- Impact assets – dominated by specialist asset managers – comprise a tiny fraction of global sustainable strategies

- Family offices are ideally placed to match impact and returns but relative deal volume is low as philanthropy remains strong

- Overcoming two-fold measurement challenges regarding both deal flow and output of impact essential to advancing industry

Impact investing, the strongest form of sustainable investment, is gaining wider attention from a very low base. But perceptions on lack of deal flow, difficulties in measuring market size and impact plus the absence of common standard as well as the need for secondary markets are all dragging the industry development down, although growing sustainability concerns will accelerate progress.

While diverse, impact investing continues to mature in terms of both measurement the management of the financial and impact performance of assets, yet the ‘visible heart’ needs futher tools to guide the invisible hand of the market.

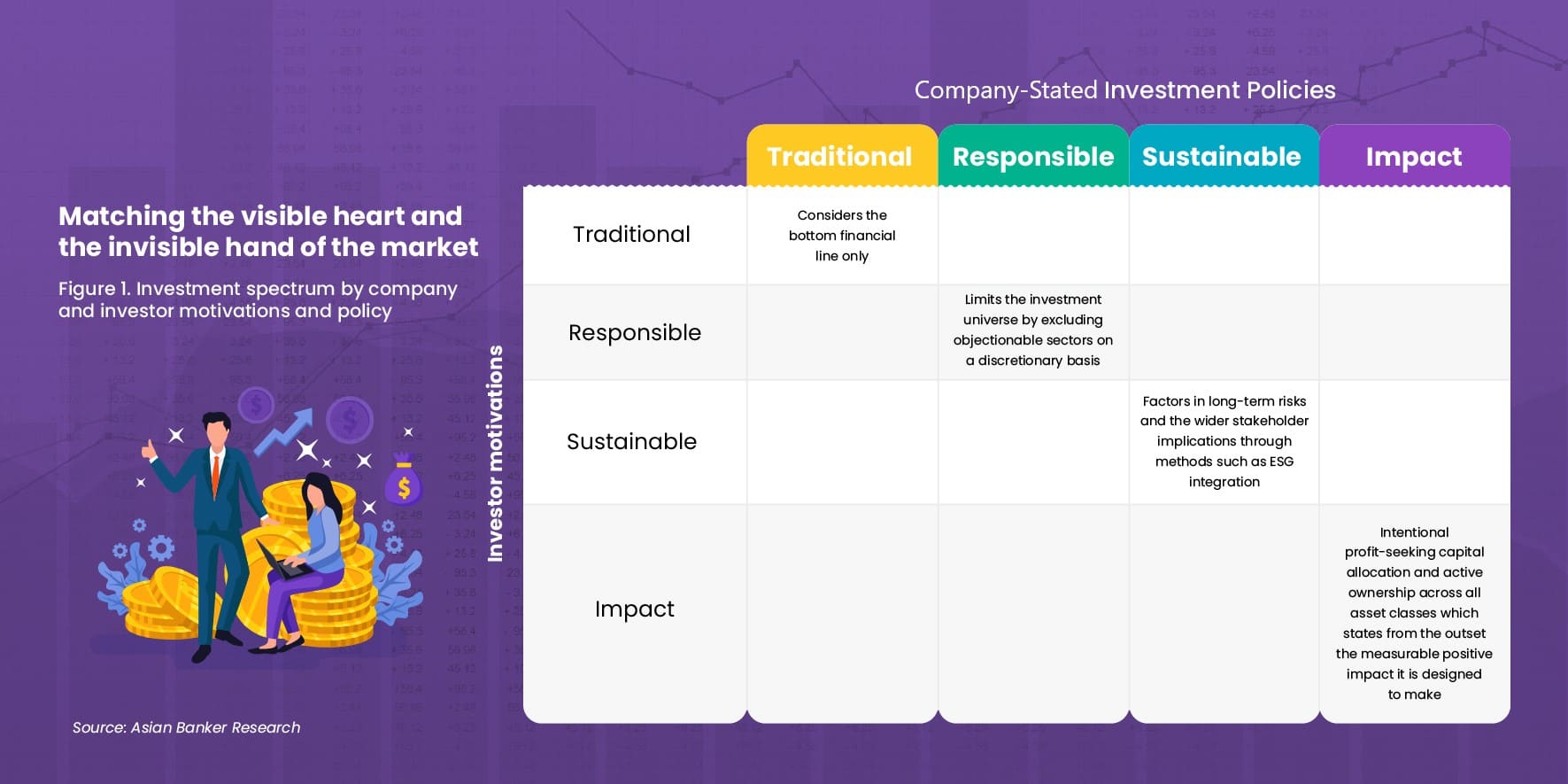

Investments can be broadly categorised into four approaches: Traditional, responsible, sustainable and impact, with each further comprised of a diversity of strategies, financial tools and risk profiles.

Traditional investments only consider the bottom financial line, while responsible approaches limit the investment universe by excluding objectionable sectors on a discretionary basis. Sustainable investments factor in long-term risks and wider stakeholder implications of investments through methods such as environmental, social and governance (ESG) integration.

Impact investing on the other hand is a risk-adjusted, intentional, profit-seeking capital allocation and active ownership across all asset classes by institutions and individuals, which states from the outset the measurable positive impact it is designed to have on the environment and society.

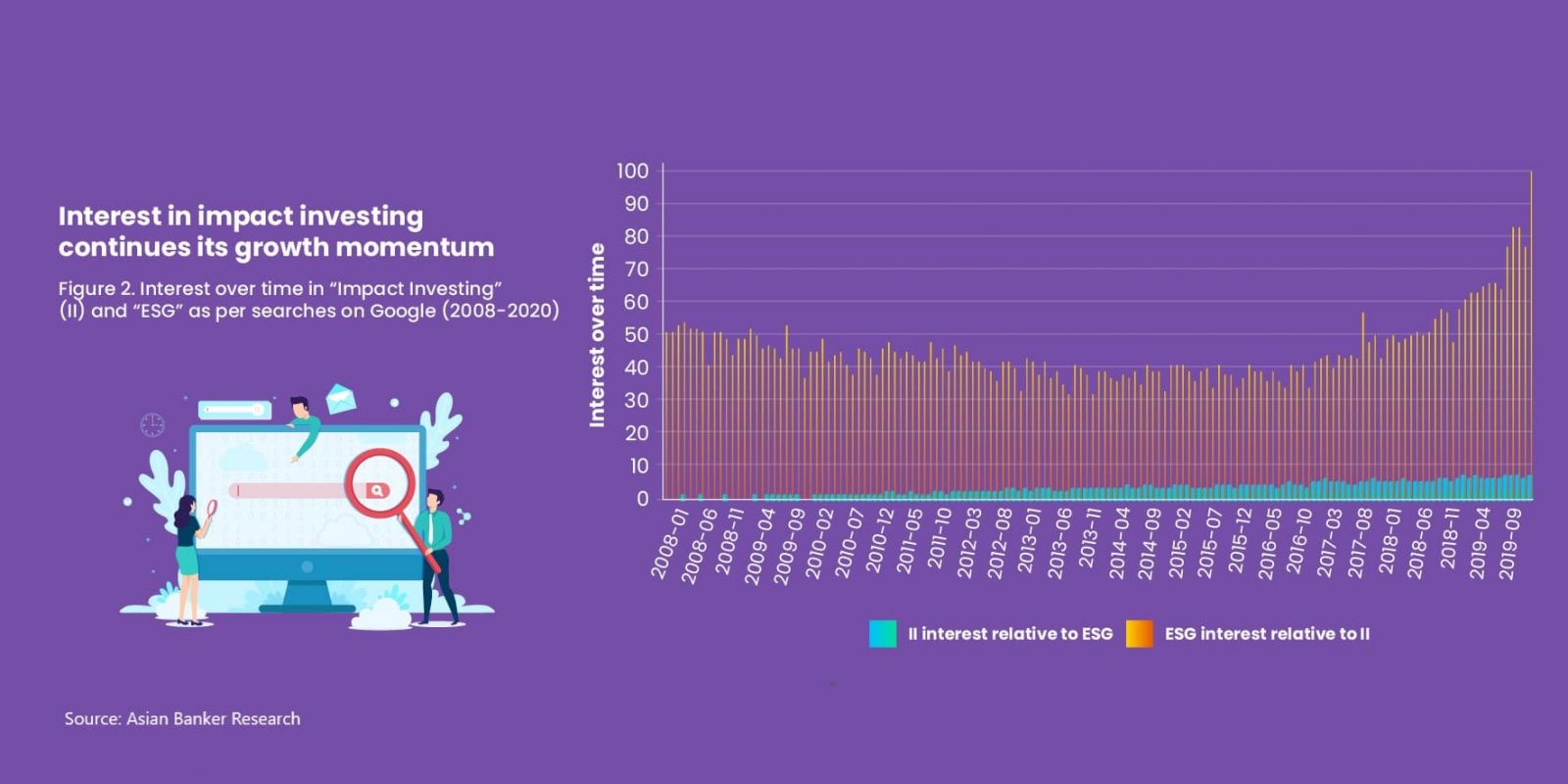

Interest in official impact investing began rising from a low base in 2008 and is set to continue its growth momentum. And yet, it is only trending in terms of search interest at about one-tenth of that relative to interest in ESG, which is increasing at an exponential rate since the beginning of 2018.

Market size and composition

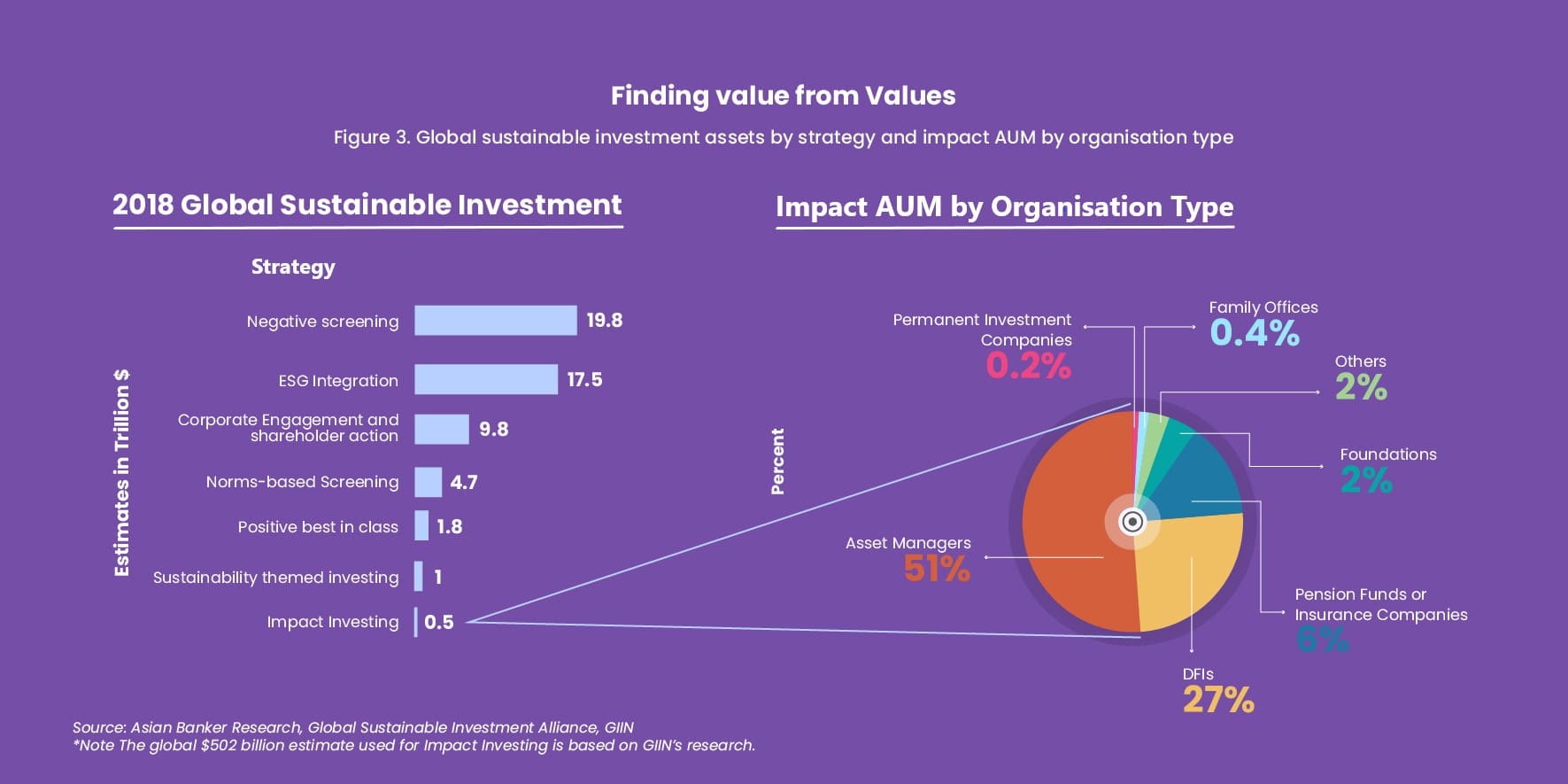

In line with registered search interest, comprehensive estimates by the Global Impact Investment Network (GIIN) indicate that the market supply of capital to impact investing is only a fraction of global sustainable assets, standing at $502 billion worldwide managed by over 1,340 organisations, as of the end of 2018.

Individual investor portfolios vary widely in size according to the data with median investor assets under management (AUM) at $29 million, whereas the average is $452 million, indicating that the majority of impact organisations are small and the deal size is skewed by large impact investing portfolios managed by several investors.

Development Finance Institutions represent only 2% of the 1,340 organisations in the survey database but account for 27% of direct impact investments.

Reflecting the specialized skills and training required to properly manage impact investments, globally, asset managers account for around 50% of estimated AUM. These managers range across asset types including venture capital, private equity, fixed income, real assets and public equities.

Energy (15%), others including real estate and retail (15%), microfinance (13%), other financial services (11%) and food and agriculture (10%) are the main areas of investment in terms of assets under management according to the survey.

The data on geographical spread of where the impact investments are deployed is less conclusive. It is best to work on the assumption that it is broadly even split between developed and emerging economies in term of the value of assets. The vast majority of official impact investing headquarters are located in North America and Western Europe, although most have regional offices and also invest outside their domestic markets.

To enable the impact sector to move further from uncoordinated innovation to marketplace building, greater communication from the fund industry – in relation to fiduciary duty – and an explanation on how the broader investment policy (that encourages investors to take on social and environmental challenges) does not violate the duties to act in behalf of an investors’ interest is needed, coupled with regulatory support.

Incentive structures that consider impact results will need to be defined and incorporated for fund managers, in addition to rankings for fund managers based on impact metrics.

A secondary market specialising in private impact products would allow for infrastructure that reduces transaction costs and supports a higher volume of activity by formally structuring impact investments, creating common frameworks, eliminating investor uncertainty and increasing deal flow and exit strategies.

Such a liquid exchange for impact-certified financial products would create an impact-compliant universe where investors can choose investments that match their risk appetite or perhaps more importantly the theme that they want to further, such as one or more of the Sustainable Development Goals.

Regulating such an exchange, in view of the long term-nature of impact investments, would mean providing scope for determining whether the exchange itself places regulatory time limitations on the holding of equity before sale or developing a voluntary system under some sort of ‘comply’ or ‘explain’ mechanism for short-term trades. High frequency short-term direct trading of private equity impact investments assets could be counter-productive to the goals of impact investing.

Secondary markets for sustainable or impact assets are already offering opportunities such as Canada’s Social Venture Connexion, Singapore’s Impact Investment Exchange or similarly, Brazil’s Socio-Environmental Investment Exchange.

Family offices – high impact, low deal size

Family offices are ideally placed to lead the investment transformation due to their flexibility and long-term horizons, compared to large banks, as well as their expertise for private equity where real impact is created. Family offices can also serve as the leader in blended finance mechanisms partnering with larger asset managers to increase investment flows.

Although the top 750 global family businesses generate annual revenues of over $9 trillion, according to Family Capital’s ranking, including 57 from China, of which 41 are from the mainland as of 2019, family offices account for less than 1% of estimated impact investing assets.

The nominal amount should dramatically increase over the next decade as we approach the sustainable development goals targeted for 2030 – irrespective of whether they are entirely met – and a transition of wealth occurs.

With over a million newly recorded US dollar millionaires in 2019 and over $15.4 trillion set to be passed down from one generation to the next through 2030 – according to global wealth researcher Wealth-X based on the segment with assets over $5 million – there is a growing trend, particularly among the younger generations to use their family resources to be more pro-active members of the global community and leave their mark on this world through sustainable solutions.

This also serves to fulfil the positive meaning that much of Generation Y is striving to achieve. Surveys consistently indicate that younger generations such as millennials are more inclined towards ESG and impact investing then their parents.

Those who belong in the older generations are also showing that they care about the world, in which future generations will inhabit, through their investment strategies. Research by Standard Charted Bank indicated that 10% of clients are interested in sustainable investment. Asset owners can also request that asset managers and companies report both the potential and actual impact of their activities.

As the population of the planet continues to grow, with all the challenges it entails, it is inevitable that smarter and more sustainable approaches will need to be developed – providing a vast universe of impact-compliant opportunities.

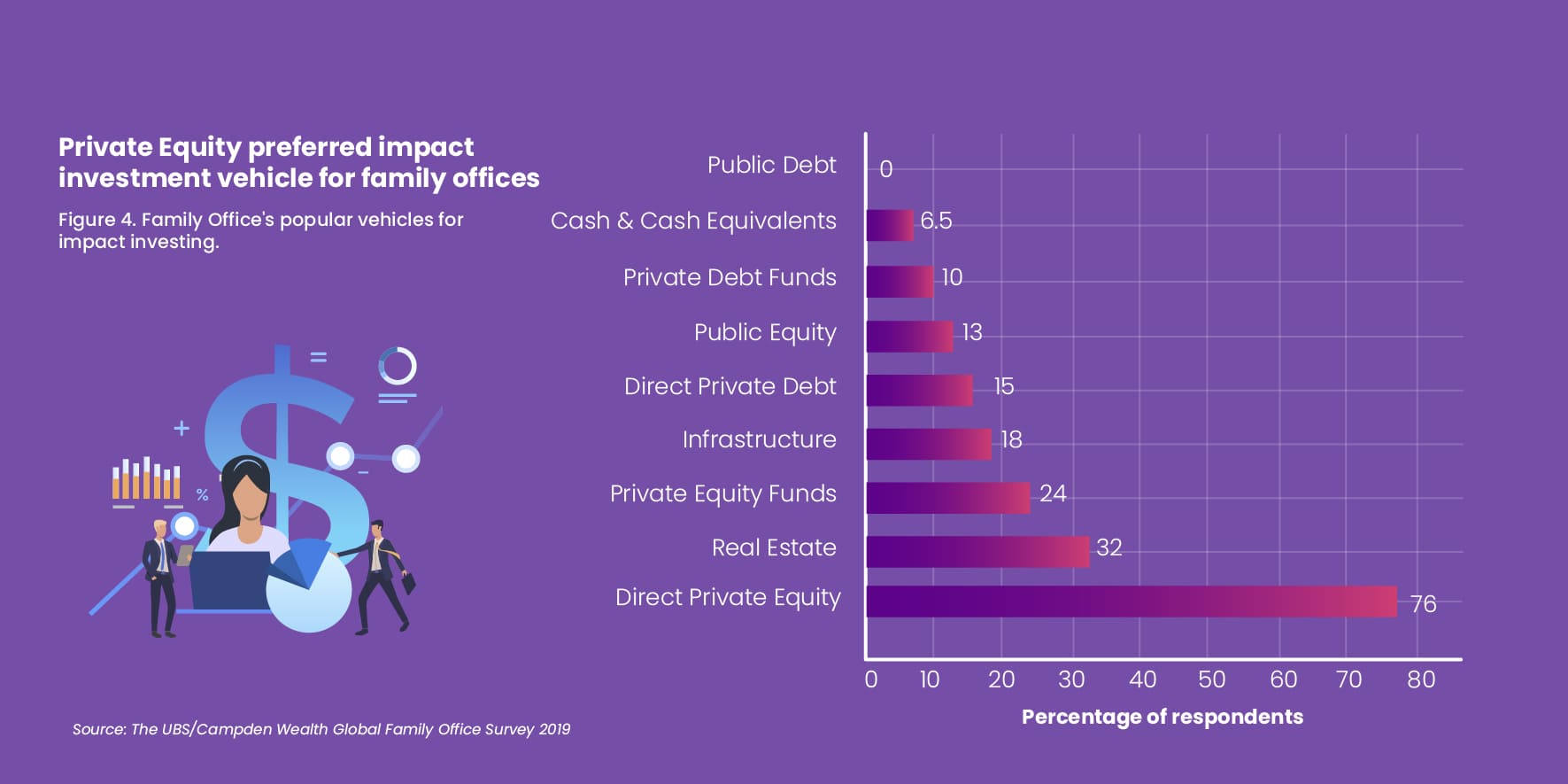

Only 12% of surveyed family offices said that that they have never been offered a sustainable or impact investment and one in four family offices globally are engaged in impact investing, according to the UBS Campden Wealth 2019 Global Family Office Report. The vast majority (71%) allocate under 10% to this approach, while the average across all impact investors is only 14%.

Direct private equity is by far the most popular vehicle (76%), followed by real estate (32%) and private equity funds (24%).

Despite these relatively low allocations to impact assets, 81% of surveyed family office impact investments indicated that they met (61%) or exceeded (20%) expectations in terms of performance, compared to their traditional investments of the same type over the prior 12-month period. The average impact assets in portfolios across all family offices participating is anticipated to average at 25% within the next five years.

Yet, the model of making money and then giving it away through philanthropy continues to be dominant among family offices, particularly in China.

According to Tony Gao Hao, director of Global Family Business Center at PBC School of Finance, Tsinghua University, most wealthy Chinese families would like to separate investment and philanthropy due to perceived challenges over fulfilling both goals simultaneously.

“They would like to gain more proceeds from investing, to have larger funds and capability for philanthropy. They fear that by aligning the two, maybe they might not achieve either,” said Gao Hao.

Although China is producing on average a new billionaire every week, Gao Hao explained that the young and new ultra-high net-worth individuals do not have much disposable cash as the business is still growing very fast, and they are still largely re-investing in acquisitions and new markets to finance new growth for the business.

“Their shares are overvalued in line with the characteristics of the new economy, and the entrepreneur realises that. They are not able to sell their shares at this stage in a high growth company as it will send a non-favourable signal to the market that there might be something wrong. They are also aware that the value of their shares may increase over the next few years,” shared Gao Hao.

Philanthropy however is a major trend in China and Gao Hao predicts larger donations will follow. “The first-generation entrepreneurs are so successful and fortunate to have large wealth. They realise that philanthropy is the best way to cherish and make contributions and to have a sustainable and safe family wealth status in society,” said Gao Hao.

“China has a long history of philanthropy. Take Li Ka-shing for example – his metaphor for succession is that his family foundation is his third son. Whereby the foundation will get an equal third of his wealth upon succession,” Gao Hao explained.

According to the 2017 China Charitable Giving Report, total charitable giving in 2017 amounted to $22 billion (RMB 150 billion), or 1.8% of gross domestic product, a tenfold increase as a percentage of GDP compared to 2014. Individual giving only accounted for 23%.

The knowns and unknowns of impact investing

Measuring both the total asset size of the market and the degree of impact is the fundamental problem, acting as a drag on the industry, in particular, the lack of financial infrastructure for classification, common standards and hence measurement of assets under management and deal flows.

Some investors underreport, some overreport, others see it as development finance, some as impact investing. Some entities are conducting impact investing without reporting or even knowing it. Serious challenges remain over counting the stock and flows of impact investments.

In relation to the data above, there are issues from a qualitative perspective. A green growth model example helps illustrate the problem. In Jiangsu province in China, as documented on New China TV, a crayfish farmer has constructed solar panels over shallow water in order to provide shade to cool the water for the crayfish. This has the combined effect of contributing towards the second sustainable development goal (SDG), which is nutrition, and SDG number 13: alternative energy. But has this, and would this count towards the impact investment global database?

The answer is it has not been counted. And it is uncertain if it would count. Moreover, there are vast sums invested in China alone by the private sector in afforestation, water projects, poverty alleviation, green energy and areas of the belt and road project. If recorded, it would show as an exponential uptick in global impact investing assets. It is difficult to ascertain the size of social or community-based investment strategies in China, which would otherwise be labelled as impact investing.

Another example relates to transition investments and whether they can be classified as impact investments. BP, the fifth largest oil producer in the world, has a large minority stake in Lightsource BP, a major player in the funding, development and long-term operation of solar projects, which became the first company in the United Kingdom to provide a reactive power service from a solar plant at night – an milestone towards energy storage of renewable energy. Would directing assets to BP constitute an impact investment?

These unsolved issues have opened a vast wave of opportunities for service providers to audit and provide transparency, benchmarks and common trustworthy standards for the industry.

Rigorous third-party ratings providers would greatly ease the investors’ comparison of prospects across particular market segments. Traditional pricing investment theories such as Modern Portfolio Theory and the Capital Assets Pricing Model need to be updated and reformed to take into account the triple bottom line of impact investments.

Accurately measuring both the size of the assets and the size of the impact would be a great leap in the battle against mis-sold ESG and impact products and accelerate investment velocity.