Globally, migrant workers make more than 90% of their remittances through off-line channels. This usually involves a string of agents and bank networks that encompasses built-in costs and inefficiencies. WorldRemit, one of UK’s fastest-growing fintech companies, is looking to change this by pioneering a mobile-first approach to remittances. The company offers a digital-only model for sending and receiving money, which means that all intermediary agents, including banks, can be excluded from the process if money is sent or remitted from or to mobile wallets held on personal devices.

WorldRemit was founded by the company’s current CEO, Ismail Ahmed. An African migrant and former anti-money laundering advisor to the United Nations, Ahmed believes that banks in emerging countries are not reaching out to everyone, particularly those living outside of metropolitan areas. Access to conventional financial services in rural areas is often limited. However, the advent of mobile technology has created new ways to reach out to areas underserved by conventional financial services, opening a new revenue pool to tap into.

Raising additional financing in the future

WorldRemit offers remittance services in 50 “sender” markets and more than 125 “receiver” markets. Receivers have options to receive money via bank transfers, cash pick-ups, mobile money wallets, or airtime top-ups.

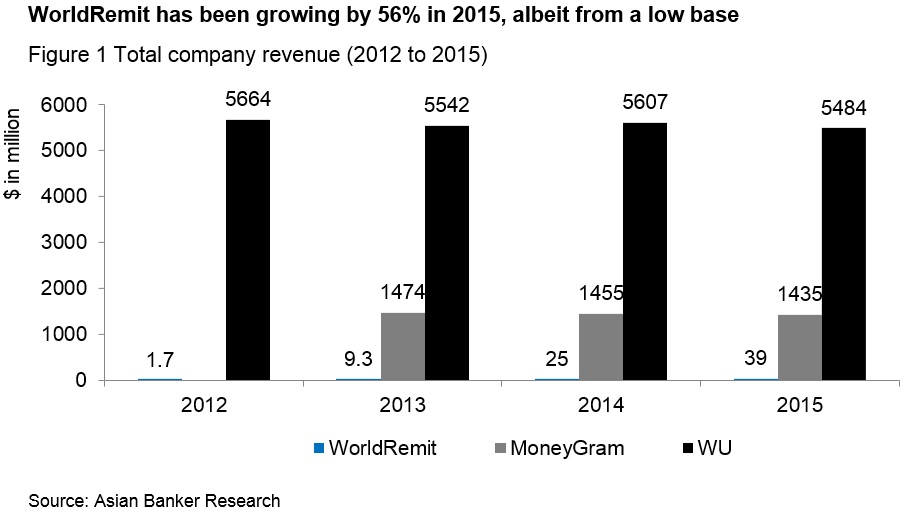

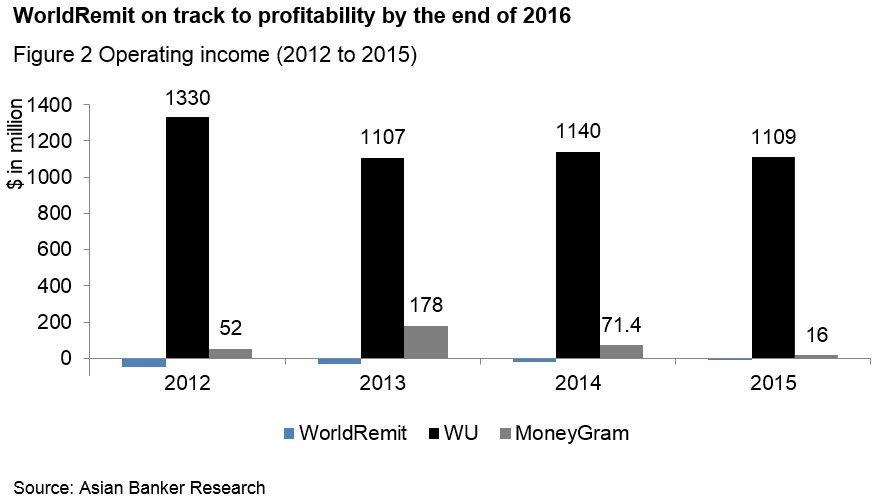

The company, which has a current global work force of 200, grew its fee-based revenue from $1.7 million in 2012 to $39 million in 2015 by targeting migrant workers. It has successfully secured close to $200 million in funding since its inception. In its latest funding round at the beginning of 2016, the company raised another $45 million from TriplePoint Venture, Growth BDC, and Silicon Valley Bank. It is exploring other options to raise additional financing in the future. However, WorldRemit’s revenues are still significantly smaller as compared to Western Union and MoneyGram, the two giants in the money transfer operator (MTO) business (Figure 1). In addition, transaction volumes are still low at around 400,000 transactions per month. Although WorldRemit did not disclose its targets for 2020, it is expecting a significant growth in transaction volume. In November 2015, the company said that it was on track to process as much as $1 billion worth of transactions in 2015.

Opening up new markets

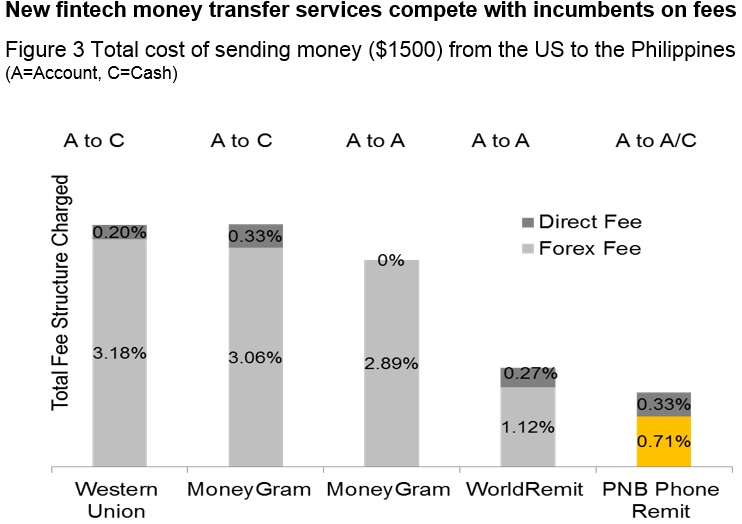

WorldRemit estimates that out of the two billion unbanked people in the world, 400 million have some forms of mobile money account. Global remittance revenue generated from digital channels is estimated to be less than 6.0% of the total. The company aims to tap into this growing customer pool through a combination of competitive pricing, a more responsive and user-friendly web design, greater fee transparency, and better customer service.

Mobile funds transfer has been successfully adopted in a number of African markets as compared to the developed countries. Over 50% of all money transfers to Africa are received via mobile money, whereas worldwide figure shows only one in three transfers. In Ghana alone, 55% of WorldRemit's transactions are to mobile accounts.

Source: Asian Banker Research

Note: Total fee structure based on MTOs/Banks’ forex rates and interbank rates from 13 April 2016. PNB is Philippine National Bank

WorldRemit’s money transfer service is based on an account-to-cash or an account-to-mobile money method. The latter, through its WorldRemit app, allows customers to send money instantly to the recipient. “Potentially, our clients can log on to our website, download the app, and arrange for money to be sent to the Philippines. And that money can be received via bank transfer or mobile money wallet, cash pick-up, or airtime top-up,” explained Michael Liu, WorldRemit’s regional director for Asia-Pacific.

The mobile money option is at the core of its operations and the company intends to make it the main transfer business over the next decade. It has more than 260 mobile wallet providers and messaging apps globally. Much of the future growth will come from Asia Pacific and Australia, given the high number of sending and receiving corridors in those regions.

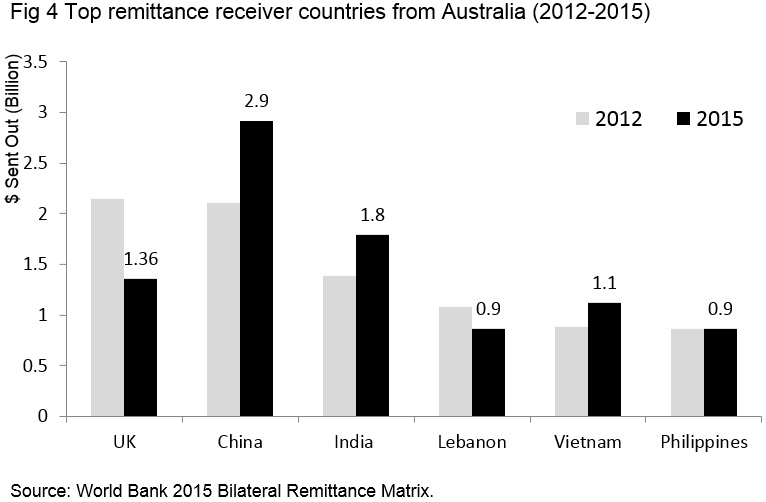

“Australia is the second largest sender market for WorldRemit after the United Kingdom, with 80,000 transactions per month. Australia and New Zealand are key sender markets to us. One in four Australians is a migrant and almost one in two is either a migrant or has a parent who was born overseas. But moving forward, we also see Japan, Singapore, and Hong Kong as important sender jurisdictions. India and South East Asia are already strong receiver markets for us and we expect to see significant growth in countries such as China, Vietnam, and Thailand,” said Liu.

Australia’s remittance sender market is worth $16.6 billion in 2015, according to the World Bank. Asian Banker Research estimates that with an average sent amount of $1,000, WorldRemit’s market share in Australia is around 5.0% to 6.0%.

With China, India and Vietnam as key growing receiver markets for funds sent from Australia WorldRemit is increasing its efforts to expand its market position

“As a money transfer business, if we want to offer a truly global service, we need to have many partnerships on both the sender and receiver sides. I do not think a company can grow and become a major player in this business if it is not prepared to establish relationships with all players, including banks,” Liu added.

Partnering banks and telcos

The company has partnerships with Safaricom’s M-PESA, international banks, and mobile operators, to name a few. It has also partnered with the UAE Exchange in integrating its Payout Application Programme Interface (API) that can process high frequency of requests.

On the cash receiving side, since more than 70% of transactions are still on a cash-out mode, WorldRemit relies on partnerships with larger financial institutions in emerging markets in facilitating the transfer of money to clients. In the Philippines, clients are offered instant bank deposits through BDO Unibank, Metrobank, and the Philippine National Bank (PNB), while partnering with telcos such as Smart and Globe for its mobile money services.

From a bank’s perspective, the mobile-first approach to remittances is an area of new competition. However, some banks in Australia, for example, are more prepared to partner with fintech organisations for money transfer services on a case-by-case basis, if it presents a value for them and if they are comfortable with the fintechs’ compliance regime.

“Banks are certainly demonstrating a growing level of interest in fintech players beyond competition, and we see more and more banks actually partnering with fintechs. As a money transfer business, we always have relationships with banks. As a digital-only money transfer provider, we find banks as more open to working with us than traditional, offline remittance companies because of the strength of our compliance systems,” Liu said.

“Our proprietary platform connects to global credit reference agencies enabling us to electronically verify customer identities in all our send markets. We also have access to global data exceeding three billion records,” Liu added.

Being a global organisation, WorldRemit has to comply with the requirements of various regulatory bodies around the world, including the following:

- Financial Conduct Authority (FCA) in the UK;

- Financial Transactions and Reports Analysis Centre of Canada (FINTRAC);

- Australian Transactions Reports and Analysis Centre (AUSTRAC);

- Financial Services Provider (FSP) and the Department of Internal Affairs (DIA) in New Zealand; and

- AMF in Quebec.

The other fast-growing relationship WorldRemit is building is directly with telcos. Mobile airtime reloads sent through WorldRemit are delivered within seconds and are free of transfer fees – as senders only pay the face value of the airtime. More than 80% of mobile connections are prepaid in Asia Pacific.

“There is a natural growth opportunity for telcos in financial services and we have seen evidence of that in the development of mobile money wallets. We expect to see telcos increasingly partner with financial services organisations as these opportunities expand,” Liu explained.

The company is signing up with telco operators at an increasing speed. Earlier this year, WorldRemit partnered with the African carrier MTN, which covers 22.5 million users in 16 countries across the African continent.

For now, WorldRemit understands the value in partnering with banks, which it still needs to “cash out”. This is partly due to weak national e-payment infrastructure and heavy cash based payment behaviour in most emerging markets in Asia. However, with new national payment infrastructure upgrades under way from India to the Philippines, and growing merchant network adoption of micro- and e-payments, mobile money and wallets are predicted to be more prevalent in the future.

“One of our key differentiators is the range of options we provide our clients for receiving money. You can arrange a cash pick-up, as with many traditional providers, but you often do not need to handle cash at all with services like mobile money wallets and airtime top-ups. In some receiver countries, our customers are actually using mobile money to pay directly for goods and services, which is a safer, easier, and more convenient way of doing things,” Liu said.

Risks posed by compliance and licensing

Compliance and licensing requirements continue to pose the biggest challenges for new fintech MTOs. These two also comprise the biggest costs in operating international money transfer services. Even new players are putting huge investments into compliance systems.

WorldRemit believes that the key strength of online platforms and account-to-mobile wallets is the complete audit trail, something that does not exist in traditional and smaller (local) agents. The company has heavily invested in compliance, but did not disclose further details. Comparatively, MoneyGram has spent $100 million on a new compliance system set to be launched this year.

WorldRemit has so far avoided any flaks from compliance regulators unlike its fintech peers. For example, its competitor, TransferWise, was working with a smaller third party operator to enter the US market between 2014 and 2015 but ran into trouble due to compliance issues. On the other hand, WorldRemit has complied with the money services business licensing requirements of 45 state regulators in the US.

Competitive responses

Traditional MTOs are also gearing up for the digital space – often in alliances with other fintech or mobile money service companies – lowering fees and adjusting business strategies. Increasing pressure on margins will be inevitable as they compete head on with new fintech startups. These challenges will only grow with the G20 leaders committing to reduce remittance costs to five percent and lowering the cost of market entry for new players, while ensuring that consumers are protected.

While WorldRemit is hoping to take a larger share in the global mobile money market, MoneyGram and Western Union are also aiming to extend their leadership into the digital money transfer services, especially keen on mobile wallets. In 2015, MoneyGram announced that it is developing a payment transfer compatibility with M-Pesa in Kenya.

MoneyGram’s digital revenue goal is to derive at least 15% of its money transfer revenue from its digital segment by 2017. At the end of 2015, 13% ($187 million) of the company’s revenue came from this source. On the other hand, Western Union launched its mobile money service in Bangladesh last April 2016 in partnership with BRAC Bank and bKash, a mobile financial service provider with 22 million users in the country, which is the eighth largest receiver of international remittances in the world.

Conclusion

When WorldRemit entered the money transfer business, its aim was to make cross-border money transfer easier for millions of migrants. Although it took some time before they were able to convince commercial banks to partner with them, the company’s ability to create major alliances across the financial industry and build its presence in more than 50 sender and 125 receiver markets are remarkable feats. By first focusing on compliance rather than entering the market swiftly, the company was able to avoid some issues that other players have faced.

Fintech players such as WorldRemit are also increasing the pressure on Western Union and MoneyGram, especially on transfer service fees. Yet, in the long run, it will not be spared from the effects of price competition and margin pressures. Incumbents like the Western Union are keen to increase the digital component of their business. Moreover, fintech players in the money transfer business such as Xoom and TransferWise have similar business models as WorldRemit. Even if the company is competitive in terms of price at the moment, it has to stay operationally lean and customer-focused if it wants to grow into a bigger and global MTO.