- Many banks believe that big data analytics offers a significant competitive advantage and will determine their success in the future

- Banks are starting to use prescriptive analytics to determine what to recommend and how to convince customers to take specific actions

- Banks that run effective data analytics-based programmes can see costs drop tremendously and get higher revenues

Consumers who use Facebook or Instagram, as well as the multitude of other digital services and apps, have come to expect offers instantly tailored to their own shopping and browsing habits, and real-time predictions about their needs. Delivery of those customised experiences is derived from data analytics, which Amazon, Apple, Facebook, Google and other companies use to predict what the consumer will want next.

After receiving real-time easy-to-use insights and offers in the rest of their lives, consumers have come to expect the same experience from their banks. So far, however, most banks have lagged behind compared to the rest of the digital world.

If banks don’t deliver the level of service that customers desire, tech companies are waiting in the wings to take away their businesses. Consumers can get services from companies that use data analytics to deliver faster and better services, such as loans from Lending Club, payments from Alipay, or investment advice from Zopa. Moreover, they are increasingly willing to switch to these non-bank service providers.

As J.P. Morgan CEO Jamie Dimon told Bloomberg, “Silicon Valley wants to take on this business. They are using big data for the credit side of lending. They can underwrite it quicker. For example, they might lend to one of our customers who’s got a $200,000 J.P. Morgan Chase loan, and this person wants to get another $20,000 for a new truck or a piece of equipment. He goes with them because he gets it in 15 minutes.” As a result, J.P. Morgan Chase set up an Intelligent Solutions unit with 200 analysts and data scientists that Dimon said can compete with any Silicon Valley firm.

The growth of data analytics – from descriptive to prescriptive

With the level of competition increasing, other banks are also seeing the importance of real-time data analytics and starting to change. In North America, for instance, Capgemini found that more than 60% of financial institutions believe big data analytics offers a significant competitive advantage, and more than 90% believe big data initiatives will determine their success in the future.

“We are seeing three areas of focus,” Peter Ku, head of industry consulting team and financial services strategist – Americas at Informatica, told The Asian Banker. First, while customer needs analytics has always been a challenge, banks are using triggers an attributes about the individual and interactions to drive marketing. Whereas fraud detection has been based on spending patterns, next-generation analytics is using the complete customer profile to detect fraud.

And finally, predictive analytics is used to look at triggers that will affect credit exposures.

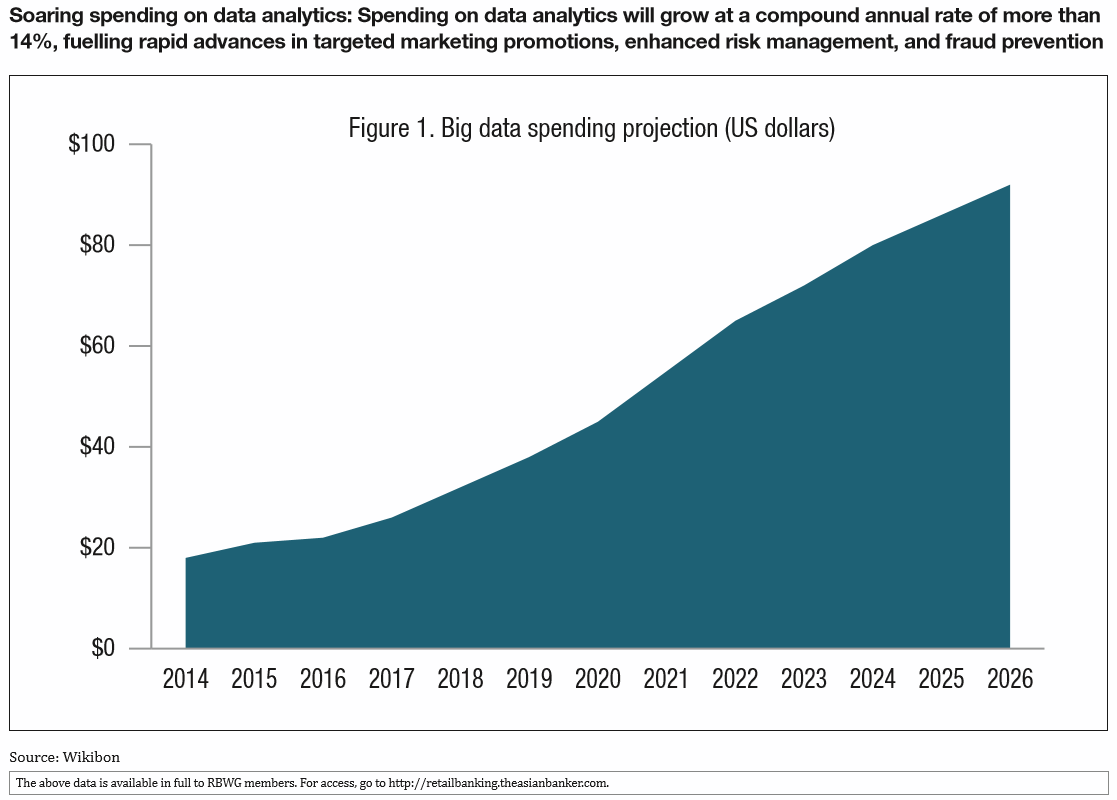

This focus on data analytics to deliver cutting-edge real-time experiences is leading to huge increases in spending on analytics, by banks and non-banks alike.

Worldwide revenues for big data analytics will grow from about $18 billion in 2014 to about $92 billion by 2026, Wikibon predicts (Figure 1).

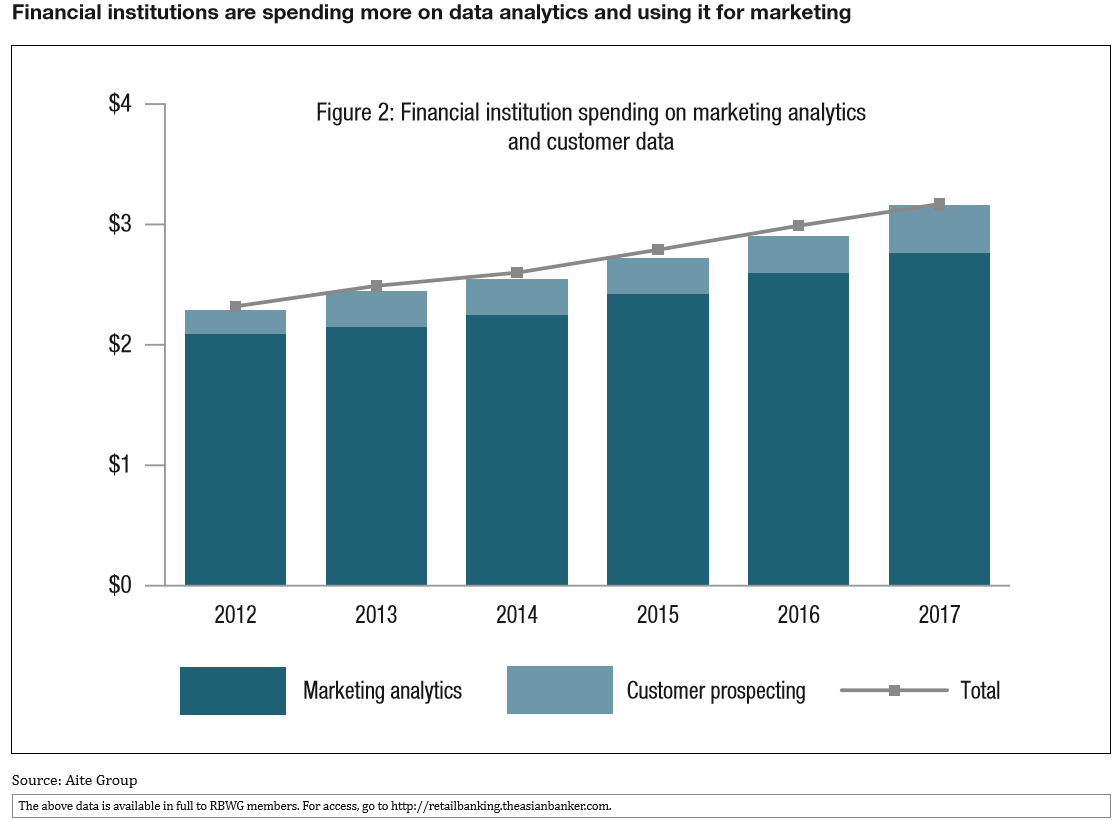

A significant portion of that spending by banks is going into marketing, with leading players delivering real-time location-based offers to their customers (Figure 2).

Beyond marketing, though, banks are also leveraging data analytics extensively for other functions, including using enhanced scoring models and customer verification for risk management, tapping a far broader set of data real-time to enhance fraud prevention, and checking multiple sources to ensure compliance with know your customer (KYC) or other requirements.

The result of data analytics in the front office is that leading retail banks are using a digitised customer experience to deliver services including real-time geolocation-based card-linked promotions, next-bestaction marketing offers, and individually customised pricing. In the back office, in operations as well as risk and other functions, banks are using data analytics to prevent fraud, handle claims, and eliminate the bottlenecks or errors in increasingly-automated back-office functions.

How to leverage data

Delivering those insights and recommendations takes far more than simply applying the business intelligence capabilities that retail banks have been using for many years. Banks need the right people with the right skills using the right data and tools to find the patterns that will drive customer product

usage and revenue up while reducing fraud and credit losses.

To derive full value from their data, consulting giant BCG advises that banks need to focus on four data analytics drivers: analysing current practices, transforming core banking processes, boosting IT performance, and creatingnew revenue streams. Making that leap is harder than it may seem. Beyond overcoming basic roadblocks such as resistance to change and a lack of qualified resources, BCG said banks also need to resolve competing priorities such as IT complexity resulting from siloed data, addressing regulatory changes, and a lack of overall vision.

On the technology side, data analytics solutions have come to rely on low-cost databases such as Hadoop, which has greatly reduced the cost for banks to store structured and unstructured data. More recently, IBM Big Data evangelist James Kobielus said, the big data platforms landscape is shifting towards Spark, which is “the centrepiece of the new cloud data services platform that’s geared to accelerating the productivity of development teams.”

A cutting-edge trend at leading banks is to combine data analytics with bioinformatics, which uses algorithms originally developed to compare DNA sequences. One bank, which receives half a million messages a year from consumers, found that it wasn’t enough to use text analytics, which parsed individual messages for key phrases and allowed them to be automatically directed to the right handler. Deloitte said the bank then used bioinformatics to take the analysis to the next level so that it could route and prioritise the messages to get customer interactions under control.

While the right software is essential, people still have a critical role to play in making sure the right data is applied, using the insights and alerts that are generated, and measuring the results. If the right data isn’t used, Ku observed, “it is garbage in, garbage out.”

Software does not have common sense, so people need to monitor the results of analytics regularly to make sure that they make sense and to avoid the errors.

Data drives performance – use cases

Retail banks that have used data analytics have seen powerful results, with the financial returns at leading performers being many times the investment.

A bank in Europe, for example, used a series of advanced-analytics models to process detailed customer information related to credit risk, behaviour, card use, and purchase patterns. BCG said the bank used the data and new models to generate an entirely new series of risk and targeted scores, which resulted in uptake surging fivefold to more than 20% and revenue growing by tens of millions of Euros.

In the UK, Lloyds Banking group said it is working with Google and using tools such as Google Big Query and Data Flow to analyse customer behaviour, understand their requirements, and deliver solutions real-time. To improve customer service, RBS used data about agents’ performance to provide personalised coaching and also leveraged artificial intelligence solutions to help staff answer customer inquiries more quickly. RBS also uses data to connect better with customers, for example, sending messages on their birthday or having staff call a customer who could borrow at a lower rate.

In the United States, US Bank deployed an analytics solution that integrates data from online and offline channels to provide a unified view of the customer. By supplying the call centre with more relevant leads and providing recommendations, Capgemini said, the bank improved its lead conversion rate by more than 100% and delivered better and personalised experiences.

In Turkey, according to KPMG Nunwood, Garanti Bank’s mobile app provides customers with alerts about deals on their favourite brands, uses GPS to notify them if they are close to a store with a special offer, and estimates the amount they will have in their account for the rest of the month based on past spending habits.

Focusing on the F&B sector, BCG said a leading European retail bank used data from its payment card unit to build a digital dashboard for restaurants and bars that display high-level aggregated information including the age and revenue brackets of customers, the customers’ behavioural segments, and whether they are first-time or repeat customers. The bank used the data to achieve penetration of more than 50% of its restaurant clients in just a few months, and it projects new revenues of $53.5 million (€50 million) with a profit margin of about 40% even after paying for its new data analytics system.

While marketing and e-commerce have been the most common uses for big data in China so far, Chinese companies are expanding their usage of data analytics to more areas. Ant Financial, for instance, has used online shopping and transaction data to determine whether small businesses qualify for loans.

Case Studies

Informatica

In retail banking, Ku mentioned three key areas of focus for data analytics to stand out - customer needs analytics, fraud, and predictive risk management. Data analytics is helping retail banks to look at triggers that will affect credit exposures, determine what products and services to offer based on triggers about the individual consumer, and use next-generation analytics to identify fraud.

One large bank in the US, for example, wanted to look for opportunities to upsell and cross-sell. Unfortunately, data mining tools weren’t giving them the right insights. “It was a data problem with inconsistencies of the definition of customers,” said Ku. When his team asked how many customers they had, the staff of the bank debated the definition of “customer” and couldn’t provide a number. Ku’s team used customer needs analysis to identify the data needed, establish a governance framework, and develop a central version of the customer. Using analytics and better data reduced the timeframe for onboarding wealthy customers from three months to two weeks and lessened marketing campaign spend by 40%.

Ku also worked with another financial institution on fraud detection. By looking at trading data, the institution reduced the lead time for identifying fraud from two weeks to three days and was able to determine which individuals were causing fraud in the system.

His team also shares best practices for future state solutions and helps make sure solutions are developed correctly. Banks primarily use Hadoop, he said, which has become a standard part of back office architecture.

“Relational database management system (RDBMS) doesn’t scale,” he said.

Interestingly, Ku also said the disparity between regions is declining. “I don’t see much difference between Asian banks and US banks,” he observed – “not much lag.”

E.SUN Bank

The key focus areas for its data analytics, E.SUN Bank told The Asian Banker, are marketing and risk. E.SUN uses analytics to understand customers’

needs and preferences so that it can provide personalised one-on-one services and improve the customer experience.

Its 360-Risk V iew initiative, for instance, is designed to identify def ault risk, assess customer value, and e valuate the loan amounts customers can afford. Automated decisions have reduced the time for approvals by as much as 50%. To fully leverage 360-Risk View, E.SUN is developing a credit capacity index (CCI) so that it can extend the application of CCI from unsecured personal loans to credit cards or other products and create “huge profits”.

On the marketing side, E.SUN started an external data centre and a public sentiment platform to collect external data, conduct sentiment analysis, assess market dynamics, and identify key customer needs.

Another key initiative by the bank is the universal customer intelligence solution (UCIS), which it can use to understand customers’ financial intentions, interests, and behaviour. UCIS utilise an intention classifier, an interest cluster, and a behaviour module to create customer financial scenarios, which give E.SUN a holistic view of the customer decision journey and insight metrics to support strategy development. “UCIS has successfully helped E.SUN increase customer satisfaction and expand digital services,” it said. “With UCIS, E.SUN transforms data into insights into action.”

What is next?

Banks have more often used data analytics to predict customers’ behaviour and deliver the right products and services to the customer at the right time. Banks are analysing different factors such as the customers’ spending patterns and demographics or even social media behaviour and GPS-based location data. Banks have also been able to track decreases in spending to predict attrition and offer retention rewards, or to spot higher usage of cash withdrawals and late payments that could forecast credit risk and make earlier collections calls.

Now, however, banks are starting to use prescriptive analytics to determine what to recommend and how to convince customers to take specific actions. Scott Zoldi, chief analytics officer of FICO, says prescriptive analytics looks at what should be done or how a bank can make an action happen, using a combination of graph analysis, simulation, complex event processing, neural networks, recommendation engines, heuristic, and machine learning.

That continuing increase in capabilities is starting to deliver a competitive advantage that enables banks to provide the same level of service customers receive from social media or technology giants, which in turn helps them retain their customers and add new ones.

Boost profitability

While large multinational banks have built their data analytics teams to boost their capabilities, smaller and local banks are delivering services that bolster their connections to the customer. Banks that lag in developing real-time comprehensive data analytics capabilities are likely to see customers flee to other banks or non-bank competitors. On the other hand, banks that do run effective data analytics-based programmes can see costs drop tremendously and get double- or triple-digit increases in revenue from their data-analytics-based businesses.