- Investments in blockchain technology is rapidly rising, crossing $1 billion in 2016

- Banks are rapidly exploring new proof of concepts but are yet to reach a scalable solution

- Regulators and industry players should work together to overcome the challenges in adopting the technology

The confidence of the financial services industry in the potential of distributed ledger technology (DLT), commonly called blockchain, has rapidly strengthened in the last two years. Leading financial institutions now seek to swiftly pilot projects to gain early mover advantage. The technology is evolving from hype to reality as new proof of concepts and use cases emerged. There is now a rising urgency to bring it to scalable industry solutions, but there remain significant challenges.

Key developments and emerging proof of concepts

Inherent advantages of this technology such as complete visibility and transparency, immutability, efficiency and smart contract capability are reshaping the thinking of how transactions will be carried out in future. Investment into the technology is rapidly rising. In 2016, the investment by venture capitals into blockchain technology had crossed roughly $1 billion (Figure 1).

.jpg)

The year witnessed stronger industry consortia and escalated efforts from financial institutions towards possible tangible returns from DLT.

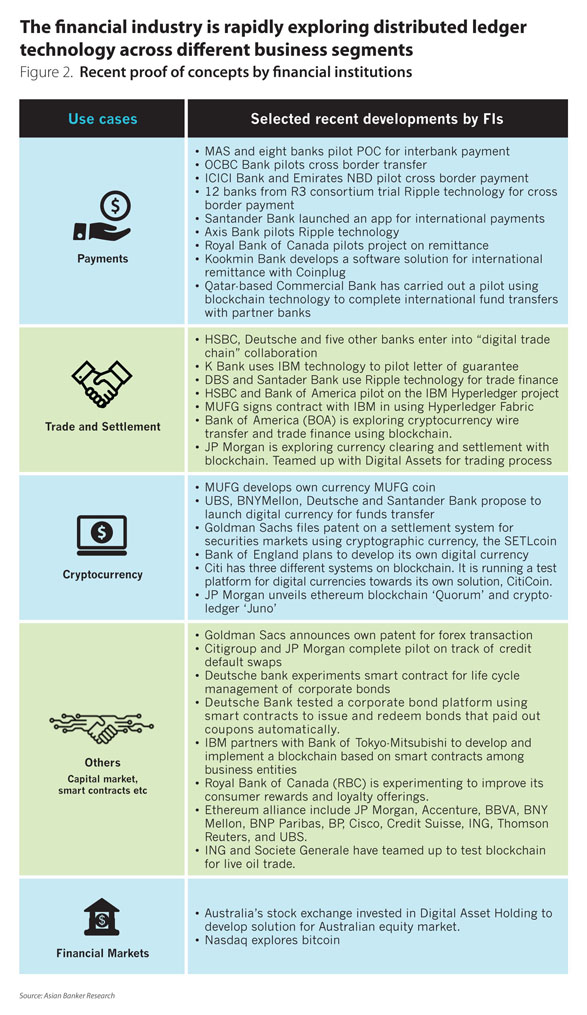

DLT finds application across different segments of financial services. Most common proof of concepts (PoC) emerged in the areas of trade finance, cross-border payments, clearing and settlement, supply chain, crypto currencies and digital identity among others (Figure 2). Smart contracts like programmable contracts that automatically execute when pre-defined conditions are met, find applications across gamut of areas including trading and settlement, mortgages and insurance.

The question remains which of these areas will be the first to become a scalable industry solution and the responses are often mixed.

For trade processes this technology comes at an opportune time. As Blythe Maters, CEO of Digital Assets Holdings, highlighted: “Post trade infrastructure environment is lagging behind with systems that are reliably processing trillions of dollars of post trade being 20 years old now, written in Cobol that is not even taught in school. They are not readily enhance-able or extendable to meet regulatory and market needs, and therefore need to be replaced. You can either spend $100 billion on old infrastructure replacing with new having same functionality at lower cost and flexibility, or you can invest into something that provides a completely different level of customer service. That’s where major market infrastructure providers are moving towards. Opportunity to be the first to provide this service to customer in this area is a very low hanging fruit and is coming at time when technology needs to be replaced.”

Payment is the other area that continues to remain a hotbed for DLT development. Various use cases demonstrate the potential of faster transactions, improved efficiency and costs. Many new initiatives in cross border payments have emerged recently, both from industry consortiums and well as individual banks. For example, OCBC carried out successful pilots of payment transactions between its subsidiaries. Transfers which typically take up to one day could be completed in less than five minutes. Other new initiatives were seen from Santander, ICICI bank, Emirates NBD, Bank of America, and MUFG among others.

“In the short term I am bullish on cross border payment – there is momentum, commitment and significant potential,” said Oliver Bussmann, fintech advisor, and former UBS group chief information officer, while sharing his views on what application based on DLT will see commercialisation first.

But opinions differ. “Cross border will have lot of focus but it is hugely complicated and involves many factors. It will probably be simpler things like harmonisation of information sharing towards confirmation, post trade related areas that will be easier to achieve and also from regulatory perspective they will easier to get across the line,” felt Sandra Ro, digitisation lead at CME group, a leading derivatives market place company.

Over last two years, industry collaboration has gained traction, especially through leading consortia like R3, Ripple, and Hyperledger. For example, Ripple formed Global Payments Steering Group (GPSG) that includes some of the major banks formulating policies and standards that will govern cross-border transfers.

R3 CEV, a leading consortium to develop solutions and standards around issuance, trade finance and smart derivatives contracts, currently has over 60 of the world’s largest financial institutions (FIs) as its members. The company developed the software ‘Corda’ that allows only counterparties involved in the transactions to be privy to the transaction. In 2016, while some of its founding members like Santander and Goldman Sachs opted to move out of this consortium it gained new members like Monetary Authority of Singapore (MAS). Recently MAS and eight banks have embarked on a PoC project to use blockchain based technology for inter-bank payments, including cross-border transactions in foreign currency, in partnership with R3. In a pilot system MAS plans to issue a digital currency that can be used by participating banks for settlement of transactions.

“What we are starting to see this year is not just technical proof of concepts, but also an understanding that technology does not exist in a vacuum. We are starting to see how this is going to fit into the existing regulatory context and the market infrastructure” said Anthony Lewis, director of research at R3 Singapore. Most industry experts agree that to be successful, DLT based projects will need to be an industry initiative, with interoperability as a critical requirement. Linux foundation’s open source collaborative effort Hyperledger saw expansion to 100 members in 2016. The initiative brings together different efforts being explored in the blockchain technology and has members like Digital Asset, IBM and R3CEV as part of its technical steering committee.

“We've been working on number of cases for financial services using blockchain. For example, with Kasikornbank Bank in Thailand, we worked on a project to fast-track traditionally lengthy procedures such as Letters of Guarantee for clients. With the Mizuho Financial Group, we are exploring the potential of blockchain for use in settlements with virtual currency. We also have PoCs in the area of trade finance with HSBC and the Bank of America Merrill Lynch. Apart from the financial services industry, we are also looking at use cases in other industries. For example, we are working with Walmart to improve the way food is tracked, transported and sold to consumers across China”, noted Zelda Anthony, head of blockchain at IBM ASEAN.

“Blockchain is about collaboration, multiple parties coming together and solving industry problems. We are finding that banks have done lot of experiments and PoC. So now what is next? I think it is really important to be thinking about what the real business case is and the prospects when you go live. I think that is where banks are starting to focus now,” she added.

Time frame for mainstream adoption

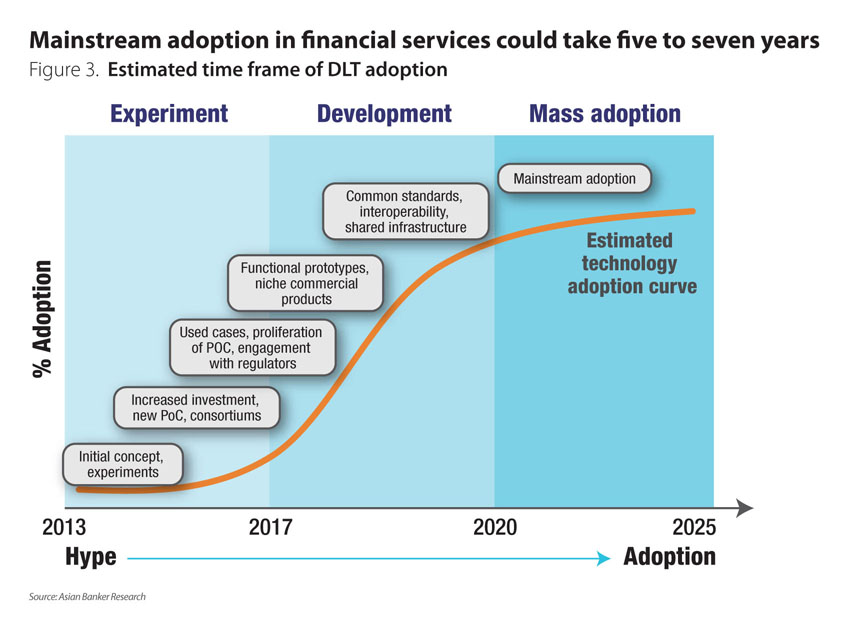

The financial services sector is probably looking at a time frame of at between five and seven years before DLT reaches mainstream industry adoption, though commercial applications may be visible within the next couple of years. The industry will have to test the new proof of concepts, develop functional prototypes that are scalable and pass many hurdles before it can achieve true scale of adoption (Figure 3). It will need greater investment of time and resources into technology development, industry collaboration and development of common standards.

There has been a proliferation of PoCs to prove the viability of the concept, increase in the number of consortia aimed at the standardisation of agreement for matter of common interest, increase in investment and significant interest from regulators. Noting these facts and talking about what would be needed if the technology were to become mainstream in next five to ten years, Master pointed that, “finally we need to see the organisation that will be trial places for adoption of this technology beginning to move now. Actual investment of time, effort, energy, reputation risk and institutional commitment to producing technology using blockchain in real world environment and you are seeing that happen. Replacing significant existing infrastructure with distributed ledger inspired technology genuinely intended for commercial adoption on enterprise scale within two years from now. If we need to see mainstream shift in five to ten years then these need to happen now.”

As investments rise, the expectations of returns become paramount. “Time horizon should be correct. If anyone thinks that cost savings will be realised tomorrow or year time – that is too short,” argued Ro. “The banks are moving from hype curve to adoption curve. Banks have done many proofs of concepts and experiments. The industry now is seeking a solution that provides a real business case,” she added.

The institutions are still in early innovation stage. “It is easier to achieve internal PoC because a bank or multiple parties within the same bank are in control. If we're looking at an industry solution, we are not there yet. But I think we will definitely see more customers going live in 2017,” said Anthony.

“When institutions look to change post trade processing from a market infrastructure perspective, then that impacts all of the institutions involved in those transactions. I think with the progress that's been made on that and the fact that they do have PoCs, we could see something go live over the next two to three years,” she added.

Growing number of blockchain initiatives around the world

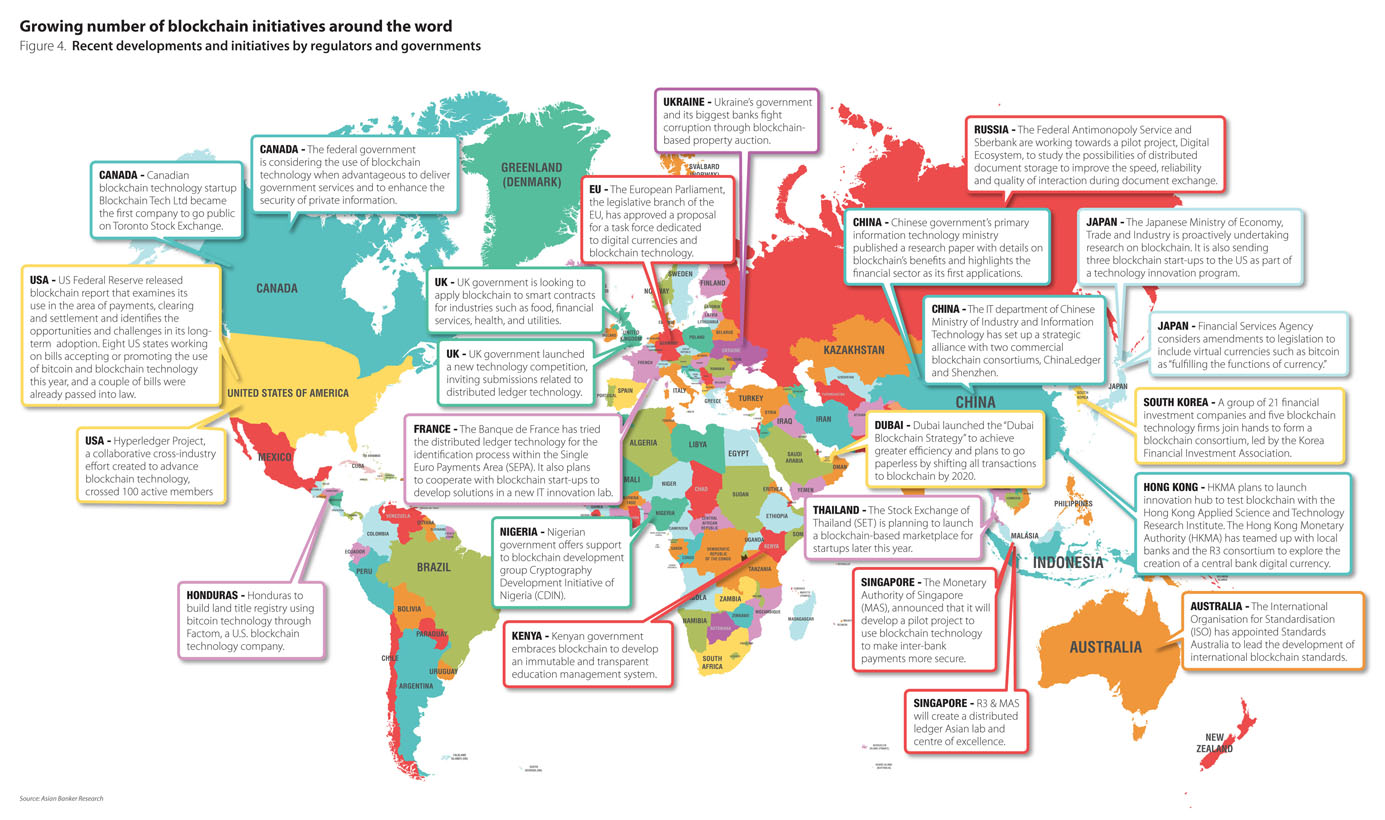

Governments and regulators are also now joining hands with the industry to explore use cases of DLT towards improving efficiency in different operational segments across industries. These government supported initiatives could lead the industry towards more concentrated efforts and boost adoption across financial services (Figure 4). For example, MAS, Singapore’s central bank launched a pilot project with the country's stock exchange and eight local and foreign banks to use DLT for interbank payments and Hong Kong Monetary Authority (HKMA) launched fintech innovation hub to test blockchain. In another example, the International Organization for Standardization (ISO) approved Standards Australia’s proposal for new international standards on blockchain, which will now lead the development of international standards in blockchain.

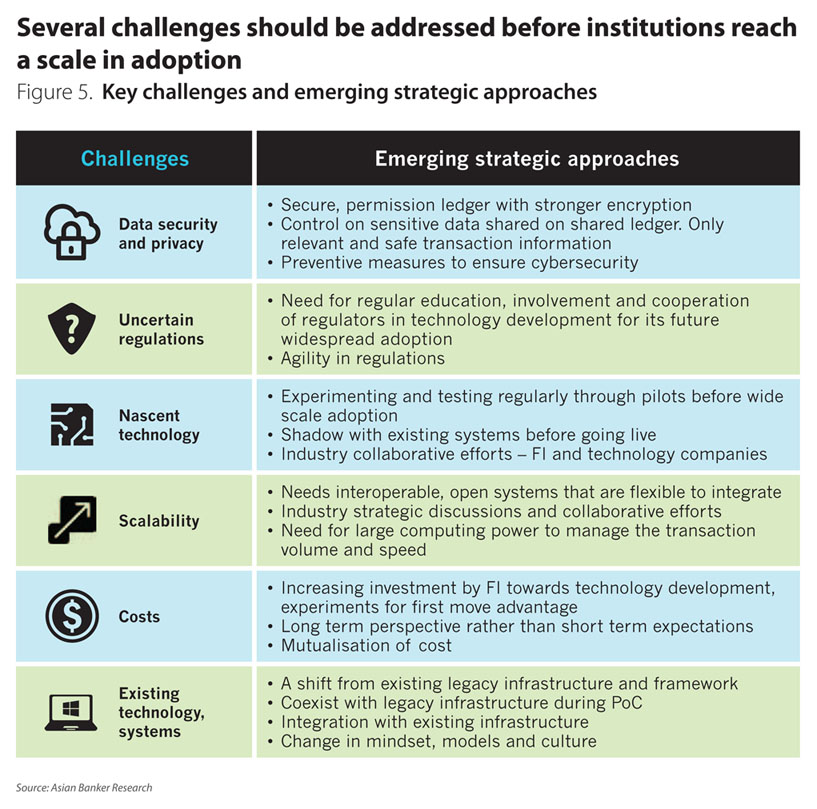

There remains a variety of risks and headwinds which will determine the design and future implementation choices (Figure 5). One of the key impediments to scale is the need for a mutually acceptable industry solution in meeting the varied business requirements. In a heavily regulated industry like financial services it requires not only close co-operation of banks and technology companies but, more importantly, regulators. The regulators are taking a cautious approach, for example, European Central Bank (ECB) recently stated in a report that blockchain technology lacks the necessary maturity to be part of its market infrastructure.

“The challenge in international payments is ensuring that the technology is available and usable by everybody in the ecosystem from the smallest fintech to the largest company. If you do a PoC, then your next step is probably to do a pilot with a number of banks. You could also do something like a ‘shadow’ where you have existing processes in place while you follow it with blockchain before you go live,” commented Anthony.

One common concern is that technology is inherently bringing mutualisation of data base infrastructure in secure environment. “For the technology to have maximum benefit it needs network effect. In other words, multiple parties need to have same religion, decide to show up at same place to worship. If that is the requirement it is fair point to say that it is going to be hard to achieve,” Masters asserted.

The companies are engaging in innovative solution finding. “It is now possible to roll out this technology in a manner that allows some but not all participants to participate fully in the distributed ledger. For those who want or need to be slower for some reason, can coexist in a non disadvantage fashion, with the ones that decide to be direct market participants. So this is no longer actually an impediment,“ said Masters. This, if achieved, would enable coexistence of those benefiting from the ability of a shared ledger with those that continue to rely on trustworthiness of settlement infrastructure provider and undertake reconciliation process accordingly.

The institutions and consortia realise the need to actively engage regulators and manage risks. In June 2016, a smart contract on Ethereum’s public, permission less blockchain was hacked to access funds, valued at nearly $50 million. The incident highlighted the risks and need for strong governance.

Security of sensitive information and money laundering are some the other risks that need to be addressed. HKMA recently raised red flags that blockchain could increase the risk of money laundering. Most consortiums are now working with regulators, explaining its risks and benefits. One key technology advantage is that the information can be shared to all parties simultaneously including to regulators which can potentially remove friction from compliance and regulatory reporting perspective.

A solution is also needed to ensure that any sensitive information in shared ledger is secure and kept confidential. The encryption of sensitive information still carries risks of possible compromise. The latest thinking for example by Corda from R3 is to avoid sharing sensitive contractual information on a ledger. Instead using shared ledger to synchronise and notify parties of proof of transaction activity.

The other key challenges that need to be addressed include the need for a scalable solution with high computing power to be able to transact millions of transactions per second.

The challenges and bottlenecks are aplenty although the technology is evolving rapidly with enormous amount of innovative thinking. It still remains to be seen what shape this technology will take in the future. Besides technology development, the industry will also need to develop a futuristic roadmap towards market collaboration, regulatory standards and shared infrastructure to realistically progress towards mainstream adoption.