- African banks improved their rankings in the top 10 largest banks in the Middle East and Africa

- Saudi Arabian banking sector demonstrated the highest strength in the Middle East

- African banks showed improvement in profitability, asset quality and capitalisation, while remaining highly liquid

The overall profitability and asset quality of banks in the Middle East and Africa improved, with average return on assets (ROA) rising to 1.3% in financial year (FY) 2021 from 0.9% in FY2020 and average gross non-performing loan (NPL) ratio easing to 4.6% from 5%. In terms of the overall strength of the banking sector, Saudi Arabian and Egyptian banking sectors demonstrated the highest strength in the Middle East and Africa respectively. This is according to The Middle East and Africa 200 (MEA200) 2022, an evaluation of the 200 largest commercial banks and financial holding companies (banks) in the Middle East and Africa for the FY2021, with a March 2022 cutoff.

This year’s evaluation covers banks from 16 countries, namely Bahrain, Jordan, Kuwait, Lebanon, Oman, Qatar, Saudi Arabia and United Arab Emirates (UAE) in the Middle East and Algeria, Egypt, Ghana, Kenya, Mauritius, Morocco, Nigeria and South Africa in Africa, and ranks them according to asset size and overall strength.

Qatar National Bank (QNB) grew its total assets by 6.6% to $300.2 billion in 2021, which marks the first time that a bank in the Middle East and Africa has held more than $300 billion in total assets. Saudi National Bank, formed by the merger of Saudi Arabia’s National Commercial Bank and Samba Financial Group in April 2021, is the third largest bank in the region. Meanwhile, National Bank of Egypt surpassed Standard Bank Group to be the largest bank in Africa.

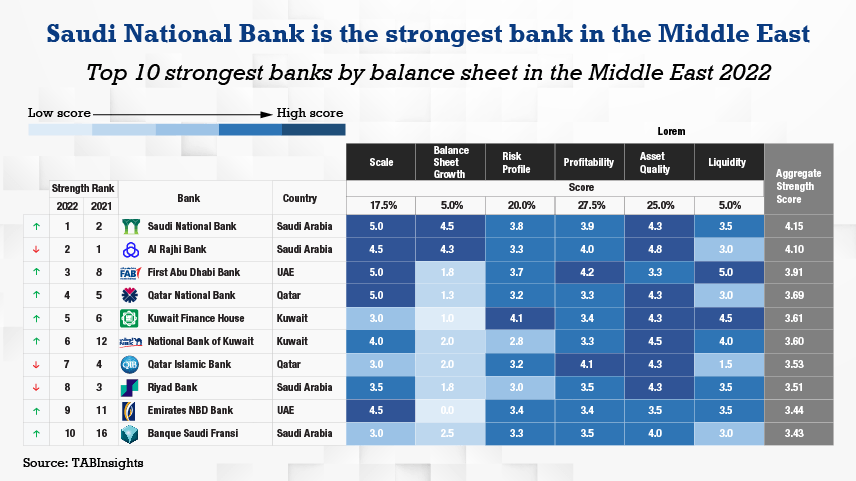

Saudi National Bank ranked first in the strongest banks by balance sheet in the Middle East, while National Bank of Egypt topped the ranking in Africa. This is based on a detailed and transparent scorecard that ranks banks on six areas of balance sheet financial performance; namely the ability to scale, balance sheet growth, risk profile, profitability, asset quality and liquidity. Saudi National Bank achieved solid profitability, as reflected by the high ROA of 1.62% and the low cost to income ratio (CIR) of 34.8%. National Bank of Egypt demonstrated strong asset quality, capitalisation and liquidity. Its gross NPL ratio and capital adequacy ratio (CAR) improved further to 1.06% and 21.4%, respectively.

African banks improved their rankings in top 10

The top 10 largest banks in the Middle East and Africa comprised three UAE banks, two Egyptian banks, two Saudi Arabian banks, two South African banks and one Qatari bank. The aggregate total assets of the top 10 rose to $1.9 trillion, an increase of 17.5% compared to $1.6 trillion in the previous year’s ranking. The increase can be largely attributed to the merger of the two Saudi Arabian banks, along with the two largest Egyptian banks changing their financial year end.

QNB and First Abu Dhabi Bank (FADB) retained their top two positions in the ranking of the largest banks in the region. With total assets of $243.5 billion at the end of 2021, Saudi National Bank ranked third. National Bank of Egypt moved up two places to fourth. Meanwhile, Banque Misr, Egypt’s second-largest bank, also leapfrogged to tenth from 15th in the previous year’s ranking. These two Egyptian banks’ financial year was amended to start from January and end in December of each year, starting from 1 January 2022. Therefore, for these two banks, FY2021 represents an 18-month period, starting from 1 July 2020 to 31 December 2021.

Emirates NBD Bank dropped two places to fifth and Standard Bank Group also slid down from fourth to sixth. The total assets of Emirates NBD Bank contracted by 1.5% in 2021, as its net loans fell by 4.8%. FirstRand and Abu Dhabi Commercial Bank (ADCB) switched their places, with FirstRand climbing one place to eighth. This is mainly driven by the appreciation of the South African Rand against the US dollar. ADCB grew its total assets by 7.1% in 2021, while the total assets of FirstRand shrank by 2.1%.

The 200 banks listed had combined total assets of $4.6 trillion, net loans of $2.5 trillion, customer deposits of $3.1 trillion and net profit of $56.8 billion. Egypt had the most banks on the list, at 24, followed by the UAE (22), Kenya (20), Ghana (18) and Nigeria (17). The UAE, Saudi Arabia, South Africa and Qatar held a larger share of total assets compare to other countries, at 20.4%, 17.9%, 11.8% and 11.7%, respectively. The aggregate net profit generated by banks in Saudi Arabia, the UAE, South Africa and Qatar accounted for 23%, 19.3%, 12.3% and 11.8% of the total net profit of the 200 largest banks, respectively.

Saudi Arabian banking sector demonstrated the highest strength

Out of the top 10 strongest banks in the Middle East, four are from Saudi Arabia. Saudi National Bank and Al Rajhi Bank took the first two spots. In addition to strong asset quality, Al Rajhi Bank continued to achieve the highest ROA among the banks in the region, at 2.7%, and lowered its CIR further to 26.9%. FADB, the strongest bank in the UAE, placed third in the ranking, followed by Qatar National Bank and Kuwait Finance House. FADB excelled in profitability and liquidity. Both its CIR and gross NPL ratio were the second lowest among the UAE banks.

Saudi Arabian banks remained the strongest in the region, as their weighted average strength score reached 3.73 out of five, higher than the average recorded by all banks in the Middle East, at 3.35. on average, Saudi Arabian banks achieved the highest score in profitability, measured by four parameters, namely operating profit growth, ROA, CIR and non-interest income to total operating income ratio. All the Middle Eastern countries posted higher average ROA in FY2021, thus the average ROA of banks on the list rose to 1.3% from 0.9% in the year before. Saudi Arabian banks saw their average ROA improved from 1.3% in 2020 to 1.8% in 2021, the highest in the region.

In terms of asset quality, Kuwaiti banks came on top, with an average gross NPL ratio of 1.3% and an average loan loss reserve to gross NPLs ratio of 312%. Saudi Arabia banks witnessed a reduction in the average gross NPL ratio from 2% to 1.6%, the second lowest in the region. Across the region, the average gross NPL ratio of banks eased from 4.3% in 2020 to 4%. Banks from Lebanon and the UAE obtained the lowest scores in asset quality, with the higher gross NPL ratio of 16.9% and 6.4%, respectively.

Middle Eastern banks reported an average CAR of 18.2%, down slightly from 18.4% in FY2020. The average CAR of Saudi Arabian banks dropped from 20.4% to 19.8%, which remained the highest in the region. The UAE banks also experienced a contraction in CAR from 17.5% to 16.6%, the second lowest in the region, while banks in Bahrain, Kuwait, Lebanon and Oman strengthened their average CAR . When it comes to liquidity, banks in Qatar, Oman and Saudi Arabia continued to underperform. The average liquid assets to total deposits and borrowings ratio recorded by Saudi Arabian banks declined from 26.7% to 22.9%, lower than the average in the region, at 31.5%.

African banks delivered improved performance

The top 10 strongest banks in Africa comprised three South African banks, two each from Egypt, Mauritius and Nigeria and one Kenyan bank. Egyptian banks achieved the highest weighted average strength score, at 3.47 out of five, followed by South Africa (3.27) and Nigeria (2.88). Standard Bank Group, the strongest bank in South Africa, saw its ROA rise from 0.7% to 1.4%. Zenith Bank, the strongest bank in Nigeria, attained solid profitability, evidenced by its 2.8% ROA and 21.2% return on equity.

The overall profitability of African banks on the list improved. On average, their ROA went up from 1.1% in FY2020 to 1.3% in FY2021, which remained below pre-pandemic level of 1.7% recorded in FY2019. Meanwhile, their average CIR went down from 52.4% to 49.4%. The ROA of Kenyan and South African banks rebounded strongly in FY2021, after falling significantly in FY2020. Kenyan banks experienced an increase in their average ROA from 1.8% to 2.7%, the second highest in Africa. Ghanaian banks continued to enjoy the highest ROA, averaging 3.3%, while Egyptian banks kept the lowest CIR, at 34.7%.

African banks on the list also reported asset quality improvement, with the aver age gross NPL ratio down to 5.9% from 6.6% in the previous year. Egyptian banks outperformed in terms of asset quality, with an average gross NPL ratio of 3.4%. The average gross NPL ratio of Kenyan banks remained the highest, at 11.5%, albeit some improvement. Nigerian banks registered a decline in average gross NPL ratio from 6.9% to 5.4%, although their average ROA weakened to 1.7% from 1.9%. In addition, African banks maintained strong liquidity positions, as their average liquid assets to total deposits and borrowings ratio stood at 43%. The overall capitalisation of African banks also strengthened further in 2021.

The operating environment for banks in the Middle East and Africa continues to improve, thus the banking sector is expected to deliver better performance. The overall profitability of banks will benefit from high oil prices and interest rate hikes.

Click here to see the Largest Banks in the Middle East and Africa 2022

Click here to see the Strongest Banks in the Middle East and Africa 2022