- Evolving regulatory stance on crypto exchanges

- FTX investors at risk

- Future of crypto platforms

The FTX meltdown had wide-ranging effects on the whole cryptocurrency market as exchanges with exposure to its native token FTT suffered from falling prices. FTT saw a sharp decline in value, hitting a two-year low last November, causing other digital assets like Ethereum and Bitcoin to tumble as well.

Allegations of improper fund management late last year triggered a significant number of withdrawals by uneasy investors—akin to a bank run—leading to a liquidity crisis. Failing to secure rescue funds, FTX finally filed for bankruptcy in November 2022.

Evolving regulatory stance on crypto exchanges

Cryptocurrencies have experienced remarkable growth in recent years thanks in part to stronger connections with regulated financial systems. As many activities in this developing industry remain unregulated, policymakers find it difficult to keep an eye on risks and countries fear these could spread throughout the entire economy.

Singapore’s state holding firm Temasek wrote down its $275 million investment in FTX and claimed it had performed due diligence over an eight-month period, including a review of the company’s audited financial statement. Various countries are now tightening their regulations on cryptocurrency exchanges.

Hong Kong Monetary Authority said upcoming restrictions on virtual assets will curb money laundering and protect investors. As cryptocurrencies do not meet the criteria for securities, Hong Kong established a new legal framework for these digital assets. The United Kingdom is also controlling cryptocurrency speculation with a new regulatory framework.

The FTX debacle sparked a debate in Korea between the Korean Financial Services Commission (FSC) and the Digital Asset Alliance over regulatory authority. There are also calls in the Korean parliament for the regulation of digital assets in the same way securities are controlled by the Capital Markets Act, giving financial regulators the authority to supervise the market.

FTX investors at risk

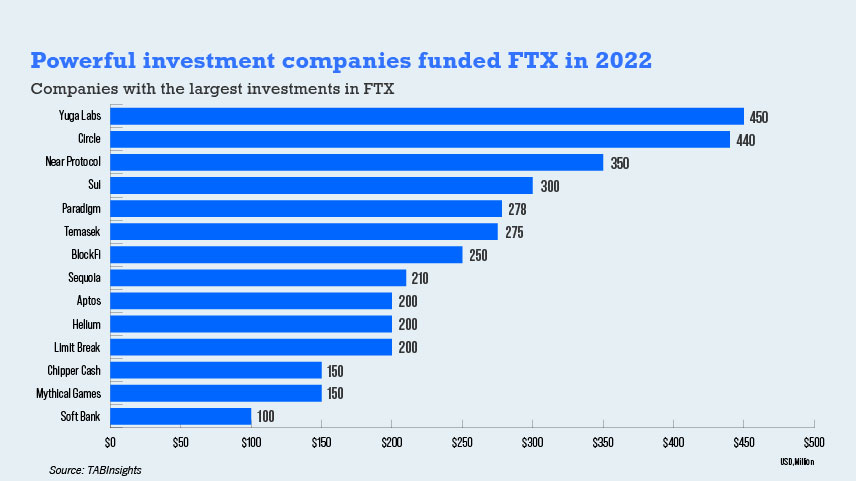

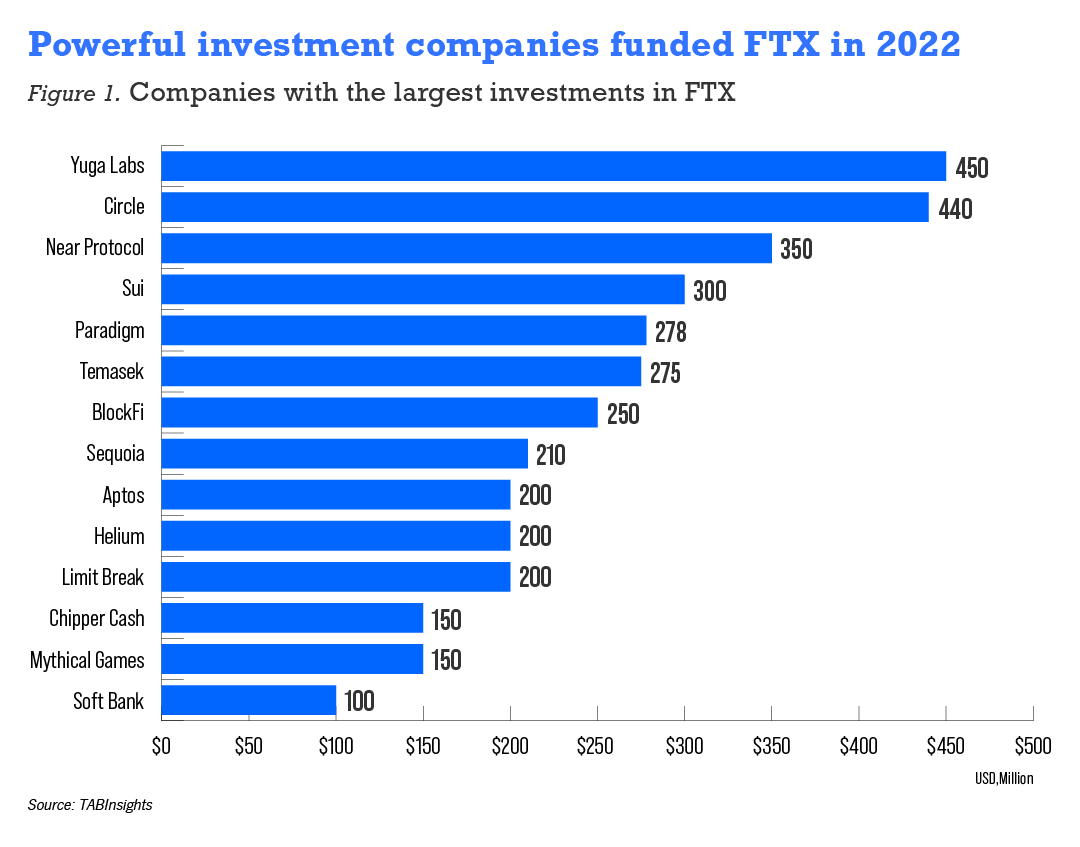

To gain the public’s confidence, FTX ran numerous TV commercials and even has a Miami arena named after it. Some of the biggest names in the bitcoin sector made significant investments in the venture capital division of FTX. In just two years, FTX raised $1.9 billion from 80 investors not only in the crypto space, but also at the institutional level. The capitalisation table of the now-bankrupt company resembles a ranking of the top hedge funds, private equity firms, and venture capital firms worldwide.

Future of crypto platforms

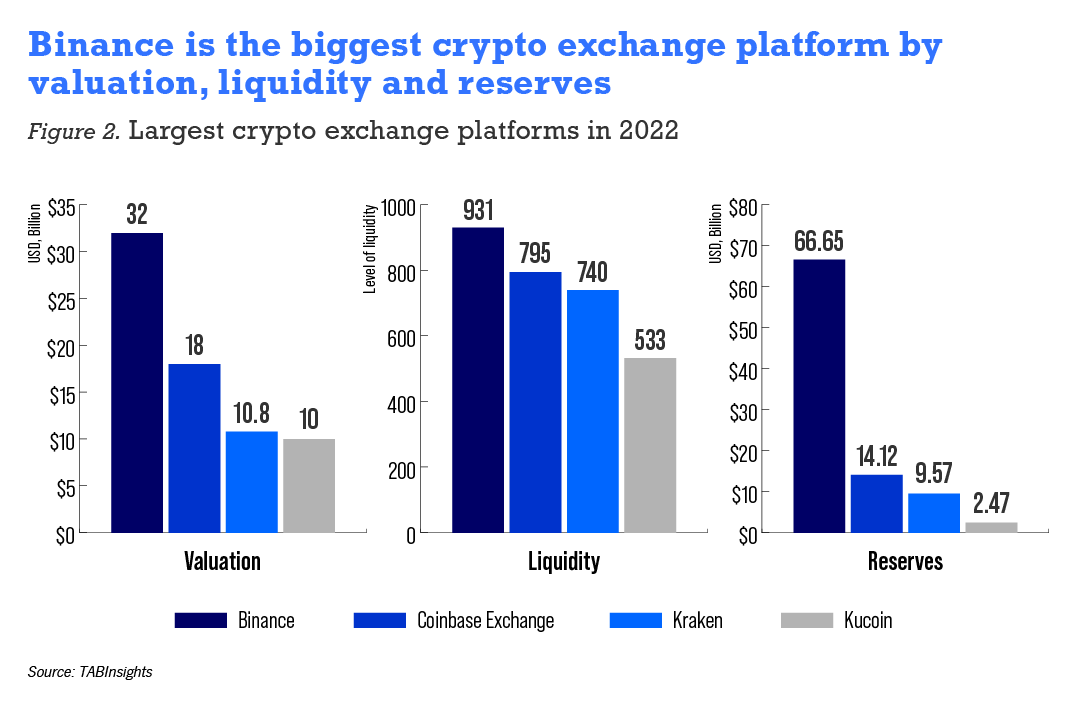

Cryptocurrency has a future, but regulation is necessary to eliminate fraud. Crypto exchange platforms are now extremely cautious so as to avoid the same collapse. Major trading platforms are racing to produce proof of reserves verified by third-party auditors. This implies that audits of crypto exchange platforms may eventually be part of regulations.

In 2023, more stringent regulation is expected to be put in place. Regulators now recognise the need for distinct regulations for centralised and decentralised exchanges. Regulatory reforms must impose legal obligations on all crypto exchanges to manage client monies with due fiduciary care.

State-run investment funds must also seek approval from a country’s financial regulator before making any investment because of the risks in crypto exchanges.

Clients must likewise reduce their exposure and understand where digital currency is stored. Exchanges that survive regulatory tightening will have to ensure that customer funds are secure and liquid to persuade users that they are not the next crypto platform waiting to crash.

The demise of FTX highlights the value of openness, proper regulatory protection, and regulatory obligations for financial activities. Regulators must act quickly to protect cryptocurrency investors in the light of the turbulence in the sector.