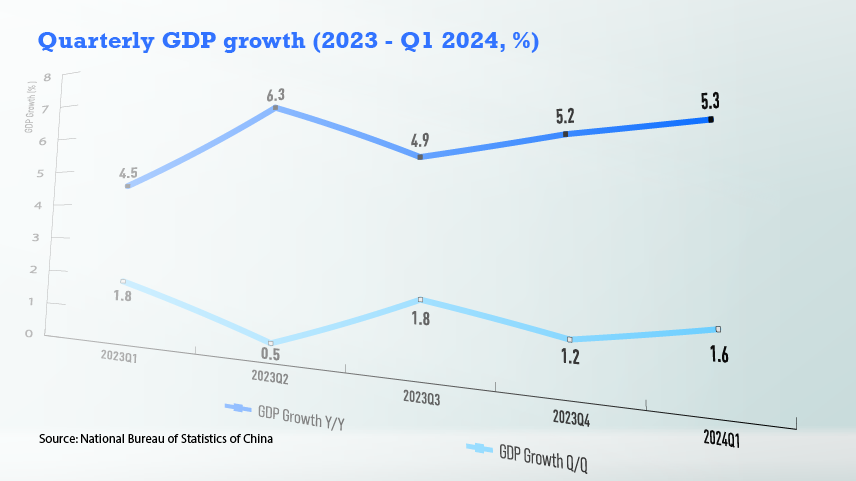

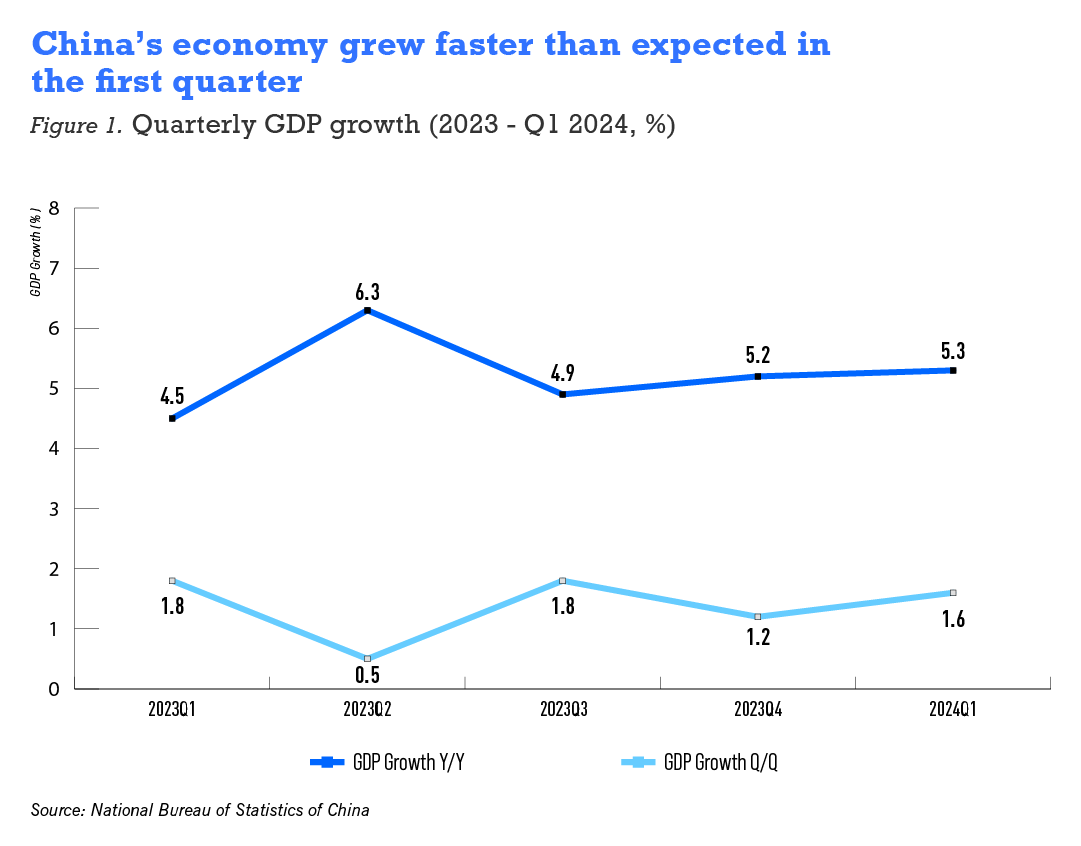

China’s national statistics bureau has just announced a 5.3% gross domestic product (GDP) growth rate in the first quarter of 2024 compared to the same period last year, and 1.6% compared with the last quarter. This seems to rebut the skepticism around China’s economic performance. Still, the question remains as to whether the numbers represent the beginning of a solid recovery trend, a random phenomenon, or worse, if the statistics should be treated with a grain of salt.

Indicators support GDP numbers

In terms of the authenticity of the GDP growth figures, they do seem to be corroborated by other supporting evidence. For example, electricity usage is famously known to be strongly correlated with economic activities. Total electricity usage increased by 9.6% in the first quarter, while industrial electricity usage increased by 8%. Freight cargo volume is another strong indicator, with an increase of 5.3%, while port turnover increased by 6.1%. Passenger traffic via all travel modes combined increased by 20.5%. Finally, credit activities in the commercial banking sector measured by M2 balance is another proven indicator of economic performance–it increased by 8.3%.

On the question of whether we are entering the beginning stage of a strong uptrend, my answer is less determined; the jury is probably still out there. This is because the strong quarterly figures are mostly driven by the first two months’ numbers. March statistics actually show some setbacks. Industrial value added, fixed asset investment and exports saw a slight drop in March. This could be driven by other factors, or pure randomness. We still need some time to ascertain a solid upward trend.

Even though the first-quarter performance instills greater confidence in the expectation that China will indeed reach its stated GDP goal of about 5% by the end of the year, it is still worthwhile to point out several challenges moving forward.

Deflation, consumption, real estate setbacks

The first issue is deflation. It is odd to see that across several statistics, nominal performance is way lower than real performance. For example, the nominal fixed asset investment increased by 4.5%, but excluding the price factor, it was actually 5.9%. Such a large gap indicates a significant deflation problem here. It is probably even odder that, amid a global climate of fighting against inflation in most parts of the world, the central bank of the world’s second largest economy needs to fight an opposite war. While the good news is that it affords more room for an aggressive monetary policy, the bad news is that the central bank may be tempted to overshoot.

The second challenge is still about domestic consumption. Total retail sales in the first quarter saw a lukewarm uptick of 4.7%, and this is against the backdrop of the aforementioned significant deflation. In real terms, it is probably a small, marginal increase. The government is going out of its way to boost consumption via various policy initiatives, such as accelerated depreciation and tax rebate measures. The impact may still take some time, but I suspect there is something structural going on here with respect to the massive shift to online shopping for even daily grocery items. There have been numerous reports over the years about retail grocery stores going out of business, displaced by Pinduoduo, JD and the like. Prices online are known to be cutthroat, which is not necessarily a bad thing.

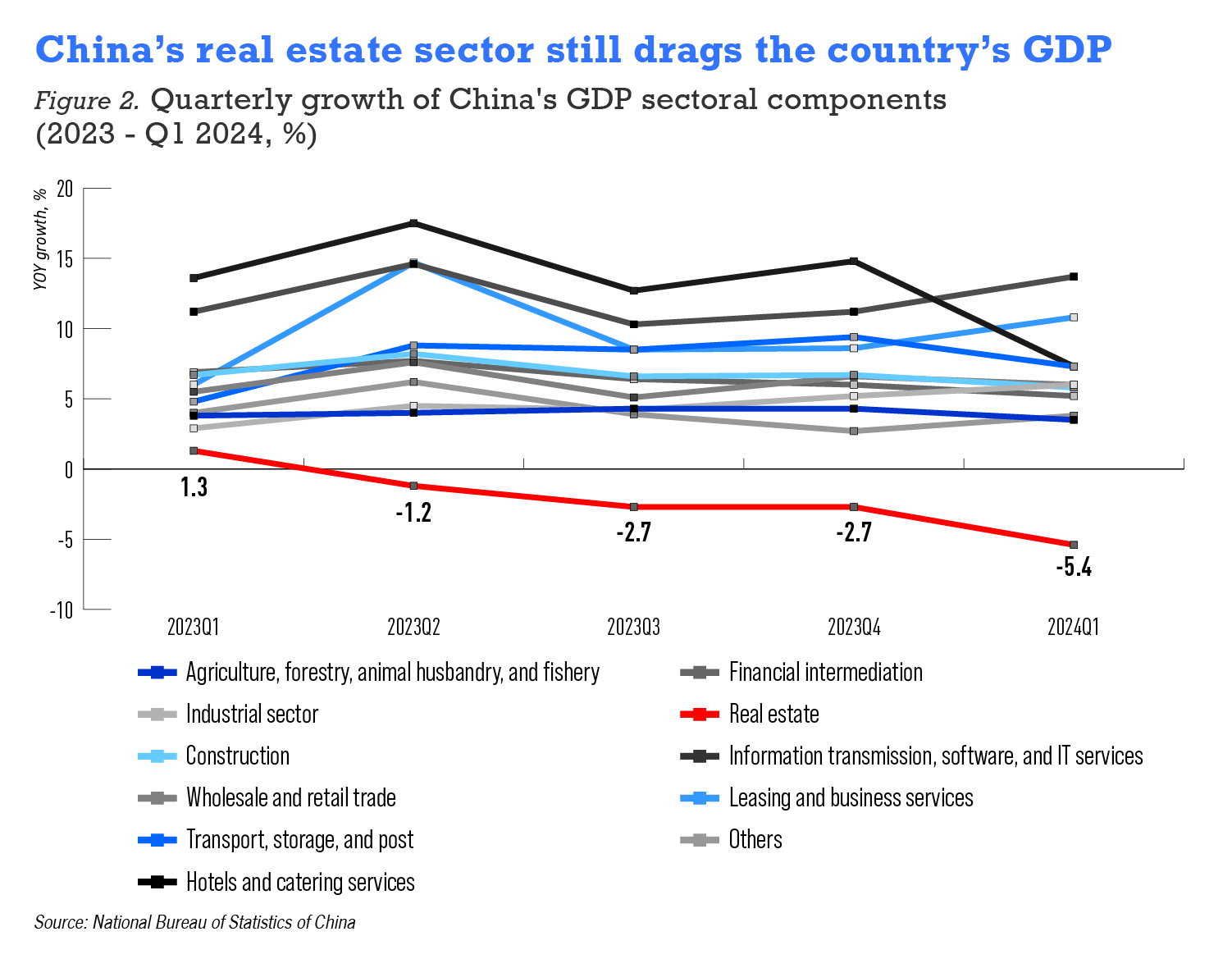

The last headache in China’s economy is the hopeless real estate sector. All of the GDP sectoral components are seeing decent growth, especially the manufacturing sectors, except for the poor real estate sector that dropped by 5.4% in the first quarter. The recovery of this sector is certainly constrained by China’s overall demographic trend, but there is still room in government policy to correct the overly and wrongly imposed restrictive measures in the past.

If viewed differently, the importance of real estate in driving China’s economic growth will be greatly mitigated moving forward. For the first time, the automobile sector appears to have overtaken the real estate sector in terms of size. The automobile sector’s total revenue last year was RMB 10.1 trillion ($1.4 trillion), while that for real estate was RMB 11.1 trillion ($1.5 trillion). The value-added growth rates for the two sectors are 9.7% and -9.5%, respectively.

It is clear that the automobile industry has overtaken real estate to become China’s largest industry sector, and its growth essentially compensates for the loss in GDP contribution from real estate. This probably says something about the transformation of China’s growth model. The government has been talking about new quality productive forces, among which electric cars is one, while real estate is not.