- UnionBank dominated the channels category while BDO and Metrobank led in product

- Maya Bank outperformed digital-only banks with 63% BQS

- UnionBank was the most helpful financial institution for managing living costs

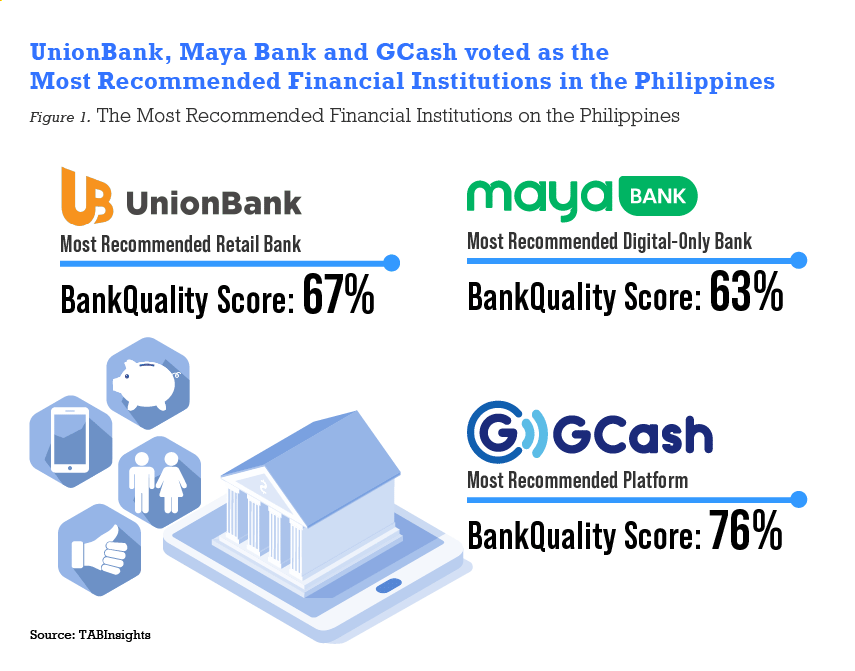

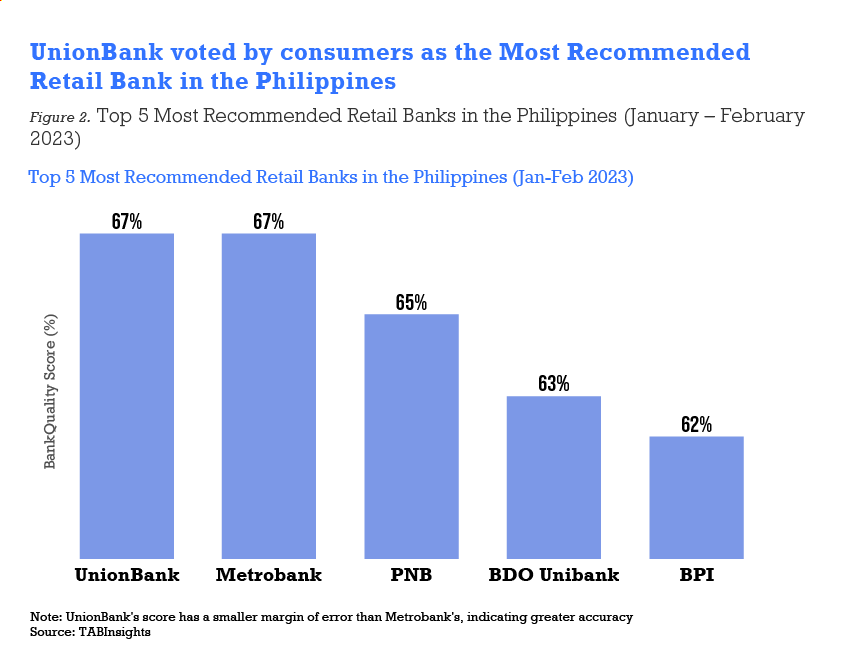

UnionBank earned top marks from customers for ease and convenience of transactions, and for having a user-friendly application. Maya Bank led digital-only banks, while GCash was the most recommended platform with a BankQuality Score (BQS) of 76%.

The BankQuality™ Consumer Survey and Rankings is a digital consumer feedback channel developed by The Asian Banker. It surveys 1,000 online customers across the Philippines to understand their engagement, experience, and satisfaction with retail financial services institutions based on their experience with service, channels, products, and support in managing living costs.

UnionBank dominated the channels category while BDO and Metrobank led in product

UnionBank also outperformed competitors in three out of five channels category: mobile banking, internet banking, and phone banking.

BDO Unibank (Banco de Oro) and Metrobank led in the product category. BDO’s competitive offerings in home loan, life and non-life insurance, and wealth advisory earned it the most votes in these categories. Metrobank’s time deposits, credit cards, and international remittance, on the other hand, were preferred by most customers. Maya Bank led in savings account and investment product and Union Bank in digital wallet and personal loan.

Maya Bank ranked first in chatbot services, BPI in branch banking, and BDO in relationships with managers.

Maya Bank outperformed digital-only banks with 63% BQS

Maya Bank gained accolades for its mobile services, secure financial transactions, and attractive daily interest rates from deposits as reflected in its 63% BQS. Customers also cited the bank’s prompt response to queries and concerns as reasons for their votes.

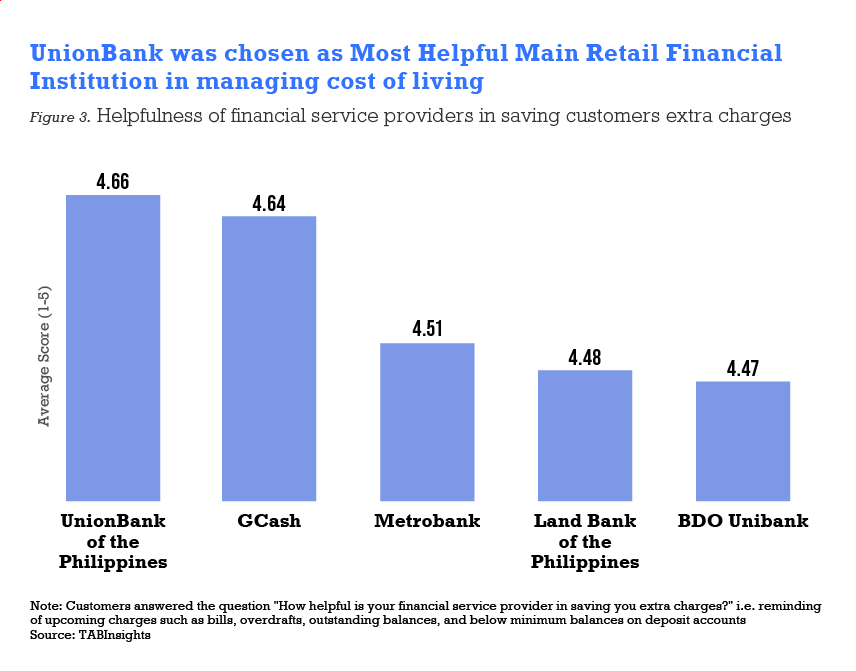

UnionBank was the most helpful financial institution in managing living costs

UnionBank was voted as the Most Helpful Main Retail Financial Institution in managing the cost of living, followed by GCash—the category in which financial institutions were scored based on how helpful they were in providing extra savings with reminders of upcoming charges such as bills, overdrafts, outstanding balances and below-minimum balances on deposit accounts.

UnionBank was also voted by consumers for having lower transaction fees compared to other banks.

Survey methodology for the Philippines

The BankQuality™ Survey was conducted in the Philippines from January to February 2023, encompassing a nationwide sample of 1000 participating respondents. The BankQuality Score (BQS) was determined by analysing the response set, which utilised a scale ranging from 0 to 1. In computing the scores for the products and channels categories, a weighted BQS was derived from the values obtained from financial institutions belonging to both the primary and secondary bank classifications. Subsequently, an average score was calculated, taking into account the total number of surveyed votes within the primary and secondary categories.

Members of TABInsights can now access the comprehensive BQS Philippines report, that includes a detailed breakdown of BQS scores for various institutions, products, and channels, here