- Top e-commerce players saw decent results despite modest Double 11 sales growth amid a crowded promotional calendar

- Pinduoduo's revenue growth outpaces Alibaba and JD.com, driving the recovery of China's e-commerce

- Alibaba responded to Pinduoduo's strong performance by switching to the 'Year-End Good Price' festival focused on 'low price strategy’

China's e-commerce sector displayed resilience, with an 11% year-on-year (YoY) surge in online retail sales during the first 11 months of 2023, surpassing the 6.1% growth recorded in 2022. While partly influenced by the low base effect, it signifies sector recovery, bolstered by a series of policies supporting consumer spending. Meanwhile, parcel deliveries in China reached a record 120 billion items on 5 December 2023, marking an 8.5% increase from 110.6 billion parcels in 2022. This highlights the e-commerce sector's growth, with consumer confidence trending upwards despite economic uncertainty.

Double 11 sales saw a modest increase

China has experienced a surge in extensive online shopping festivals, including the world’s largest event, Double 11, as well as 618 and Double 12 shopping festivals. The e-commerce market is also witnessing livestreaming platforms gaining a larger share, with sales surging by 59% YoY in the first 10 months of 2023, constituting 18% of all online retail.

Leading e-commerce players still achieved decent results despite the modest overall sales growth in this year's Double 11 shopping festival, amid a crowded promotional calendar and the increasing prevalence of livestreaming commerce. The platforms increased discounts to lure price-conscious customers and simplified promotions with direct price cuts to address concerns about complex discount systems.

Alibaba observed positive YoY growth in gross merchandise volume (GMV), order volume, and participating merchants on Tmall and Taobao. JD.com, meanwhile, reached record transaction volume, order volume, and user engagement levels. Pinduoduo (PDD) disclosed record-breaking participation from brands, merchants, and products, with a 107% YoY increase in order volume for the ' RMB 10 billion subsidies' ($1.4-billion subsidies) programme. Douyin and Kuaishou, among others, reported substantial growth during Double 11. Douyin Mall's GMV rose by 119% YoY, and Kuaishou saw a nearly 50% YoY increase in overall order volume.

PDD’s strong growth signals e-commerce recovery

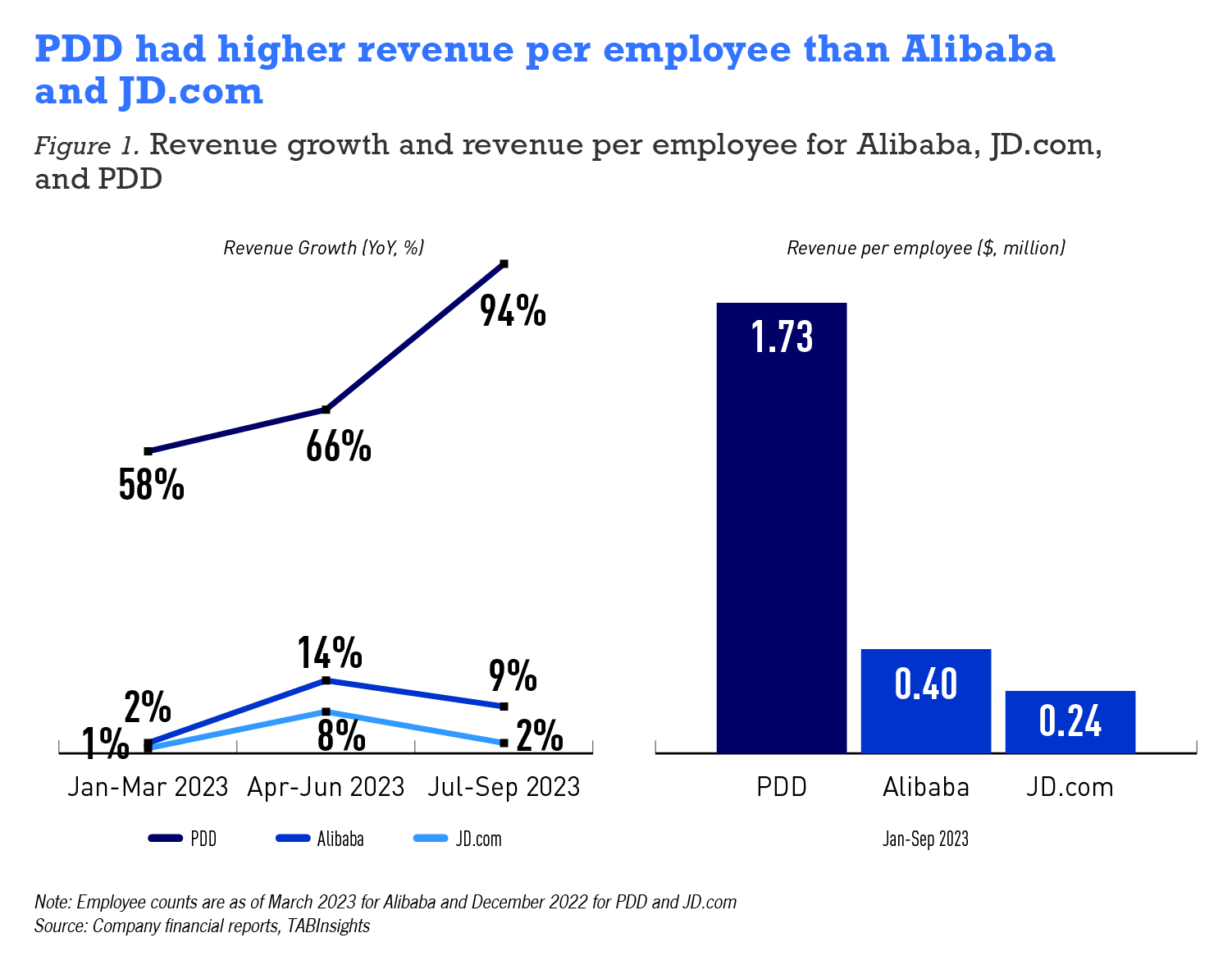

PDD's remarkable growth outpaces Alibaba and JD.com, driving the recovery of China's e-commerce. In the first three quarters of 2023, PDD Holdings, the owner of the PDD and Temu shopping platforms, saw its revenue climb by 58% YoY, 66% YoY, and 94% YoY, respectively. As of 18 December 2023, PDD's market capitalisation surged by 84% in 2023, surpassing Alibaba since 30 November 2023. In contrast, Alibaba's market capitalisation decreased by over 23%, and JD.com's fell by 54%.

Despite JD.com and Alibaba having revenues three times larger, PDD demonstrated greater efficiency in revenue generation per employee. It employed 12,992 people as of December 2022, while Alibaba and JD.com had 235,200 and 450,700 employees. PDD surpassed JD.com and Alibaba in revenue per employee at over $1.7 million in the first nine months of 2023, outperforming Alibaba's $0.4 million and JD.com's $0.24 million.

Alibaba revamped Double 12 with Year-End Good Price Festival

In response to PDD's strong revenue growth in the September quarter, Alibaba canceled its traditional Double 12 shopping festival. Instead, it introduced the 'Year-End Good Price' festival, which took place from 9 December to 12 December. This strategic shift reflects a commitment to adapting to the evolving e-commerce scene, highlighting a 'low price strategy' to foster growth and expand market share. The festival saw a nearly 20% YoY increase in participating products and an 829% YoY surge in order volume for the 'RMB 10 billion subsidies' ($1.4-billion subsidies) programme.

Meanwhile, JD.com faces challenges such as a smaller user pool than competitors as high operating costs due to high service quality, and a complex organisational structure hinder the implementation of its strategy. Richard Liu Qiangdong, founder and chairman, urged proactive measures to address competition and management issues.