Introduction

Enhancing service capability with innovative features for better customer retention is a competitive mandate for almost all banks today. Back in 2012 the trend was towards expansion of self service, with service differentiation in channels and contact centers becoming increasingly important.

Kotak Mahindra Bank, the fourth largest private sector bank in India by asset size, sought to improve the service capability at its contact centers. To do so, it implemented innovative processes, aided by technology, to address the challenge of significant numbers of waiting calls due to heavy peak time volumes. The bank brought in service innovation by enabling its interactive voice response (IVR) system to automatically call back customers rather than customers waiting on the phone in a queue. The project won The Asian Banker ‘Best Self-Service Banking Project Award’ for 2012.

This project has delivered stronger customer satisfaction and significant cost savings to the bank. With fast paced technology development, the bank has continued to expand on its contact centre service capabilities to further enhance customer experience.

The challenge

Presently, Kotak Mahindra Bank has a distribution network of over 1310 branches and serves more than 4.6 million customer accounts with its contact centres playing an important role by handling around a million calls per month. As the Bank’s customer numbers steadily increased, it resulted in a a significant surge in the volume of inbound calls.

This rise in call traffic meant a longer waiting time in queues for its customers resulting in customer dissatisfaction and significantly high rates of call abandonment. During the long wait times calls occasionally dropped-out unexpectedly due to telecom network issues leading to further dissatisfaction among customers.

In order to manage the problem of aggravated traffic during peak hours and at times of unexpected traffic, such as in case of technical malfunction at any of the other channel or outlets, the bank looked for a technical solution and settled on “courtesy callback”.

Features and functionalities

Courtesy callback is an automated service offering with a call back facility to customers who have called the Bank's IVR and waited in queue for more than 45 seconds. This innovative service limits the time spent by a customer waiting to get in touch with a phone banking officer.

The process is fairly simple. Once the customer opts to be called back, they leave their phone number and exit from the call. The system writes a database record to log the callback information while also advising the estimated call back time to the customer. The request remains in the system and when the system determines that an officer with the appropriate service/skill category for the caller is close to being available (based on the choice of selection from IVR and officer capability needed, as determined by the callback scripts), then the customer is called back using the recorded phone number. The system validates the customer and then connects the call to the officer.

The unique feature of this service is that when a customer chooses to use this option, the queue position remains intact even after disconnecting. For example, if a caller was in the 5th position in the queue when a call back was requested, callback functionality maintains that position despite call disconnect. When the position approaches the head of the queue and is about to be serviced, the system automatically initiates an outcall and patches the customer with the officer. This is the equivalent of using a substitute to maintain a queue position.

If the system cannot reach the callback number provided by the caller (for example, the line is busy or there are network issues) or the caller cannot be validated, then the call is not patched through to an officer. With this system, the officer is always guaranteed that someone is waiting when they take the call, improving officer productivity and efficiency. The system also presents the call context to the officer through computer telephony integration (CTI) as a screen pop-up.

In the event the caller cannot be reached after a configurable maximum number and frequency of retries, the callback is aborted and the database status is updated appropriately. Reports to determine if any manual callbacks are necessary based on business rules, are available.

The call back time varies depending on the traffic and is on average about 6.6 minutes.

Technology partner and product

The callback solution was devised in partnership with Servion Global Solutions that specializes in customer interaction management solutions and applications for Contact Centers. Servion was involved in the development of this solution, its implementation and day to day operational support for the system.

The bank has a consolidated IP based Contact Center with the ability to handle calls originating from any location, serviced by any officer located at any location, thus enabling true virtualization. The system enables validation of the customer and enables officers with a CTI screen that shares the customer details and call context with the officer, ensuring faster resolution of the query.

The centres are positioned at four different locations with each having a mix of product expertise, addressing business continuity and risk management considerations for the bank. The system enables the call to be connected to any relevant officer across any of these locations based on prioritization.

The bank is providing the callback service 24 x7. Currently it has about 320 officers to handle calls at peak times and skeletal staff during late nights.

The solution was customized to meet the unique requirements of the bank and the project implementation took four months to complete. It was successfully launched in December 2012, achieving given time frame and cost targets.

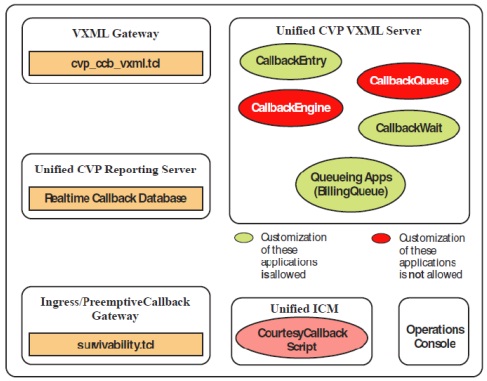

The callback solution was integrated with the customer voice portal (CVP) reporting server which receives data from the IVR system. The solution comprises an automated call back queue and callback engine application.

Figure 1: The System Components

Source: Kotak Mahindra Bank

Business impact

Kotak Mahindra Bank is the first in bank India to launch this service, leading to a first mover competitive advantage by creating a ‘wow’ factor among customers. The courtesy callback functionality provides the following key advantages

• A contextual and deliberate customer experience

• Improving the call management service levels of the bank

• Notable cost saving

As the first implementation of its kind in the country, the bank saw an immediate impact. The project resulted in an immediate drop in call abandonment by 50% with over 3000 customers using the service within the first fortnight after the launch in 2012. At that time the bank was offering this service to all its customers that had a wait time of over 20 seconds.

Over the years the bank has brought about various contact centre enhancements such as increasing its staff in the contact centre, adding functions to IVR to improve straight through processing of calls and providing toll free numbers for customers to dial-in at the centers. The system was upgraded to manage 5 local languages which enhanced customer experience.

Digitisation and recent developments in channel innovation impact the role played by the contact centers today. The bank has successfully migrated a large segment of its customers to mobile banking and introduced new innovative features. For example the bank now offers a variety of SMS alerts including an SMS service enabling the customer to receive a call back at a preferred time These features have successfully resulted in reducing the number of calls to the call centre, leading to lower operational cost as the cost of a voice call is significantly higher than a SMS response.

The bank now aims to manage its service level such that that it successfully answers 90% of its callers who want to speak with an officer within 10 seconds. It is primarily during times of unexpected surges in call traffic that the call wait time exceeds the target service levels and the bank is required to offer a call back service. Today the bank offers its call back service to all its customers whose wait time exceeds 45 seconds.

The bank currently receives approximately 750,000 calls at the contact centers every month of which about 440,000 callers opt to speak to an agent. Around 45,000 on average are offered the courtesy call back service every month although some of the customers prefer to stay on the call rather than accept call back service. Consequently, about 12,000 customers use the call back service every month and the average success rate for call backs is 88%. Since the launch of this system the call abandonment rate has dropped significantly from 12% to 4%.

The solution also brings notable cost savings for the bank through reduced telecom expenses. As customers often call at toll free numbers provided by the bank, it means that the bank has to bear the call charges while customers are waiting to speak to an agent. With this implementation the customers can disconnect the call within less than a minute which has meant significant call charge savings for the bank. The decline in call abandonment has also meant lower numbers of repeat calls, also helping to lower the telecom expense.

Future plans

Kotak Mahindra Bank recently merged with ING Vysya Bank and is in the process of offering uniform service to its customers. The bank however recognizes that given the fast pace of technology development it needs to continuously keep innovating to maintain competitive advantage and still sees benefits from its ‘courtesy callback feature’.

In the near future the bank’s IVR system is going to undergo a revamp to make it functionally robust to enable better prioritization of queries and ensure faster customer validation. This will also strengthen the self service features and enhance integration with its contact centres thereby enabling customers to access officers with just the tap of a button. The courtesy callback feature could aid the transition especially if call traffic increases due to the ease of reaching officers offered by the new digital services. The feature will also continue to help the Bank manage any call surges in the future.

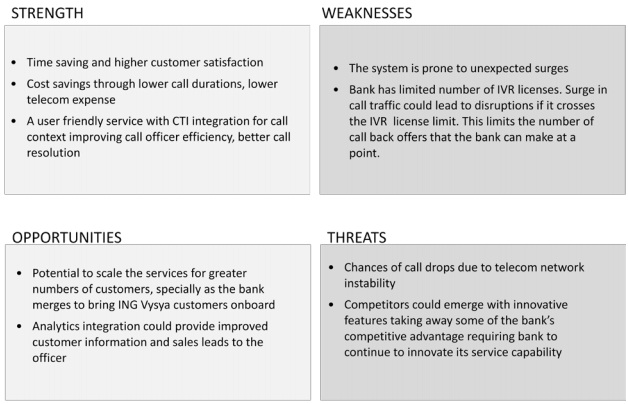

SWOT ANALYSIS