- Financial Supervisory Commission's “Bank 3.0” vision is a key driver towards digital adoption

- Banks have an urgent need to differentiate their products and services in a crowded retail banking market

- Digitisation will enhance bank services to provide better customer experience

With 39 banks serving 23 million people, Taiwan has one the most crowded retail banking markets among Asia’s developed economies. This is despite the spate of bank mergers that have occurred in the last 11 years, 52 in total. In the midst of intense competition, banks see the development of new digital platforms as essential to grow their businesses by allowing them to provide consistent, personalised and secure customer experience across a full range of channels and media.

The Financial Supervisory Commission’s (FSC) Bank 3.0 vision has been developed to drive the adoption of digital platforms that will deliver enhanced financial services and better customer experience.

The Bank 3.0 vision is part of the government’s scheme to deregulate and promote the use of online and mobile banking services. The FSC approved 12 financial services to be made available on digital platforms. This allows Taiwanese banks to extend online banking functions from account transfers and mutual fund sales to online applications for standardised, low-risk retail banking products, personal and home loan processing and wealth management services.

In addition, as part of the FSC ’s financial technology development promotion plan, banks are being encouraged to promote mobile payment businesses. Various mobile payment technologies will be intr oduced. In addition, terminal equipment for mobile payment will be increased, and convenient mobile payment service channels will be further promoted. Paypal, OrangePay, AliPay, and InterPay were granted licences to operate electronic payments as part of the government’s efforts to expand online payment options in Taiwan. Domestic mobile credit card payments using Host Card Emulation (HCE) technology have also been introduced. For

example, E.SUN Commercial Bank has obtained the FSC’s approval to launch the service.

The FSC has been pushing for the establishment of an authentication and identification service centre. Identity verification is one of the important developments that fintechs are focusing on to enhance security for electronic transactions, and are cooperating with financial institutions to develop new solutions as threats continue to evolve.

They are developing identification standards in line with international norms, such as tokenisation, as well as exploring biometric authentication technologies such as voice recognition and finger vein verification.

CTBC Bank

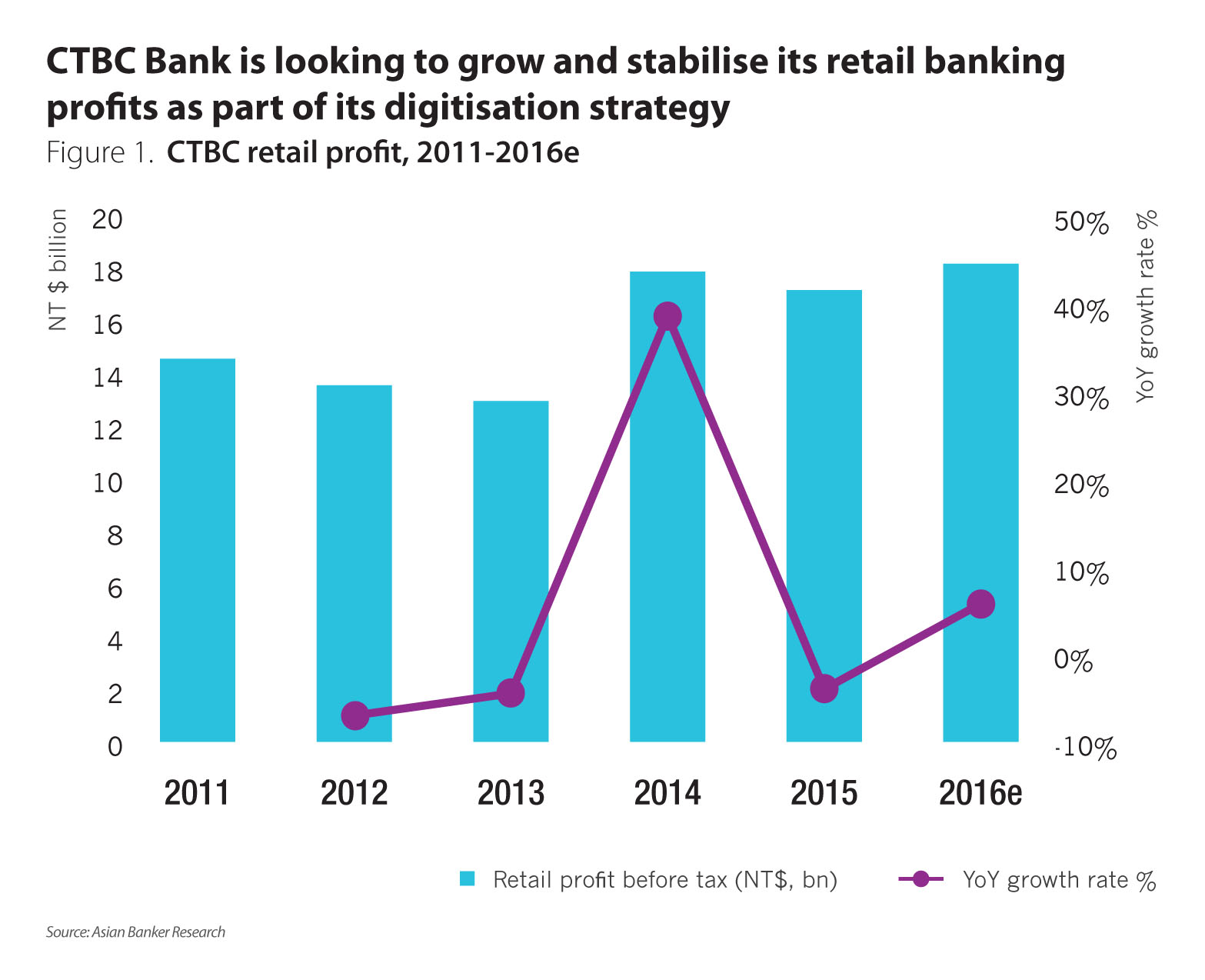

CTBC Bank has expected that its retail banking profit in 2016 would hit $0.6 billion (NT$ 18.1 billion) (Figure 1) and retail banking assets to reach around $22.7 billion (NT$ 700 billion), a remarkable 24.1% increase in local currency from 2015 . The bank attributes these improvements to its continued effort to plan ahead and adapt to market trends. CTBC Bank is the first to launch a mobile transfer by QR code and linked payment notification to Facebook, WhatsApp and other social media platforms to provide a seamless customer experience. In addition, it launched a new digital branch at the end of 2016, which enables mobile consulting and sales via iPad, digital process improvement and technology innovation such as facial identification, and cardless withdrawal via finger vein. It adopted the use of big data to integrate financial service to customer’s everyday life. The bank was also ranked first in customer satisfaction for both web and mobile banking.

The bank is also enhancing its customer relationship management system for the high net worth (HNW) client segment that involves adjustments to its client acquisition approach and increased use of digital channels. CTBC takes HNWI’s needs for diversified products and asset allocation into consideration and provides more customised products and professional financial advice to its HNW clients. It provides them with more than 2,000 specific or tailor-made products such as onshore and offshore exchange traded funds (ETFs), bond, structured notes, and stocks to fulfill their needs. Other enhancements include customer experience improvements where customised products and services could be designed by leveraging their “customer focus mechanism. The bank has formed a five-step method on financial advisory business including KYC, modules strategic portfolio, customise asset allocation, optimise solution, and spontaneous after-sales service. All these help to provide the HNW clients with a more holistic and customised solution for enhanced wealth management. By the end of May 2016, total AUM has surpassed $56.8 billion (NT $1.75 trillion) with a YoY 10% growth rate (Figure 2).

The bank revamped its client acquisition and sale approach to meet the needs of its customers. The goalbased approach was implemented for its mortgage offering. This encompasses the combination of a onestop house purchasing guide and customised financial services. The guide incorporated a “five step to your house” map that leads the customer through the entire house purchase process by integrating different services such as house registration with big data analytics to offer customers a choice of different loan packages to suit their profile and requirements.

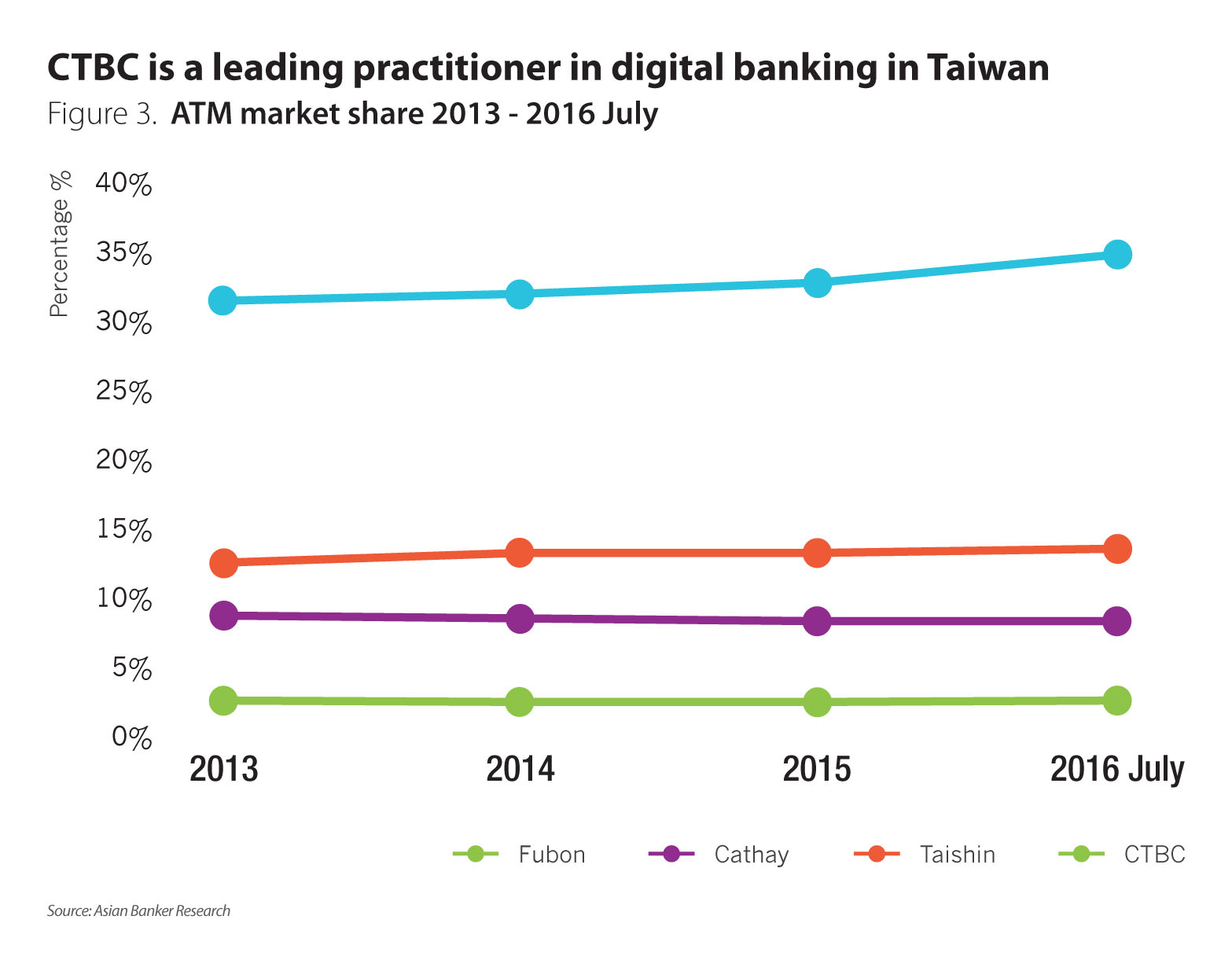

In addition, CTBC Bank introduced biometric and finger vain identification for cardless ATM cash withdrawal transactions, claiming to be the first and only bank in the country to offer such a service. By July 2016, the bank has reached No. 1 market share of 34.4% in ATM numbers (Figure 3). The bank was also first t o launch financial planning tools to help customers record, classify, and analyse their spending automatically. In addition, the tool also allows customers to record

their spending anytime and anywhere. It also expanded the use of mobile banking to apply for and purchase the bank’s financial products. CTBC customers can apply for credit cards through mobile banking, make digital payments, receive marketing and promotion offers, redeem O2O rewards, and pay bills. The CTBC credit card app has also led the market in implementing the easier Bluetooth payments process and micro-positioning services to provide precision push message and provide a smarter and more holistic experience.

All of these efforts are a reflection of CTBC Bank’s objective of providing customers with quick, easy, fun, simple, and safe service and experience in the digital and mobile environment

Cathay United Bank

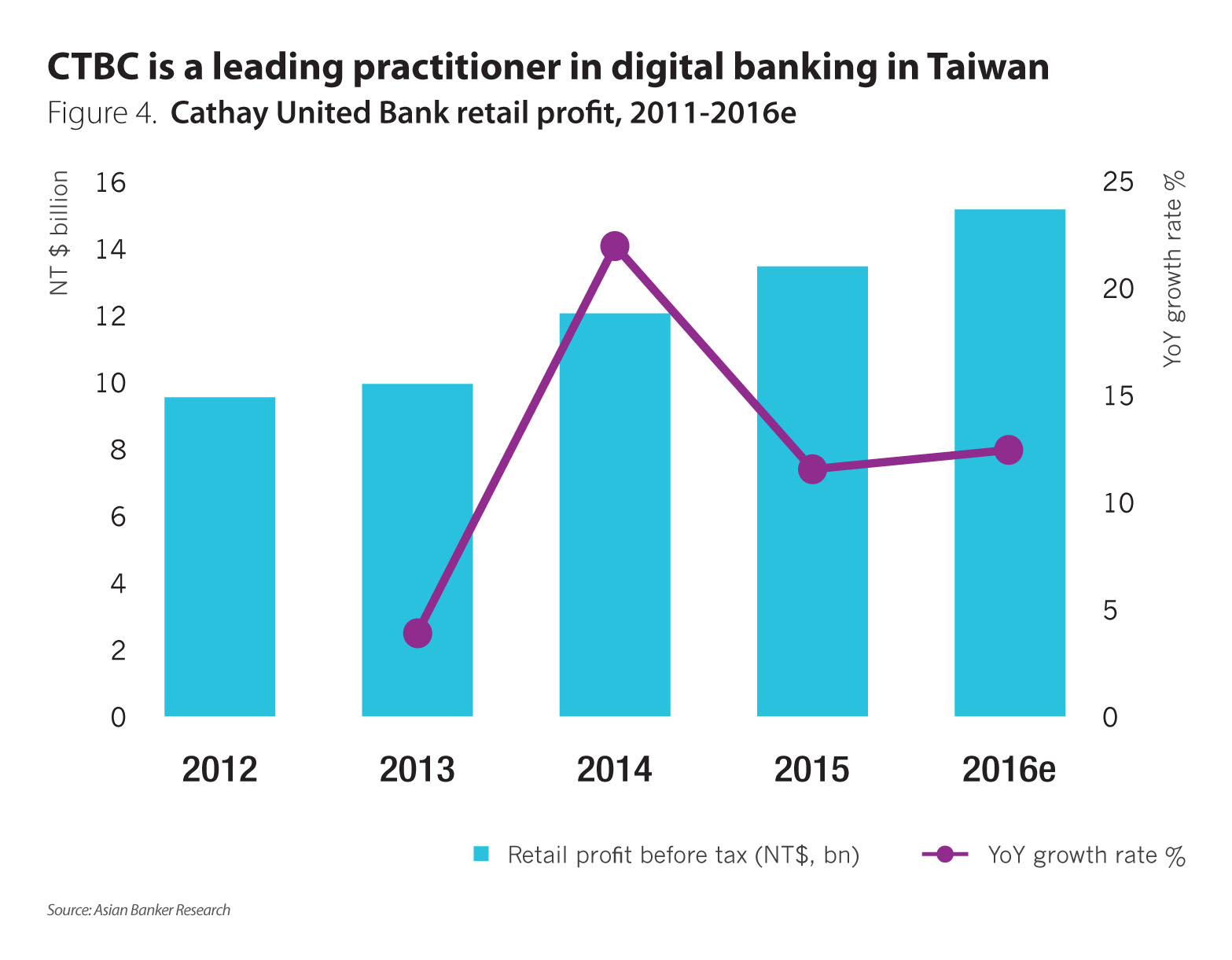

Cathay United Bank (CUB) is expected to grow and record a consolidated profit after tax of $0.5 billion (NT $15.1 billion) in 2016 (Figure 4). CUB maintained the growth of its business with new products and partnership tie-ups, such as a collaboration with Costco, exclusive agreements with Taipei Metro and product innovation such as KOKO "Keep It Simple" ecosystem.

CUB collaborated with Costco to issue co-branded credit cards to tap into customers and gain market share among the middle income earners. This has been one of the most successful schemes with over 1.08 million customers. Apart from this, CUB also teamed up with messaging app Line, which has more than 17 million users in Taiwan, to introduce a mobile payment service, whereby, users can open virtual bank accounts and transfer money to their friends and contacts.

In addition, the bank opened a full-service branch in the Philippines, one of the fastest growing economies in Asia with a growth rate of 5.8% in 2015. In 2016, the bank also applied for a licence to operate in Myanmar to expand its services, customer base and presence in the region.

In an effort to focus more on innovation and digitisation, CUB has been de voting large amounts of resources in channel enhancement and product innovation, becoming the first bank to establish the KOKO "Keep it Simple" ecosystem to provide integrated services of finance, social community, lifestyle and mobility in one pack age. The package includes an app, a credit card, an internet banking platform, and impression branches with interactive zones to provide a comfortable environment for customers interested in future banking.

Furthermore, CUB was also given the exclusive right to install ATMs at all stations of the Taipei Metro or MRT. The bank has already installed 300 ATMS in 177 stations of Taipei Metro. CUB also offers other services such as a QR code reader, NFC sensory, and coin dispensingfunctions. These ATMs have become major

sources of convenience for completing financial transactions. The bank also launched a payment service with Masterpass and is planning to invest into private cloud and network modernisation technologies.

Looking forward

Taiwanese banks have been actively investing in technology and innovations with the strong support of the FSC . However, these banks should partner with established technology companies and fintechs to provide improved and secured services to their retail customers.