Singapore’s top three banks—DBS Bank (DBS), Oversea-Chinese Banking Corporation (OCBC) and United Overseas Bank (UOB) are shifting from rate-driven profits to fee-based growth built on wealth management, cross-border connectivity and sustainable finance in 2025.

This integrated model reflects a sector-wide move towards diversified, recurring income streams anchored in client asset management, regional flows and environmental, social and governance (ESG)-linked finance. Falling interest rates, persistent funding cost pressures and competitive lending conditions have narrowed net interest margins (NIM), reducing lending profitability. As a result, the market structure now favours fee-generating businesses that can provide stable revenue over the long term. The shift ensures that income streams remain resilient, even when lending margins are under pressure, and that growth comes from client activity and regional flows rather than interest rate movements alone.

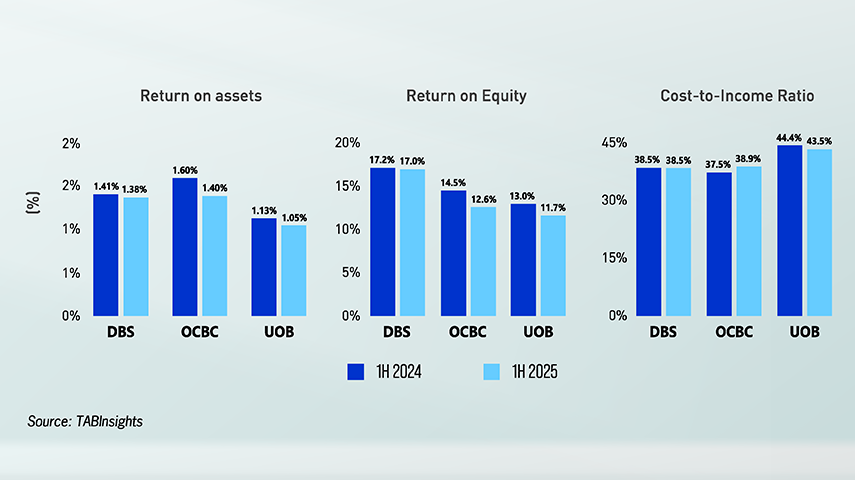

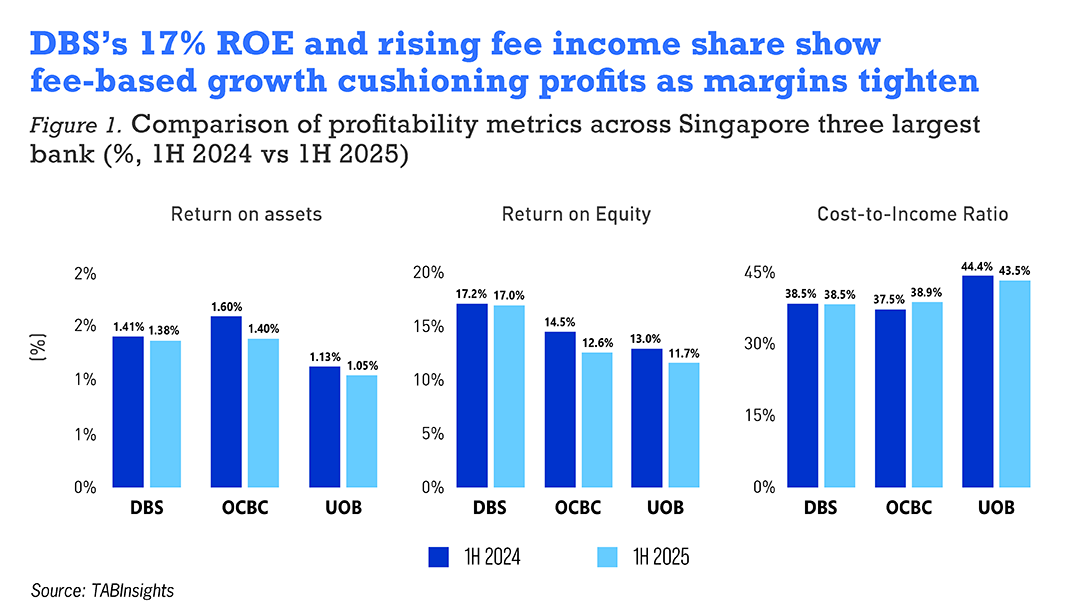

Banks deliver results from the new model

DBS’s first-half 2025 pre-tax profit rose to a record level primarily because of large inflows into its wealth management franchise, which translated directly into sustained fee income growth rather than reliance on lending spreads. OCBC advanced its SGD 3 billion ($2.23 billion) revenue programme for 2023 to 2025, increasing fee income and regional flows that strengthened both its wealth and connectivity businesses. UOB reached major integration milestones after acquiring Citi’s ASEAN (Association of Southeast Asian Nations) retail operations, expanding its regional footprint and cross-border capabilities. Fee income is also reinforcing capital, enabling further expansion and client flows that reinforce the three growth engines.

Macroeconomic forces accelerate the transformation

Macroeconomic conditions reinforce the move to fee-based growth. A 125-basis-point decline in the Singapore Overnight Rate Average from 3.03% in January to 1.78% in August narrowed NIMs by nine to 28 basis points year-on-year (YoY), reducing loan yields and deposit costs and raising the urgency of securing non-interest income.

The Singapore dollar strengthened by 6% to 7% in the first half of the year, attracting cross-border flows and boosting assets under management (AUM) by 12.2% to over SGD 6 trillion ($4.46 trillion), expanding the foundation for fee-generating investment services.

Trade realignment is also adding to regional connectivity. US–China tariffs of 30-35% and ASEAN duties of up to 49% have pushed supply chains into Southeast Asia, increasing demand for trade finance, treasury mandates and regional banking solutions. Regulatory measures such as the ASEAN Economic Community Strategic Plan for 2026 to 2030, and the Qualified ASEAN Banks (QAB) scheme, which lowers licensing and capital barriers— are expanding opportunities by raising flows of goods, capital and services across ASEAN markets.

At the same time, Singapore’s gross domestic product (GDP)—forecast to ease from 2.6% to 1.7%, with domestic loan growth at 3.4% YoY—underscores the value of stable, fee-based income. Sustainable finance provides a more reliable revenue source through ESG-linked lending, investment products and advisory mandates, aligning income with regulatory priorities and client demand for long-term sustainability.

Wealth management scales into a sector-wide performance driver

The most visible shift is in wealth management, which is now delivering measurable inflows, asset growth and revenue expansion across the three banks. DBS secured over SGD 14 billion ($10.41 billion) in new client assets in the second quarter, increasing total AUM to a record SGD 442 billion ($328.45 billion) and increasing wealth management income by 8% to SGD 2.84 billion ($2.11 billion).

OCBC’s wealth fee income rose 25% to SGD 548 million ($407.47 million), with total wealth income reaching SGD 2.66 billion ($1.98 billion), representing 37% of group income. UOB added SGD 3 billion ($2.23 billion) in net new money, boosting wealth income by 15% and reinforcing its post-Citi ASEAN-4 integration.

Rising AUMs, inflows and healthy fee margins embed wealth management strongly as a pillar beyond interest income.

DBS is advancing digital wealth through analytics-led personalisation to deepen relationships and boost cross-selling. OCBC leverages bancassurance via Great Eastern, an insurance company, to improve margins and retention. UOB embeds wealth propositions across its ASEAN-4 footprint. These initiatives are integrating high-margin services into broader client relationships, which in turn feed cross-border flows and ESG-linked investment demand.

Regional connectivity multiplies capital and service flows

Cross-border connectivity is powering the second growth engine. DBS expanded its ASEAN and Greater China network, converting cross-border relationships into deposits, treasury mandates and investment flows. Income from its South and Southeast Asia segment rose 15% to SGD 897 million ($665.86 million), driven by increased trade and investment into the region’s supply-chain hubs, which in turn generated higher transaction banking and advisory volumes.

OCBC integrates banking and insurance across Singapore, Malaysia, Indonesia and Greater China via its “One Group” model. UOB scaled its ASEAN-4 retail and small and medium-size enterprise (SME) network, now serving over 8.4 million customers with higher current account and savings account (CASA) balances, greater card billings and broader lifestyle partnerships. These initiatives deepen client value chains, converting regional scale into cross-border flows that strengthen earnings resilience.

Sustainable finance expands as a primary revenue stream

Sustainable finance is rapidly gaining scale as the third growth engine with OCBC’s sustainable loans rising 19% YoY to SGD 53 billion ($39.41 billion), or 16% of its corporate loan book. UOB has built targeted lending and investment partnerships to position itself as a leader in ASEAN green financing. DBS embedded sustainability criteria into corporate lending, trade finance and advisory, integrating ESG-linked products into core client solutions. This positions ESG not as a niche product but as a core revenue stream.

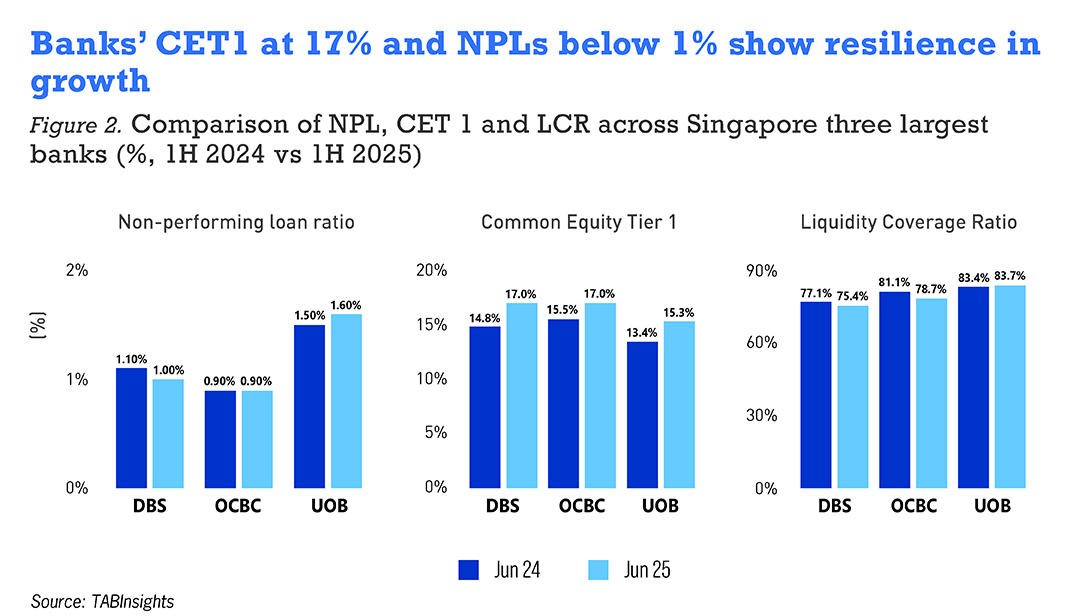

Capital strength and technology drive scalable growth

Capital strength underpins the scaling of the three growth engines. Non-performing loan ratios remain low, with DBS at 1.0% and OCBC at 0.9%, while common equity tier 1 (CET1) ratios remain robust at 17.0% for DBS and OCBC, while 15.3% for UOB. This capital position supports sustained investment in wealth, regional and sustainable finance activities, even during periods of slower growth.

Technology is amplifying scalability and efficiency. DBS applies analytics-led personalisation in wealth and transaction services. OCBC has digitised regional wealth onboarding to accelerate acquisition and reduce friction. UOB operates a unified ASEAN payments and cards platform, enabling seamless cross-border engagement. These digital strategies reduce unit costs while broadening reach.

Forward guidance underscores continuity in integrated growth model

The integrated model now combines wealth management, regional networks and sustainable finance for ESG-linked growth. Future plans focus on deeper regional penetration, broader multi-product coverage and a larger portfolio of sustainable financing for institutional and corporate clients. Execution in these areas is expected to expand market share in trade, investment flows and ESG financing, while reinforcing earnings stability and shaping ASEAN’s financial framework. Over the next decade, aligning capital strength, client demand and regional integration will define profitability and extend Singapore’s financial influence in the region.