Revenue per employee is widely used as a proxy for how effectively banks convert human capital into revenue. It provides insight into operational efficiency, technology adoption and strategic focus—offering a perspective beyond total assets or global reach.

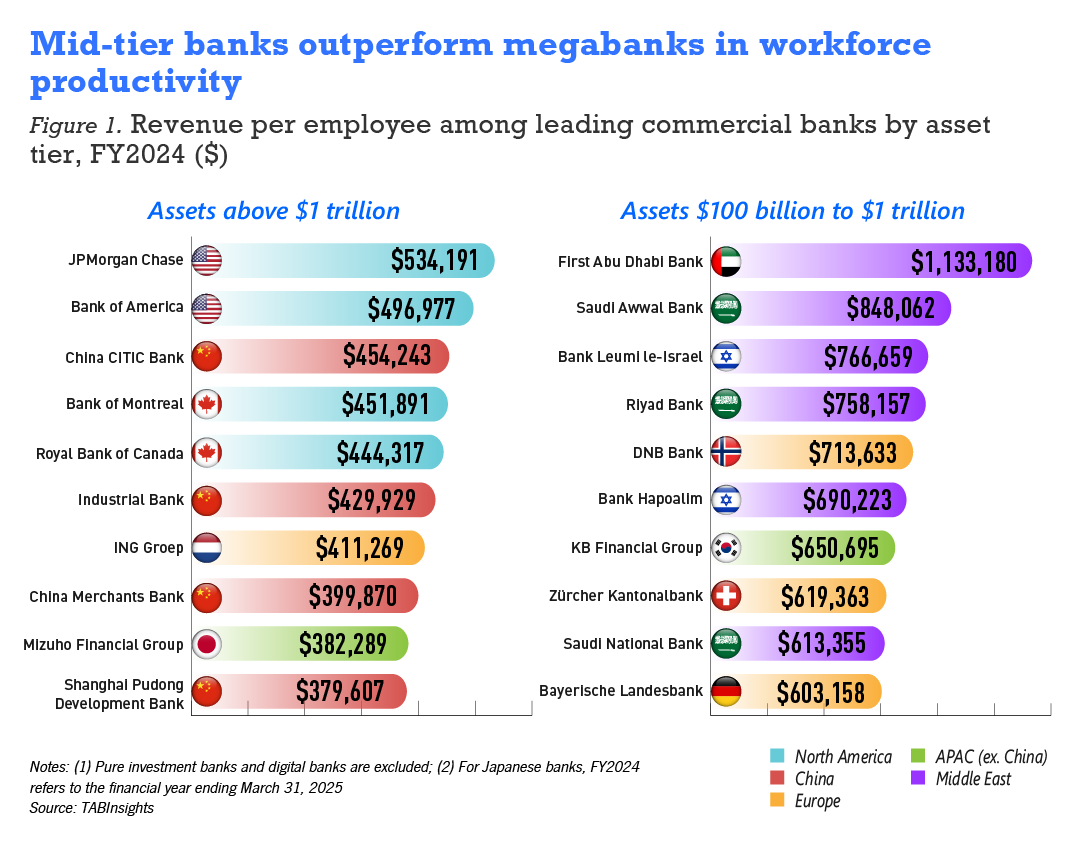

This analysis compares two banking segments—large banks with assets exceeding $1 trillion and mid-sized banks with assets between $100 billion and $1 trillion—highlighting notable differences in workforce productivity worldwide. Observations across both segments also show how operational strategies, technology adoption and regional conditions influence per-employee performance. While megabanks lead in total workforce, mid-sized institutions often achieve higher per-employee productivity.

US megabanks top workforce productivity among large banks

Among large banks with assets exceeding $1 trillion, North American and Chinese institutions dominate revenue per employee. The top 10 large banks average $438,458 per employee in the financial year (FY) 2024, ranging from $379,607 at Shanghai Pudong Development Bank to $534,191 at JPMorgan Chase, suggesting that even at massive scale, operating model design and digital platforms can support higher workforce efficiency.

JPMorgan Chase and Bank of America occupy the top two spots, reporting $534,191 and $496,977 per employee. JPMorgan Chase operates a diversified model—spanning investment banking, asset management and consumer banking—alongside significant investment in AI automation, factors that likely contribute to its high workforce productivity. Bank of America benefits from its market-leading digital platform, which supports employees’ shift toward higher-value tasks. Canadian banks also perform strongly, with Bank of Montreal ($451,891) and Royal Bank of Canada ($444,317) excelling at balancing cross-border operations with cost discipline.

China contributes four banks to the top 10, with China CITIC Bank leading at $454,243 per employee in FY2024, followed by Industrial Bank ($429,929), China Merchants Bank ($399,870) and Shanghai Pudong Development Bank ($379,607). These banks illustrate elements of China’s ongoing banking modernisation. China CITIC Bank has invested heavily in automation and data analytics, reducing operational friction and boosting employee output, while China Merchants Bank focuses on high-growth sectors.

European and Japanese banks round out the top 10. ING ($411,269 per employee) stands out for its digital-first approach to retail banking, while Japan’s Mizuho Financial Group ($382,289) excels in corporate banking across Asia.

Middle Eastern banks excel in mid-sized bank employee productivity

For banks with total assets between $100 billion and $1 trillion, the top 10 institutions by revenue per employee show significantly higher workforce productivity, averaging $720,510—more than 60% higher than their large-bank counterparts. Middle Eastern banks dominate this segment, reflecting business models that are often more concentrated in high-margin activities. Many of the top-performing mid-sized banks are located in high-growth or financially dense regions, where economic activity, hydrocarbon wealth and regulatory conditions can support profitability. Strong corporate relationships and government-linked projects also enhance revenue potential.

First Abu Dhabi Bank leads the group with $1,133,180 per employee—more than double JPMorgan Chase’s figure—supported by a digital-first operating model and exposure to high-value business segments. Saudi Arabia contributes three top performers—Saudi Awwal Bank ($848,062), Riyad Bank ($758,157) and Saudi National Bank ($613,354). Their performance underscores the advantages of operating in concentrated markets and prioritising corporate and institutional banking, which avoids the cost intensity of mass-market retail operations.

European banks add diversity to the list. Norway’s DNB Bank ($713,633) and Switzerland’s Zürcher Kantonalbank ($619,363) combine efficient operating structures with clearly defined regional strategies. South Korea’s KB Financial Group ($650,695) illustrates how mid-sized banks in East Asia can blend digital capabilities with traditional banking franchises to generate solid per-employee output.

Productivity differences reflect strategy, technology and regional dynamics

Differences in revenue per employee appear to reflect variations in strategic focus, technology adoption and cost discipline. The most productive institutions deploy digital capabilities to support revenue-generating activities while aligning organisational structure with core business priorities.

Large banks operate at scale but must manage legacy IT systems, complex regulations and extensive geographic footprints. These factors can slow enterprise-wide digital integration and can may dilute per-employee productivity. By contrast, top-performing mid-sized banks often benefit from greater agility. With fewer legacy constraints, they adopt digital platforms quickly, embed automation and integrate employee training.

Business model concentration reinforces this advantage. High-performing mid-sized banks operate leaner structures and focus more on high-margin activities such as corporate banking, investment services and wealth management. This specialisation can help employees develop expertise, shorten decision cycles and support higher-value transactions, which may enhance efficiency and revenue-generating capacity.

Cost discipline complements these factors, with mid-sized banks maintaining tighter control over non-revenue functions and minimising redundancy to ensure a greater share of human capital is allocated to revenue-generating activities.

Regional dynamics accentuate these differences. North American banks excel in large-bank efficiency through diversified business models and advanced digital adoption, while China’s strong representation reflects the rapid modernisation trajectory of its banking sector. The top mid-sized Middle Eastern banks leverage digital-first models and operate in concentrated markets.

In conclusion, revenue per employee provides a nuanced view of operational effectiveness. While large banks dominate in total assets and workforce size, mid-sized banks currently convert human capital into revenue more efficiently. Large banks will need to continue streamlining operations and adopting agile, digital-first models that balance scale with efficiency, leveraging technology and process optimisation to boost productivity without compromising service breadth. Mid-sized banks, meanwhile, must maintain strategic focus and avoid bureaucratic inefficiencies as they grow, ensuring high workforce productivity remains sustainable.

View the complete ranking of the World's 1000 Strongest & Largest Banks.