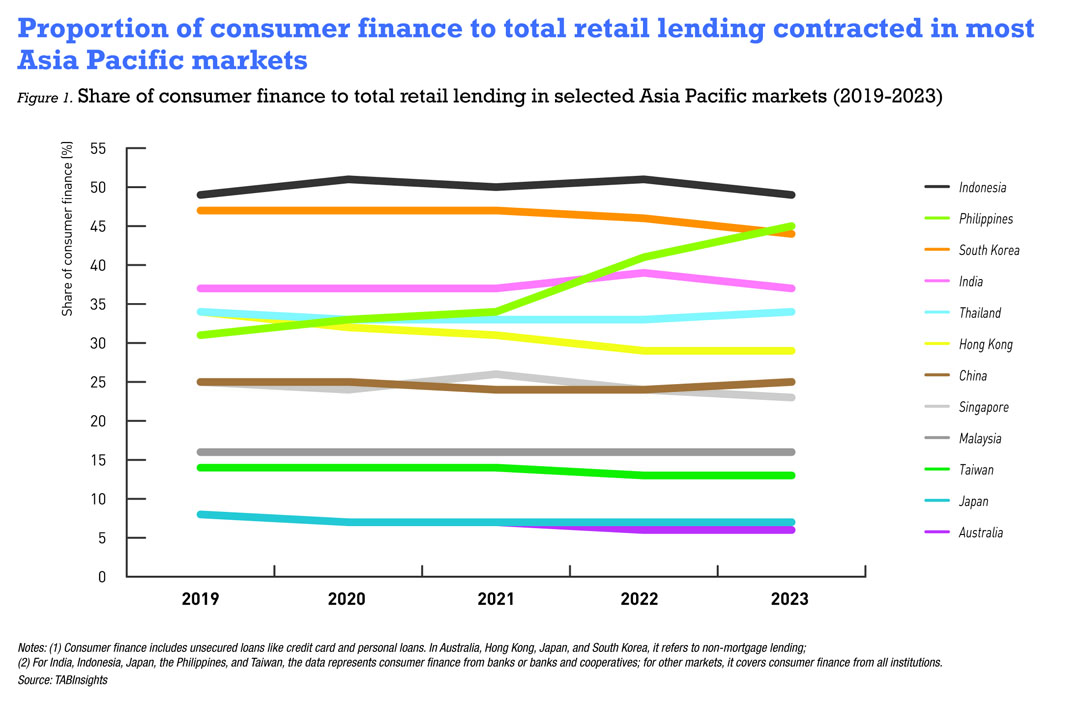

Consumer finance contributes less to total retail lending in most Asia Pacific markets, with the exception of the Philippines and India. Hong Kong and South Korea saw notable declines in the share of consumer finance relative to total retail lending from 2019 to 2023. Conversely, the Philippines experienced a significant increase in its proportion of consumer finance.

In 12 key markets across Asia Pacific, 10 reported a decrease in the proportion of consumer finance relative to total retail lending from 2019 to 2023. Consumer finance encompasses unsecured loan categories such as credit card loans and personal loans. However, in Australia, Hong Kong, Japan, and South Korea, the data refers to non-mortgage lending that includes auto loans.

Consumer finance varies widely across markets, accounting for between 6% and 49% of total retail lending in these 12 markets in 2023. Indonesia, the Philippines, and South Korea have a higher share of consumer finance within total retail lending, exceeding 40%. In contrast, Australia had the lowest proportion of consumer finance among these markets, with Japan, Taiwan, and Malaysia also below 20%.

Consumer finance in Hong Kong and South Korea

Consumer finance in Hong Kong accounted for 29% of total retail lending in 2023, decreasing gradually from 34% in 2019. Unlike mortgages that grew at a compound annual growth rate (CAGR) of 7%, consumer finance remained unchanged in 2023 compared to 2019. While credit card advances reported CAGR of 4% between 2019 and 2023, loans for other private purposes dropped by 1% during the same period.

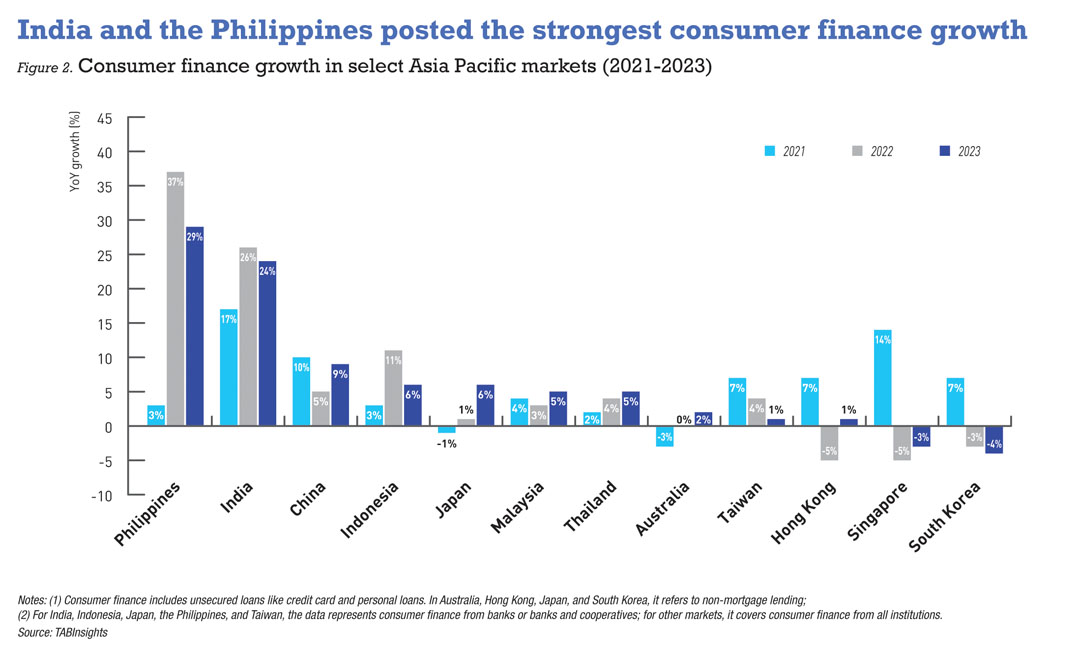

In 2023, consumer finance in Hong Kong rebounded by 1%, driven by a resurgence in private consumption amid the reopening of the economy and improved consumer sentiment. This marked a recovery from the 5% decline in 2022. The growth of credit card advances accelerated from 8% in 2022 to 11% in 2023, while loans for other private purposes that decreased by 7% in 2022, saw a more modest decline of 1% in 2023.

In South Korea, consumer finance as a share of total retail lending decreased from 47% in 2019 to 44% in 2023. Both mortgages and consumer finance grew at 8% CAGR from 2019 to 2021, driven by accommodative macro policies and a rally in asset markets. However, consumer finance saw -3% CAGR from 2021 to 2023, contrasting with 4% CAGR for mortgages.

The Bank of Korea’s interest rate hikes since August 2021 increased consumer loan repayments, with most consumer finance waiving early repayment fees. Stricter consumer finance regulations also contributed to the decline. South Korea’s high level of household debt, surpassing GDP, has long been regarded as a major risk factor for the economy.

India, the Philippines posted strongest growth

Between 2019 and 2023, India and the Philippines saw the strongest growth in consumer finance, with CAGR of 20% and 19%, respectively.

In the Philippines, consumer finance surged remarkably, escalating from 31% of total retail lending in 2019 to 45% in 2023, fueled by increased consumer spending post-2022 economic reopening. Borrowing became prevalent amid high inflation and pandemic-induced savings constraints, and banks showed a greater appetite for risk exposure. Between 2019 and 2023, consumer finance expanded at a 19% CAGR, surpassing the 7% CAGR of mortgage lending. Consumer finance experienced a sharp surge, with growth rates rising from 3% in 2021 to 37% in 2022, sustaining at 29% in 2023, while mortgage lending growth slowed down due to higher interest rates.

In India, consumer finance surged, growing from 15% in 2020 to 26% in 2022 and 24% in 2023, driven by robust economic growth, easier loan access, and intense lender competition. The sector’s share of total retail bank lending rose from 37% in 2019 to 39% in 2022 but fell back to 37% in 2023. A 39% increase in housing loans, notably influenced by HDFC Bank’s merger with Housing Development Finance Corporation, outpaced consumer finance growth.

Growth in Indonesia strengthened from 3% in 2020 to 11% in 2022, supported by rising credit demand and improved consumption, though it slowed to 6% in 2023 due to tighter monetary policy.

In Thailand, growth increased from 2% in 2021 to 5% in 2023, with credit cards and personal loans seeing major gains. This led to significant household borrowing, with 30% of borrowers having over four accounts, reflecting a slow post-pandemic recovery and high household debt levels.

.jpg)