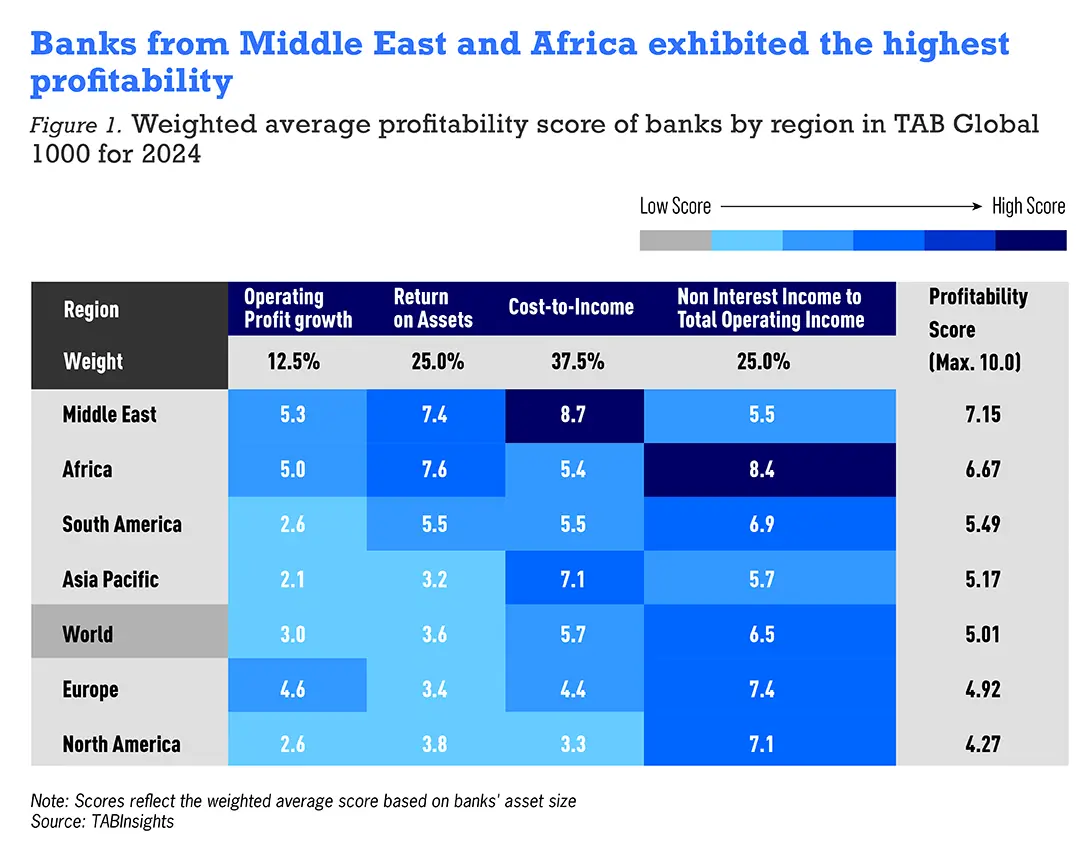

Banks from the Middle East and Africa outperformed in overall profitability, with half of the top 10 most profitable banks globally hailing from these regions. Both regions saw notable improvements in bank profitability in financial year (FY) 2023. Higher interest rates widened net interest margins (NIM), boosting performance. Additionally, African banks, particularly from Nigeria, realised substantial gains from foreign exchange revaluation, making Nigerian banks the most profitable globally. Middle Eastern banks, especially from the United Arab Emirates (UAE), benefited from robust oil prices and a strong economy.

Middle Eastern and African banks stood out in operating profit growth and return on assets (ROA), according to the TAB Global 1000 World’s Strongest Banks Ranking 2024. In FY2023, the average ROA for banks from Africa and the Middle East reached 2.4% and 1.7%, respectively, significantly exceeding the global average of 0.8%. Additionally, banks from the Middle East and Asia Pacific demonstrated superior operational efficiency, with cost-to-income ratios (CIR) averaging 33% and 42%, respectively, compared to the global average of 50%. African and European banks excelled in revenue diversification, achieving average non-interest income ratios exceeding 40%.

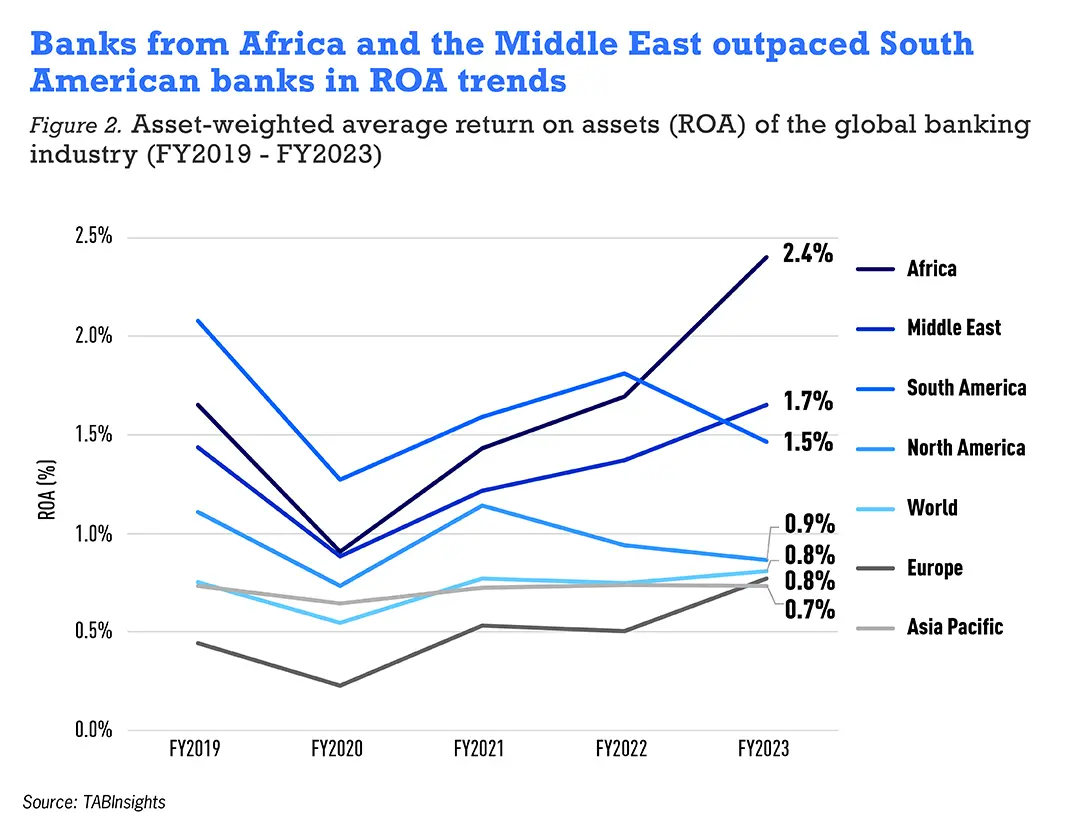

Banks from Africa and Middle East achieved the highest ROA

Banks from Africa, the Middle East and South America have maintained higher average ROA than those from other regions. Between FY2019 and FY2022, banks from Africa ranked second in ROA, with an average of 1.4%, trailing South America, which recorded an average of 1.7%. Interest rates in Africa and South America are higher than in other regions. In Africa, elevated rates are driven by inflationary pressures, economic volatility and risk premiums linked to political and financial instability. Similarly, South American countries face persistently high rates due to inflation, challenges in monetary policy and efforts to attract foreign investment.

In FY2023, however, African banks surpassed those in South America, achieving an ROA of 2.4%, up from 1.7% in FY2022, supported by a persistently high-interest rate environment. South American banks saw a decline in average ROA to 1.5%, down from 1.8% in FY2022, driven by challenges in asset quality and slower loan growth. The high profitability of African banks was also supported by several factors, including stricter capital regulations that improve risk management and efficiency, the dual effects of inflation on loan values and costs, effective control of operating expenses and high market concentration, enabling economies of scale and increased market power.

Meanwhile, Middle Eastern banks also demonstrated strong profitability, benefiting from low-cost current and savings accounts as a key funding source in most countries in the region. The average ROA of Middle Eastern banks surpassed that of South American banks, rising from 1.4% in FY2022 to 1.7% in FY2023, supported by high oil prices and solid economic conditions. With stronger liquidity, UAE banks outperformed their counterparts in countries such as Qatar and Saudi Arabia, with ROA rising from 1.6% in FY2022 to 2.1% in FY2023.

Despite a strong performance in bank profitability, significant disparities persist. The top 10% of the 1000 Strongest Banks Ranking outperformed the rest, with the average ROA increasing from 2.63% in FY2022 to 3.73% in FY2023. In contrast, the ROA of the middle 80% of banks remained relatively stable, ranging from 0.86% to 0.92% over the same period. This gap can be partly attributed to differences in cost management. The top 10% in cost efficiency achieved an average CIR of 28% in FY2023, while the middle 80% had a much higher average CIR of 50%.

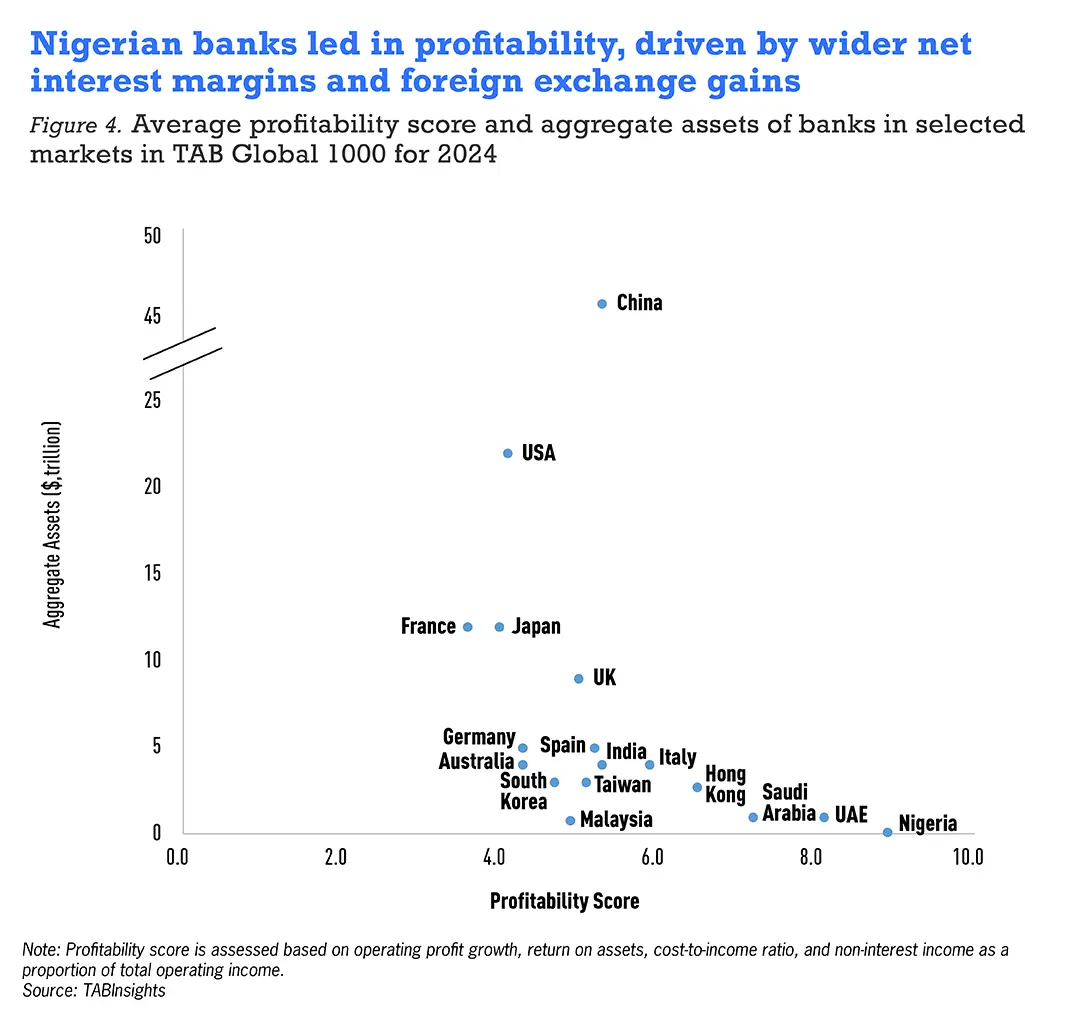

Four Nigerian banks are among the top 10 most profitable banks in the world

In this year's TAB 1000 evaluation, Nigerian banks secured the highest average profitability score, assessed through operating profit growth, ROA, CIR and non-interest income as a proportion of total operating income.

The combined net profit of Nigerian banks listed in the 2024 ranking surged by 219% in 2023, driving the average ROA up to 3.8%, compared to 1.7% in the previous year. This was mainly fuelled by wider NIM, foreign exchange gains and expansion into other African markets. The Central Bank of Nigeria raised its monetary policy rate several times in 2023, reaching 18.75% by year-end. Furthermore, the sharp devaluation of the official exchange rate resulted in significant foreign exchange revaluation gains, as banks held long net open positions in foreign currency. Nigerian banks' combined net interest income and non-interest income rose by 81% and 158%, respectively, in 2023. Meanwhile, the average CIR for these banks improved from 56% in 2022 to 39% in 2023.

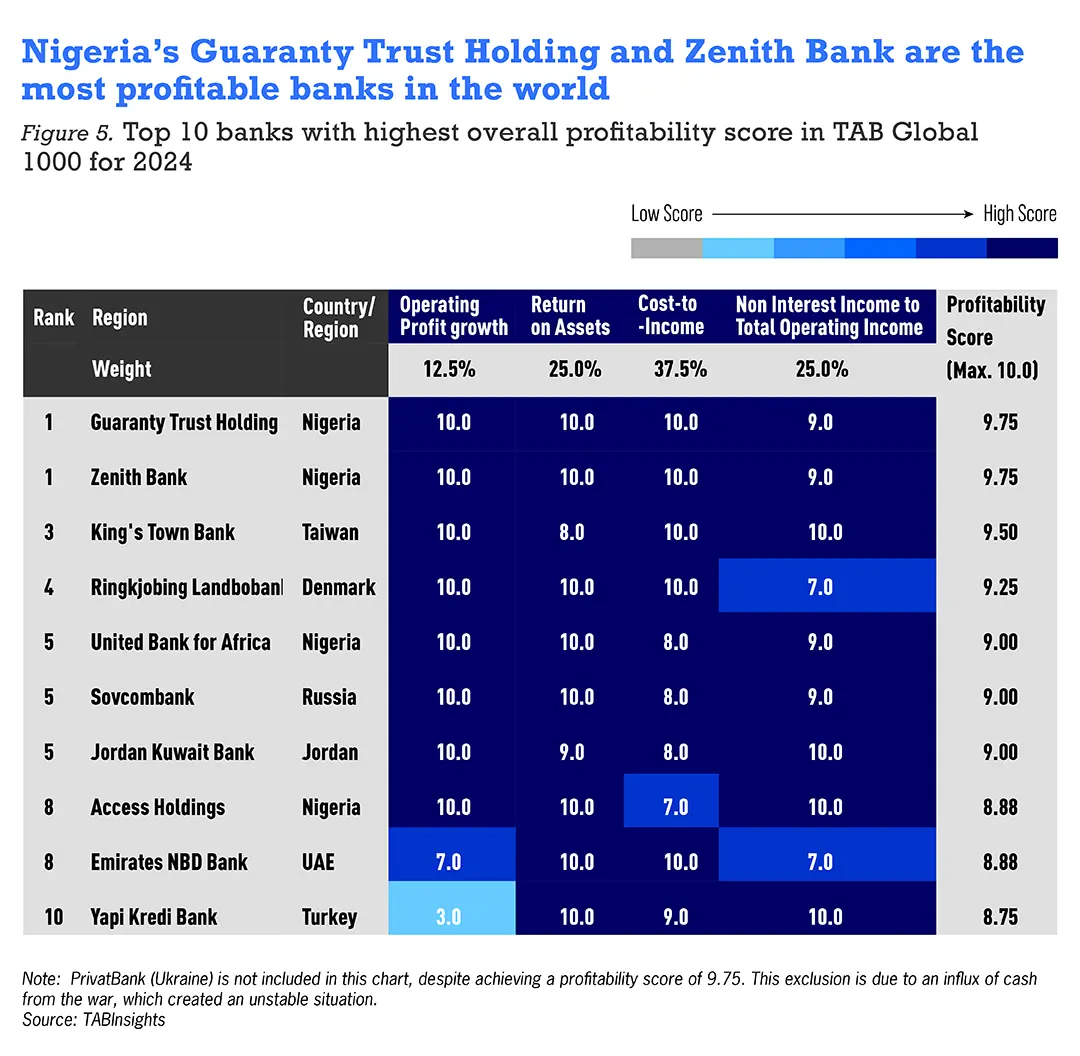

Four Nigerian banks are placed in the top 10 most profitable banks in the world, namely Guaranty Trust Holding, Zenith Bank, United Bank for Africa and Access Holdings. Both Guaranty Trust Holding and Zenith Bank received an overall profitability score of 9.75 (out of 10) in the Strongest Banks Ranking 2024, followed by United Bank for Africa at 9.0 and Access Holdings at 8.88. All these banks experienced significant improvements in profitability in 2023.

Among these banks, Guaranty Trust Holding had the highest ROA at 6.8% in 2023, followed by Zenith Bank at 4.2%, United Bank for Africa at 4.1% and Access Holdings at 3.3%. Guaranty Trust Holding also saw the largest increase in ROA in 2023, largely driven by foreign exchange revaluation gains, which contributed around 40% to its operating income.

Meanwhile, the substantial growth in operating income led to a significant improvement in the CIR of these banks, with Guaranty Trust Holding having the lowest ratio at 24%. Additionally, all these banks displayed high revenue diversification, with non-interest income accounting for 54% to 58% of total operating income.

In the Middle East, UAE banks achieved the highest average profitability score, followed by banks from Egypt, Saudi Arabia and Qatar. The combined operating income and net profit of all UAE banks listed in the ranking rose by 29% and 46%, respectively, in 2023. Emirates NBD Bank, based in the UAE, ranks among the top 10 most profitable banks globally and holds the largest asset size within this group. Its net profit surged by 65% in 2023, with ROA rising from 1.8% in 2022 to 2.7% in 2023. This growth was driven by a stable low-cost funding base, healthy balance sheet growth, increased transaction volumes and lower impairment charges.

Sustaining the profitability achieved in FY2023 is challenging for banks, as many central banks have begun lowering rates to stimulate economic growth, which narrows margins. African banks face greater difficulties in maintaining profitability compared to their Middle Eastern counterparts. While factors such as stricter capital regulations and effective control of operating expenses have contributed to improved profitability, African banks' strong performance in FY2023 was largely driven by external factors, such as foreign exchange gains, which provide short-term boosts but also introduce vulnerabilities. In July 2024, a finance bill imposing a 70% tax on Nigerian banks' windfall foreign exchange profits was passed, prompting bank CEOs to lobby for a reduction. Combined with a new foreign exchange system, Nigerian banks face challenges in maintaining profit levels. Additionally, asset quality issues continue to weigh on African banks' profitability. Achieving sustainable profitability will require an increased focus on operational resilience and long-term strategic planning.