- The expected rise in NPLs did not materialise in FY2021, largely due to the implementation of various measures and the strengthened risk management

- Average ROA of Asia Pacific banks improved slightly to 0.72%, as pre-provision operating profit of banks grew and loan loss provisions reduced

- Banks in Australia, Hong Kong, Indonesia, Malaysia and Thailand maintained a CAR of over 18%

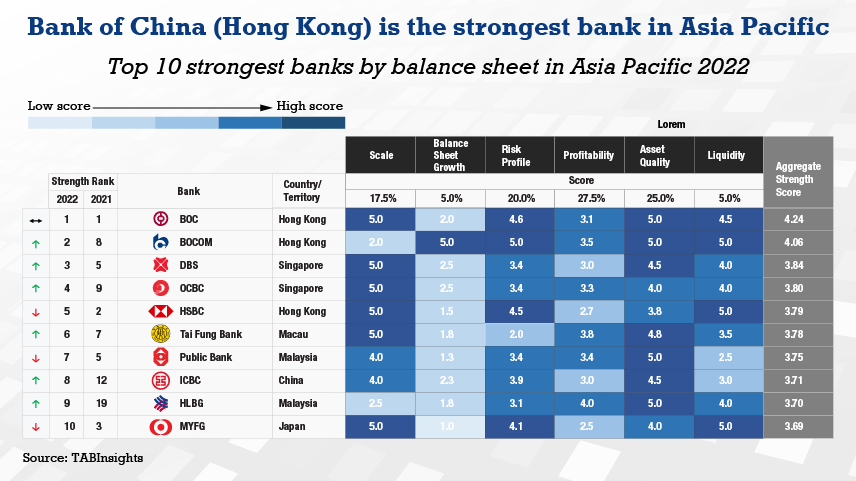

Bank of China (Hong Kong) has continued to top the annual ranking of The Asian Banker 500 (AB500) Strongest Banks by Balance Sheet, while the strongest banks in China, Japan, Macau, Malaysia and Singapore also ranked among the top 10 strongest banks in Asia Pacific. The ranking is based on a detailed and transparent scorecard that evaluates commercial banks and financial holding companies on six areas of balance sheet financial performance: the ability to scale, balance sheet growth, risk profile, profitability, asset quality and liquidity.

Bank of China (Hong Kong) performed well in scale, risk profile, asset quality and liquidity. In addition to strong capitalisation and liquidity, Bank of China (Hong Kong) also kept a low gross non-performing loan (NPL) ratio of 0.3% and a high loan loss reserves (LLRs) to gross NPLs ratio of 229% in 2021.Its cost to income ratio (CIR) increased from 30% in 2020 to 34% in 2021, due to ongoing investment in its strategic priorities and the implementation of low-carbon operation initiatives. Despite the increase, the ratio was still much lower than the average of 43% for all the 500 banks.

Most of the top 10 strongest banks demonstrated robust performance in the areas of scale and asset quality but were weaker in balance sheet growth. Hong Leong Financial Group in the top 10 improved the most, followed by Bank of Communications (Hong Kong) and OCBC Bank. Hong Leong Financial Group achieved better asset quality and profitability in FY2021. DBS Group and Public Bank, the strongest bank in Singapore and Malaysia, ranked third and seventh, respectively. Both banks showed improvement in asset quality, ROA and capital adequacy ratio (CAR).

In terms of the overall strength of the banking sector, Singapore and Hong Kong banking sectors demonstrated the highest strength in Asia Pacific. Meanwhile, banks in countries such as Australia, Malaysia, South Korea and Thailand also achieved higher strength scores than the average recorded by the 500 largest banks in Asia Pacific, at 3.18 out of 5.

Asset quality improved

The expected rise in NPLs did not materialise in FY2021. The average gross NPL ratio of the 500 banks on this year’s ranking improved to 1.5% in FY2021 from 1.6% in FY2020 and the average LLRs to gross NPLs ratio also strengthened to 195%. The slight improvement in the asset quality of banks can be largely contributed to the various debt relief programs and regulatory relaxation measures, as well as the strengthened risk management. However, 2022 and 2013 may see NPLs rising.

Fifteen out of the 22 markets recorded a reduction in average gross NPL ratio, including India, Pakistan and Sri Lanka. The asset quality of the Indian banking sector continued to improve, with the average gross NPL ratio of Indian banks on the AB500 list easing to 5.9% in FY2021 from 7.5% in FY2020. Sri Lankan banks saw a decline in the average gross NPL ratio from 9% to 8.1%, albeit remaining high. Pakistani banks also had a lower average gross NPL ratio, averaging 6.6%, compared with 7.5% in the previous year.

Banks in South Korea, Australia, Taiwan, China and Vietnam demonstrated better asset quality, while banks in Bangladesh, Sri Lanka, Brunei, Kazakhstan and India obtained lower scores in asset quality. The average gross NPL ratio of Bangladeshi banks remained the highest, at 12.7%, followed by banks in Sri Lankan, Kazakhstan and Pakistan. On the contrary, banks in Australia, South Korea, New Zealand, Hong Kong and Taiwan achieved average gross NPL ratios below 1%.

Banks in most markets had sufficient loan loss buffers to weather asset quality risks. The average LLRs to gross NPLs ratio of banks in Malaysia, South Korea and Vietnam rose significantly, while banks in Brunei, Japan, Cambodia and Sri Lanka had lower average LLRs to gross NPLs ratio than banks in other markets. The average LLRs to gross NPLs ratio of Vietnamese banks reached 186% in 2021, up from 134% in 2020.

Average ROA rose to 0.72%

The profitability of the Asia Pacific banking sector recovered with faster-than-expected rebound of the economy. The broadly stable asset quality allowed banks to reduce loan loss provisions. Meanwhile, the pre-provision operating profit of banks also grew, as they benefited from the economic recovery. On average, the ROA of these banks was up from 0.64% in FY2020 to 0.72% in FY2021.

Banks in Kazakhstan, Sri Lanka, Vietnam, Cambodia, Indonesia and Singapore obtained higher average scores in profitability, measured by four parameters, namely operating profit growth, ROA, CIR and non-interest income to total operating income ratio. By contrast, banks in Australia, Bangladesh and Japan continued to underperform.

Banks in Kazakhstan, Indonesia, the Philippines, Sri Lanka and Malaysia registered the biggest increase in average ROA. Indonesian banks saw average ROA rise from 1.3% in 2020 to 1.7% in 2021, which was still lower than 2.1% recorded in 2019. Banks in Bangladesh, India and Vietnam experienced an increase in their average ROA in both FY2020 and FY2021. The average ROA of Indian banks went up from 0.29% in FY2019 to 0.93% in FY2021, while Vietnamese banks posted a higher ROA at 1.36% compared to 1.15% in 2019. For Indian banks, FY2021 refers to the financial year ended 31 March 2022. Despite the improvement, the average ROA of banks in Bangladesh was the second lowest in the region, at 0.29%.

Vietnamese banks witnessed the largest improvement in CIR, with the average CIR reduced from 44.7% in 2020 to 37.7% in 2021. This is followed by banks from New Zealand, Sri Lanka and Thailand. On the contrary, average CIR of banks in Hong Kong and the Philippines weakened the most.

Capitalisation and liquidity remained sound

In terms of capitalisation, Indonesian banks came out on top, with the average CAR rising from 21.9% in 2020 to 23.9% in 2021. Meanwhile, the capital positions of banks in countries such as Australia, New Zealand, Sri Lanka, South Korea, Thailand and Malaysia strengthened. Hong Kong banks remained strongly capitalised, although their average CAR dropped slightly from 20.4% in 2020 to 19.6% in 2021. In addition to Hong Kong and Indonesia, some other markets also maintained a CAR of greater than 18%, including Australia, Malaysia, and Thailand.

Banks in Bangladesh and Vietnam delivered weaker performance in capitalisation compared to other markets. The average CAR of Bangladeshi banks weakened from 11% in 2020 to 10.4% in 2021, while most Vietnamese banks’ capitalisation strengthened. In Vietnam, TPBank announced it completed all the requirements of Basel III at the end of 2021 and its CAR stood at 13.2%. VP Bank and HDBank increased their CAR to above 14%. On the contrary, the CAR of BIDV, VietinBank, Sacombank and Vietcombank remained below 10%.

On average, banks in Brunei, Japan and Pakistan maintained high liquid assets to total deposits and borrowing ratios of over 50%. Hong Kong banks were also highly liquid, with liquid assets to total deposits and borrowing ratio of 48.3%. By contrast, the liquidity level of banks in Sri Lanka and New Zealand remained the weakest in the region, with their average liquid assets to total deposits and borrowing ratios decreasing to 11.6% and 18.7%, respectively.

Overall, Asia Pacific banking sector delivered better than expected financial results in FY2021. While the profitability of banks in several markets will benefit from the rising interest rates, higher interest rates may impact negatively banks’ asset quality and funding costs in 2022 and 2023. Meanwhile, loan loss provisioning has been rising in 2022, which will put pressure on profit in 2022.

Click here to see the Strongest Banks in Asia Pacific 2022