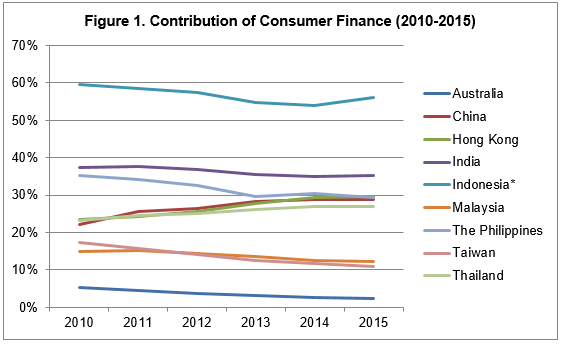

In the Asia Pacific region, the consumer finance business varies widely across countries. Among the markets covered in this report, the contribution of consumer finance to total retail lending ranges from 2% to 56% (Figure 1). In Indonesia, consumer finance stood at 56% of their total retail loan portfolio in 2015, which is considerably higher than the consumer finance portfolio of other markets. India held the second-largest share of consumer finance at 35%. The 2% share of consumer finance in total retail loans in Australia was lowest among these markets, followed by Taiwan (11%) and Malaysia (12%). The share of consumer finance in other markets is around 30%.

The contribution of consumer finance to total retail lending ranges differ among Asia Pacific countries

Source: The Asian Banker Research

The above data is available in full to RBWG members. For access, go to http://retailbanking.theasianbanker.com

Consumer finance evolves at different speeds in the region. During the past five years, consumer finance has slowed in Australia and Taiwan. Its growth decelerated in some markets, such as China, Malaysia, and Thailand. However, some markets also experienced faster growth, such as India and the Philippines.

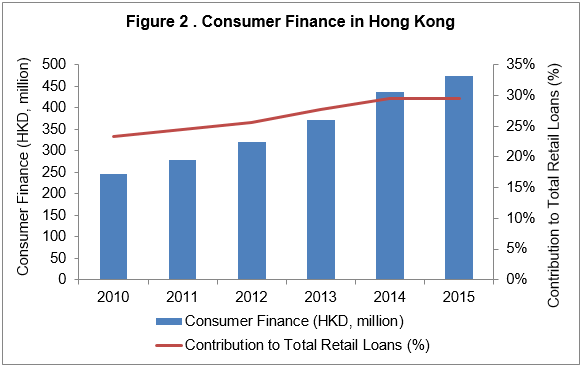

Hong Kong

Consumer finance in Hong Kong experienced a 14% compound annual growth rate (CAGR) between 2010 and 2015, supported by the existing low-interest-rate environment (Figure 2). During 2010–2015, credit card loans and other personal loans registered a CAGR of 8% and 17%, respectively. Credit card loan growth slowed to 3% CAGR between 2013 and 2015, while other personal loans for private use had flat growth during the same period, mainly because banks enhanced their loan portfolios and improved flexibility on credit assessments amid stiff competition.

Consumer finance has grown gradually and contributed more to retail loans

Source: The Asian Banker Research

The above data is available in full to RBWG members. For access, go to http://retailbanking.theasianbanker.com

Meanwhile, some banks are believed to market consumer finance as an alternative to mortgages, as Hong Kong has tightened mortgage requirements. In 2014, authorised institutions were required by the Hong Kong Monetary Authority to adopt more prudent underwriting standards on personal loans, due to concerns over the high level of household indebtedness.

In 2015, both credit card loans and other personal loans for private use grew at a more moderate rate compared with the previous year, partially due to fluctuations in economic conditions. Credit card loans expanded only 1%, which is lower than 6% in 2014. Other personal loans for private use went up by 12%, compared with 22% in 2014. It is expected that consumer finance will see a second year of single-digit growth, as Hong Kong faces more sluggish economic performance in 2016.

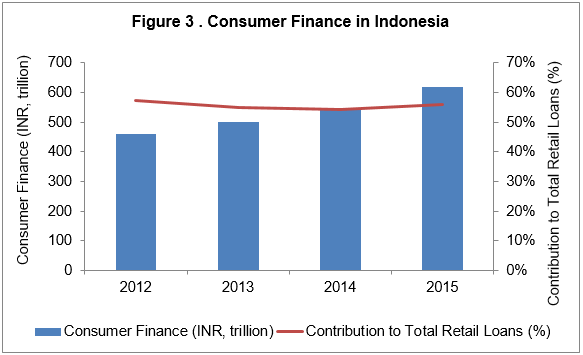

Indonesia

Consumer finance in Indonesia stood at 56% of total retail loans as of end-2015, the highest among countries covered in this report (Figure 3). However, the ratio of debt to gross domestic product in Indonesia’s households is significantly lower than that in other countries, mainly due to weak loan demand and less availability. The economy expanded by 4.79% in 2015, the lowest rate since 2009. This, along high inflation rate, high interest rate, and the rupiah’s depreciation have seriously affected consumer confidence and spending.

Consumer finance is the largest contributor to retail loans

Source: The Asian Banker Research

The above data is available in full to RBWG members. For access, go to http://retailbanking.theasianbanker.com

The share of consumer finance went up by 2% in 2015, because consumer finance outstripped mortgages and car loans in terms of growth. Consumer finance experienced a 13% increase in 2015, higher than 10% in 2014 and 9% in 2013. Mortgages grew at a slower pace and car loans saw a decline of 12%, as the uncertain economic situation in Indonesia exerted downward pressure on long-term lending.

Bank Indonesia lowered its policy rate by 25 basis points to 7.50% in February 2015 in an attempt to boost economic growth. The central bank also eased regulations to spur bank lending. However, these have had minimal impact. Consumers are taking a wait and see approach on consumption, and banks are maintaining caution on loan growth to curb nonperforming loans.

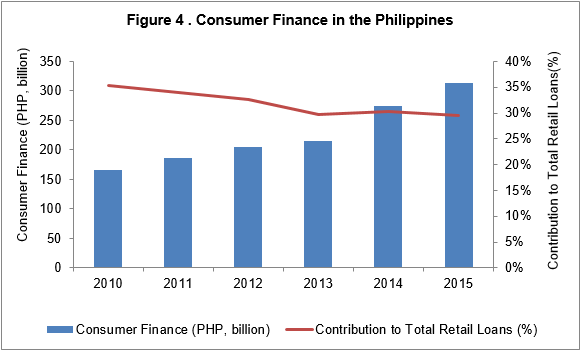

Philippines

Consumer finance in the Philippines grew at a 5-year CAGR of 13% and comprised 29.5% of total retail loans as of end-2015 (Figure 4). The share of consumer finance in total retail lending has declined in the past few years, because car loans and mortgages grew at a higher CAGR of 21% and 19%, respectively.

Consumer finance growth accelerated, but its contribution to retail loans has dropped

Source: The Asian Banker Research

The above data is available in full to RBWG members. For access, go to http://retailbanking.theasianbanker.com

From 2014, the Philippines has achieved accelerated growth in consumer finance with a CAGR of 21%, on the back of economic stability. The sustained growth in remittances from overseas Filipino workers has also helped boost consumer spending and investing. Due to intense competition, banks have expedited loan approval processes and offered various types of promotions, such as lower interest rates, enhanced product offerings, more flexible payment terms, and attractive giveaways.

In September 2015, the Bangko Sentral ng Pilipinas (BSP) issued new guidelines to monitor salary loans, which are loans granted to individuals on the bases of their regular salary, pension, or other compensation. Credit granting standards and policies will be adopted to provide better consumer protection. In 2016, the country also intendsto regulate the credit card industry, as there has been an increasing number of customer complaints on issues such as undisclosed charges, excessive fees, and unfair collection and harassment. The proposed law gives BSP authority to supervise the operations of credit card issuers, acquirers, and transactions.

Thailand

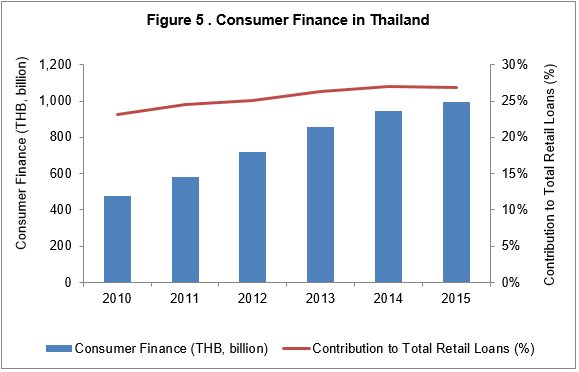

The contribution of consumer finance to total retail lending shows an upward trend in Thailand (Figure 5). However, consumer finance has had a more moderate increase between 2012 and 2015, as both banks and households have been more cautious. Consumer finance growth slowed from 18.7% in 2013 to 10.4% in 2014, in part because consumer confidence was negatively affected by the political unrest in Thailand. In 2015, consumer finance expanded by only 5.5% and stood at $27.6 billion. 2016 is expected to be another year of single-digit growth for consumer finance, given the challenging conditions.

Share of consumer finance increased, but consumer finance growth moderated

Source: The Asian Banker Research

The above data is available in full to RBWG members. For access, go to http://retailbanking.theasianbanker.com

In 2015, the economic slowdown, high household debt, and lower purchasing power all exerted an adverse impact on consumer finance, although the political situation has stabilised. Furthermore, Thailand suffered from its worst drought in decades. Banks have tightened consumer lending approvals, due to concerns over deteriorating credit quality amid lacklustre economic conditions. Nonperforming loans (NPL) in the consumer finance business have been rising gradually, and the NPL ratio went up from 2.3% in 2013 to 3.2% in 2015. Meanwhile, banks lent more to small- and medium-sized enterprises, which also led to less credit to individual customers. Consumer spending remained weak, because of the soft macroeconomic environment and high levels of household debts accumulated in the past few years.

Taiwan

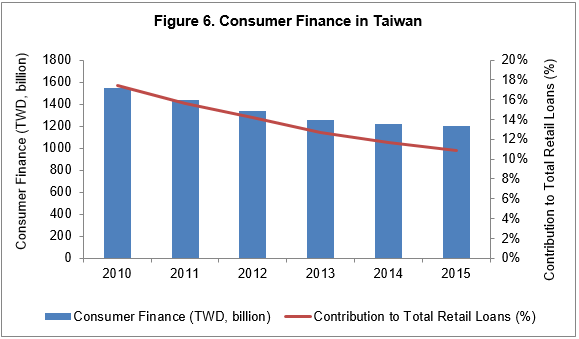

During the past few years, Taiwan has reported a remarkable and sustained drop in both consumer finance and contribution of consumer finance to total retail loans (Figure 6). The drop can be largely attributed to sluggish economic growth and lacklustre labour market performance. Consumer confidence remains depressed and consumer finance demand is weak.

Consumer finance and its share in total retail loans declined gradually

Source: The Asian Banker Research

The above data is available in full to RBWG members. For access, go to http://retailbanking.theasianbanker.com

Real wages have remained stagnant over the past few years. This, together with job uncertainty, has led to the continued decline in consumer finance. The unemployment rate among low-skilled workers is lower than that among higher-skilled workers, thus higher-skilled workers face a greater risk of unemployment. Meanwhile, households in Taiwan spend a large part of their income on mortgages. Another reason for the decrease is that the development of consumer finance in Taiwan started earlier compared to other Asian countries. Therefore, its consumer finance business was relatively well developed before 2010, particularly for card lending, and consumers depended heavily on lending for their consumption. Among different categories of consumer finance, home repair loans suffered the biggest fall between 2010 and 2015 (–21% CAGR). Credit card loans posted a 5-year CAGR of -8%.