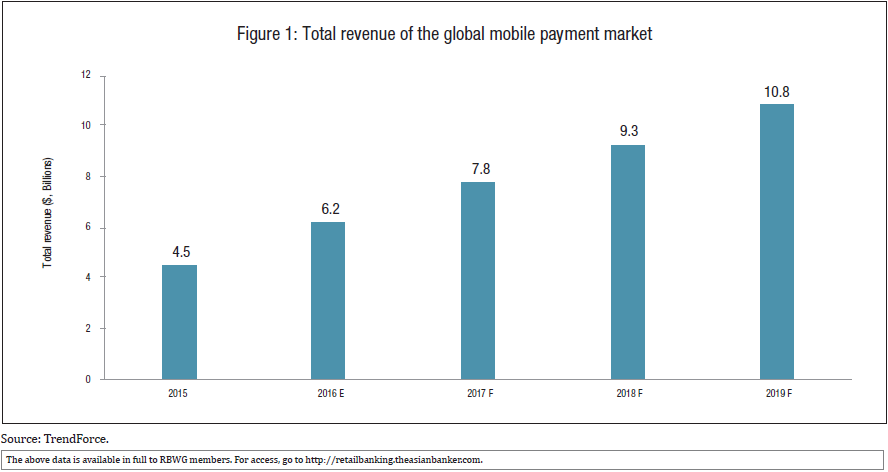

- Mobile payments revenue will increase from $4.5 billion in 2015 to $10.8 billion by 2019

- A key challenge for mobile payments has been interoperability, as telcos only offer such service to their own customers

- Despite tremendous amount of hype around mobile payments, global volumes in markets, especially outside China, remain relatively low

Key developments in mobile payments globally

While mobile payments take-up has been slow so far, usage is on the rise. TrendForce expects mobile payments revenue to increase from $4.5 billion in 2015 to $10.8 billion by 2019 and mobile payments volume to rise to $1.0 trillion by 2019 (Figure 1). It also believes that mobile payments will reach $3 trillion by 2021.

The global mobile payment market is projected to generate $10.8 billion worth of revenue by 2019 according to TrendForce

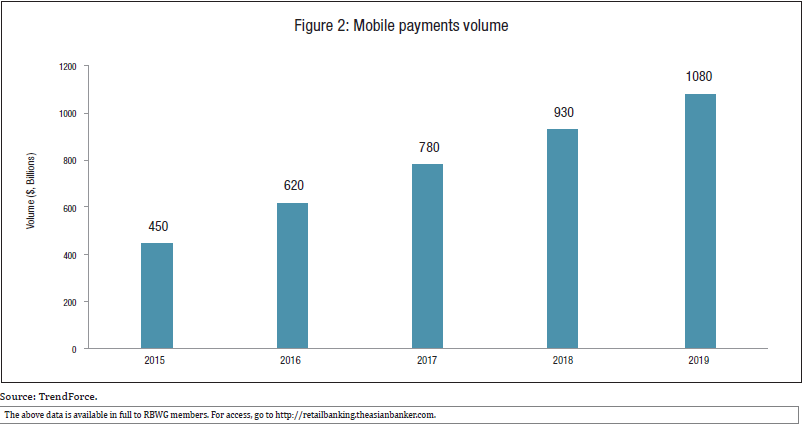

Mobile payments continue to grow rapidly, even if the percentage increase may be lower because of a higher base. Volumes will keep increasing in the coming years as catalysts such as data-analytics-based value-add services and increased security through biometrics lead to greater value and convenience for consumers (Figure 2).

Volume of mobile payments expected to surge by 2019, driven by technology and analytics

While these numbers only represent 5% of the consumer card payment volume now, the number will increase to 11% by 2021. That volume is hugely concentrated in Asia, with China accounting for 58% of mobile commerce volume this year.

One challenge to growing the volume is that mobile payments are used more for service-oriented purchases such as media downloads and food service delivery rather than higher value purchases. There is also a demographic gap, as more than 80% of millennials have made a purchase on a mobile device compared with 57% of baby boomers.

Consumers’ preference to pay using their cards rather than their phones is also a key challenge to the rapid growth of mobile payments. Multiple studies have shown that consumers want a convenient and easy-to-use app that makes online and offline shopping easier; gives them the extra budgeting or pricing information they need; and offers benefits such as discounts from loyalty programmes. They also want special services at certain types of merchants, such as being able to order fast food in advance and skip the queue to pick up their meals. While mobile payments providers in China offer many of these features, banks and third parties in other markets have been slow to offer this extra value that consumers prefer.

Consumer-focused and data-driven innovations that provide more value-add are becoming a catalyst for change in more markets, though there are tremendous variations depending on the country, culture or company where the service is delivered.

The basic service that banks and other providers offer is, simply, payments. While many banks have rolled out their own proprietary payments services as part of mobile banking, their usage has been low even if the number of customers who signed up for the service is high.

A key shift over the past year or two has been the continuing expansion of Apple Pay, Samsung Pay, Android Pay and other “Pay” services into an increasing number of markets worldwide. Large banks such as Bank of America in the US and ICBC in China, as well as scores of smaller banks around the world, have teamed up with these “Pay” providers to offer their customers convenient mobile payments linked to a digital credit or debit card.

Apple Pay, for instance, has partnered with banks in the US, Australia, China, Singapore and other markets.

Although the number of users rose 400% year-over-year, with more than half of the transaction volume outside the US and approximately 11 million points-of-sale (POS) accepting Apple Pay, the base is still small.

Apps are adding value

Beyond just basic payments, mobile payments providers are beginning to offer innovative services that use data analytics, global positioning system- (GPS) based location, and other tools to deliver more convenient services.

As Elle Kim, head of global business development, Samsung Pay, told Pymts.com, “When we talk about providing cool payment services, we are starting to think about how we can pull together all the different things we do from the consumer electronics point of view. If all we do is tap, most people will think, ‘Hang on a minute, my card does that,’ so we need to figure out how to innovate and bring more value to consumers.”

A small number of merchants are also beginning to use the full power of data analytics to provide location-based services. Issuers such as Moven Bank have added in budgeting features, location-based offers, and immediate contextual credit during purchases.

The holy grail for many companies is to offer a mobile wallet that would enable consumers to replace almost everything in their wallet – credit cards, debit cards, loyalty program cards, building access cards, and even their identification cards – with a mobile phone that stores everything digitally. While a number of companies are working on developing an e-wallet, only a few organisations, such as Alipay and Tencent in China, have successfully put a large number of services on one device.

Telcos get in the game with direct carrier billing

Telcos are increasingly getting into the mobile payments space by rolling out direct carrier billing (DCB), which enables consumers to charge payments to their prepaid or post-paid telco account. Ovum estimates the volume of DCB at more than $15 billion in 2015, with more than half in Asia. Japan has perhaps the largest volume globally.

However, a key challenge so far has been interoperability, as telcos only offer such a service to their own customers. Consumers using different telcos cannot always perform basic services such as paying the merchants or splitting bills for a meal. An important development though, is that interoperability is gradually rolling out. For example, the three largest telcos in Indonesia – XL, Indosat and Telkomsel – are collaborating to develop interoperable services in the country. Leading operators in other markets including Thailand - AIS, dtac, and TrueMove – and Tanzania - M-Pesa, Tigo, Zantel and Airtel are following suit.

Functionality

Banks, fintechs, telcos, and a multitude of other service providers offer the basic function of making payments. A growing number of providers are, however, going beyond this service.

Value-added service

In much of Asia as well as in North America and Europe, mobile payments providers ranging from the smallest coffee companies to the largest banks and retailers have focused on offering a single service that is available through a simple-to-use app. More companies are, though, going beyond these basic payments to provide greater convenience and added value to their customers.

Starbucks, for instance, enables its customers to receive promotions, leverage GPS to find stores, and use “mobile order and pay” to order ahead so they can walk-in to pick up their orders. Taco Bell, which also has an order-ahead app, said its average mobile order is 20% larger than in-store orders. Walmart Pay gives customers rebates if its “savings catcher” feature finds lower prices at a competitor, allows consumers to pay using their mobile phone without stopping at the cashier, and prompts them to redeem unused gift cards that are linked to the app. Uber now links with Hilton Honors (HH) so that HH members can check-in on their way to the hotel.

Financial technology (fintech) companies, with their own independent mobile payment services, are also adding value to payments. US-based Shift Card, for instance, allows users to spend using iTunes accounts, loyalty points, bitcoins, or other options. UK-based Revolut lets consumers load multiple currencies using lower spot interbank foreign exchange rates, then send money abroad or travel without incurring higher foreign exchange fees. Apps such as YNAB help customers to better manage and spend their money by offering budgeting services that show consumers how much they have left to spend in categories, such as clothes or restaurants, and then helping them to manage their money.

Some banks have also developed innovative services. Emirates NBD in the UAE, for example, offers biometric login, overseas remittances within 60 seconds to countries including India and the Philippines, an impulse savings app called Shake n’ Save, and person- to-person (P2P) money transfer services.

A number of other apps also offer P2P payments. PayPal-owned Venmo enables P2P payments, social features such as friends’ or payments interactions, and the ability to send a billing request. Meanwhile, Fastacash introduced a global social payments platform that allows users to transfer value as well as digital content using social media and other messaging platforms.

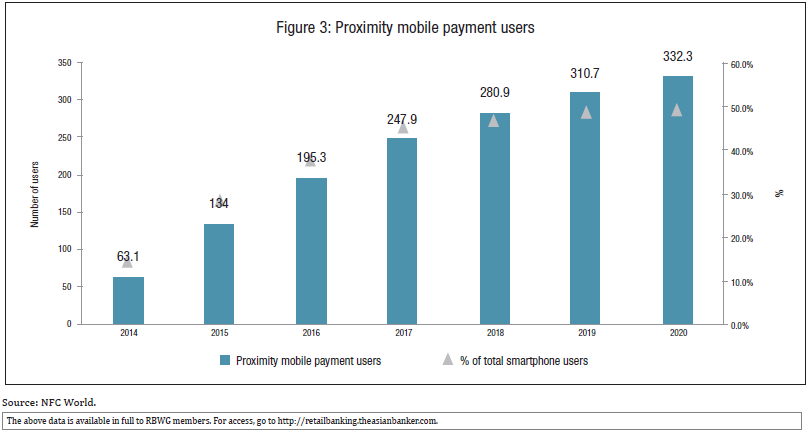

Mobile wallets

The market that has had the most success with mobile wallets is China, where the leading players offer as many features and functions as possible. China already has the largest number of mobile payments users in the world and, with more value-add services as well as more acceptance points offered by the dominant players in the country, mobile payments will continue to increase significantly (Figure 3).

China’s mobile payments will continue to boom

Alipay, the largest mobile payments company with more than 400 million active users, allows customers to move money from their bank accounts or cards into its mobile payments service. Alipay sets its payment threshold higher than Apple at $300 (RMB2,000) and is offering a money market fund for investors and loans for borrowers. It also launched a QR-based one- second payments service and is working on virtual reality technology that lets consumers pay bills with a nod or a gesture.

Tencent similarly enables consumers to pay for purchases, online and offline. iResearch data shows that Tencent nearly doubled its mobile-payments share from 11% in 2014 to 20% in 2015, while Alipay’s share fell from 82% to 68%.

Case Studies

Several leading players in mobile payments exemplify the cutting-edge services made available to consumers.

TransferTo

When TransferTo started ten years ago, its chief executive officer Eric Barbie told The Asian Banker, it focused on enabling customers to send small amounts of less than $20 across border using prepaid mobile airtime. It has now established relationships with more than 400 telcos and hundreds of corporates, particularly in emerging markets, and has become a UK-regulated authorised payments company.

More recently, it has begun connecting with mobile wallets such as M-PESA and has more than 400 million mobile money accounts for P2P payments in amounts sranging from about $50 to $500. TransferTo has also started offering services for corporates to make payments to companies or individuals. Vendors can also send invoices telling small merchants that payments can be made on a mobile wallet through a local telco.

MatchMove

Singapore-based MatchMove enables consumers to “spend, send and lend”. Shailesh Naik, the company’s CEO, told The Asian Banker: “On the spend side, we allow anyone to get a widely accepted card like Mastercard or Visa. You can spend as you wish.” Individuals or businesses can send money abroad to family members or for goods and services. It uses data and algorithms to provide a credit score that its partners can use to offer loans.”

A key differentiator, Naik said, is that it is a business-to-business (B2B) service. “We identify one or two banking partners in a market. They know the regulations. Our goal is to go to the larger community using their apps for service. What we do is accelerate their ability,” he explained. MatchMove invests in the latest technologies, providing a roadmap to QR codes, blockchain, or other state-of- the-art capabilities.

Another differentiator is its focus on three services. “Competitors only focus on one,” Naik said. “PayPal, only on spend. Our combination puts us in a different category.”

Global mobile payments volume still weak

While there is a tremendous amount of hype around mobile payments, the reality is that volumes in markets, especially those outside China, remain relatively low.

Even though mobile banking is very popular globally, consumers are simply not taking out their mobile phones before their cards in large enough numbers to make a significant dent in payments volumes.

The tipping point towards mobile payments is, however, getting closer. Value-added services that provide a compelling reason to use the phone rather than a card, better accessibility to payments, and the number of younger phone users, are among the key factors that will lead to change.

Moreover, leading players in China are beginning to take their services abroad, and their cutting-edge services could bring the tipping point even closer. Alipay continues to reach agreements with merchants and service providers in every region to enable Chinese consumers to use their cards abroad, and it has started to launch services in more markets for domestic consumers to use the Alipay wallet. Tencent has similarly started to take WeChat Pay to more markets.

Banks that develop their own leading-edge mobile payments services, whether through internal development or partnerships with leading players, stand to gain new customers and raise their revenues. Those that lag behind, on the other hand, face potential disintermediation from services such as Alipay or WeChat Pay. Convenience, security and value-add remain keys to success.