- Banks have recognised their wealth management business as an important source of revenue, as consumers become more financially and technology-savvy

- In 2016, top banks in emerging markets have higher market shares in their industry as compared to top banks in mature markets

- The demand for wealth management products and services will continue to grow

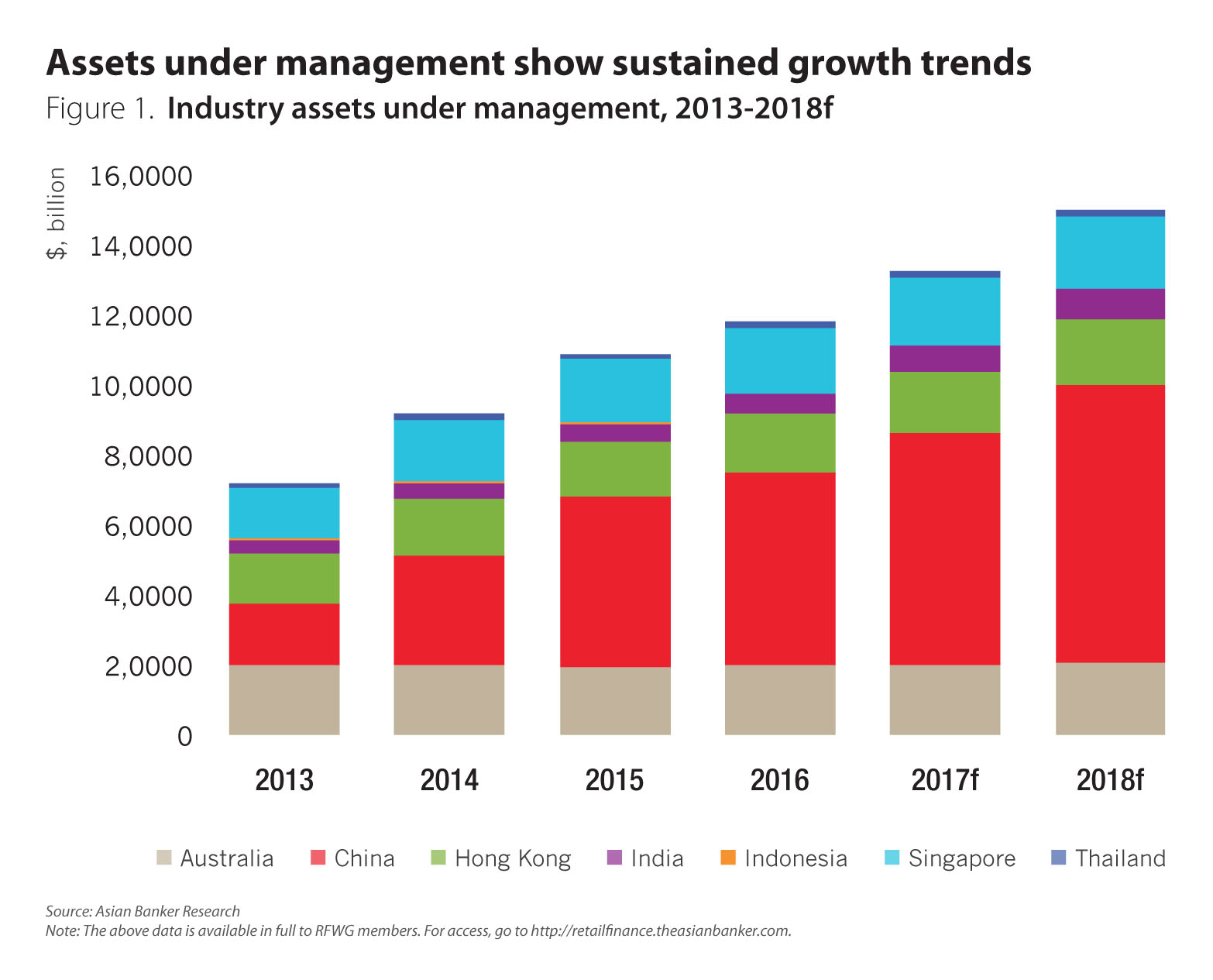

Wealth management activities have increased in Asia Pacific. In selected countries, combined industry assets under management (AUM) have reached about $11 trillion in 2016. This figure has grown at an average 18% annually for the past three years, and will sustain its upward trend to approximately $15 trillion by 2018 (Figure 1). However, despite growth trends in industry AUMs, some banks fall short in expanding their market share and customer base.

In this report, Asian Banker Research compares the AUM of top banks and their subsidiaries among selected Asia Pacific countries, and consider industry trends that drive their AUM performance. Banks have recognised their wealth management business as an important source of revenue, as consumers become more financially and technology-savvy. Some banks have expanded their customer base and have grown their AUMs by successfully implementing strategies in customer relationship management, as well as improving customer acquisition and experience by leveraging on technology. In selected countries in the region, the AUMs of top banks and their subsidiaries grew at an average 15% yearly to about $3 trillion in 2016. By 2018, the AUMs of top banks are expected to grow at an average of 18% a year to about $4 trillion. The countries chosen for this review are Australia, China, Hong Kong, India, Indonesia, Singapore and Thailand.

Retail banks’ AUM in emerging versus mature markets

In 2016, top banks in emerging markets such as China, India, Indonesia and Thailand, have higher market shares in their industry AUMs, as compared to top banks in mature markets such as Australia, Hong Kong and Singapore. Among the emerging markets, top banks in Thailand led the pack, accounting for a 70% market share or about $178 billion of its industry AUM in 2016. Market shares of top banks in Indonesia and China contributed to more than 30% of their industry AUMs. In these markets, banks and their subsidiaries continue to play key roles in the distribution of wealth management products and services, as compared to independent asset management, insurance, trusts and fund advisory companies. In contrast, in mature markets, other firms that are not subsidiaries of banks have a fair share in their industry AUMs. In particular, banks in Hong Kong have accounted to only 7% or about $123 billion of its $2 trillion industry AUM last year. Top banks in Singapore accounted to about 14% or $256 billion of their industry AUM, while top banks in Australia covered 22% or $457 billion of the country’s industry total.

Australia

The Australian Prudential Regulation Authority has imposed a new capital requirement for Australian banks this year, wherein common equity tier one capital (CET1) ratio should be at least 10.5% by 2020. To generate additional capital, banks have been opting to divest from their wealth management units, as costs outweigh gains in retaining fund management business. In particular, compliance costs in life insurance have risen, while wealth management income have moderated. In 2016, the four major Australian banks accounted for 22% or $457 billion of the industry AUM, a drop from the 27% or $565 billion market share recorded in 2013.

Despite slowing growths in AUMs, banks still consider wealth management as a key income growth driver. For this reason, banks have left fund management functions while focusing on distribution of managed funds, life insurance and superannuation. For instance, Commonwealth Bank of Australia (CBA), with AUM amounting to $270 billion as of June 2017, has sold its life insurance business and partnered with to AIA Group. This partnership allows CBA to leverage on AIA’s insurance capability, while it focuses on distribution strategies to tap its existing 13 million retail customers. The four major banks in Australia are moving towards adopting this new wealth management business model in their asset management, insurance and fund advisory units.

Hong Kong

In 2016, industry AUM grew at an average 4% annually in the past three years to $2 trillion. However, the AUM share of banks barely moved at 7% last year from 8% in 2013. This reflects steep competition in Hong Kong’s fund management industry, with market players consisting of local and foreign banks and non-banks. The industry’s market players have recognised the growing demand of retail investors in higher returns and more diversified portfolio allocation. In efforts to grow their AUMs, fund management firms have increased their product offerings. As of March, the authorised unit trusts and mutual funds of the Securities & Futures Commission of Hong Kong totalled 2,203, up by 3.3% from the previous year. Last year, China and Hong Kong jointly launched the Shenzhen-Hong Kong Stock Connect, a platform that allows cross-border investors to directly access the stock markets of both countries. Leveraging on this development, the Bank of China Hong Kong’s Remittance Plus service has become well positioned with customers investing in Hong Kong and China stock markets. By allowing customers to make international toll-free phone banking services, the bank has opened-up opportunities to capture a bigger share in the industry AUM. In addition, the bank has launched its China-themed mixed asset fund in August, on expectations Chinese stocks and bonds will be bullish.

Singapore

As Singapore aims to become a regional hub for fund management and domiciliation, the Monetary Authority of Singapore have supported a competitive environment for local and foreign wealth managers. The country’s industry AUM has grown at an average 15% yearly to $2 trillion in 2016. With a large pool of market players, banks’ share in the industry AUM remained low at 15% and 14% in 2013 and 2016, respectively. Given the steep competition, banks have recognised the potential of leveraging on technology to improve market penetration and customer experience. For instance, DBS Bank has launched its DBS iWealth in its digital platforms, allowing customers to access services, product information and research, trade equities and invest in funds online or using their mobile phones. This has strengthened its stickiness, with about 70% of its wealth customers actively managing their wealth digitally.

China

The annual growth of industry AUM in China remains robust at 20% to $6 trillion in 2016, but has slowed from the average 57% annual growth in the past three years. This moderation is mainly due to the clamp down of the China Banking Regulation Commission on wealth management products (WMPs) in the country. Nonetheless, banks remained key distribution channels of WMPs and mutual funds in the country, in which top banks have accounted for 34% of the industry AUM last year. With stricter compliance rules, banks have leveraged on technology to remove impediments to their AUM growth. In the case of ICBC Bank, it has introduced a robo-adviser service for its WMPs, allowing customers to access investment advice through their mobile phones. Last year, the bank’s personal WMP AUM increased by 3% year-on-year to $408 trillion.

India

In India, wealth management activities such as mutual funds and insurance schemes expanded by an annual increase of 16% to an estimated industry AUM of $554 billion in 2016. Top Indian banks and their subsidiaries have captured about 22% share or $122 billion of the industry AUM last year. This is higher than its 16% market share recorded three years before. Particularly in mutual funds, banks in India have recognised the increasing demand in this investment, as retail investors look for higher returns and shift to creating long term wealth. In 2016, top Indian banks’ share in total mutual funds AUM expanded close to 40% in 2016. Despite AUM growth trends, banks have recognised that overall mutual funds penetration remains shallow in India. In efforts to grow their customer base ad AUMs, local banks have focused on improving customer relationship management. For example, ICICI Bank has opened two branches exclusively for wealth management. It has designated teams of relationship managers who prioritise the banking and investments needs of their wealthy customers.

Indonesia

In Indonesia, banks have sustained their leadership in wealth management engagements. Although relatively small compared to emerging markets in Asia Pacific, the mutual funds AUM in the country totalled $20 billion in 2016, up 16% a year ago. The share of top banks in the industry AUM accounted to 37% or $8 billion of the industry AUM in 2016, up from its 30% share three years before.

Despite banks’ growing engagement in mutual fund distribution, penetration remain small at $20 billion in 2016, compared to other emerging markets in the region. Banks have recognised the low mutual fund penetration in the country, despite a rising population of high net worth individuals (HNWIs) in the country. The number of Indonesia’s HNWIs stood at 54,400 in 2016, up 13.7% from the previous year. HNWI wealth increased by 14.3% to $184 billion during the same period, data from research firm Capgemini Financial Services showed. Given the low fund penetration, banks leverage on technology to address the gap. For example, Bank Central Asia has been using its digital platforms to offer new funds and investment planning services.

Thailand

In Thailand, wealth management activities are on the rise, with the industry AUM growing at a three-year average rate of 15% to $178 billion in 2016. Top Thai banks’ share in industry AUM, was close to 70% in the past three years to $123 billion in 2016. However, the industry is still relatively small compared to emerging markets in the region like India. Although, the country has one of the highest growing population of high net worth individuals (HNWIs) up at an average 13% annually, they still prefer cash or traditional deposit products over investment products like mutual funds. Thai banks have recognised the gap in financial knowledge among the mass affluent and HNWIs, as some banks implemented more customer-centric programs that engages wealthy customers. For example, Kasikornbank has launched its family wealth planning services in 2016, which supports both personal, business and family wealth investments of customers.

Demand for wealth management products and services will continue to grow

Consumers in Asia Pacific countries have become more financially knowledgeable and tech-savvy. More bank customers will be looking for higher returns in their savings, as compared to returns from traditional banking products. This also means customers will be more inclined to investment planning. Similarly, as wealth managers allow customers to access its services through digital platforms, more markets limited by branch constraints will be tapped.