The financial sector is experiencing a dynamic transformation with the emergence of digital banks, generative artificial intelligence (AI) and large language models and blockchain-based decentralised finance (DeFi) models. The convergence of these technologies is paving the way for Web 3.0 to potentially disrupt traditional models.

Ecosystem partnerships and open banking are enabling new models in payment and embedded finance. The adoption of quantum computing will further shorten the computation time and processing. Financial institutions (FI) need to gear up for the future of finance that will be much more personalised, real-time, scalable, intelligent and open.

Speed of digital transformation poses a challenge

Modern customers now expect a more personalised, relevant, and real-time service through digital channels. This has pushed banks to provide an end-to-end digital experience for customers, upgrade their mobile banking services as well as expand their digital offerings to small and medium-sized enterprises and corporates.

A survey by TABInsights shows that 50% of FI are challenged by the speed at which digital transformation needs to take place in order to address customer expectations and pain points, and the insufficiency of skilled talent to enable various aspects of digitalisation. Two other obstacles faced by 40% of FI are the rapid pace of tech developments and organisational readiness to innovate. Improving the core technology, cloud adoption and data integration emerged as other pressing concerns.

Emphasis on data-driven strategies, harnessing AI-based analytics

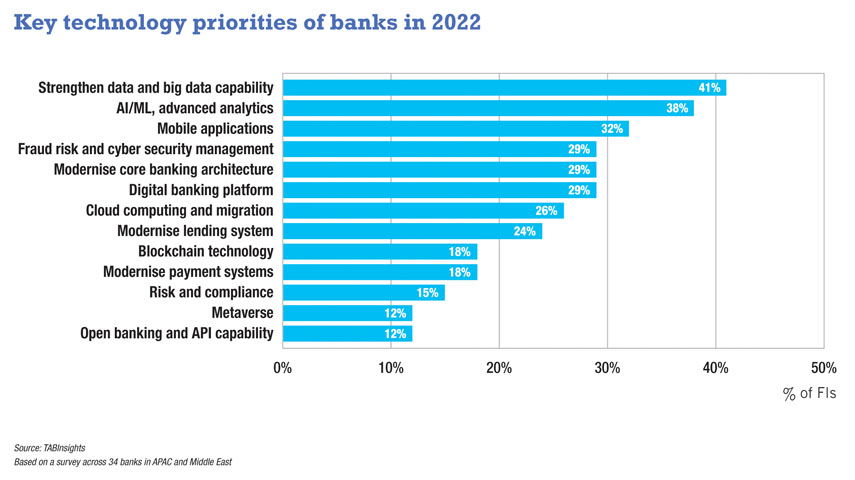

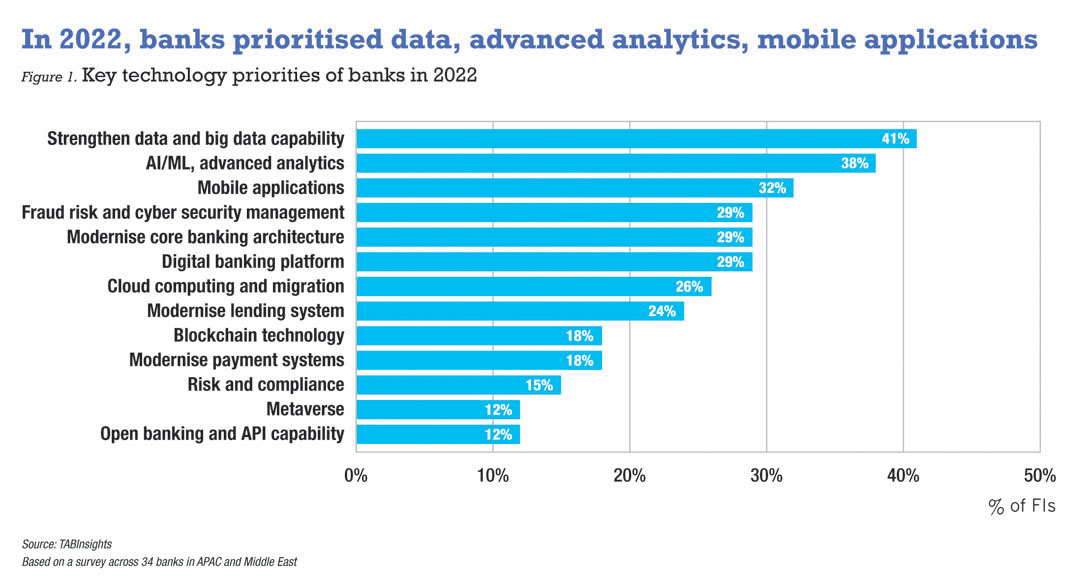

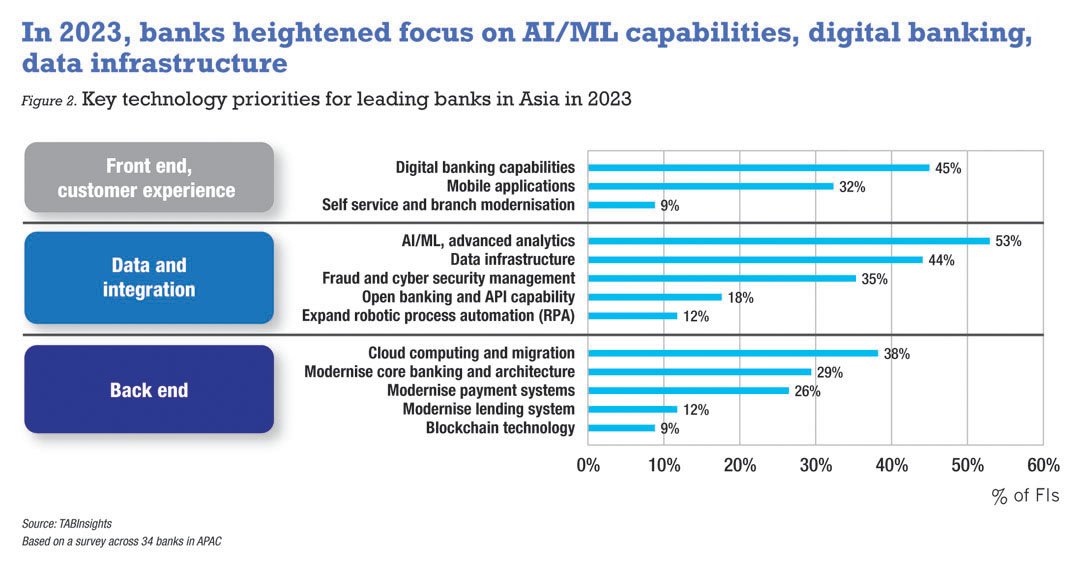

Most banks realise the urgency to update their data capability in order to become an insight-driven and intelligent bank of the future. A survey by TABInsights shows 41% of surveyed banks in APAC prioritised investment into data management and 38% into AI and machine learning (ML) in 2022. In 2023, 53% of banks are prioritising investment in strengthening their AI and advanced analytics capability.

AI applications for personalisation, efficiency, risk management

AI applications in banks remain narrowly focused on improving efficiency in four business areas—precision marketing, fraud and risk management, customer engagement and experience, and operational efficiency. Leading banks are expanding scale in AI applications. Given the intensifying threat landscape, several banks have focused on intelligent risk management using AI and ML towards real-time fraud detection, anti-money laundering screening, risk warning systems, and improving credit analytics, among others. Banks also focus on improving operational efficiency through robotic process automation, with the best banks deploying these over 1,000 processes.

Meanwhile, there is also a growing focus across the industry to focus on transparency and ethics in the use of AI models. Banks increasingly see the use of large language models like ChatGPT in improving conversational AI capability in future. Banks are now also exploring federated learning for distributed ML model training without transferring the raw data.

Strengthening underlying data foundation

Managing data has become an increasingly gargantuan task with data silos and ever-growing data volumes. This adds to the complexities in data governance while increasing the use of unstructured big data in analytics. Banks realise the urgency to strengthen and integrate data. Many banks in the region have already invested in the data lake to integrate data sources and generate insights from this data. Some banks use private cloud to integrate data from multiple sources for processing, operational reporting and real-time analysis through AI platforms.

Accelerating shift towards scalable cloud infrastructure

Growing data volume and the need for advanced analytics accentuate the need for cloud-based infrastructure. Leading large banks in Greater China are shifting applications to private clouds while many banks in Southeast Asia have preferred hybrid and multi-cloud. Some banks already have over 80% of systems on cloud, but many in the industry are still in the transition stage, prioritising their non-mission critical applications first.

However, there are issues in cloud adoption for transaction-heavy critical systems, with 60% of FI expressing concern about data privacy and security, and an increase in operational costs per transaction on cloud.

Embracing modular core technology architectures

New cloud-native banks with modern digital cores such as Mox Bank, Alex Bank, TNex, and Timo are leapfrogging, riding on a technology advantage. Meanwhile, traditional banks struggle with modernising outdated, inefficient, and slow legacy core banking systems. Highly complex core replacement is not a route that most banks are willing to venture into. Leading banks are modernising architecture to modular microservices and hollowing out the core system, extracting apps and services to extend its operational viability.

Industry dynamics are changing at speed. There is increased competition as well as ecosystem play across the industry, enabling new business models such as buy-now-pay-later, digital lending, embedded finance and banking-as-a-service. To maintain dominance and retain market shares, banks will need to continually adapt technology to transforming modalities, strategise and innovate processes, and develop the skills needed to support initiatives in the pipeline.