• Revenues increase by 159% in 2023

• GX Bank marks a pivotal step in GFG market expansion

• Grab Unlimited enhances user engagement

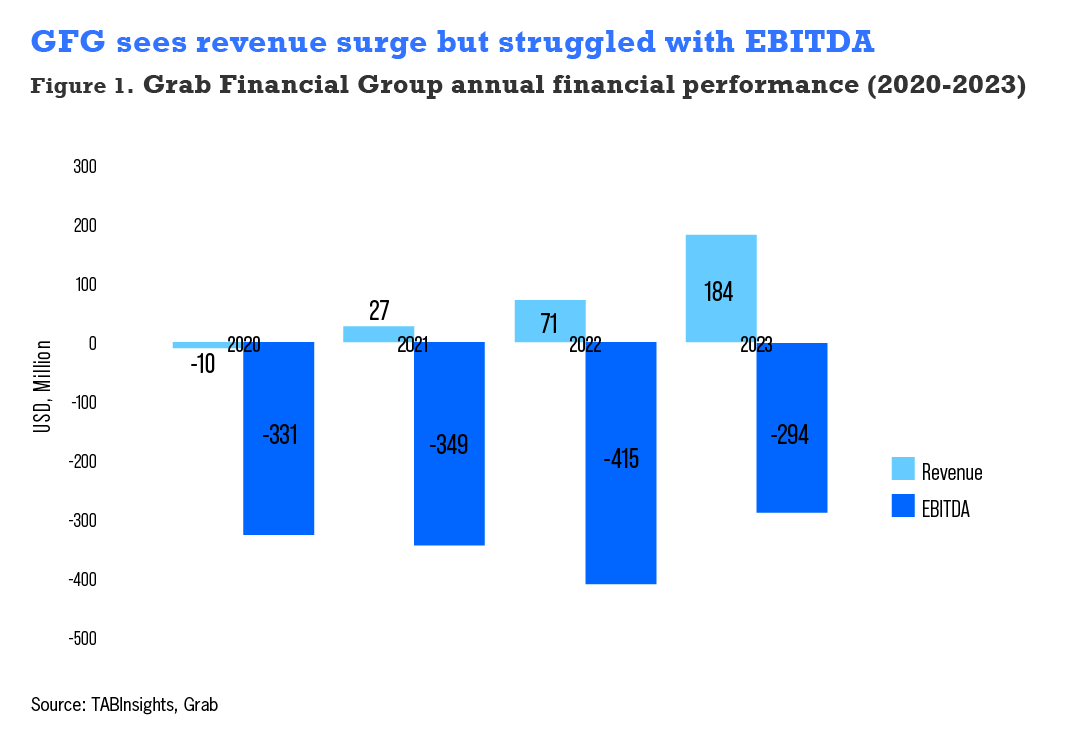

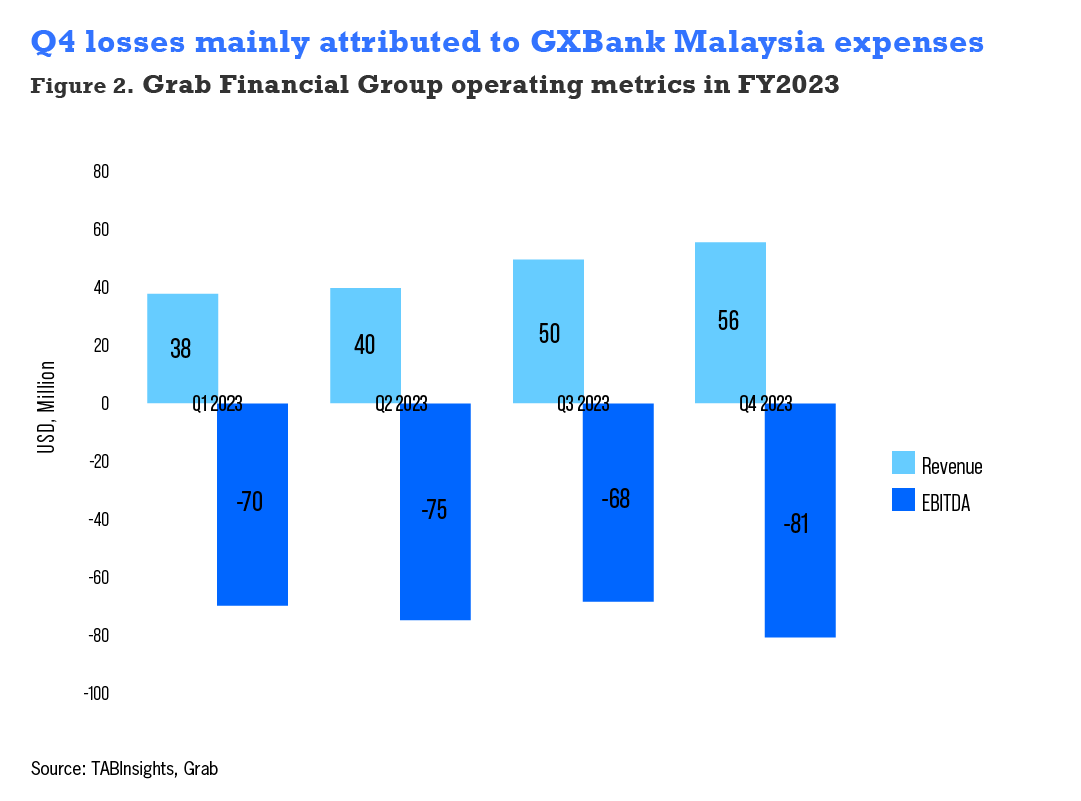

Grab Financial Group (GFG) reported a significant revenue increase in 2023, but faced challenges in reducing EBITDA (earnings before interest, taxes, depreciation, and amortisation) due to the quarter-on-quarter (QoQ) losses throughout the year. This was largely due to costs incurred in launching its GXBank in Malaysia, which significantly impacted the company’s financial performance.

Revenue increase of 159% in 2023

GFG saw a 159% increase in revenues, mainly attributed to better monetisation of payment services, improved lending performance, and reduced incentives. However, EBITDA fell to -$81 million QoQ.

GrabFin, a new brand encompassing digital payments, insurance, lending, and wealth management offerings, maintained consistent costs despite higher expenses associated with increased on-demand transactions.

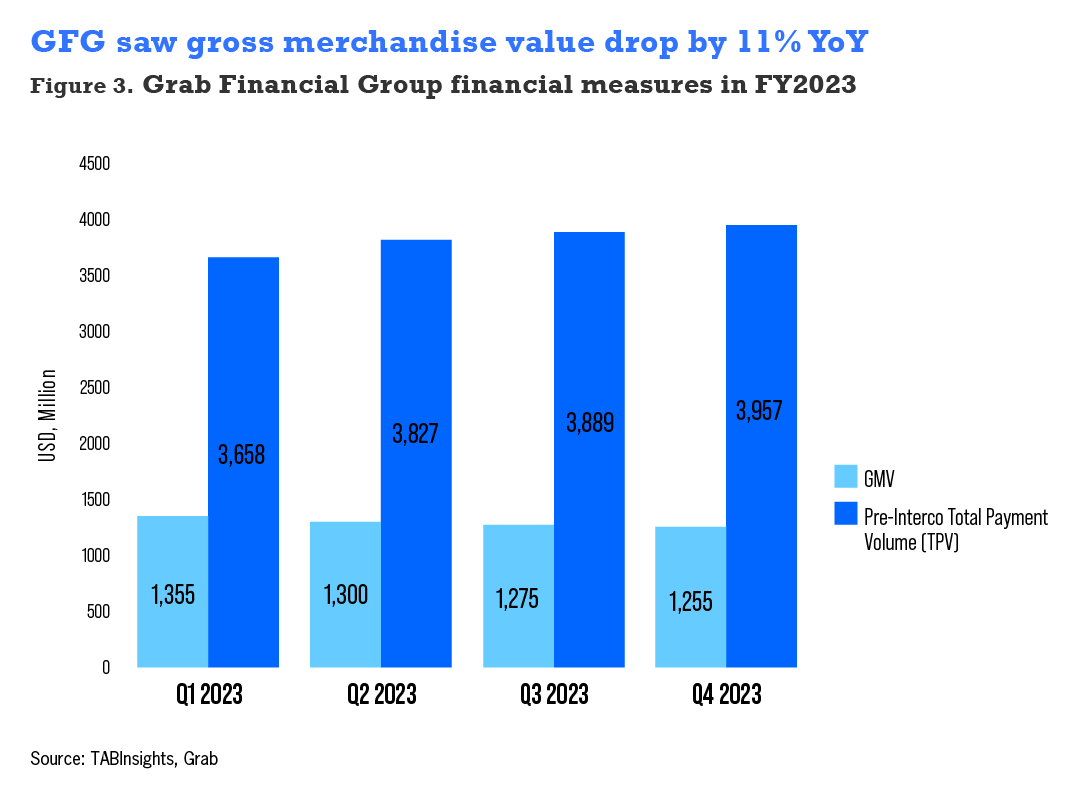

Although its total payments volume and EBITDA declined in 2023, GFG remains focused on enhancing its ecosystem transactions and customer experience.

The significant 57% year-on-year (YoY) increase in loan disbursements amounting to $1.5 billion in 2023, along with the accumulation of $374 million in customer deposits in digital banks in Singapore and Malaysia, highlight Grab’s strong foundation for expansion. The company’s ability to double its revenue in a challenging economic environment speaks to its monetisation and diversification strategies.

Anthony Tan, group CEO and co-founder of Grab said: “We’re now the largest on-demand platform in the region, at a scale that is over three times larger than our closest competitor. Yet, there’s much to achieve with our partners, having operated in the region for over a decade.”

The company’s robust growth in digital finance is evident through increased operational efficiency, higher loan disbursements, and growing digital bank deposits in Singapore and Malaysia.

GXBank marks a pivotal step in market expansion

GXBank attracted over 100,000 depositors within just two weeks of its launch, expanding the company’s user base and signalling a potential contender in the Malaysian market. About 79% of these depositors were already existing Grab users, demonstrating the effective cross-utilisation of its extensive ecosystem. Customer deposits in both GXS Bank in Singapore and GXBank in Malaysia amounted to a total of $374 million as of 31 December 2023.

Another challenge faced by GFG is a 14% YoY decline in financial services gross merchandise value (GMV) during the fourth quarter and 11% YoY decline in 2023, as its strategic attention remains on driving ecosystem transactions.

Grab Unlimited strategically enhances user engagement

The company aims to enhance user experience through the launch of Grab Unlimited, Southeast Asia’s largest on-demand paid loyalty programme. This initiative is designed to increase customer lifetime value through cross-selling and service differentiation. This approach has led to increased user frequency and retention, particularly evident in the cross-selling of Grab Unlimited for supermarket deliveries, which has significantly attracted new users to the platform.

Grab expands its user base by targeting travellers and forming product partnerships. The company is set to introduce family accounts, allowing users to share payment methods and track each other’s activities for enhanced security. Grab uses generative artificial intelligence to enhance productivity, developing an in-house marketing tool powered by a large language model. This marketing tool reduces content generation time and improves quality and click-through rates.

.png)