• High-net-worth individuals in China favour the top 12 banks holding nearly 90% of the private banking market

• Large banks are preferred for stability, risk management, and broad range of services

• Slowdown in potential HNWI client growth will intensify bank competition

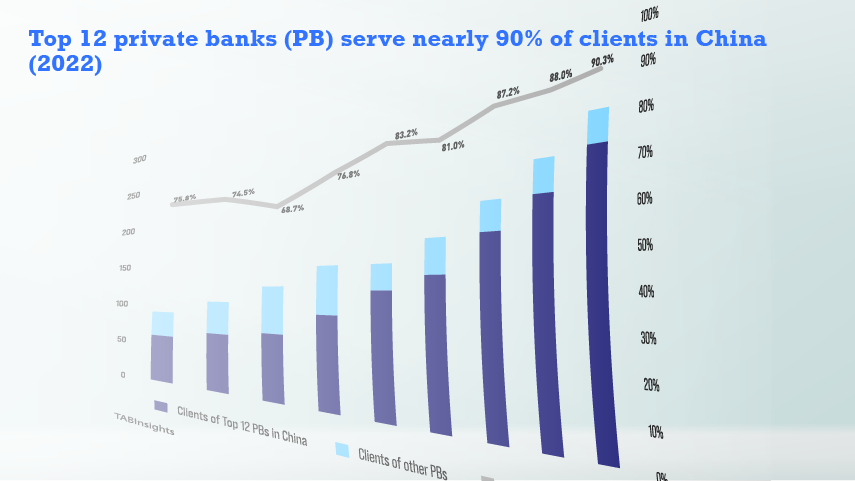

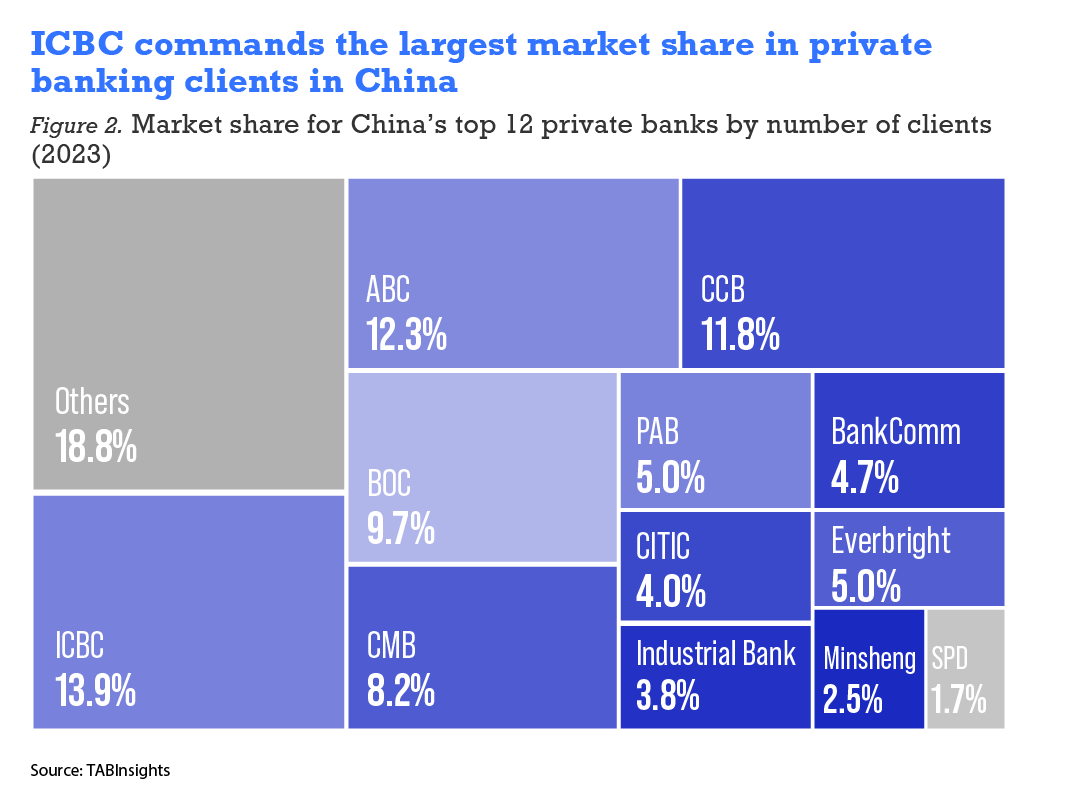

The COVID-19 pandemic has shifted client preferences towards larger institutions. Since 2019, the proportion of private banking clients choosing services from the top 12 banks, including the big four state-owned banks— ICBC, ABC, CCB and BoOC— and leading joint-stock banks, has increased from 70% and is projected to reach 90% by 2025.

The stability and risk management capabilities of large banks have attracted wealthy clients. These banks accounted for around 80% of clients in 2022, a share expected to increase to 90% by 2025. Their appeal lies not only in financial strength but also in comprehensive risk management systems, advanced technological infrastructure, and global reach, supporting a diverse range of services from traditional wealth management to customised investment solutions.

This trend is expected to further entrench the dominance of top-tier banks within the sector, increasing the competitive pressures, especially among smaller city and rural commercial banks which cannot operate outside their designated area.

As Chinese economy slows down, a slowdown in the fast growth rate of the potential HNWI client pool is anticipated to come to a halt in the coming years, following a period of rapid expansion. This will likely place additional pressure on the sector. Smaller institutions may find it challenging to compete unless they differentiate themselves through distinct niches or specialised services that resonate with dedicated client bases.

.png)

The forecast for China’s private banking landscape suggests that scale, brand recognition, and service diversification will become even more crucial determinants of success. This trend will increase wealth disparity among clients, as top-tier banks continue to attract the most affluent individuals, leaving smaller players to contend with a more limited market segment.

To navigate these challenges, financial institutions need to innovate and specialise, striving to carve out unique positions in a consolidating market. This shift could usher in a new era of innovation within the private banking sector as institutions adapt to a changing economic environment and evolving client expectations.

For a deeper understanding of the evolving dynamics and detailed forecasts of China’s private banking sector, please refer to the full China Private Wealth Outlook Report 2024.