- China’s reopening fuels record-high savings and drives investment opportunities

- Common Prosperity and carbon neutrality goals transform advisory services, philanthropy and sustainability

- Common Prosperity fosters heightened awareness of sustainability and philanthropy

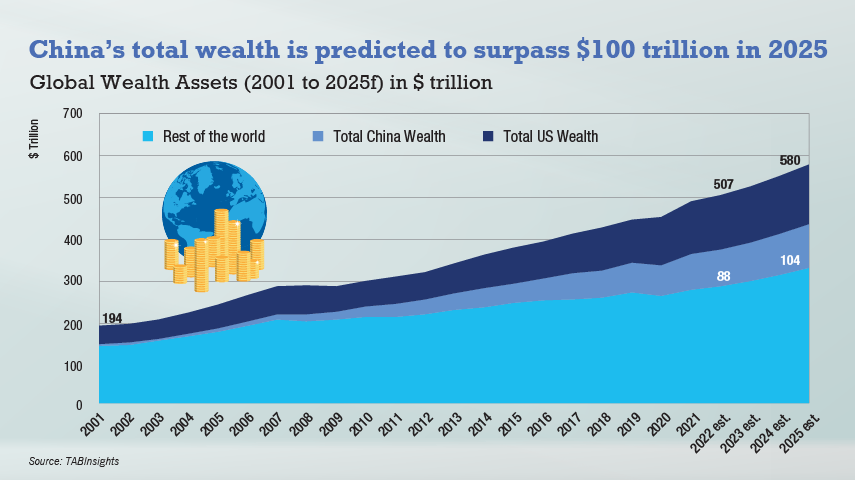

Since China joined World Trade Organisation (WTO) in 2001, the country has experienced a sustained period of robust economic growth. According to TABInsights, China’s wealth has significantly increased from $4 trillion in 2001 to $88 trillion in 2022; this growth has positioned the country as the world’s second largest wealth management market after the United States (US).

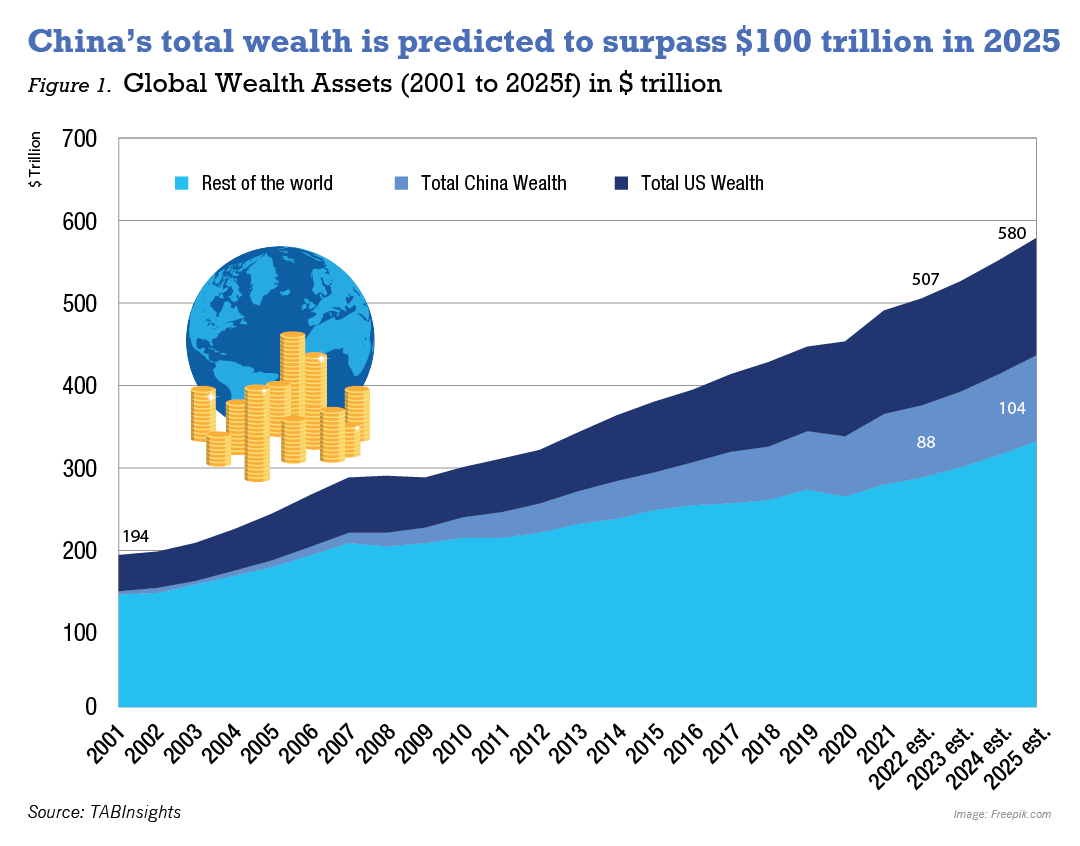

Behind China's rapid economic growth lie certain structural challenges such as the relatively low proportion of financial assets in Chinese individual’s wealth portfolio compared to other regions.

Currently, real asset accounts for nearly 70% of the overall wealth portfolio in China, which is more than double the levels of the US and Europe due to the booming real estate market in the past decade. However, as the real estate market tumbled, there is likely a shift towards capturing wealth in the form of financial assets.

The surging market demand spurred innovation in China’s wealth management products and trust services, outpacing the regulatory measures.

To address market flaws and ensure stability, Chinese regulators are undergoing a major revamp in the regulatory framework, aiming to rectify the market flaws through new regulations and legislation. The “Guiding Opinions on Standardising the Asset Management Business of Financial Institutions” is one overarching piece of regulation that aims to reshape the ecosystem. This new asset management regulation was officially implemented in 2022, after three and a half years of transition period. It seeks to eliminated implicit principal payment guarantees, multi-tier nesting and maturities mismatching. The reclassification of trust business issued in March also mandated the trust companies to reposition themselves as genuine wealth managers rather than shadow banks.

As a result of these regulatory changes, Chinese wealth managers are facing pressure, particularly trust companies are the heavily impacted by the new market realities. In 2022, 56 Chinese trust companies experienced an 18.76% decrease in revenues, amounting to $17.06 billion (RMB 118 billion) compared to the previous year. Only 20 out of 56 trust companies achieved profitability in 2022. Even banks that manage the most wealth in China have not spared from the challenges.

Two leading wealth management banks, Ping An Bank and China Merchants Bank, reported major slumps in wealth management fee income, with decreases of 21.5% and 14.28% year-on-year (YoY), respectively.

Chinese wealth managers who can adapt to market realities and can navigate the new normal have the potential to capitalise on market opportunities by increasing product penetration and strengthening their advisory capabilities. However, the industry is expected to undergo a reorganisation in the coming years, with small to middle-tier players facing the biggest existential threats.

China’s reopening fuels record-high savings and drives investment opportunities

After three years of implementing its Zero-COVID policy, China’s reopening signals new opportunities for the wealth management market.

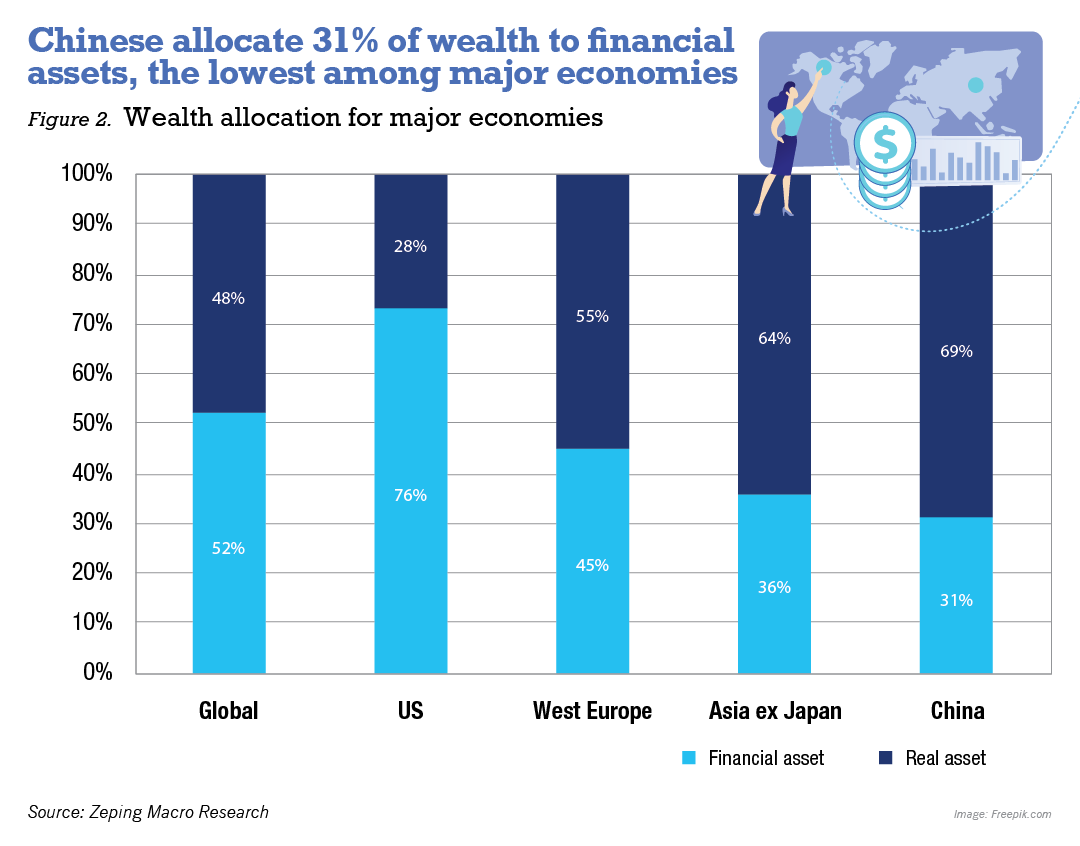

As China’s economic growth slumped to one of its worst levels in nearly 50 years in 2022, households accumulated record-high savings as precautionary measure.

The People’s Bank of China reported household deposits reached a historic high of $1.86 trillion (RMB 12.8 trillion) as of October 2022. Considering the loan balance, net deposits increased by $1.36 trillion (RMB 9.3 trillion), which is nearly equivalent to the total net increase in household deposits over the past decade. However, the future trajectory of these savings hinges on income prospects and the overall economic outlook.

With the easing of COVID-19 restrictions, China’s economy is expected to rebound and create a higher demand for wealth management. This presents a chance for Chinese wealth management firms to help clients identify investment opportunities and allocate their excess savings to more efficient assets. Sectors such as technology, healthcare and renewable energy are expected to offer new avenues of investment.

Offshore investment has emerged as one growth area for Chinese high-net-worth individuals (HNWI). Prior to COVID-19 pandemic, Chinese there was an increasing interest among Chines HNWI in cross-border financial investments, overseas property purchases, and non-financial cross-border needs such as education for their children and medical treatment abroad.

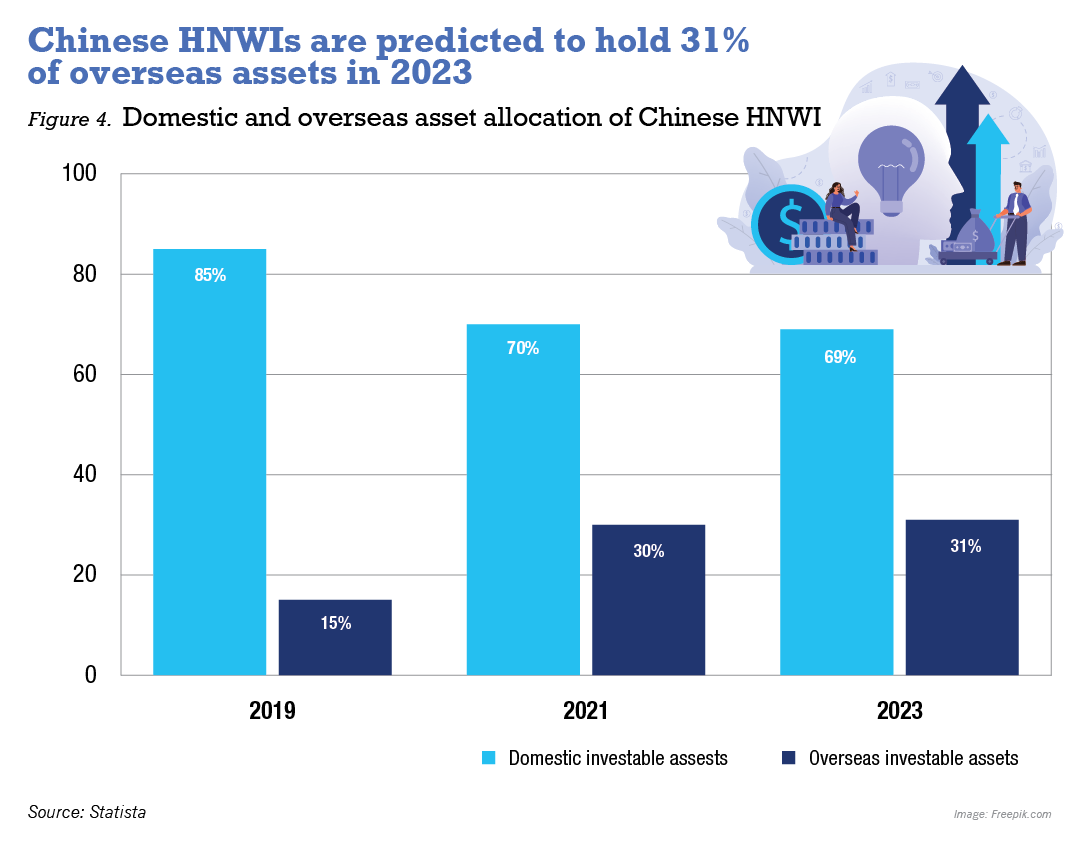

As the value of domestic real-estate slowly decreased and the equity market’s significant volatility during the self-imposed COVID isolation period, Chinese HNWIs are seeking to diversify their investments outside the country. The proportion of their overseas asset allocation has risen to 30% in 2021. This trend highlights the desire of Chinese HNWIs to explore international opportunities and mitigate risks associated with a concentrated domestic portfolio.

The focus of HNWI has expanded from personal needs to encompass family and corporate requirements, covering areas such as succession planning, taxation, law and insurance. Hong Kong remains the preferred cross-border offshore business centre, while Singapore has gradually increased its attractiveness.

Since the border reopening, more than 628,000 mainland visitors who went to Hong Kong from January to February 2023, 75 times more than the travellers in the same period in 2022, according to the Immigration Department.

Janet Pang Shuk-ching, head of distribution, wealth and personal banking at HSBC Hong Kong, highlighted that the number of non-local customers visiting the bank’s branches in February 2022 had doubled compared to January, primarily led by mainland Chinese customers. To address the rising demand for services, HSBC has opened its three branches in Hong Kong on weekends since March 2023.

Offshore trusts set up by the Chinese in Singapore grew by 44% between 2021 and 2022, according to the news publication, Nikkei Asia. This is the highest level in the past five years, surpassing the 23% YoY rise seen in 2019, before the pandemic.

However, Chinese HNWIs still face difficulties in allocating assets overseas, given the tight capital controls, transaction costs, liquidity considerations, exchange-rate fluctuations and lack of information, compounded by language and cultural barriers. All these bring opportunities for domestic wealth managers to help their HNWI clients navigate the outbound wealth allocation.

Common Prosperity and carbon neutrality goals transform advisory services, philanthropy and sustainability

The Chinese government’s ‘common prosperity’ initiative aims to reduce income inequality and ensure that the benefits of economic growth are shared more broadly across society. This has led to increased government support for philanthropy and greater incentives for individuals and corporations to contribute to charitable causes.

Globally, HNWI individuals often utilise offshore accounts for tax reduction or avoidance through legal planning. Since the 2008 financial crisis, an international network against anti-tax avoidance has been etablished.

Core regulatory documents such as the Foreign Account Tax Compliance Act and the Common Reporting Standards Multilateral Competent Authority Agreement on Automatic Exchange of Financial Account Information (CRS MCAA), together with the development trends in the internationalisation of anti-money laundering rules and the information transparency of beneficial owners, have ushered the world into an era of tax transparency.

These developments have ushered in an era of tax transparency and China is no exception. Under the common prosperity drive, tax planning will be a core service for Chinese HNWI.

China’s six ministries and commissions, including the State Taxation Administration, Ministry of Finance, People’s Bank of China (PBoC), China Banking Regulatory Commission, China Securities Regulatory Commission and China Insurance Regulatory Commission introduced the Administrative Measures on Tax-Related Information Due Diligence of Non-Resident Financial Accounts in May 2017. The measure aimed to adapt international standards to China’s national conditions to provide legal basis and operation guidelines.

Governance structures are also pivotal, as they add value to a family business. Family-run businesses face the complexity of managing family relationships intertwined with business imperatives. Developing a well-functioning management team that carefully balances family managers with non-family professionals is essential for success. While each family has its own dynamics, structures, and interpersonal relationships, identifying best practices in family governance ensures the smooth business transitions across generations.

Common prosperity fosters heightened awareness of sustainability and philanthropy

The asset and wealth management industry is undergoing a significant shift towards environmental, social, and governance (ESG) considerations. Asset managers are projected to increase their ESG-related asset under management (AUM) from $18.4 trillion in 2021 to $33.9 trillion by 2026, according to TABInsights.

PricewaterhouseCooper’s (PwC) Asset and Wealth Management Revolution 2022 report showed that ESG assets are expected to constitute 21.5% of total global AUM within the next five years. In the Asia Pacific (APAC) region, 80% of asset managers surveyed plan to increase their ESG-related AUM in the next 24 months.

Chinese HNWI are more aware of sustainability issues and the potential benefits of ESG investing. In fact, a majority (96%) of asset managers surveyed in the APAC believe that integrating ESG into their investment strategy will improve overall returns. Moreover, 64% of institutional investors in APAC, including those in China, have reported higher performance yields from ESG investment compared to non-ESG equivalents.

With the increased awareness and perceived benefits, investors, including Chinese HNWI, are willing to pay higher fees for ESG performance. About 72% would pay higher fees for ESG funds, and 67% of them are willing to pay between 21 to 40 basis points.

Despite the growing interest and willingness to invest in ESG products, there are obstacles to ESG adoption in China and the broader APAC region. Major challenges highlighted by asset managers include policy and regulations, fear of greenwashing allegations, and insufficient reliable data on ESG products.

ESG investing is gaining momentum globally, with China and the APAC region leading in terms of growth rate in ESG AUM. Chinese HNWIs are becoming more attuned to sustainability issues and are integrating ESG considerations into their investment strategies. However, they must address the need for more reliable ESG data and consistent regulation to ensure the continued growth and success of ESG investing in the region.

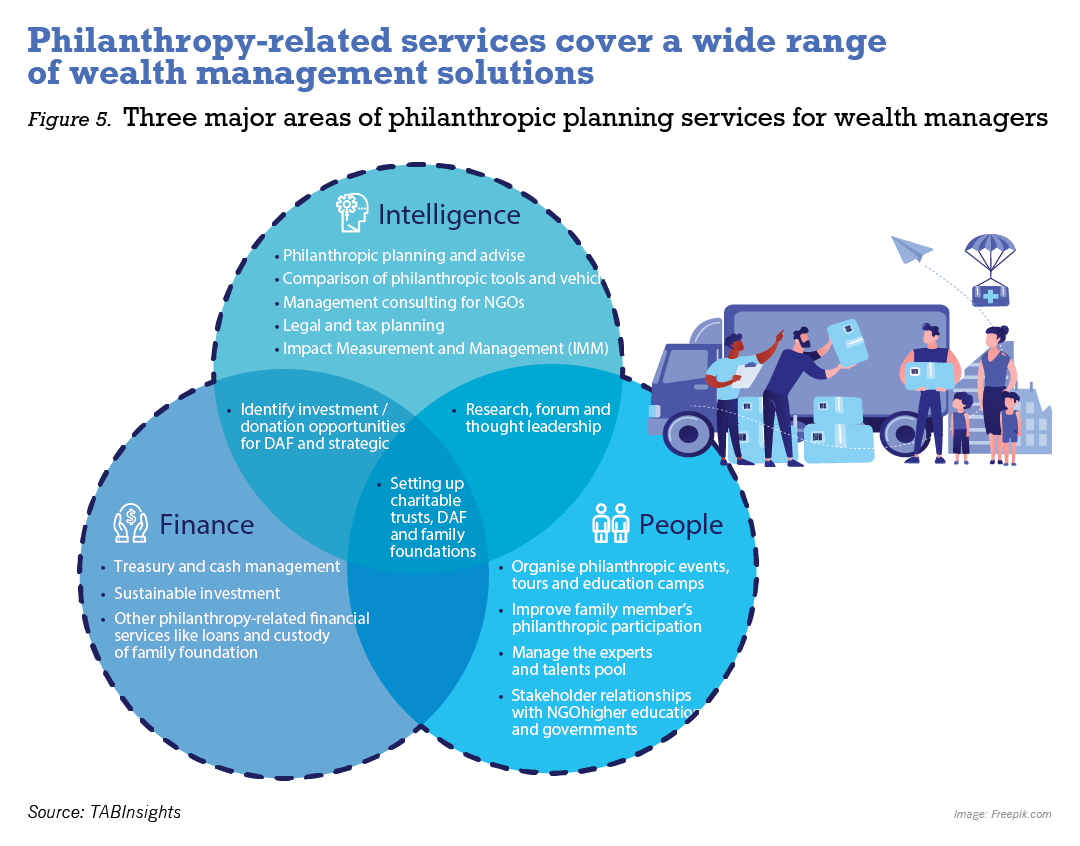

The philanthropic demands of HNWI are becoming more diversified, encompassing areas like agricultural technology, rare disease medicine research, sustainable development, and social impact investment such as education and gender equality.

In the process, strategic philanthropy has become mainstream, with HNWI wanting to take ownership of objectives, approaches, strategies and impact, as opposed to the traditional “cheque philanthropy” where donations are simply given to charities without direct involvement or influence on how the funds are utilised.

China’s philanthropy sector is experiencing significant growth with a rise in the number of philanthropic participants and specialised business. Wealth management firms are launching dedicated philanthropic planning services, leading to further expansion and intricacy of China’s philanthropic ecosystem.

Overall, the outlook for China’s philanthropy sector is optimistic, with strong government support, a growing culture of corporate social responsibility, and increasing innovation and engagement with international networks.

As China continues to grow and evolve, its philanthropic sector is likely to play a pivital role in shaping the course of wealth-for-good initiatives.

To view the full report: https://reports.tabinsights.com/global-private-wealth-management-market-outlook