- DeFi users are expected to grow ten times to 70-100 million within three years

- Emergence of assets classes with digital representation capabilities

- Market valuation considerations of cryptocurrencies

- Rising costs driven by high energy consumption

With the significant growth of the digital assets markets in the past few years, the traditional financial indicators may come short in capturing the true market valuation of cryptocurrencies and emerging digital assets such as NFTs. Furthermore, challenges remain as unexpected operational costs increase in tandem with the widening adoption of digital assets.

The prospects of digital assets have increased in attractiveness. Upon the release of Satoshi Nakamoto’s white paper, Bitcoin: A Peer-to-Peer Electronic Cash System, in 31 October 2008, few could have predicted a future where the possibility of immense value creation by Bitcoin and other cryptocurrencies could reach a multitrillion-dollar valuation.

Mavis Mok,

CEO of HWGG Capital

Oi Yee Choo,

Chief commercial officer,

ADDX

The number of cryptocurrencies has exceeded 15,000 and market capitalisation has reached $2.4 trillion as of December 2021, according to Coinmarketcap. Mavis Mok, CEO of HWGG Capital stated, “Investors have a wide range of cryptocurrency options to choose from. Cryptocurrencies have evolved to become a viable asset that can be used for purchases as well as investments, thus financial institutions have started to become invested in the use of digital assets as well.”

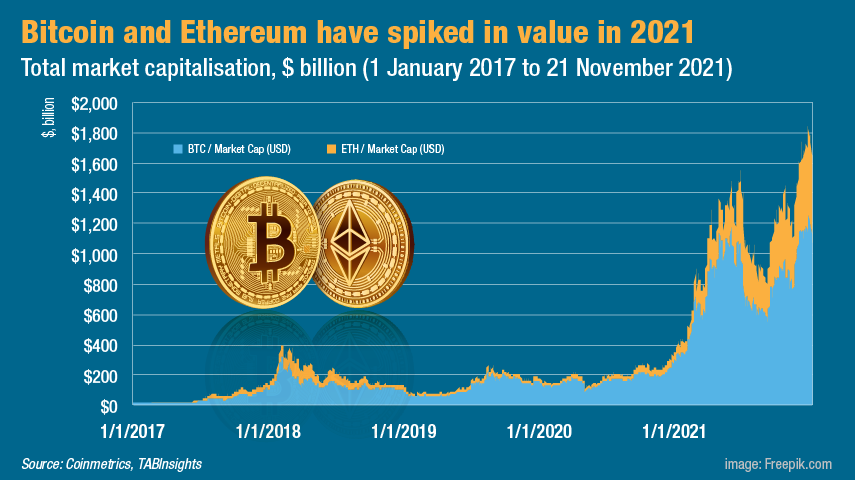

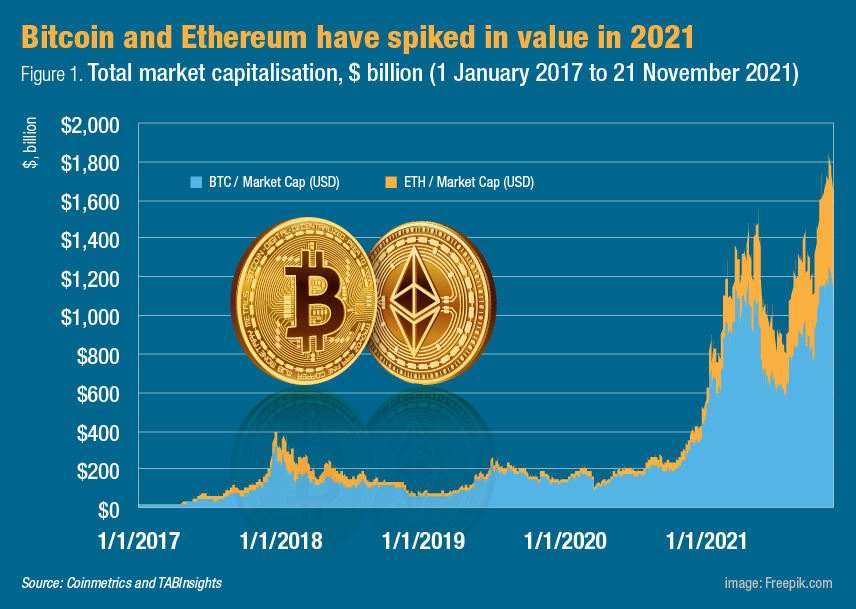

Bitcoin surpassed the $1 trillion valuation in February 2021, while Ethereum has seen its market capitalisation reach the $500 billion threshold in mid-November 2021. According to Coinmetrics, Bitcoin and Ethereum together dominate the cryptocurrency market and make up almost 60% of the market capitalisation of all cryptocurrencies. Oi Yee Choo, chief commercial officer at capital markets platform ADDX, said, “Cryptocurrencies are very likely the digital gold of our age.”

DeFi users expected to grow ten times within three years

An emerging digital assets class is decentralised finance (DeFi) protocols, which are applications that sit atop a blockchain. Arthur Cheong, co-founder of venture capital fund DeFiance Capital, stated “Currently, there are about five to ten million DeFi users, and within the next three years one should expect the user base to increase to 70-100 million users.”

Arthur Cheong,

Co-founder,

DeFiance Capital

Jothi Menon,

CEO,

RtistiQ

Despite the expected proliferation of DeFi, there are regional differences to consider. According to Chainalysis, in May 2020, DeFi activity as a share of total transaction volumes skyrocketed in Central and Southern Asia due to the introduction of several new protocols including Uniswap, Instadapp and dYdX.

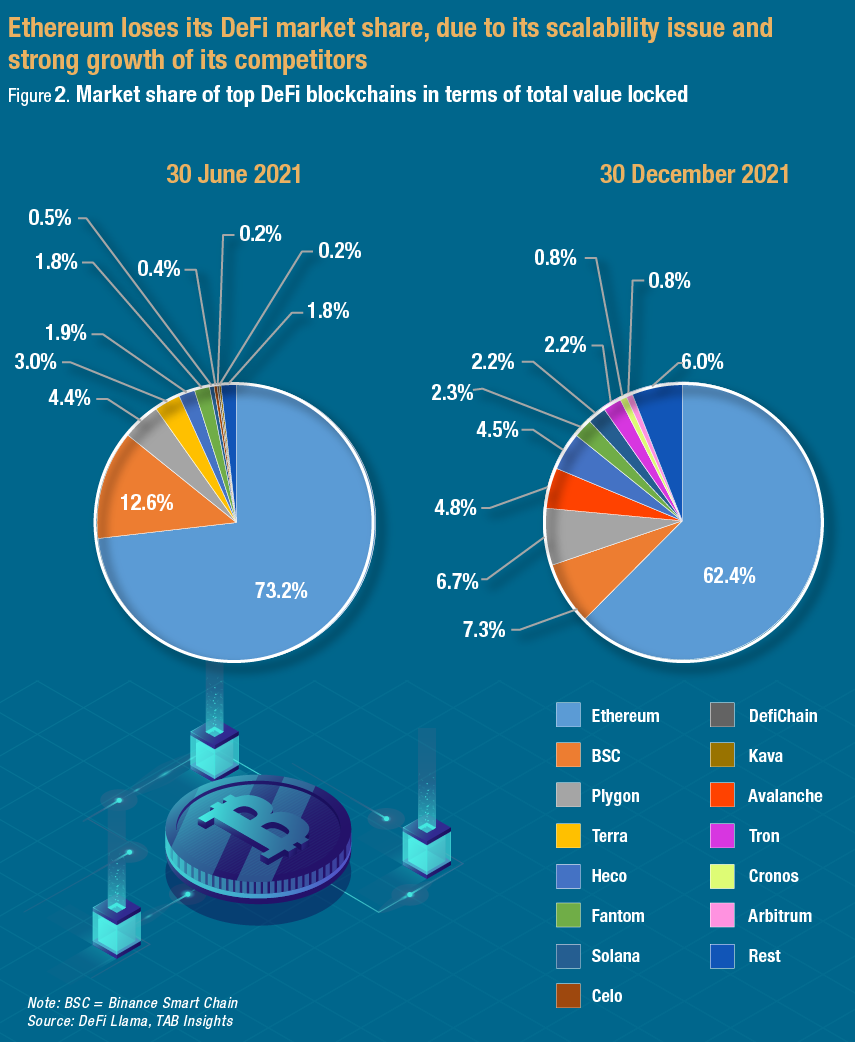

While Bitcoin dominates the cryptocurrency market, Ethereum dominates the market for DeFi protocols. Cheong highlighted, “Ethereum has 10,000 nodes globally and anyone can choose to connect to a node from a laptop.” According to 24 December 2021 market capitalisation values, DeFi Llama stated that about $216 billion are the total values locked in top ten DeFis.

DeFi protocols are applied to various areas in the financial services industry, including asset management, derivates, lending, insurance, options, payment and trading. They are capable of facilitating multibillions of dollars in cryptocurrency transactions in a highly efficient manner.

Cheong said, “DeFi services can be hundred times faster than traditional (centralised) finance services, and as a result the DeFi company can move faster and satisfy customer needs much faster. Already we have seen that DeFi allows for the development of new service areas such as automated market maker, for example Uniswap, and permissionless lending.”

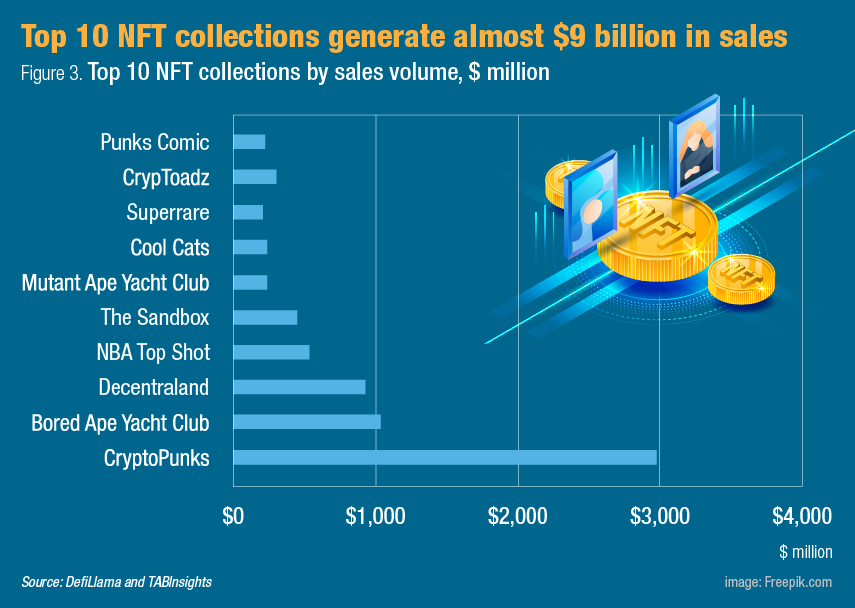

Emergence of assets classes with digital representation capabilities

Digital assets are an emerging phenomenon and numerous more manifestations are yet to become live or increase in scale, such as non-fungible tokens (NFTs) that have enjoyed extraordinary growth in 2021. In its October 2021 report, DappRadar indicated that an average of 1.2 million unique active wallets are connected daily to blockchain games, representing around 55% of the blockchain industry’s activities. CryptoSlam lists 462 NFTs and presents that the first collection of Curio Cards was minted back in 9 May 2017. NFTs have had a tremendous market appreciation in 2021.

In December 2021, RtistiQ launched an art exchange platform featuring NFTs into its distribution services. Jothi Menon, CEO of RtistiQ, said, “With the introduction of NFT, we saw several opportunities to use the blockchain technology to provide the primary art market participants access to art in a different way. This is relevant, as circulation of art has gone beyond the local markets. NFT offers the possibility to build in a digital element, thereby improving the authentication of art and transparency into the life cycle of art from the artist to the art galleries’ executions that may hold the asset for a period. For RtistiQ, NFT also gives the opportunity to reflect the physical asset, for example a piece of art, in a digital format.”

Moreover, an increasing number of states are considering digital assets in the form of central bank digital currencies (CBDCs). According to Atlantic Council, 87 countries (representing over 90 percent of global GDP) are exploring a CBDC and nine countries including Bahamas, Nigeria and China have reached launch.

Reportedly, the People's Bank of China announced an adoption surge in the digital RMB. Between June and October 2021, the central bank recorded almost seven times more personal e-wallets and nearly three times more corporate e-wallets. The number of transactions had increased by 212%, and the total transaction value had gone up from $5.4 billion to $9.7 billion. Meanwhile, the average transaction value had decreased from $76.25 to $64.53, indicating that the digital RMB is going mainstream. Currently, many countries including Singapore are researching and conducting proof of concepts on CBDCs as a mean to streamline cross-border payments in both the retail and wholesale spaces, thereby reduce transaction fees and improve financial inclusion.

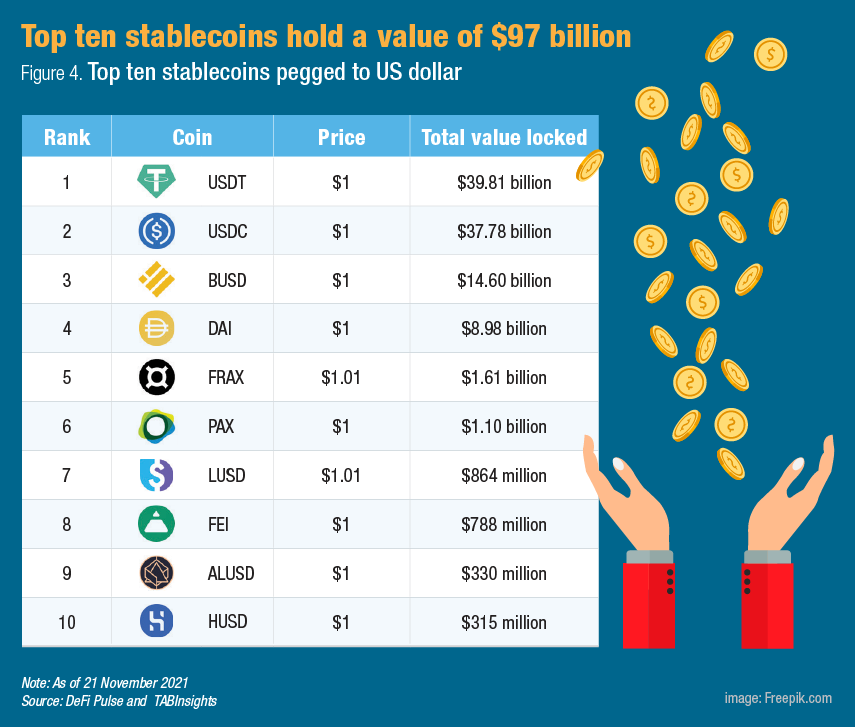

Another emerging digital asset class is stablecoins, which are cryptocurrencies used within the DeFi ecosystem. According to DeFi Pulse, the global supply of stablecoin is almost $97 billion, and they offer a range of services to both individuals and merchants, for example fintech Paxos provides custodial services. One purpose of stablecoins is to bring stability to the day-to-day fluctuation of cryptocurrencies that market participants want to hedge against. This is possible as stablecoins are pegged to external references with known price stability. Such references can be fiat currencies such as the US dollars or commodities such as gold.

The Malaysia-based HWGG Capital offers a blockchain payment ecosystem in its HWGCash app. Mok highlighted, “We always believe that digital assets are more than just a form of investment asset class. Despite the volatility of some of the digital assets’ nature like Bitcoin, stable tokens like tether or our native HWG Cash digital currency can be an effective medium of transactions for businesses and individuals.”

Mok stated, “The diversity of investable asset types will significantly increase in the coming years. Businesses in the financial sector, but also in industry, should become familiar with the new opportunities to take advantage of this next stage of digitalisation. Currently, there are already some projects and prototypes, but in a few years, there will be thousands of digital assets available to anyone.”

Market valuation considerations of cryptocurrencies

Despite the attraction of potential gains, the immense value creation by cryptocurrencies and other kinds of digital assets is based on inexact valuation methods. In comparison, other asset classes such as fiat currency use precise and generally accepted valuation methods. For non-digital assets, investors may use several factors, including stores of value, units of measurement and mediums of exchange.

In our survey, investors seem to value digital assets based on very different factors. One factor is the use case of digital assets for specific purpose such as lending. Menon said, “The real utility of digital assets is better known to those that have selected a cryptocurrency for a particular purpose. However, many of the cryptocurrencies are just adoptions of blockchains and not embedded in blockchain. That means that they are just tokens that are based on other tokens. Real blockchain companies are about 300.”

In a similar vein, Mok highlighted, “Investors should value digital assets based on their use cases, which will dictate how widely available and application digital assets will be in the future. Widespread adoption of digital assets will lead to easier and faster issuance of new securities, while cross-border transactions will be streamlined. These benefits apply to already existing types of securities, like bonds, fund shares, and in a few years, stocks. Beyond just improving efficiencies of existing types of securities, digital assets will allow completely new types of securities to be created.”

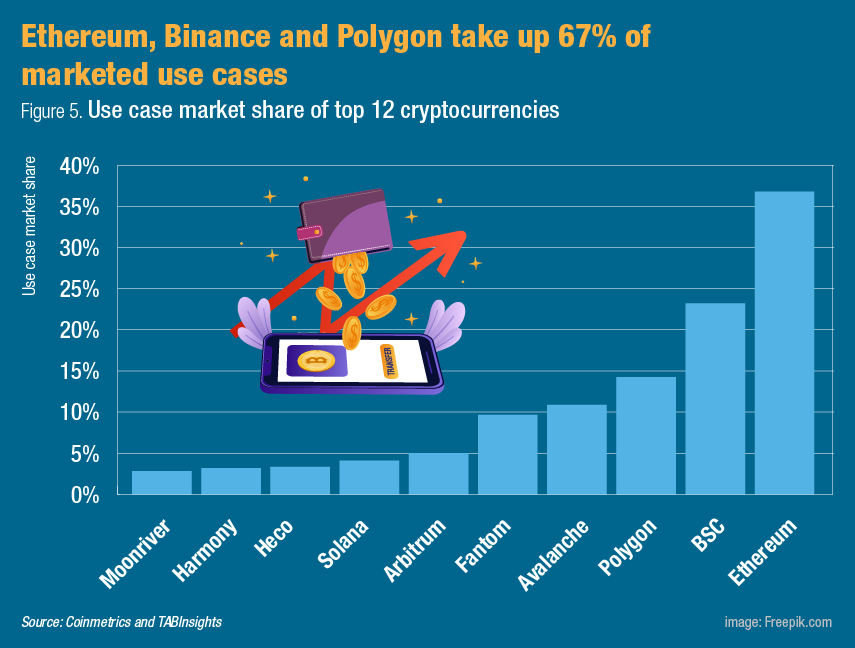

Observations of use cases suggest that the cryptocurrency market is skewed in its distribution. As the majority of the marketed cryptocurrencies (more than 15,000 as of December 2021, according to CoinMarketCap) are utilised in few use cases, while others are found in numerous use cases.

Cheong stated, “There is an issue with the current market structure. Most DeFi protocols sit atop Ethereum right now, and they are expanding into other blockchain platforms such as Solana and Binance Smart Chain. However, there is an element of risk if Ethereum is affected by a bug, then it will affect the entire DeFi application built on top of it.”

The skewed market shares distribution in the cryptocurrency market is associated with more risks. Menon added, “Last year we experienced several unexpected obstacles, as countries were considering banning the use of Ethereum.”

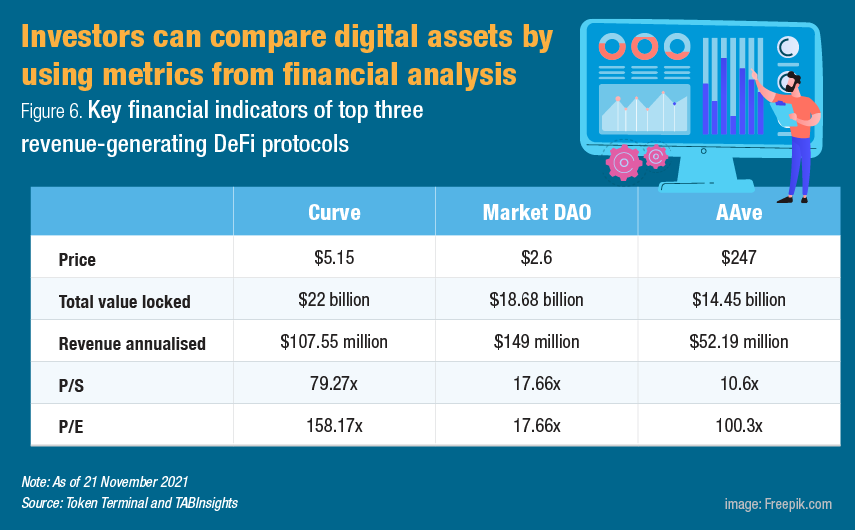

DeFi protocols along with other digital assets have created immense value since their introductionand one way to exercise valuation is to consider the use of measures from other markets such as the stock market. For example, investors can view market capitalisation of specific DeFi protocols and apply metrics such as price to earnings (P/E) and price to sales (P/S). Cheong said, “These metrics consider the revenue DeFi protocol produces and origin in fundamental analysis of assets.”

Cheong added, “Besides the financial market indicators, other quantitative indictors are currently being developed, such as the number of active users per different periods and services it generates for user.”

Rising costs driven by high energy consumption

The valuation of digital assets has to take into account the potential costs. The so-called asset generators of cryptocurrency, for example, the miners or issuers, must consider fees for confirming transfers or accepting redemptions.

Cheong stated, “Today many DeFi applications are utilising Ethereum and the fees are rather high to access it. But with newer blockchain solutions there is a likelihood that fees will reduce substantially.” Fees for Bitcoin transactions have been diminishing substantially, as reported by Chainalysis.

However, there are more cost considerations. RtistiQ has recently partnered with Singapore-based crypto payments platform Triple A to send and receive payments via the company’s newly approved cryptocurrency platform. Menon said, “Blockchain payments transactions offer a much better competitive cost structure than traditional payment providers in the fintech space, such as Paypal and Stripe.”

Liquidity, the degree to which an entity sends on digital assets, for example the Bitcoin it receives, can be poor. Chainalysis reported that illiquidity in Bitcoin was at 75% as of 20 November 2021, meaning that Bitcoin owners are holding their assets for long periods.

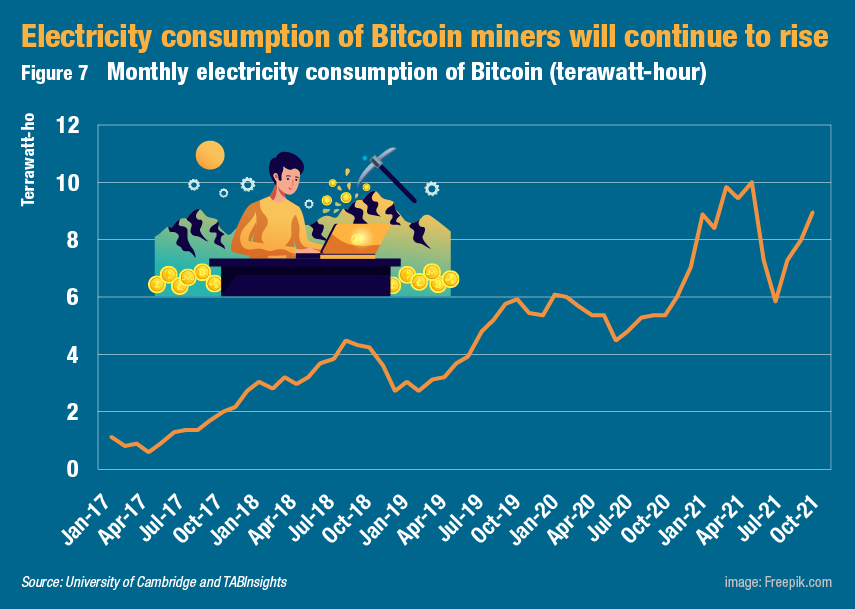

Another major cost consideration for digital assets is energy. At the industry level, the electricity and energy consumption to power computers and other equipment to mine cryptocurrencies have been highly criticised. According to Cambridge Centre for Alternative Finance, the asset generation of Bitcoin consumes 0.52% of total world production of electricity and 0.26% of total world energy produced. Compared with gold mining that consumes about 131 terawatt-hour per year, Bitcoin alone consumes 115 terawatt-hour per year. The energy consumption will continue to rise with the growing adoption of cryptocurrencies and digital assets that utilise cryptocurrencies.

For companies using cryptocurrency for various purposes, such as payments in the case of RtistiQ, one outcome of the debate on energy consumption is the higher costs of operation. Menon gave an example of how such costs can affect operations of an art exchange business and how to practically avoid them. He highlighted, “The different platforms can include a gas fee in the bill, the fee varies with the actual usage and price of energy consumed. The platform providers have also started to provide transparency into the actual usage through various sophisticated reporting tools. However, one can avoid such fees by setting up bridges to several other cryptocurrencies and hereby reduce costs associated with electricity and energy.”

As valuations of digital assets have increased exponentially, investors have to consider the several factors that influence valuations including use cases, market power of the asset, energy costs, liquidity, and fees for holding and sending digital assets. While the understanding and observations of these factors can discipline valuation attempts, the speculative element in digital assets trading remain an unresolved mystery. Moreover, technology choices and fitting policy development processes remain unresolved issues.