- Technological innovation and disruption have redefined customer journey and existing business models in 2017

- The new transaction banking business is grounded in the prevailing use of analytics for process automation

- Blockchain technologies are influencing the future profile of regional clearing and settlement spaces

In the latest The Asian Banker annual survey of transaction banking trends across Asia Pacific, the impact of data analytics on improving service excellence in payment and cash management emerged as a leading theme. The nature and structure of transaction banking in Asia Pacific has evolved since 2014, when banks were still working to develop their full suite of offerings and fill gaps in their range of products and services.

By 2017, technological innovation and disruption have redefined the customer journey and existing business models, to emphasise how banks focus on customers and their ability to innovate. Throughout the region, banks and transaction banking service providers are focusing on becoming more customer-centric, and are driven by an increasingly competitive environment.

A stagnating global macroeconomic outlook has dampened growth expectations and impacted the global commodity super-cycle. Incumbent Asian banks have now to grapple with new entrants for customers in the supply chain and enterprise resource planning space, business and e-commerce networks look to meet new corporate supply chain and value chain requirements.

In 2017, banks are looking to improve their service excellence, increase efficiencies and reduce errors in their regional treasury and shared service sectors. While new entrants may understand the new business and transaction flow differently, banks are focusing on digitisation and making processes more digitally straight-through. This includes payment automation and disruption, and digitising collections, receivables, and payment systems; innovation in digitisation stems from changing customer requirements to manage their liquidity positions.

A movement to harmonise national payment systems is emerging across the region, in China this is evident in disruptions to retail payment systems, while across ASEAN in Thailand and in Singapore for example, real-time mobile payments and NFC technologies are being upgraded and harmonised. However, the limited standardisation amongst countries in terms of customer protection, digital security,and regulatory and compliance is an issue that has yet to be addressed.

Continuous investment in financial technologies is now a given, and so much is happening on the digitisation front that will continue to evolve and disrupt the regional transaction banking space. Of particular note is the advancement in cloud-based infrastructure investment and open application programming interface (API) development that are being undertaken by several banks.

The new transaction banking business is increasingly being grounded in the prevailing use of analytics for process automation and algorithm utilisation in decision-making. Additionally, cross-border payments and regional initiatives are spurring developments and increases in regional and intra-regional trade flows in the Asia Pacific, China’s steady moves in encouraging renminbi (RMB) internationalisation as well as its high profile "Belt and Road" initiative are examples of a growing web of regional trade linkages.

Continuous digital innovation and the standardisation of payment systems stand out as common themes in cash management and payment across Asia Pacific. Particularly in the payments space, these themes revolve around trends and schemes in harmonisation and in creating common standards. The emergence of regional domestic players, made possible by the retreat of many global transaction banks is shaping the future of transaction banking in the region. The growing pressure and increasing burden of regulatory reporting is causing many international banks to re-evaluate their global strategy. Domestic banks are seizing this opportunity to fill in the vacant spaces and break out of their domestic market.

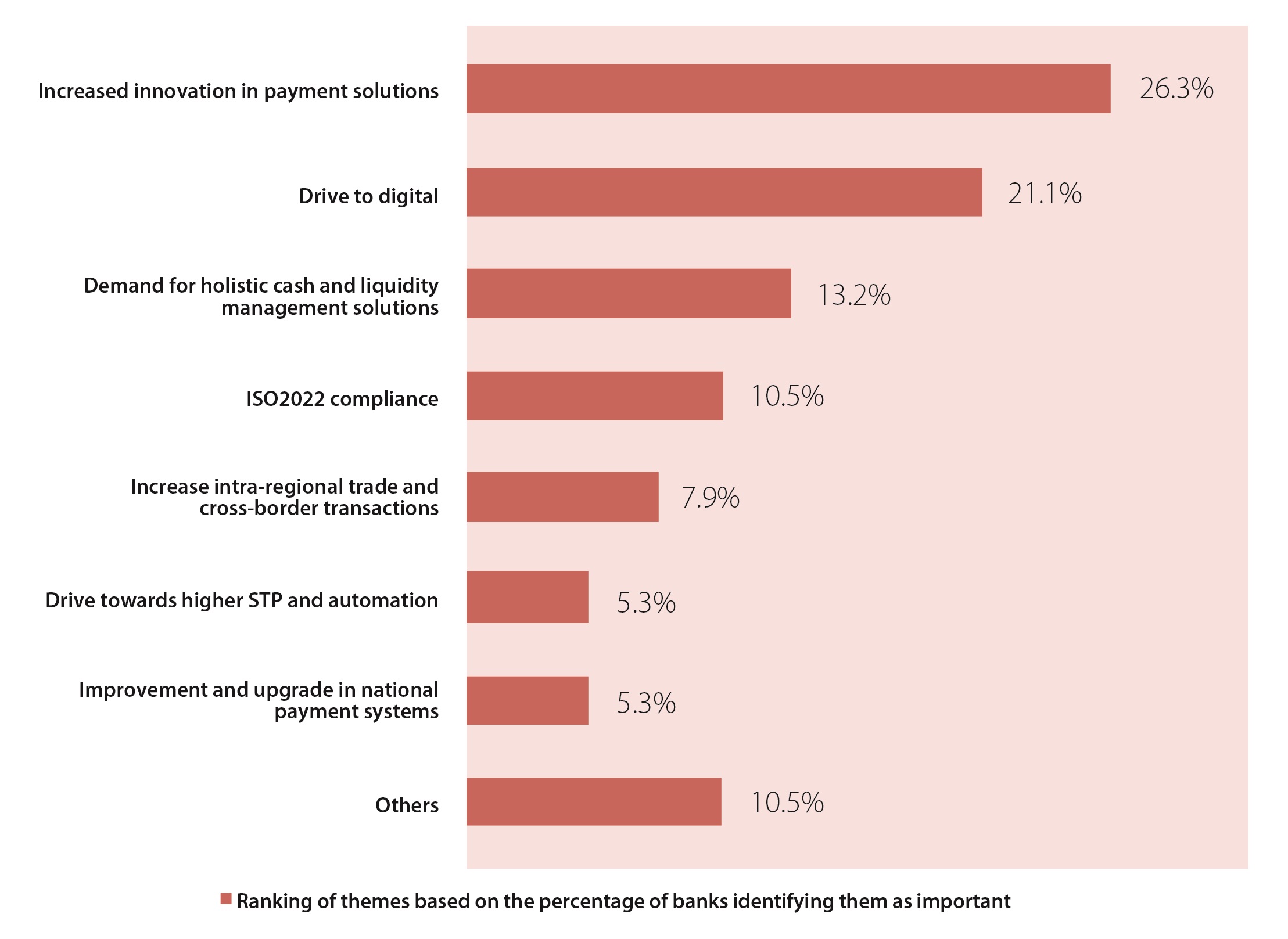

The future of payment and cash management in the Asia Pacific is being determined by key themes in the transaction banking space today (Figure 1). Forward-looking players in the industry are already anticipating the future of standardisation and inter-operability in the use of quick response (QR) codes, mobile payments, and near field communication (NFC) throughout the Asia Pacific. Transaction banking players are focusing on providing a seamless service and digital platform for a new generation of digitally connected clients and customers. Blockchain technologies are increasingly influencing the future profile of regional clearing and settlement spaces, many banks are also exploring how related blockchain technologies can enhance fraud and security management.

Improving customer experience and reviewing business models key priorities of Asia Pacific transaction banks

Figure 1. Emerging key themes in payment 2016/2017