- After nine years in operation, Nubank achieves 498% net income growth in 2023

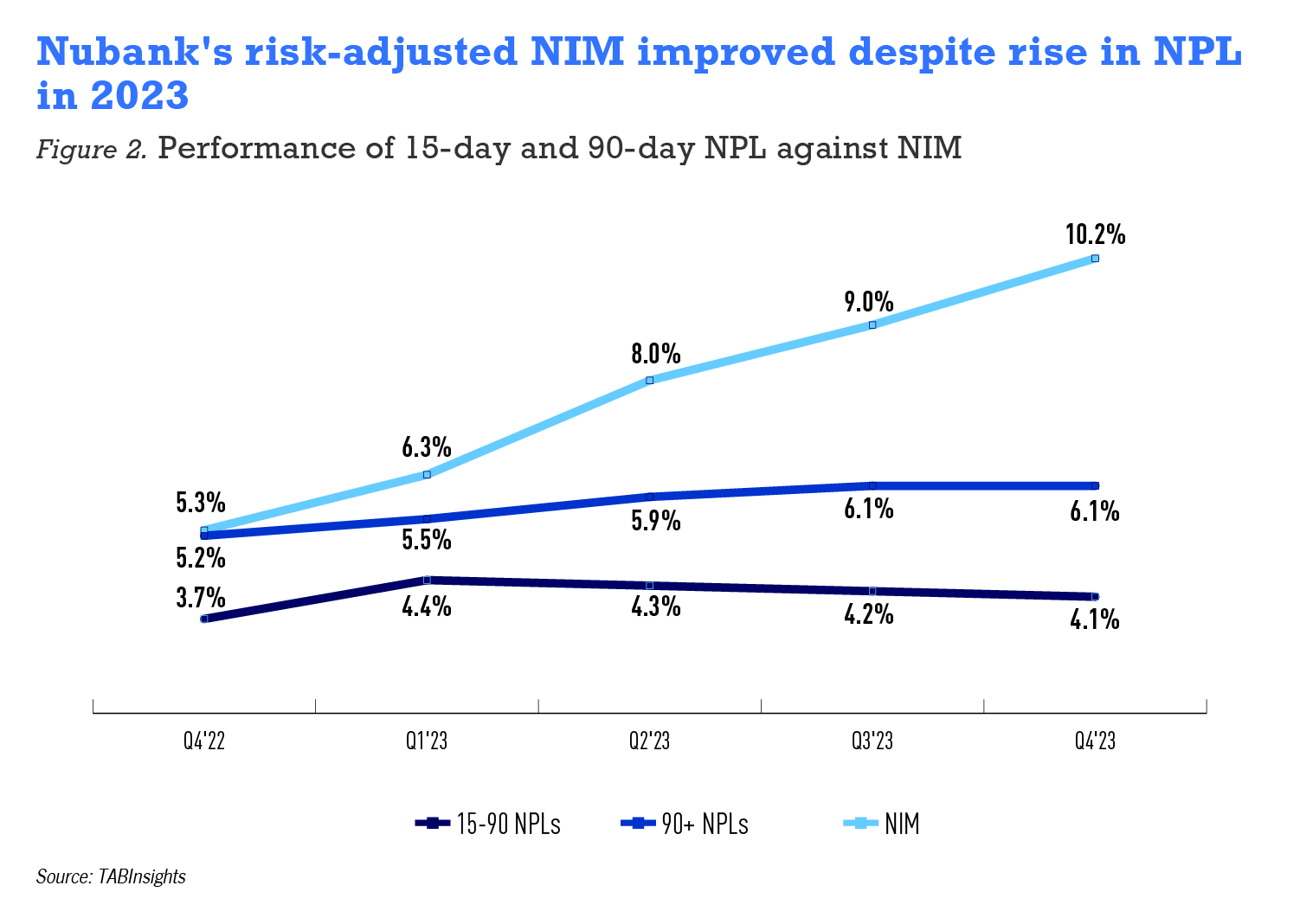

- Risk-adjusted NIM improved from 5.3% to 10.2% in Q4 2023, NPL (90d+) rose from 5.2% to 6.1%

- Planned customer acquisition and expansions in Mexico and Columbia

Nubank's financial performance showed significant improvement between FY2020 and FY2023. Initially, the bank reported losses, with net income at BRL -888 million (-$171 million) in FY2020 and BRL -919 milllion (-$165 million) in FY2021.

However, a notable turnaround occurred in FY2022, when net income increased to BRL 1.9 billion ($365 million), signalling the start of a recovery. This growth pattern continued robustly into FY2023, when net income surged to BRL 5.3 billion ($1.1 billion), underscoring Nubank’s strong profitability and strategic advancements.

The bank’s revenue escalated from BRL 3.8 billion ($0.74 billion) in 2020 to BRL 39 billion ($8.1 billion) in FY2023, reflecting the bank’s substantial growth in customer base and service expansion. The cost-to-income ratio (CIR) also shows a positive trend, reducing significantly to 31% in 2023 from higher levels in previous years, indicating enhanced operational efficiency and cost management.

.webp) Nubank’s quarterly data for 2023 shows a consistent good performance, with total revenue of BRL 11.6 billlion ($2.4 billion) in Q4, marking a significant increase from previous quarters in the same year.

Nubank’s quarterly data for 2023 shows a consistent good performance, with total revenue of BRL 11.6 billlion ($2.4 billion) in Q4, marking a significant increase from previous quarters in the same year.

This growth rate aligns with the annual figures;the bank’s gross profit for Q4 2023 was reported at BRL 5.3 billion ($1.1 billion), with the gross margin expanding to illustrate operational efficiency. The net income for Q4 2023 is notably higher at BRL 4.3 billion ($861 million), compared to BRL 282 million ($58 million) in Q4 2022, reflecting a substantial increase and contributing to the annualised return on equity (RoE) of 23%.

The adjusted net income for Q4 2023 was reported separately, leading to an adjusted annual net income figure that complements the year’s strong performance.

Risk-adjusted NIM improved from 5.3% to 10.2% in Q4 2023, despite a rise in NPL (90d+)

Nubank’s quality of assets in its Brazil segment demonstrated resilience, with a slight reduction in the 15 to 90-day non-performing loan (NPL) ratio to 4.1%, and stability in the 90+ day NPL ratio at 6.1% from 2022 to 2023.

This equilibrium signifies judicious management of both emergent and persistent delinquencies . The risk-adjusted net interest margin (NIM) continued to escalate, reaching a record high of 10.2%, a year-on-year increase of 120 basis points from the third quarter's 9%, underscoring Nubank's proficient risk pricing.

Founder and CEO David Vélez stated: “We are building the largest consumer platform in Latin America, with strong earnings-generating capabilities, having delivered over $8 billion in revenues and $1 billion in net profit in 2023."

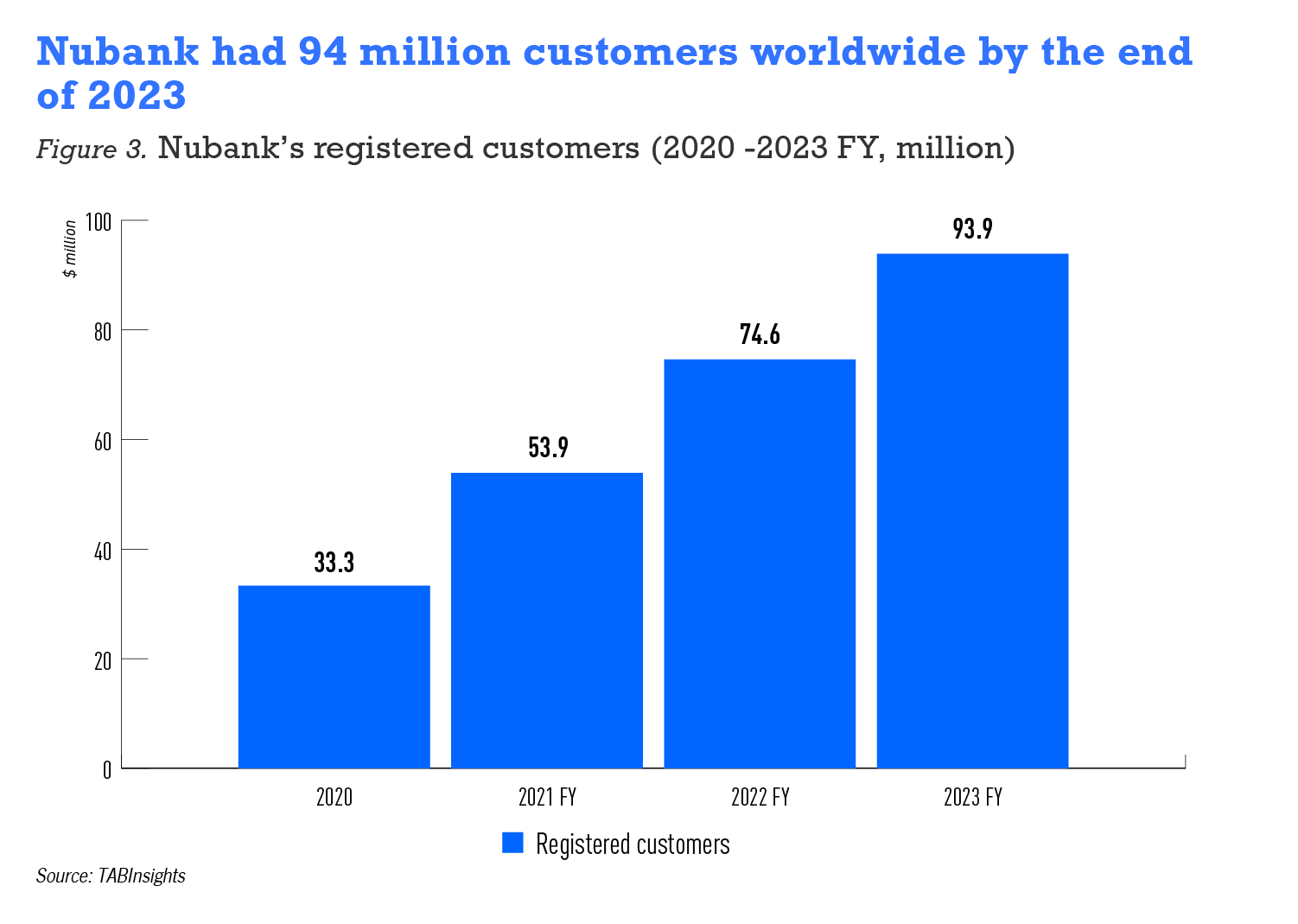

Nubank welcomed 4.8 million new customers in Q4 2023, marking a year-on-year (YoY) increase of 19.3 million and bringing its global customer count to 93.9 million. This significant growth affirms Nubank's position as one of the largest and most rapidly expanding digital financial platforms worldwide. In Brazil alone, Nubank's customer base now encompasses 53% of the adult population, ranking it as the country's fourth-largest financial institution by customer numbers.

The bank's monthly average revenue per active customer rose to BRL 51 ($10.6), reflecting a 23% YoY increase on a foreign exchange neutral basis, with the highly-engaged cohorts generating BRL 124 ($27). Notably, over 61% of its monthly active users regard Nubank as their primary banking institution, showcasing its success in building engagement and revenue streams.

The significant revenue from highly-engaged customer groups underscores Nubank's targeted approach and its diverse financial services. These customers, using varied services like credit, investments, and insurance, boost per-customer profitability. Focusing on these users suggests potential for increased revenue per customer, reflecting strong trust in Nubank's offerings.

Velez added: “As we work towards surpassing the 100 million customers milestone in 2024, we are investing heavily in new growth avenues to keep transforming potential into profit. We are unlocking the untapped opportunity of our secured and unsecured lending portfolio, gaining share in the upmarket segment in Brazil, and strengthening our presence in Mexico and Colombia with new products and features.”

Nubank's operational prowess is highlighted by its cost-effective service model, maintaining a monthly average cost to serve per active customer at BRL 4 ($0.9). This efficiency has contributed to an improved efficiency ratio of 36% in Q4 2023, positioning Nubank among Latin America's most efficient firms.

Despite these achievements, Nubank faces challenges in maintaining growth momentum. Its ambitious expansion into Mexico and Colombia, along with scaling lending operations, requires meticulous execution to balance growth with asset quality.

The bank plans to diversify its product offerings with significant investments in technology for real-time payments, open banking, and artificial intelligence.