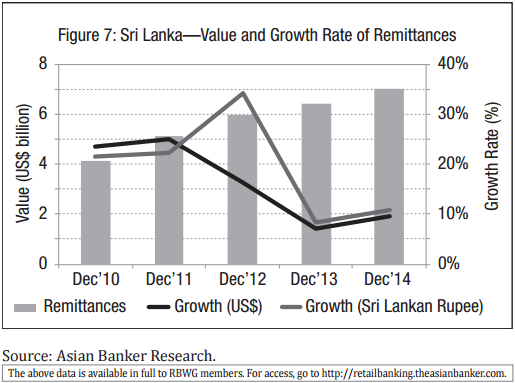

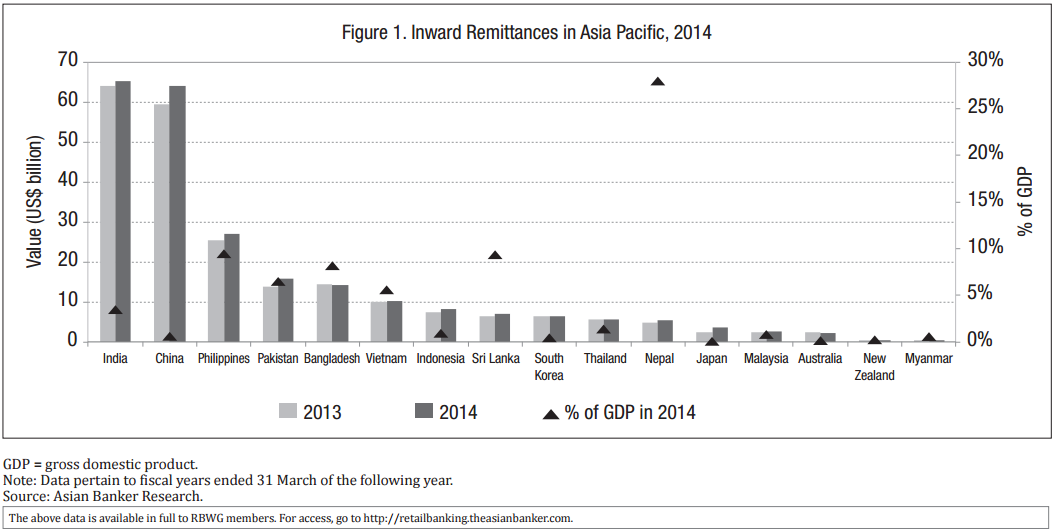

In the Asia Pacific region, total inward remittances amounted to more than $240 billion in 2014, a 6% increase from 2013. This represented a compound annual growth rate (CAGR) of 5% in 2012–2014, lower than the 9% received in 2010–2012. The slowdown in 2014 is mainly due to exchange rate volatility, as remittances are reported US dollars. The currency weakness in some host countries lowers the dollar equivalent of remittances, and migrant workers hold off from sending money home. Other factors such as economic growth and immigration policies in migrant destination countries also significantly impact remittances.

Remittances to most Asia Pacific countries have been growing at a slower pace over the past two years (Figure 1). India, the largest remittance-receiving country, has witnessed a sharp slowdown in inward remittance growth. Growth of remittance flows to countries like Bangladesh, Nepal, and Sri Lanka have also declined. Among the Asia Pacific nations, Indonesia and Malaysia have seen stronger remittance growth over the past two years, with the former growing by 13% in 2014.

Remittances to most Asia Pacific countries have been growing at a slower pace

The above mentioned inward remittance data excludes unrecorded flows. A substantial amount of remittances are sent through informal channels to countries with underdeveloped financial systems, such as Myanmar. Although Myanmar banks have been offering inbound remittance services in cooperation with financial institutions in other countries, Myanmar workers in Malaysia, Singapore, and Thailand still prefer informal channels. Formal channels are safer than their informal competitors. However, they are less convenient and more expensive.

India, China, and the Philippines have been the top remittance recipients, which will remain unchanged in the near future. When it comes to contribution of remittances to gross domestic product (GDP), Nepal is the top recipient of remittance in the region, followed by the Philippines and Sri Lanka. Remittances play a critical role in the economies of these countries.

The slowdown in remittance growth is unlikely to be a significant concern, but the heavy reliance of gross domestic product (GDP) on remittance contribution is of concern. Remittances improve the living conditions of the receiving households, and contribute to the increase in private consumption and foreign exchange reserves. It also assists in recovery and reconstruction when a country goes through unexpected disasters or crises. However, the dependency on remittances also puts countries at risk or creates negative effects. For example, remittances lead, to some extent, to fewer incentives for those remittances-receiving households to work harder. Furthermore, migrants who go abroad lead to a loss of talent in their home countries. In fact, some migrants settle down abroad and cut down the amount of money sent back home resulting in a permanent drain of talent and resource in the home country.

Money sent back home is often underused in many of these countries. Governments are aware of the fact that receiving money from migrants working abroad is not enough to tackle the problem. Ideally, remittance receipts should be used more effectively. The governments of these countries need to create more jobs and encourage business expansion, as the lack of job opportunities in home countries is the main reason for these migrants to seek employment abroad. In addition, more attention should be paid to education to improve the skill sets of future generations.

In fiscal year (FY) 2014, the amount of money sent home by Bangladeshi migrant workers went down by 1.6%, the first fall since 2000 (Figure 2). Remittance flows from the United States (US) increased by 25% to $2.3 billion as the economy recovered. Remittances from Saudi Arabia and United Arab Emirates (UAE), the biggest employers of Bangladeshi workers, fell by 19% and 5% in FY2014, respectively. Fewer Bangladeshis succeeded in seeking employment overseas in FY2014. On the other hand, more migrant workers returned home, mainly due to the issues relating to the legal status of Bangladeshi migrant workers in the Middle East. The growth of remittances to Bangladesh picked up in FY2015, as Saudi Arabia reopened the labour market for Bangladesh and more migrants were employed in Qatar and Oman. In early 2015, Saudi Arabia lifted a seven-year ban on the recruitment of Bangladeshi workers. During the past two years, around 60% of remittances were received from the Middle East compared to 63% in 2015.

Remittances picked up in FY2015, as the Middle East rehired Bangladeshis

India is the largest receiver of remittances in the world. Remittances sent by Indians working abroad are approximately equal to 25% to the country’s foreign exchange reserves. Besides unskilled and low-skilled migrants, there are also a large number of highly skilled Indian professionals employed abroad, which can partially explain the significant levels of remittances to India. Migrant workers tend to cut down the amount of money they send home the longer they live abroad. However, that is not the case with most overseas Indians. Compared to migrants from other nations, overseas Indians maintain a relatively stronger bond with their homeland (Figure 3). Remittance flows to India are expected to improve, partly due to the greater financial inclusion in India. The government’s financial inclusion program leads to more bank accounts being opened in unbanked rural areas, which has the potential to accelerate the growth of inward remittances to India. In addition, the use of technology, such as contactless mobile payments, will also help the flows of remittances.

Remittances are expected to improve in India due to financial inclusion

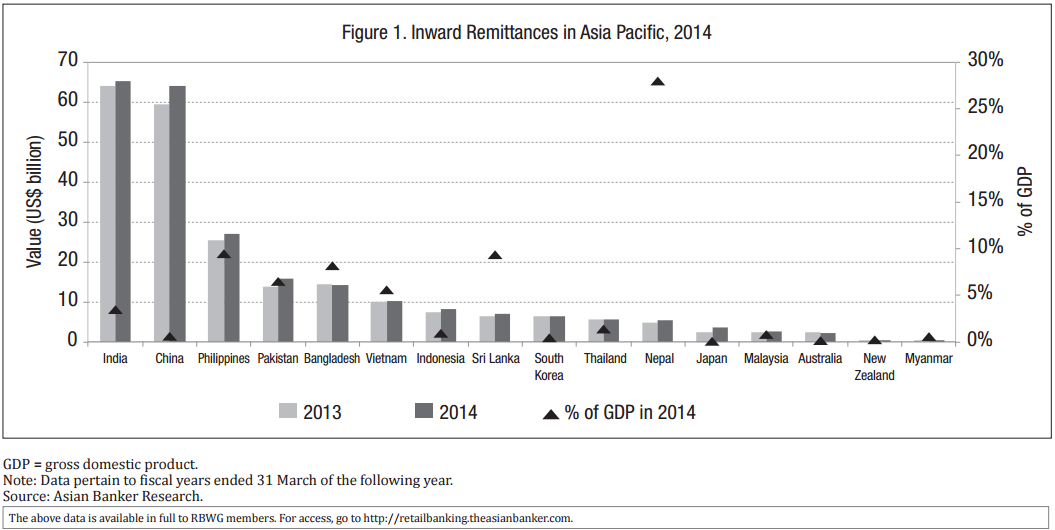

Nepal is the top recipient of remittances as a share of GDP among Asia Pacific countries. The proportion of remittances reached 28% in FY2014, up from 18.5% in FY2011. Nepal relies more on remittances than the official figures suggest, as remittances are understated. The country maintains its balance of payments surplus supported by the large amount of remittances received. More than two million Nepalese work abroad, mainly due to the high unemployment rate in the country. Nepal’s economy is still dominated by agriculture and a large portion of the population works in the agricultural sector. Most Nepalese migrant workers are employed in the Middle Eastern countries, and a large number of them work as unskilled labourers. The growth in inward remittances to Nepal is expected to increase due to the earthquake in April 2015 (Figure 4). Remittances sent back by Nepalese workers abroad continues to be a key source of money that helps in the rehabilitation efforts in the country.

Nepal will see higher even higher remittances because of the earthquake

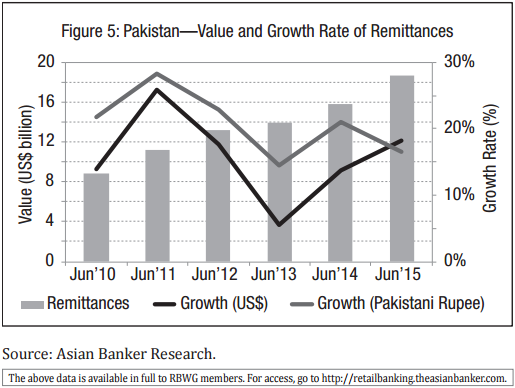

Total inward remittances to Pakistan reached $18.7billion in FY2015, which was approximately equal to the foreign exchange reserves for the country (Figure 5). Remittances have grown at a CAGR of 16% during the past five years, which can be largely attributed to the launch of the Pakistan Remittance Initiative (PRI) in 2009. PRI was established as a joint initiative of State Bank of Pakistan, Ministry of Overseas Pakistanis, and Ministry of Finance to facilitate and support workers’ remittances into Pakistan. Meanwhile, more remittances have been sent through formal channels due to the promotion of formal channels under the scheme. The growth rate of remittance flows slowed to 5.6% in FY2013, as the amount of money sent by Pakistanis working in UAE, the second largest source of inward remittances, declined by 3%. In FY2015, UAE recorded the largest increase with 36%. Pakistan received 30% of the remittances from Saudi Arabia, which is the largest source of remittances. The US contributed 14% of all remittance inflows in FY2015, compared to 16% in the previous year.

Pakistan’s remittances in FY2015 was approximately equal to its FX reserves

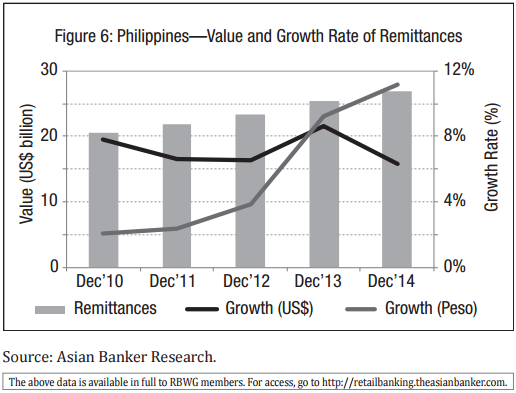

The Philippines is the third largest recipient of remittances. Remittances sent home by overseas Filipinos accounted for around 9.5% of GDP. Remittances from Europe declined by 5% in FY2014, while remittances from the Middle East and Oceania saw the greatest increase, by 23% and 21%, respectively. The amount of money sent home from the Americas accounted for the largest share (46%) in FY2014, although this was down from 52% in FY2012. Due to the continued depreciation of some host countries’ currencies against the US dollar, inward remittances to the Philippines fell for the first time since 2003 in August 2015 on a monthly basis (Figure 6). Remittances in the first eight months of 2015 went up by 3.9% year-on-year compared to 6.7% a year earlier, and this slowdown in the growth of remittances will continue in 2015. Banks and other remittance service providers have been making efforts to expand their coverage. Besides, the introduction of mobile phone technology provides overseas Filipino workers in more countries an alternative to send money home.

Due to the peso’s depreciation, inward remittances fell for the first time in 2015

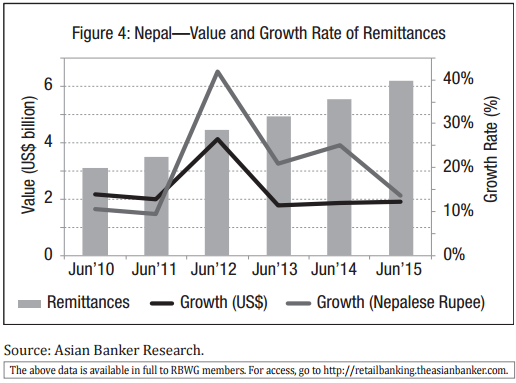

In FY2014, $7 billion in remittances flowed into Sri Lanka, amounting to 9.4% of GDP. Remittances sent by Sri Lankan workers abroad are an important source of foreign exchange for the country. The reduction of poverty in recent years is largely due to strong remittance growth. Remittances received grew by 7% in FY2013 and 9.5% in FY2014, slower than the 25% growth in FY2011 and 16.3% in 2012 (Figure 7). The slowdown in remittance growth can be partially attributed to plunging oil prices, as migrants are mainly employed in the Middle East. Under the new labour agreement signed between the governments of Saudi Arabia and Sri Lanka in 2014, Sri Lankans employed in Saudi Arabia can gain some benefits and rights, such as the right to retail their own original passports, which will improve their working environment. In the first seven months of 2015, remittances went up by 2% year-on-year, compared to 11% a year earlier. The government faces fiscal pressure as exports, tourism, and foreign direct investment, the other main sources of income, have not performed that well

Remittance growth slowed due to plunging oil prices