- Digital agility is key to winning in the future of retail financial services

- Hyperpersonalisation - leveraging big data and artificial intelligence to provide highly personalised and customised offers that reflect customers’ preferences

- Platforms – building customer-centric ecosystems that integrate lifestyle needs and financial services

The retail financial services industry continues to undergo a process of transformation in terms of how it is connecting and servicing customers. The disruption from fintech players and platform providers reverberates across the industry as new ecosystems are formed and distinct competitive advantage is realised through the application of emerging technologies. The top 10 banks evaluated from this year’s programme of more than 100 institutions for the “Best Retail Bank in 2020” completely reflect this paradigm shift.

This year, almost 350 submissions were evaluated from both banks and non-bank retail financial services players located across the Asia Pacific (APAC) and the Middle East and Africa (MEA) regions. Important modifications to the International Excellence in Retail Financial Services Awards programme were incorporated as the balance scorecards used to assess institutions were revised to reflect new performance benchmarks, while institutional response to the COVID-19 global pandemic was also assessed. Moreover, given that customer experience has become an important priority for retail players as users engage across various digital touchpoints and ecosystems, the inaugural BankQuality Consumer Survey and Ranking was launched, which involved 11,000 bank customers in 11 markets across Asia Pacific.

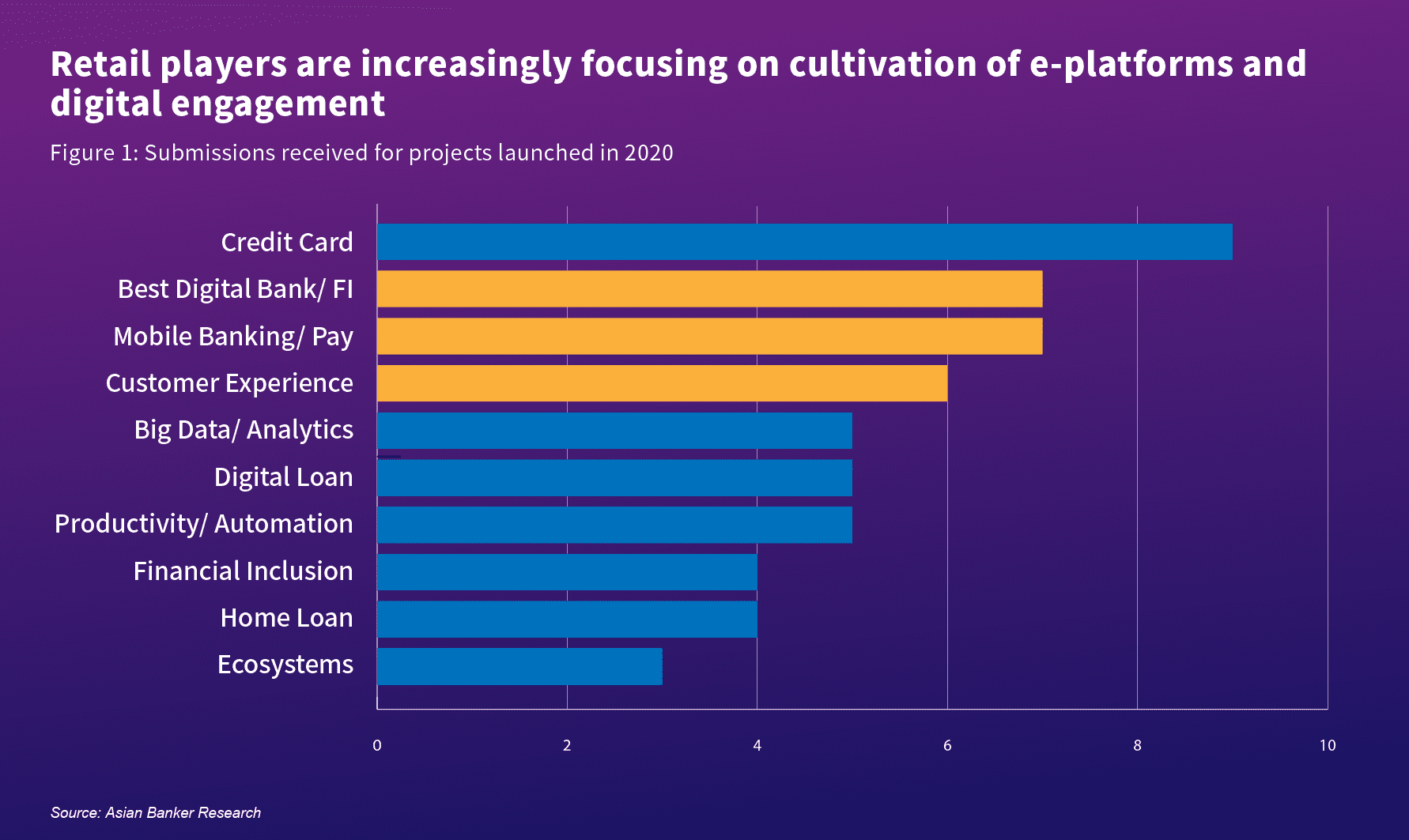

The key focus areas for various retail players in 2020 are centred on best digital bank, mobile banking and customer experience that are fairly consistent with the priority areas of 2017-19 (see Figure 1). Retail financial institutions continue to defend their market position and franchise strength through the cultivation of e-platforms as the digital strategy is reoriented from simple customer onboarding to one of engagement, making it all the more critical in this uncertain COVID-19 era. New opportunities for growth are now predicated on the ability to provide a superior customer experience in a smooth, efficient and seamless manner.

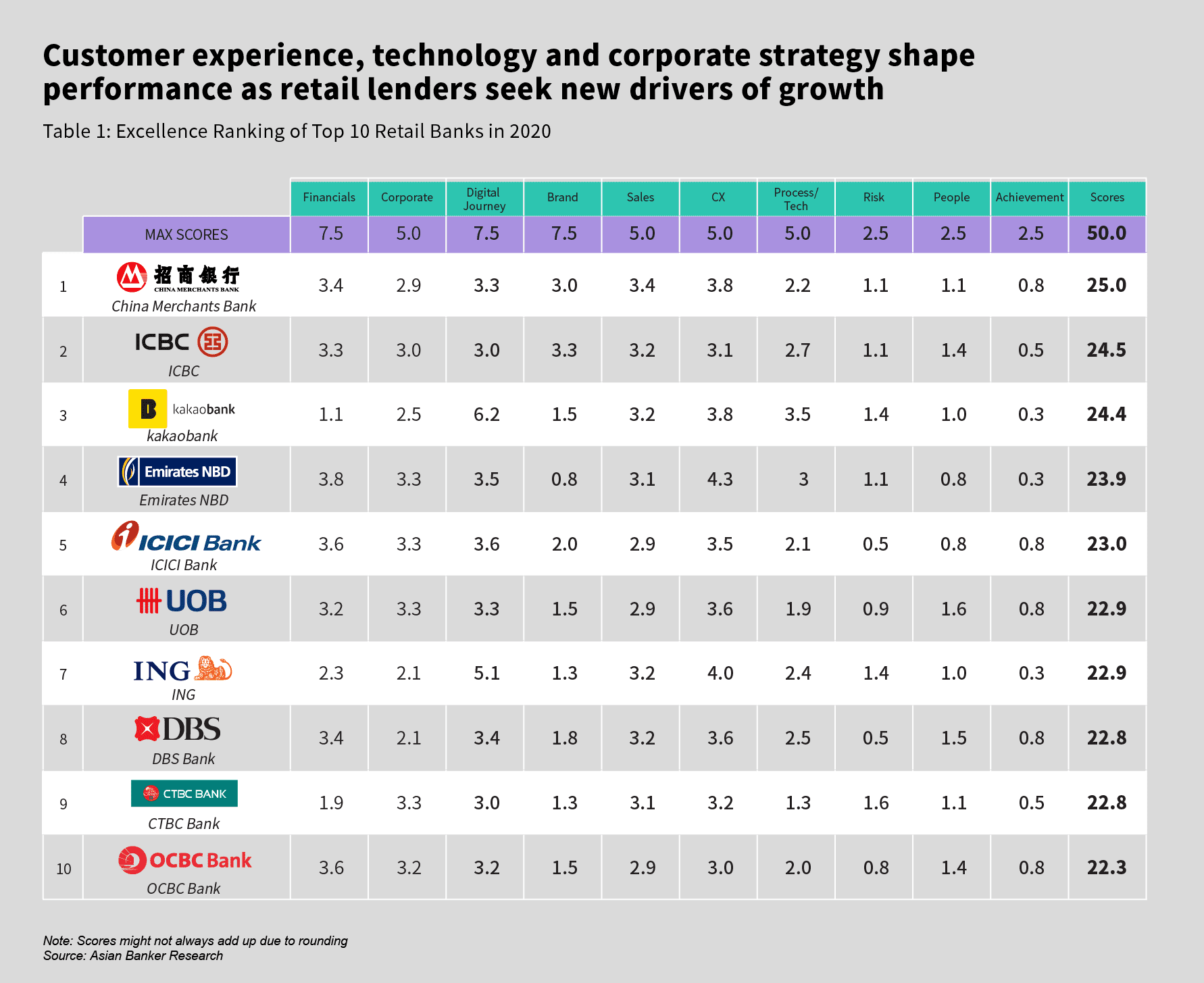

China Merchants Bank (CMB) took the overall lead in this year’s programme (see Table 1). It scored high in customer experience, sales, brand and risk management while steadily consolidating its positioning via application of advanced data and analytics. With the strong ecosystem it has built via its CMB App that now exceeds 100 million users, CMB’s ability to connect and stay relevant to customers via daily lifestyle scenario tools, while partnering with leading platforms, is testament of the evolving role of banks in enabling clients. Personalisation is a key focus in this year’s programme and the ability it gives retail players to reach specific audiences and provide customers an experience designed specifically for them remains a key customer acquisition and retention priority.

Some of the top 10 retail banks, such as ICICI Bank and Emirates NBD, have rolled out comprehensive digital banking services and/or application programming interfaces (APIs) across various verticals encompassing food, travel, transportation and others as open banking materialises in key financial jurisdictions. Digital payments and wallets functionalities remain equally game-changing as retail providers seek to address emerging threats from various non-bank platforms.

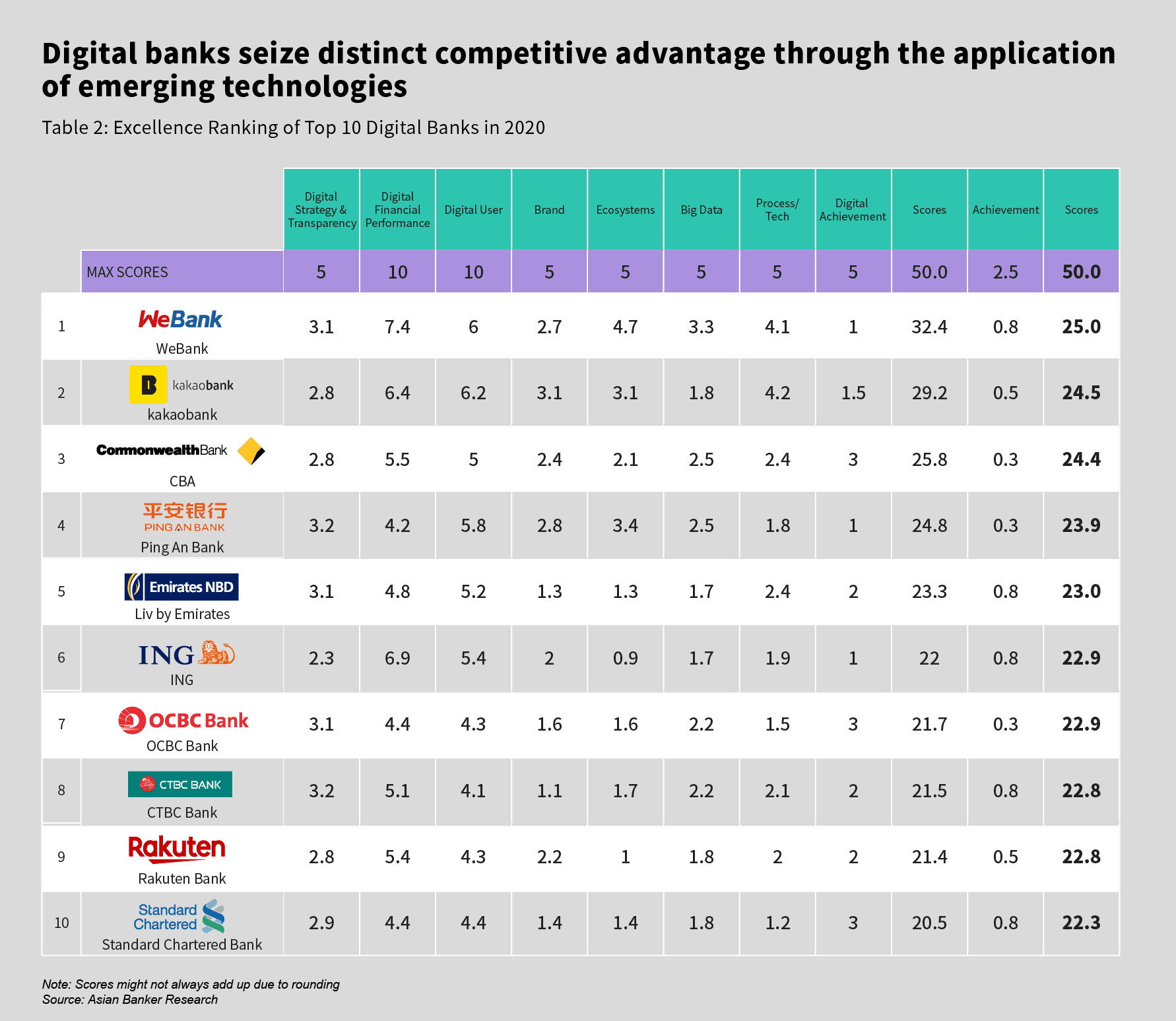

Examining the top ranked digital banks this year China’s WeBank came out on top (see Table 2) due to its concerted strategy to connect all kinds of internet companies and financial institutions to jointly create an inclusive finance ecosystem fostered by digital and fintech capabilities. This is showing results as WeBank has partnered with dozens of banks to offer various credit, wealth management and deposit services. In 2017, WeBank launched its 'Collaborative Business' ecosystem based on the Collaborative Business Model' a new type of production relationship formed between multiple parties, on the basis of equal economic benefits and status among participants. WeBank has further enhanced its successful FISCO BCOS platform by broadening cooperation and services.

Similarly, second place Kakaobank Built on the back of South Korea’s highly popular messaging platform Kakao continues to resonate. Kakaobank turned profitable in first quarter 2019, launched a securities account and is about to open its first fintech lab. Kakaobank’s strong results have been largely driven by increased interest profit from new bank loans. As of December 2019, its outstanding loan balance was KRW14.88 trillion ($12.56 billion) compared with KRW9.08 trillion ($7.66 billion) a year ago. In a country of 52 million people, the bank rapidly grew its customer base to 12 million users as of March 2020, of which 10 million are digitally active.

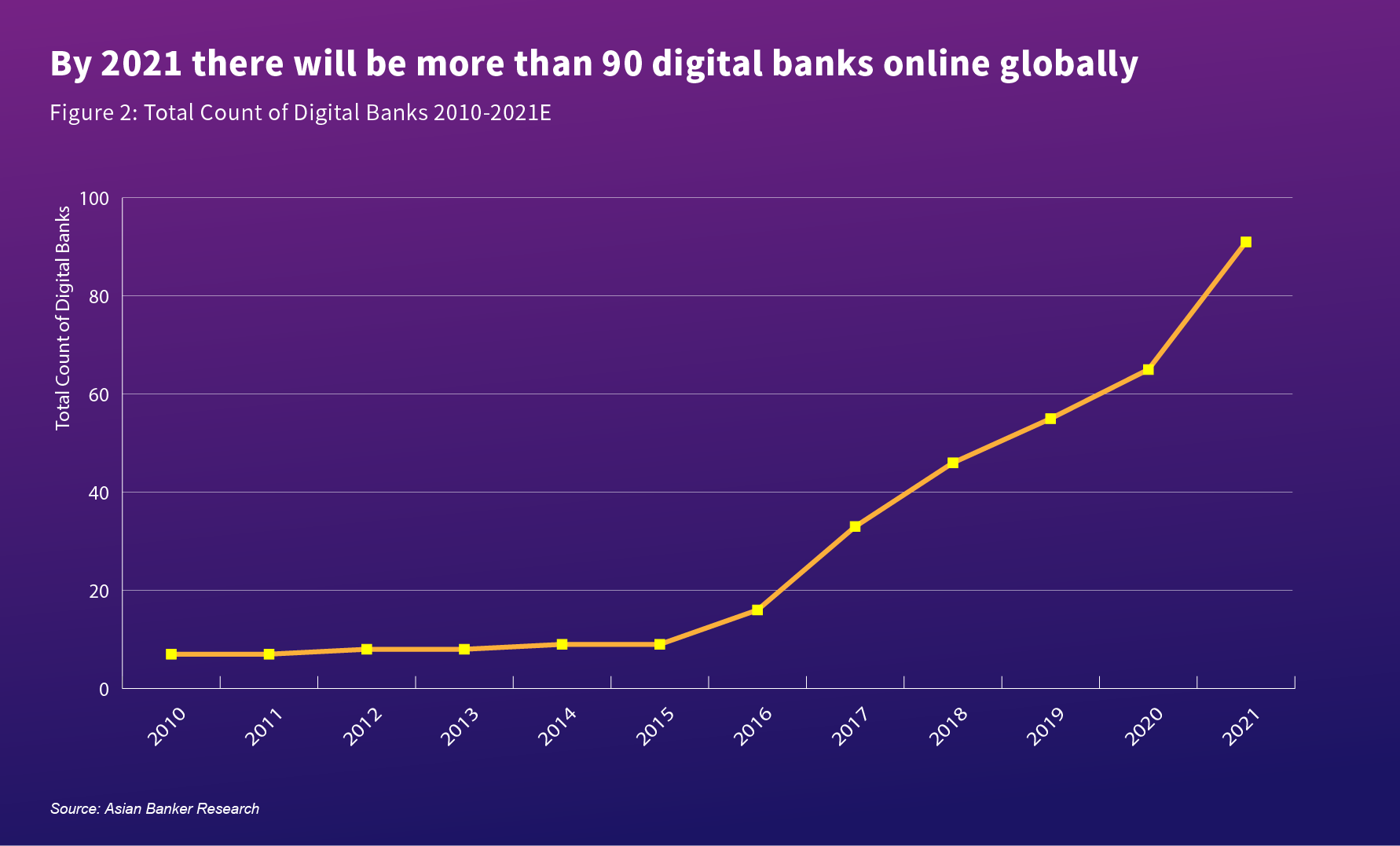

Digital banking has taken relative importance amid social distancing measures. The use of online and mobile banking has increased and challenges from fintechs and bigtechs have emerged, prompting various lenders to enhance their digital offerings. We are seeing a continued rise of digital banks and our projection is that by next year more than 90 digital banks will be operating globally (see Figure 2). In APAC the vast majority of new digital banks being launched in 2020-21 have a presence in progressive regulatory jurisdictions such Hong Kong, Singapore and Malaysia; the Grab and Singtel tie-up as well as Razer Youth Bank application in Singapore for full digital bank licenses or Axiata Group and AirAsia voicing their interest in Malaysia reflects this broader shift. Similarly, Ant Bank, Fusion Bank and WeLab Bank are all existing digital banking propositions in the Hong Kong market that are in various stages of rollout.

But what does this mean for the retail banking landscape as a whole? For Singapore these new entrants pose a significant challenge to incumbents and our expectation is that between 4% and 11% of retail deposits may potentially be siphoned off by the new digital only banks. Drawing from the experience in China 10% of retail deposits are already controlled by various fintech players operating in the market. Likewise, for both Malaysia and Hong Kong the potential impact on top line numbers will significantly impact the profitability of the traditional “brick and mortar” operators. Digital banks globally have done well in the onboarding process, but must prove themselves across the financial lifecycle as they expand into more complex product areas such as mortgages and personal wealth solutions.

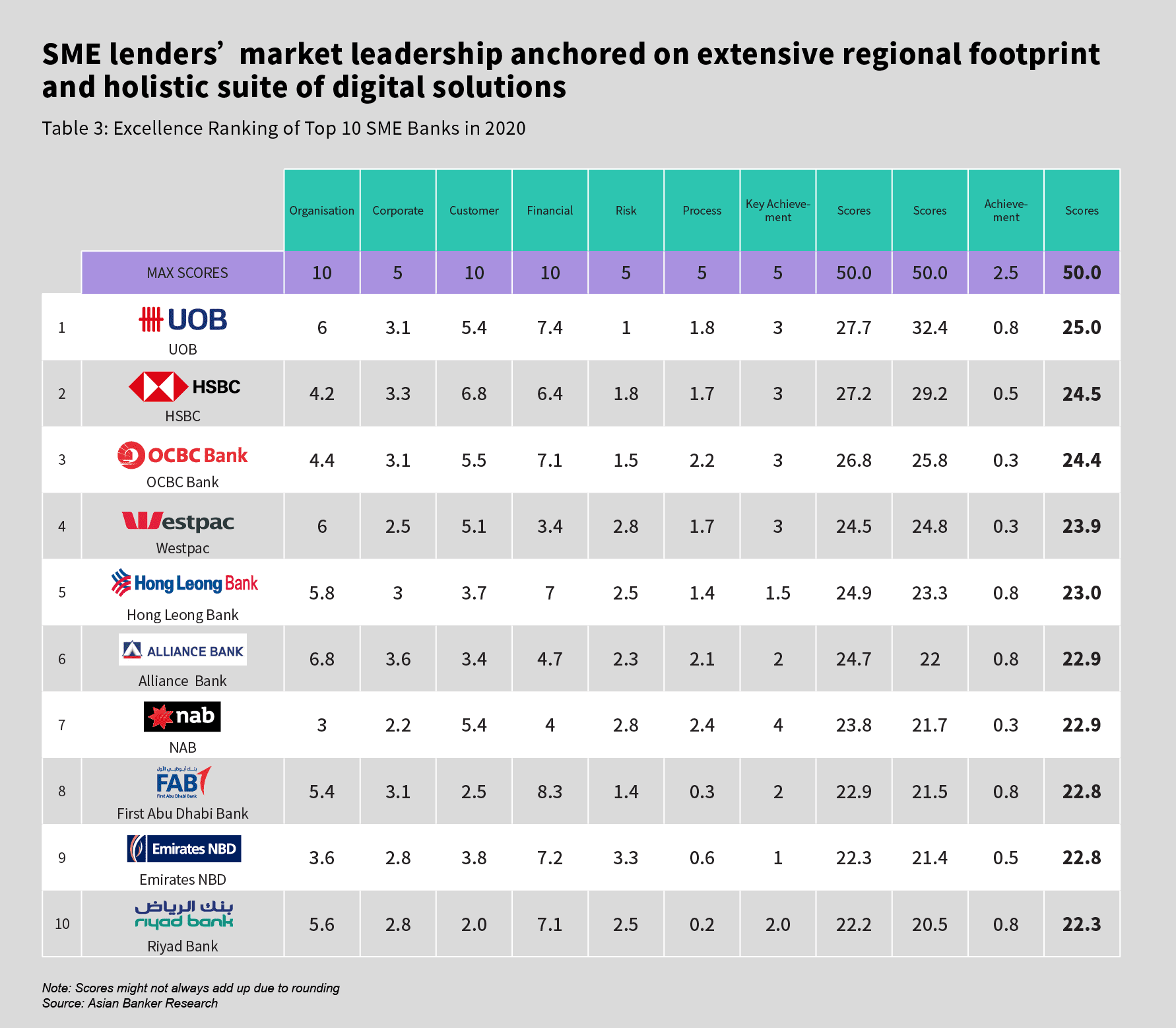

On the small and medium sized enterprise (SME) banking front, we have UOB leading the pack (see Table 3) followed closely by HSBC and OCBC. While OCBC has expanded its regional footprint and deepened its engagement with SMEs in terms of overall SME banking relationships it lags behind HSBC and UOB on financial KPIs such as profitability, net interest margin (NIM) and cost management. UOB grew only slightly its total regional SME loan book in the single digit in 2019 reflecting already the challenging regional environment, while OCBC saw only flat growth. A standout is UOB’s BizSmart, a platform of digital business management solutions that gained traction last year with 40% increase in sign-ups and the bank’s suite of integrated business management solutions for SMEs in ASEAN connecting with UOB accounts and facilities. HSBC is also commendable given its decent top line growth during the 2019 turmoil and one of the highest net promoter score (NPS) scores in that field and comprehensive response to the COVID 19 crisis.

Futureproofing retail finance by redefining customer experience

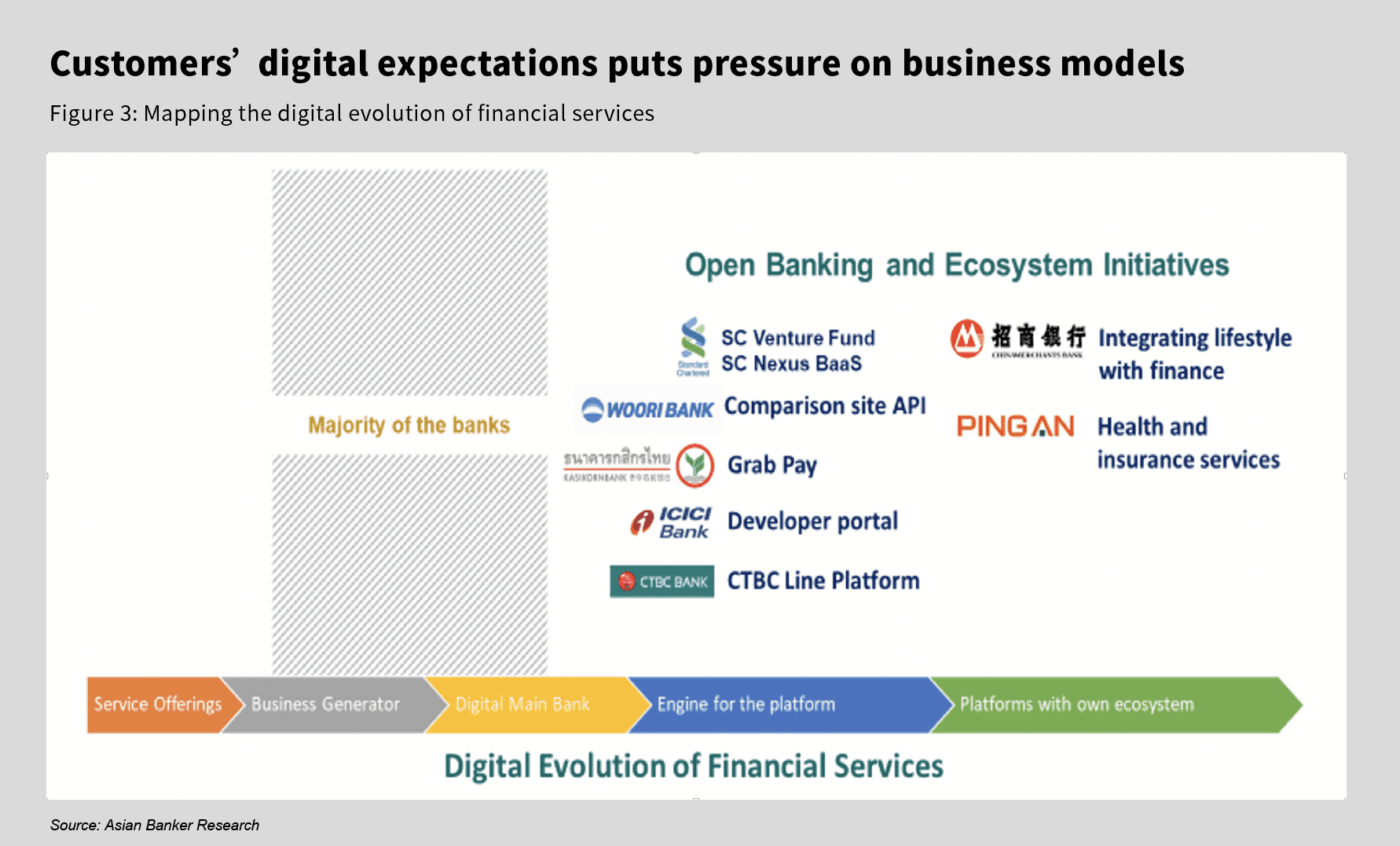

The future of retail finance will move beyond banking, focused primarily on helping customers meet their needs in an easy, safe and seamless manner. Evolving digital experiences are redefining what it means to have a superior customer experience (see Figure 3). Moving forward here now looking at the evolution of financial services the first stage is where the industry was broadly up to 2010 in terms of having digital based service offerings. Most banks today are still in the second stage where digital channels are being monetised but they are still not principally digital banks. The third stage is where the transformation and shift are complete as banks become fully digitised and/or are positioned as digital banks themselves, such as those digital banks in Asia or neo-banks in the United Kingdom. In the fourth stage banks become an engine for the platform, i.e. they plug into the ecosystem platform while in the fifth stage, banks become platforms with an ecosystem – they have open architecture allowing other players access and integration.

New entrants including digital-only banks, tech giants and fintechs are revolutionising customer engagements by leveraging customer data to offer targeted services reinforcing this brave new era of hyper-personalisation. As expectations continue to evolve, it will be harder to be all things to all customers. The new paradigm has shifted from simply providing banking products to one of targeted customer outcomes. With open banking being phased in, improved connectivity through 5G rollout coupled with a growing intent for a “wow” experience, retail players are hard pressed to develop a clear point of difference. Adapting to this evolving ecosystem will be paramount in separating the winners from the losers, and institutions without digital agility and resilience at a retail level are likely to be tested in the days and months to come.

The fact that digital banks have adopted a low-fee pricing strategy for their services has undoubtedly helped them build a large customer base. The comparatively lower set-up costs and operational expenses compared to that of traditional banks allows digital only players greater financial flexibility. However, given the lack of sustainable revenues maintaining profitability has been a cumbersome process. Digital banks are increasingly under pressure to turn their business profit-making entities and are well advised to take cues from ING Australia, Rakuten Bank and even Kakaobank that has finally attained profitability.

While a confluence of factors is supporting the growth of digital banks is brewing, success is not guaranteed unless new retail players can transform into data-driven, high-performance and profitable operations.

For details of the Excellence in Retail Financial Services Awards programme 2020 click here