Many bank boards do not have enough members with technology expertise, a critical skill set given the significant impact of board-level decisions on a bank’s technology strategy. On average, technology representation on bank boards is only 13.3%, based on an analysis of 330 bank boards across regions, including the largest 30 banks in Africa, 100 in Asia Pacific, 50 in Europe, 20 in the Middle East, 100 in North America, and 30 in South America.

As banks navigate the complexities of the digital era, board composition should evolve to include members with robust technology expertise. Having tech-savvy board members is crucial for overseeing strategy, cybersecurity, regulation, and customer experience effectively. Their expertise ensures that boards can navigate digital transformation, leverage technology for competitive advantage, and manage associated risks adeptly.

Lack of sufficient technology expertise

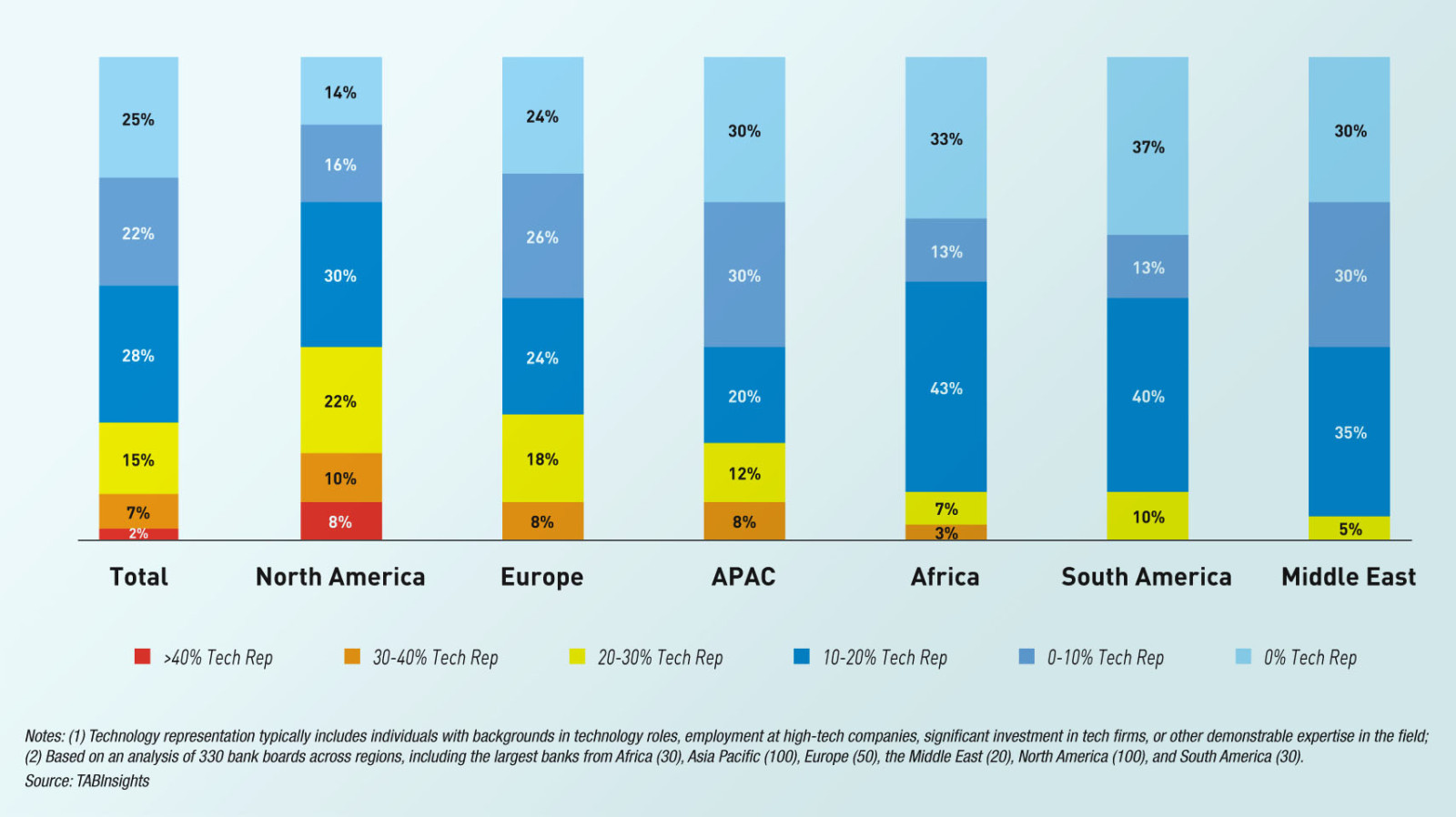

Globally, only 9% of banks have more than 30% technology representation on their boards, and 15% have between 20% and 30%. Additionally, 25% of banks have no tech representation on their boards at all, and 22% have between 0% and 10%.

There are notable regional disparities in the integration of technology expertise on bank boards. North America leads with 40% having over 20% tech representation, followed by 26% in Europe, 20% in Asia Pacific, 10% in Africa and South America, and 5% in the Middle East.

North America leads in tech representation on boards

North America leads in technology representation on boards compared to other regions, with an average presence on the boards of the top 100 largest banks in the region at 18.5%. Notably, it stands out as the only region where certain banks have technology representation on their boards exceeding 40%.

For example, Fifth Third Bancorp from the US and EQB from Canada showcase the highest levels of technology representation on boards, at 63% and 55%, respectively. Fifth Third Bancorp’s board of 16 directors includes 10 with expertise in digital innovation, cybersecurity, fintech, and information technology. Additionally, banks such as Morgan Stanley, Bank of New York Mellon, and State Street also maintain technology representation on boards exceeding 40%.

In Europe, half of the top 50 largest banks in the region have less than 10% technology representation on their boards.

Meanwhile, only four banks, including Danske Bank in Denmark, Banco de Sabadell in Spain, Standard Chartered in the UK, and Zürcher Kantonalbank in Switzerland, have over 30% technology representation. Europe has a higher proportion of bank boards with over 20% technology representation compared to Asia Pacific.

In Asia Pacific, only 8% of banks have 30% to 40%, while another 12% have 20% to 30%. Banks such as Axis Bank and ICICI Bank in India, ANZ and Commonwealth Bank of Australia, Bank of East Asia in Hong Kong, and Krung Thai Bank in Thailand exceed 30%.

However, most megabanks in China and Japan show less than 10% technology representation. For instance, ICBC, Bank of China, Mitsubishi UFJ Financial Group, and Sumitomo Mitsui Financial Group each have only one director with technology expertise.

Africa, Middle East and South America lag behind

At just 5%, the Middle East stands out with the lowest percentage of banks having over 20% of technology representation on boards, underscoring a significant gap in this aspect.

Additionally, 30% of the top 20 largest banks in the region lack any technology representation, while another 30% have only 0% to 10%.

Among these banks, Bank Hapoalim of Israel and Riyad Bank of Saudi Arabia have the highest levels of technology representation on their boards.

However, banks such as Al Rajhi Bank, Saudi National Bank, and First Abu Dhabi Bank demonstrate comparatively lower levels of performance in this regard.

In both Africa and South America, only 10% of the top 30 largest banks have technology representation on boards exceeding 20%. Leading in Africa, Access Holding achieves 33%, while no banks in South America exceed 30%.

In South America, Bancolombia in Colombia, Banco Galicia in Argentina, and Itau Unibanco Holding in Brazil show relatively higher levels of technology representation on their boards, each surpassing 20%. However, 37% of banks in the region lack any technology representation on their boards, the highest among all regions, highlighting a significant lag in integrating technological expertise at the board level.