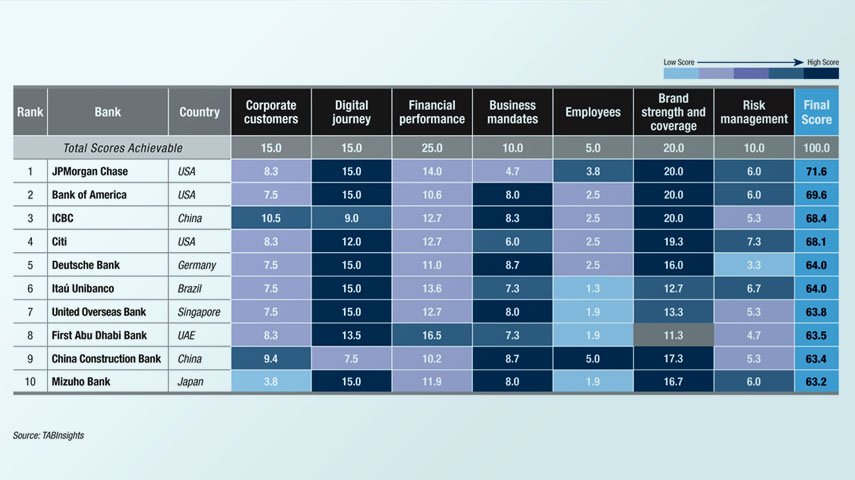

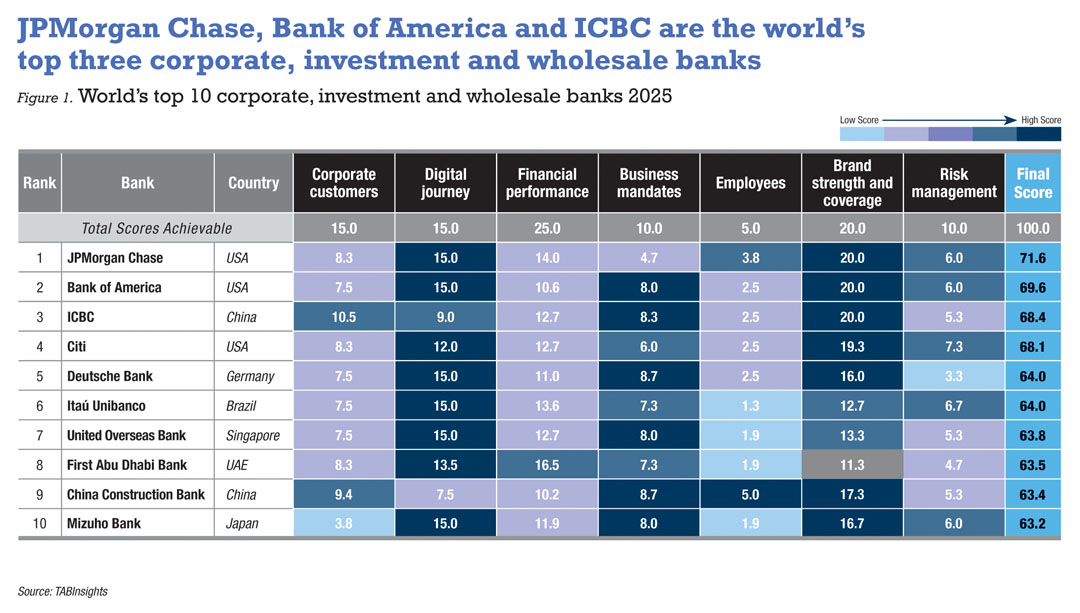

JPMorgan Chase, Bank of America and Industrial and Commercial Bank of China (ICBC) top the inaugural TABInsights World’s Top 50 Corporate, Investment and Wholesale Banks Ranking. The ranking evaluates these banks across seven critical dimensions, including corporate customers, digital journey, financial performance, business mandates, employees, brand strength and coverage and risk management.

It features 50 banks from 20 countries and jurisdictions, with corporate, investment and wholesale banking revenues ranging from $1.4 billion to $70 billion, and pre-tax return on assets (ROA) spanning from 0.2% to 3.5%. Collectively, these top 50 banks generated approximately $720 billion in corporate, investment and wholesale banking revenue in the financial year (FY) 2024, accounting for about 40% of their total revenue.

The structure and scope of business units vary across banks, reflecting their strategic priorities and client segments. Corporate banking primarily serves medium-to-large enterprises, offering services such as lending, cash management and trade finance, while also catering to small businesses in some institutions. Investment banking focuses on capital markets, mergers and acquisitions (M&A), and advisory services for large corporations, institutional investors and governments. Wholesale banking provides large institutional clients with specialised services such as syndicated loans, cross-border financing and advanced risk management.

Global corporate, investment and wholesale banking is evolving with a strong focus on technology-driven solutions and efficient growth. Banks are deploying integrated digital platforms, cloud infrastructure and artificial intelligence (AI)-driven analytics to streamline workflows, enhance the client experience and manage costs. Services across treasury, trade, capital markets and lending are being consolidated to improve delivery and enable cross-selling. As demand for Environmental, Social, and Governance (ESG)-linked financing grows, banks are embedding sustainability into their offerings.

The top 10 also includes Citi, Deutsche Bank, Itaú Unibanco, United Overseas Bank (UOB), First Abu Dhabi Bank (FAB), China Construction Bank and Mizuho Bank. JPMorgan Chase, Bank of America and Citi capitalise on their extensive scale and global networks, while Itaú Unibanco, UOB and FAB focus on regional expansion and specialised offerings. Meanwhile, Chinese banks prioritise supporting government-defined sectors and maintaining stability, while Deutsche Bank and Mizuho Bank refine their strategies around core strengths.

Top three banks

JPMorgan Chase’s position as the world’s leading corporate, investment and wholesale bank is reinforced by its global presence, digital capabilities, diversified revenue streams and long-established corporate client relationships. With over 90% of Fortune 500 companies among its clients, the bank’s influence spans a wide range of industries. In 2024, JPMorgan Chase further solidified its leadership by merging its Commercial Banking unit with its Corporate and Investment Bank, creating a more streamlined structure that enhanced client coverage and facilitated cross-selling.

Technology plays a pivotal part in JPMorgan Chase’s strategy, with 98% of its production applications migrated to strategic data centres or the public cloud by 2024, ensuring scalability and resilience. Additionally, over 175 AI applications have been deployed to enhance client analytics, risk management and regulatory compliance.

JPMorgan Chase continues to dominate global investment banking. In 2024, it led global investment banking fees for the 16th consecutive year and ranked first in M&A, equity capital markets and debt capital markets within a single calendar year. The bank also maintained its leadership in markets revenue, a position it has held since 2011. Furthermore, JPMorgan Chase maintains a dominant presence in payments, processing over $10 trillion daily and controlling 28.7% of SWIFT dollar flows.

Bank of America ranks second among global corporate, investment and wholesale banks, reflecting its digital innovation and strategic focus. The bank’s transformation is driven by its digital offerings, with 86% of clients conducting transactions via digital platforms. In 2024, the bank processed over $1 trillion in corporate payment approvals through the CashPro® App, marking a 30% increase. The Erica® virtual financial assistant was integrated into CashPro® Chat, resolving over 40% of client inquiries. Additionally, CashPro® Insights provides personalised, data-driven recommendations, further enhancing client engagement.

Platform investments supported strong performance, contributing to new client acquisition and deeper engagement across business lines. In 2024, Bank of America’s Global Commercial Banking unit recorded its second-highest year for new client acquisition, serving one in five US middle-market companies. Both the Global Corporate and Investment Banking and Capital Markets divisions saw solid results, with a 30% rise in investment banking fees. The Global Markets division benefited from increased investor activity, with greater use of Deal Central and CashPro® Capital Markets Insights driving improved efficiency and scale.

ICBC is China’s leading corporate, investment and wholesale bank, ranking third globally. With state-backed scale and a well-established corporate finance franchise, it has built strong client confidence across domestic and cross-border markets. As the world’s largest bank by corporate, investment and wholesale banking assets, reaching $2.7 trillion at the end of 2024, ICBC grew its corporate customer base by 10.7% during the year. The segment’s pre-tax ROA edged up to 1.3%, while the cost-to-income ratio (CIR) remained low at 26%.

In settlement and cash management, ICBC streamlined onboarding for basic, new-entity and payroll accounts and deployed its intelligent digital runoff-warning model. The bank also expanded application programming interface (API) access for key offerings, introduced new digital capabilities, and applied large language models for AI-driven settlement-finance advisory. In 2024, it maintained 15 million corporate settlement accounts and served two million cash-management clients, including 12,700 multinational users. Additionally, its investment banking arm excels in M&A advisory and structured-finance solutions. In bond markets, ICBC underwrote significant domestic issuances and arranged numerous panda-bond programmes, reinforcing its leadership in China’s cross-border debt capital markets.

Top banks by region

In Europe, Deutsche Bank is a leading corporate, investment and wholesale bank with its Corporate Bank and Investment Bank divisions accounting for 60% of total revenue. By leveraging its global network and integrated expertise, Deutsche Bank has strengthened its corporate client base. From 2022 to 2024, the Corporate Bank division saw an almost 40% increase in incremental business with multinational clients. Meanwhile, the bank has intensified its focus on ESG and sustainable finance, actively promoting sustainable bonds.

The bank also advanced its digital capabilities, including the rollout of HausFX, a consolidated workflow solution for fixed income and currencies that streamlines foreign exchange operations. In 2024, its Investment Bank division grew revenue by 15%, with a 9% increase in fixed income and currencies and a 61% rise in origination and advisory. Strengthened client relationships and platform enhancements contributed to the growth in fixed income and currencies, while increased client activity, improved market conditions and earlier platform investments supported the growth in origination and advisory.

In Asia Pacific, ICBC and UOB lead the region’s corporate, investment and wholesale banking sector. UOB excels across key dimensions, including its digital journey, financial performance, business mandates, brand strength and coverage. The bank has expanded its network across ASEAN and Greater China to support growing regional trade and investment flows. It has enhanced its wholesale offerings in trade, cash and treasury services, supported by improved connectivity and platform upgrades. Its digital platform, UOB Infinity, consolidates key transaction and liquidity tools into a single interface. Partnerships with regional investment agencies further strengthen its capacity for cross-border facilitation.

In FY2024, wholesale banking contributed 47% to UOB’s total revenue. Revenue from this segment declined by 5% due to narrower margins, though this was partly offset by stronger investment banking and treasury performance. Nonetheless, the segment maintained a solid pre-tax ROA of 1.8% and an efficient CIR of 26%, highlighting its financial strength.

In Latin America, Itaú Unibanco is the leading corporate, investment and wholesale bank, primarily operating through its corporate and investment banking arm, Itaú BBA. Its digital transformation, driven by AI, data analytics and a unified client platform, has resulted in measurable improvements in customer satisfaction, operational efficiency and risk management. In 2024, 85% of working capital transactions and 70% of foreign exchange dealings were conducted through its digital channels.

The bank’s wholesale business spans 19 countries, processing around 500 transactions per second and covering the activities of approximately 90% of Brazilian companies. While this division contributed 34% to total revenue, the second lowest among the world’s top 10 corporate, investment and wholesale banks, it achieved robust financial results. In 2024, the division recorded a pre-tax ROA of 2.4% and a CIR of 37%, alongside continued improvements in non-performing loan ratios.

In the Middle East, FAB is the leading corporate, investment and wholesale bank, supported by strategic initiatives, digital advancements and robust financial performance. Although it operates in fewer global markets than some of its peers, it has been expanding its international footprint and broadening its product suite. Aligned with its sustainability goals, the bank has integrated ESG principles across its operations. In 2024, its Corporate and Commercial Banking, Investment Banking and Global Markets divisions collectively achieved 15% revenue growth, contributing 67% of total revenue. The bank posted a pre-tax ROA of 2.2% and a CIR of 15% across these divisions.

In 2024, FAB’s Investment Banking division saw a 19% revenue increase, driven by strong deal execution and landmark transactions across diverse sectors. The division capitalised on a solid deal pipeline and a broad range of offerings, securing top-tier rankings in the investment banking league tables for the Middle East and North Africa. Meanwhile, its Global Markets division saw an 18% increase in revenue, driven by heightened client activity and enhanced cross-selling of foreign exchange, interest rate and structured products.

In Africa, Standard Bank is a leading corporate, investment and wholesale bank, supported by its extensive footprint and strong client relationships. Despite macroeconomic challenges such as inflation and currency depreciation, the Commercial Banking division continued to invest in client-specific solutions, operational efficiency and technological advancements. Initiatives such as process automation and improved collections systems helped control costs while driving transactional growth. The bank expanded its structured lending solutions and cross-regional offerings, while its strong Africa–China ties fostered valuable trade connections, enhancing business relationships and promoting trade between Africa and China.

In the Corporate and Investment Banking division, Standard Bank reinforced its position with a diversified portfolio, particularly in foreign exchange, custody and debt capital markets across sub-Saharan Africa. While currency devaluations presented challenges, the bank achieved stable revenue growth, particularly in energy and infrastructure sectors. By leveraging local market expertise, sector knowledge and partnerships with global institutions such as ICBC, Standard Bank effectively served both multinational and local corporates.

Brand strength and coverage

JPMorgan Chase, Bank of America, ICBC and HSBC received the highest scores in brand strength and coverage, based on three indicators including the number of markets served globally, the range of top-line products offered and market share from corporate, investment and wholesale banking revenue. Close behind are Citi, Bank of China, Wells Fargo, China Construction Bank and MUFG Bank.

JPMorgan Chase, Standard Chartered, HSBC, ICBC and Bank of China lead in the number of markets served globally, while most banks perform well in the number of top-line products offered. JPMorgan Chase, in particular, serves clients in more than 100 markets worldwide, supported by an on-the-ground presence in 177 locations in the US and over 60 countries internationally, following its expansion into 24 new countries over the past five years.

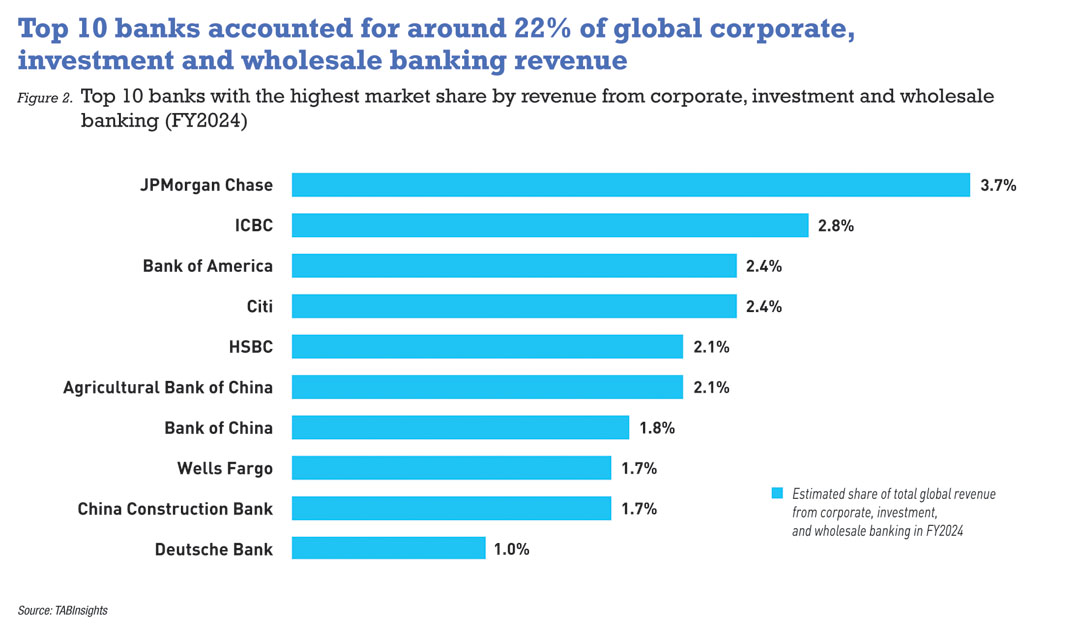

The top 10 banks by corporate, investment and wholesale banking revenue accounted for approximately 22% of global revenue in these segments in FY2024. This group included four Chinese banks, four US banks, and one each from Germany and the UK. The limited European representation, with only HSBC and Deutsche Bank, highlights ongoing regional challenges, such as fragmented regulation and slower post-pandemic recovery.

JPMorgan Chase led the group with $70.1 billion in revenue, capturing a 3.7% market share, despite having smaller assets than China’s big four banks and HSBC. ICBC followed with $53.2 billion and a 2.8% share. Bank of America and Citi reported $45.8 billion and $45.7 billion, respectively, each holding a 2.4% market share. This highlights the dominance of US and Chinese banks that capitalise on their scale and strategic positioning in high-value transaction banking and cross-border services. The top US banks focus on global banking networks and innovation-driven models, while Chinese banks benefit from state-supported domestic expansion and infrastructure financing.

Financial performance

First Abu Dhabi Bank, HDFC Bank, Saudi National Bank, MUFG Bank, Emirates NBD, JPMorgan Chase and Itaú Unibanco scored highest in financial performance, assessed through indicators such as revenue contribution from corporate, investment and wholesale banking, revenue growth, assets, ROA, changes in ROA, CIR and changes in CIR.

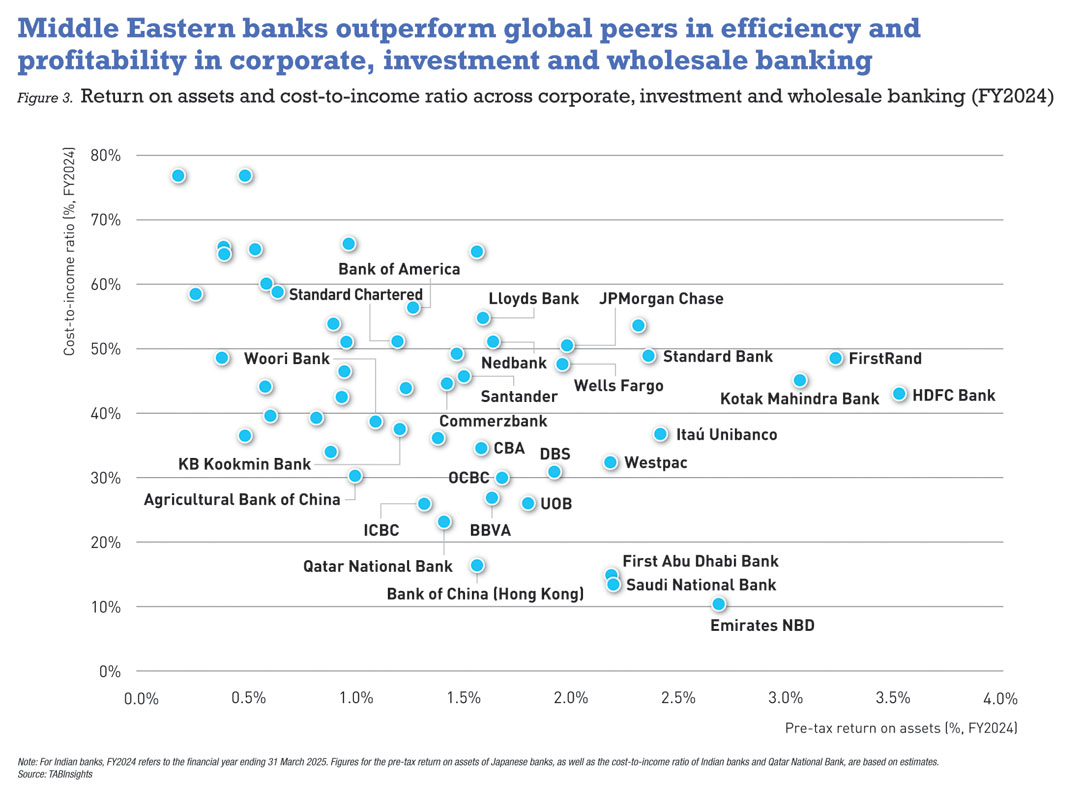

Middle Eastern banks deliver top-tier efficiency alongside solid profitability. Emirates NBD leads with a pre-tax ROA of 2.7% and a CIR of just 11%. Saudi National Bank and First Abu Dhabi Bank follow closely, each posting a pre-tax ROA of 2.2% and a CIR below 15%. Scale economies, low funding costs and lean branch networks underpin these outcomes, enabling these banks to generate robust margins with minimal overhead.

Indian and South African banks achieve top-tier ROA despite mid-range cost levels. Indian private and South African banks rank among the most profitable globally in corporate, investment and wholesale banking based on pre-tax ROA. HDFC Bank stands out with a pre-tax ROA of 3.5% for the financial year ending March 2025, while Kotak Mahindra Bank posted 3.1%. In South Africa, FirstRand delivered a pre-tax ROA of 3.2% and Standard Bank achieved 2.4%.

By contrast, many Western banks generate moderate returns while shouldering substantial expense burdens. Legacy branch networks and ongoing technology upgrades continue to drive up costs. Many European lenders have an ROA below 1% or a CIR above 50%, and they are accelerating their cost-optimisation efforts to stay competitive with leaner peers.

In conclusion, the inaugural TABInsights World’s Top 50 Corporate, Investment and Wholesale Banks Ranking highlights the prominent positions of JPMorgan Chase, Bank of America and ICBC, showcasing their strength in a competitive global banking landscape. These institutions, alongside other top players, are shaping the future of corporate, investment and wholesale banking. They leverage technology to enhance efficiency and customer service while navigating challenges. The top banks in this ranking are not only dominant in their respective regions but are also driving global trends that influence the evolving landscape of banking.