- Metaverse applications are growing everywhere except finance

- Use cases like digital branches and transactions struggle to generate impact

- Overcoming user-adoption challenges

Tech giants like Meta, NVIDIA and Apple have launched their own versions of the metaverse, raising questions about its impact on the financial services industry. Various stakeholders are leading the banks in exploring the metaverse to see whether it can make an actual difference, and if it has a sustainable future in the industry. These include JP Morgan, Union Bank of the Philippines (UnionBank), Shinhan Bank, China CITIC Bank, and Industrial and Commercial Bank of China (ICBC).

Metaverse applications are growing everywhere except finance

The metaverse and gaming spaces share similarities, creating a digital twin for users and serving as a platform for socialising, merging physical, augmented and virtual realities, and supporting transactions in a virtual environment for diverse products such as gaming gear, non-fungible token (NFT) art pieces, and mutual funds.

The metaverse has potential in various financial sectors, including digital payments, digital asset marketplaces, and retail product showcases. It enables immersive interactions in industries like healthcare, education, creator economies and public services.

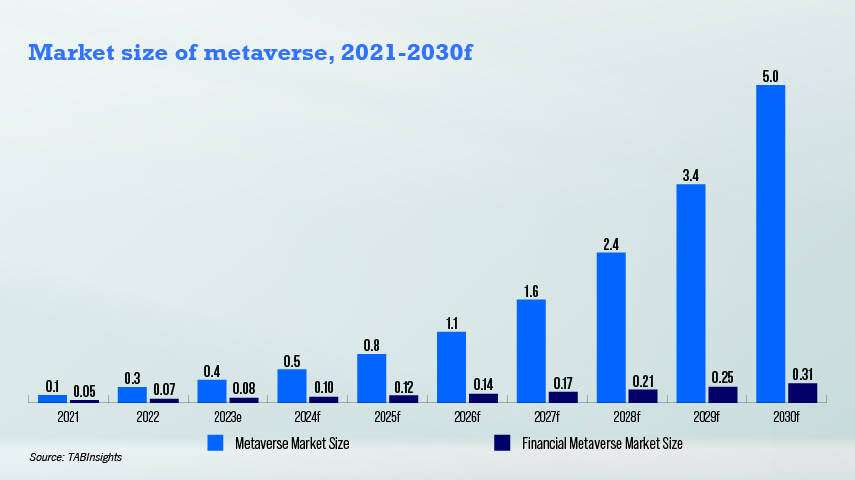

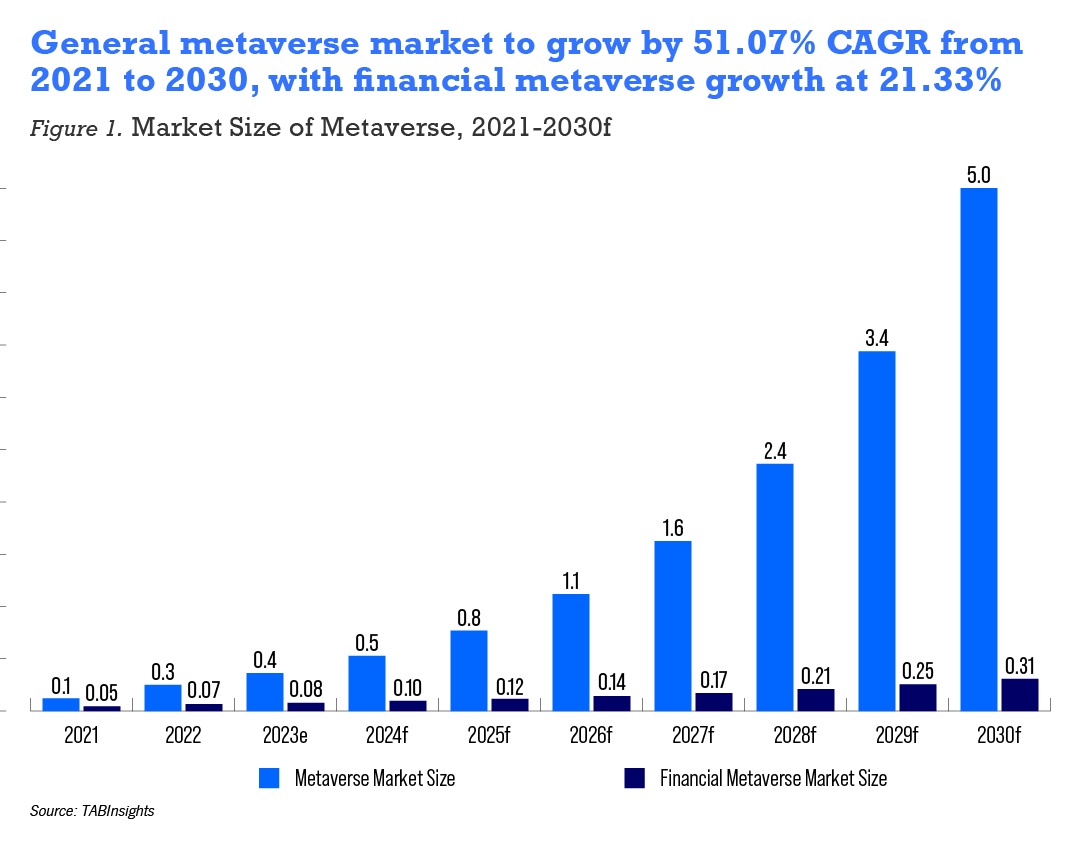

S&P Global estimates 34.7 million augmented reality-virtual reality (AR/VR) headsets worldwide by 2022. The opportunities in the metaverse seem immense—McKinsey and Boston Consulting Group estimated that its market size will reach $5 trillion by 2030. However, financial services currently contribute less to this market value, and will continue to drop from the current 22% to 6% in 2030, and growing much slower, which suggests that financial services in the metaverse might never really take off.

The metaverse has gained popularity in the smart manufacturing industry, enabling virtual experiences and decision-making through digital twins and industrial metaverses. This technology simulates production processes, predicts maintenance, optimises supply chains, and enhances collaboration.

By leveraging blockchain, NFT, and cryptocurrencies, the metaverse offers decentralised transfers, lending, and automated market makers (AMM), opening up new market segments worth billions of dollars to the traditional financial world. However, the actual application of the metaverse in industries has not lived up to the hype.

Use cases like digital branches and transactions struggle to generate impact

Most bank metaverse initiatives often turn out to be confusing and overlook the most important element of the return on investment.

JP Morgan was one of the first leading banks to launch a virtual branch in ‘Decentraland’ in February 2022, using the bank’s blockchain unit, Onyx, but it offers nothing new in the metaverse. The virtual bank only displays the bank’s accomplishments on a virtual wall and lacks differentiation from traditional branches.

UnionBank partnered with Hex Trust, a digital asset custodian, in December 2022 for its Tech-up Pilipinas initiative, offering a secure environment for customers to interact with the metaverse and NFT. UnionBank offers new experiences for customers, but there is confusion around the difference between NFT assets and wallets.

Shinhan Bank’s Shinamon metaverse pilot-tested crypto-lending and cross-border stablecoin remittance but these functions have not been fully commercially launched and generate low income.

Chinese banks are imagining the metaverse on a different path. After the crypto ban, decentralised finance in China’s banking sector has been reduced to central bank digital currencies (CBDC) and blockchain for settlements and remittances.

ICBC and CITIC were the first banks to present in the metaverse, using technologies such as AR, holographic infrastructures and voice-to-text to provide a more frictionless, value-added novel experience. However, these innovations do not necessarily generate more income.

CITIC’s credit cards in its metaverse only account for 30,000 monthly active users (MAU), which does not directly impact its business. The bank has 100 million credit cards in use. Other companies like Sokin, a fintech building metaverse payments, transactions and investments infrastructure, and Zelf, a neobank, launched embedded banking services into Discord for gamers, but the implementation has little impact on the financial world.

Overcoming user-adoption challenges

There is limited user-adoption in the metaverse, with customers abandoning it quite quickly. Banks in the metaverse have fewer visitors from day to day, posting lower MAU rates compared to their own mobile apps, resulting in fewer payments and transactions.

The metaverse aims to attract customers and increase transactions, but people don’t transact simply because of a novel engagement method. To become a genuine, lively marketplace, there has to be exclusive products and services, facilitated by advanced technologies.

Optic technologies such as holographic optical elements can bring a more seamless experience by allowing lightweight, thin form factors, and low-cost 3D displays. Apple’s Vision Pro goggles could revolutionise a more personalised metaverse banking experience by providing customised investment opportunities or financial plans in a three-dimensional, interactive format.

However, such evolutions don’t just happen overnight. Vision Pro and other metaverse technologies require financial innovations for widespread adoption, as they cannot induce general acceptance on their own.