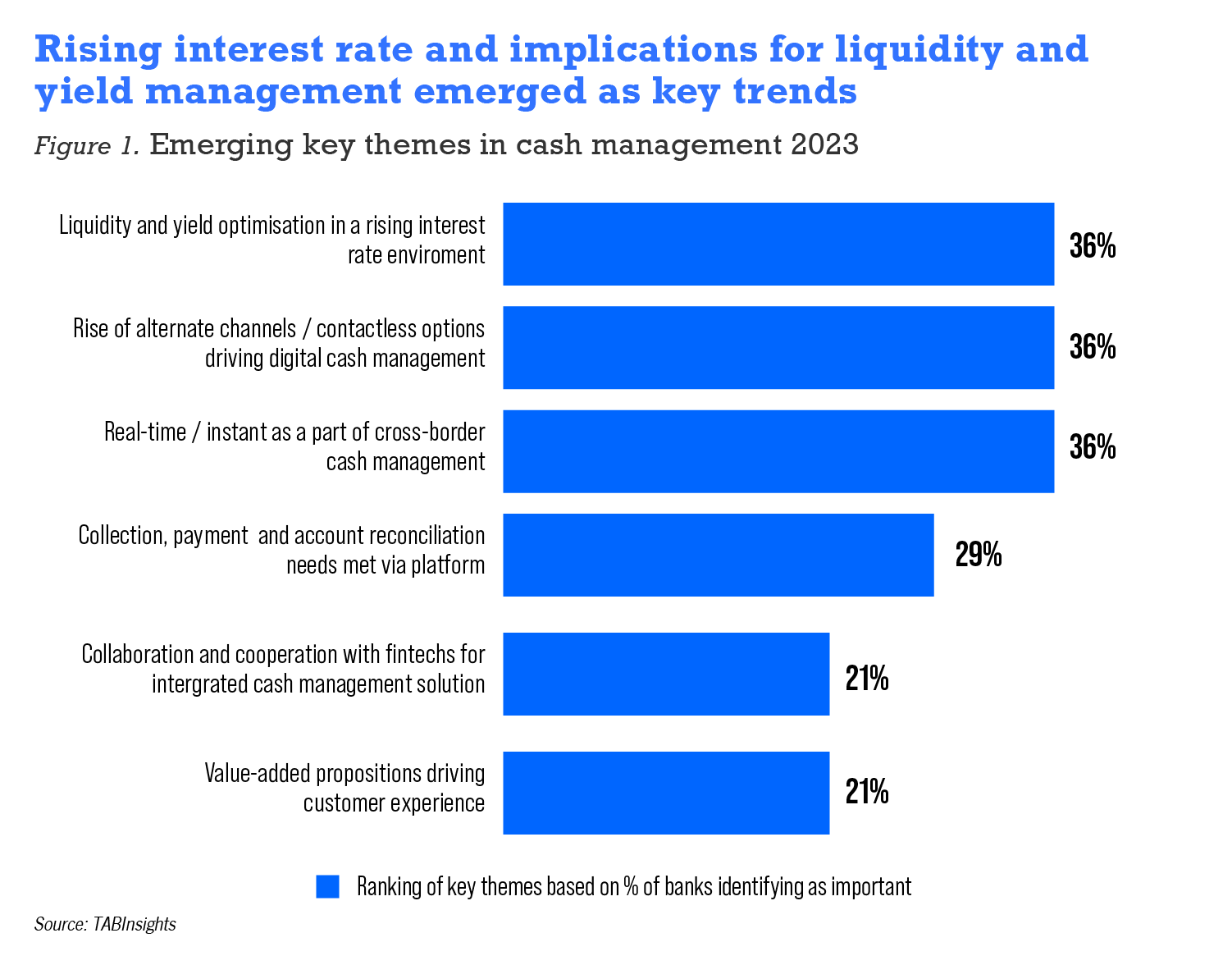

In the 2023 TABInsights annual survey of cash and treasury management conducted amid a tighter global interest rate environment, it is evident that the focus on investment and liquidity management has intensified among cash-rich enterprises seeking better opportunities to invest excess liquidity. Consequently, treasurers and cash management executives are turning to their financial service providers to minimise costs and risks while optimising yield and liquidity through centralisation and innovation.

For smaller companies experiencing liquidity challenges, optimising account balances has become even more critical.

The transition from cash to digital along with the move to digital wallets is driving the shift towards digital payments. Efforts to streamline and enhance digital payments between financial institutions (FI) and payment service providers (PSP), combined with reduced merchant fees for smaller transactions, have resulted in higher contactless payment limits and new options such as tap-to-pay.

Superapps supercharge speed and efficiency of digital payments

The broader availability of mobile devices and internet services has accelerated digital payment trends in Asia. The surge in usage of superapps like WeChat and Alipay in China, Kakao in South Korea, and GooglePay and PayTM in India has played an important role. These superapps offer consumers a range of services including messaging, e-commerce, consumer-to-business payments, peer-to-peer payments, and more.

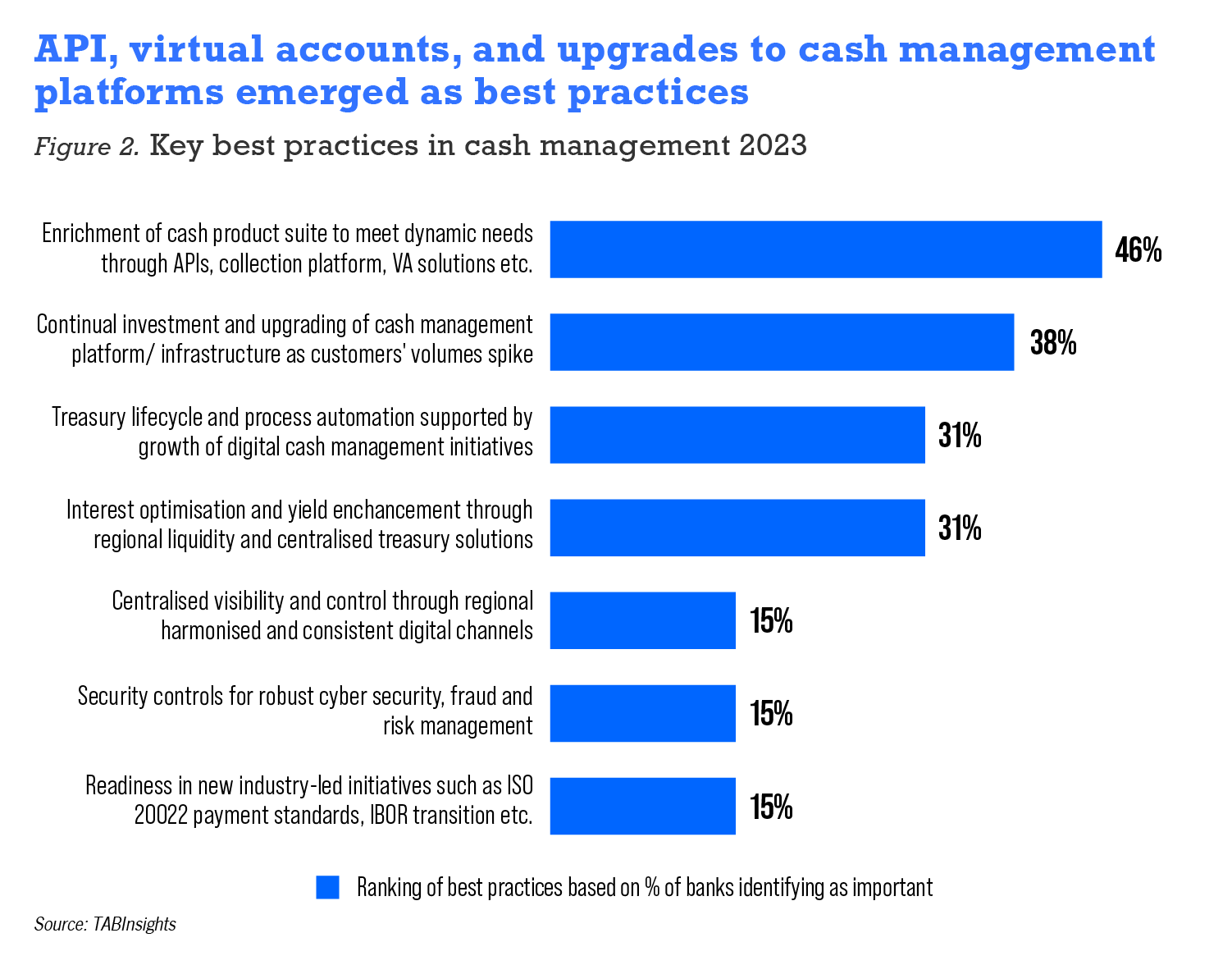

To accommodate the exponential demand for faster, more scalable and efficient payment solutions, 38% of respondents in the TABInsights survey have turned to making continual investment and upgrades in their cash management platform and payments infrastructure.

The importance of real-time or ‘just-in-time’ treasury—where information is accessed precisely when it is needed—continues to gain prominence. With the evolution of cross-border businesses, especially from emerging opportunities for Asia Pacific, effective treasury management predicated on enhanced digital capabilities has become an imperative for companies to address expansion and growth prospects in the region.

Some 36% of respondents identified real-time information as an integral part of treasury operations for managing visibility of their cash and liquidity positions. As a best practice, 31% of the respondents spotlighted the criticality of workflow process and treasury lifecycle automation enabled through application programming interface (API), multi-bank connectivity and cutting-edge technologies, while 46% of the respondents described them as being merely the necessities of today’s corporate cash management ecosystem.

Treasury’s priorities in an uncertain rising interest rate environment

In the light of escalating borrowing cost, many corporations have adopted a cautious approach towards fund utilisation and external financing. The uncertainty in cash flow projections has further contributed to conservative investment choices.

To address these challenges, corporate treasurers are focusing on capital preservation and reducing reliance on external funding. It’s imperative that funds are not left idle in accounts, balances are optimised to yield returns, and effective interest rate management for borrowings is in place. Companies with extensive operations in Asia face additional complexities due to currency fluctuations and regulatory restrictions, which hinder efficient surplus liquidity extraction.

In this climate, banks have stepped up with enhanced cash management products and solutions. Innovations in open finance, technology, and instant payments are meeting the dynamic needs of corporate treasuries.

For instance, Bank of China (Hong Kong) has strengthened its cash pooling solutions, empowering treasurers to manage liquidity across single or multiple entities within the same corporate group. This distinguishes the bank in the liquidity management space. In addition to scheduled sweeps, it offers cross-border manual sweeps via corporate e-banking, allowing customers to proactively manage cash flows between Hong Kong, Mainland China, and other selected markets. The bank also provides on-demand, real-time online transaction sweeps, optimising internal usage of funds and reducing the need for overdraft facilities at the subordinate account level.

United Overseas Bank (UOB), serving a substantial base of large corporate, and small and medium-sized enterprise (SME) customers in ASEAN and Greater China, ensures optimisation of customers’ operating funds and deposit balances. UOB has introduced the UOB BizCA+ and UOB BizMax accounts in Malaysia, enabling customers to earn interest on excess funds. An automated pooling solution consolidates balances overnight for interest calculation and redistributes them the following day, with interest disbursed monthly. This solution streamlines investment activities, saving time and resources while maintaining daily liquidity.

Deutsche Bank has responded to the needs of customers with higher borrowing requirements by developing innovative solutions that align with local approval, documentation, and reporting requirements. Automation of foreign exchanges conversions based on pre-agreed arrangements, alongside compliance with local regulations, facilitates liquidity centralisation in the same currency or cross-currency. Interest optimisation improves yields on balances retained in onshore markets. For financial institutions, Deutsche Bank offers high-yielding instruments and competitive returns on balances held with USD and EUR correspondents, minimising cumbersome procedures.

API a significant enabler of real-time processing

In response to the increasing demand for instant payments and real-time functions, banks have developed solutions and platforms to facilitate the seamless transition to a cashless ecosystem. In many respects, the shift to real-time itself has been driven by the increasing use of API that enable the dynamic exchange of data and transactions across various systems, both within and outside the company.

API have brought about several new possibilities in banking, including real-time validation of beneficiary details before executing payments. This not only reduces the risk of fraudulent transactions but also minimises operational bottlenecks caused by failed or returned payments. The financial industry now witnesses a plethora of API use cases, with many yet to be explored.

Hang Seng Bank, for instance, has embraced API solutions across 13 industries, offering over 100 cases covering collection, account management, and payment solutions. One example is the bank’s collaboration with an educational organisation in Hong Kong. Hang Seng implemented an API-based solution that met the institution’s need for an efficient digital platform to handle a high volume of collection and payment transactions while tracking the status of each incoming payment in real-time. This solution not only streamlined payment processing but also enhanced the institution’s working capital flow.

Similarly, OCBC accelerated the digital transformation of government disbursements through an API initiative known as GovCash. This eliminated the need for paper cashier orders and allowed Singaporeans to withdraw government payouts instantly and securely at OCBC teller machines across the country. OCBC also leverages API technology to provide end-to-end QR solutions for customer payments and collections, delivering a seamless electronic payment experience.

The integration of artificial intelligence (AI) with API is revolutionising banking operations. API combined with AI offer more than just reduced turnaround times and improved connectivity. For instance, treasury departments can now use AI to process real-time data, enhance invoice processes, visualise payment timing, analyse customer payment behaviour, automate in-house banking, create virtual accounts, and generate accurate cash and liquidity forecasts based on historical and current data.

Bank of America serves as an example by harnessing AI and machine learning (ML) to enhance processes. The bank’s intelligent receivables iREC solution uses invoice and receipt data to automate cash application by matching receipts against invoices. CashPro forecasting uses ML algorithms to understand customer payment trends, resulting in improved cashflow forecasts for more effective cash management and planning.

Keeping up with cash management platform enhancements

The widening gap between banks’ cash management offerings and evolving customer expectations necessitates a fundamental shift. Many banks are compelled to replace or upgrade their existing cash management platforms. The surge in digital transactions, coupled with evolving demands call for an ongoing commitment to innovation, flexibility, scalability and operational efficiency.

India’s financial landscape has experienced a surge in instant payments, driven by platforms like the Unified Payment Interface (UPI) and Immediate Payment Service (IMPS). Multiple settlement cycles across various payment rails, including UPI, IMPS, and RuPay, have significantly fuelled this growth, offering round-the-clock settlement.

Kotak Mahindra Bank has enhanced digital capabilities and improved customer experiences through the introduction of innovative platforms like Kotak FYN and the Fusion cash management platform (CMP). Kotak FYN serves as an enterprise portal that seamlessly integrates customer journeys across various transaction banking products. It provides a unified view of services such as trade, account services, collections, and payments, enabling user classification into different corporate personas.

Fusion, another noteworthy addition, is a cutting-edge CMP harnessing API. It seamlessly integrates various enterprise resource planning data, file formats, and reverse management information systems to cater to diverse corporate payout requirements. The platform offers an extensive array of payment methods, including real-time gross settlement and national electronic funds transfer, a pioneering feature in the local market. The platform’s improved user interface and real-time transaction processing have contributed to a remarkable 14% increase in processing speed.

Mizuho Bank has augmented its regional CMP and extended its reach to key markets in Asia and Oceania. One major achievement is the introduction and rollout of an additional module for this regional platform. This module, based on service-oriented architecture, plays a pivotal role in servicing and supporting other processing systems and modules in generating and delivering advisories and notifications.

The digitalisation journey within the banking sector remains dynamic and adaptive, reflecting the evolving needs and expectations of customers in an increasingly digital world.