- China and Japan continue to lead the region in the number of banks on the list

- Banks’ balance sheet growth accelerated the most in Thailand and India, largely attributed to mergers and acquisitions

- The pandemic is expected to further accelerate bank consolidations

Industrial and Commercial Bank of China, China Construction Bank, Agricultural Bank of China, Bank of China and Mitsubishi UFJ Financial Group have remained the top five largest in Asia Pacific, according to The Asian Banker 500 (AB500) 2020, an evaluation of the 500 largest commercial banks and financial holding companies (banks) in the Asia Pacific region. This year, the financial information in the first half of financial year 2020 (1H FY2020) was collated and incorporated into the assessment of how banks performed during the COVID-19 pandemic.

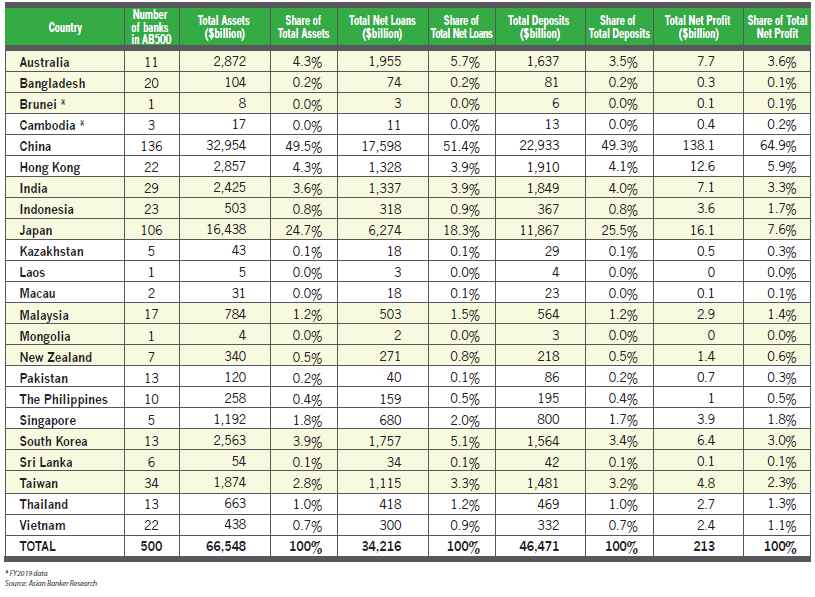

This year’s evaluation covers 23 countries and territories, and the 500 largest banks combined had $66.5 trillion in total assets, $34.2 trillion in net loans and $46.5 trillion in customer deposits. These banks generated aggregate net profit of $213 billion in 1H FY2020, compared with $240 billion in 1H FY2019. It’s the first time that banks in Kazakhstan have been included in the evaluation. The five banks from Kazakhstan on the list had total assets ranging from $3.75 billion to $24 billion.

Australia and New Zealand Banking Group overtook Commonwealth Bank of Australia as the largest bank in Australia. These two banks are very close in terms of total assets, same as Shinhan Financial Group (Shinhan) and KB Financial Group (KB) in South Korea and Vietnam Bank for Agriculture and Rural Development (Agribank) and Bank for Investment and Development of Vietnam (BIDV) in Vietnam. In this year’s ranking, Shinhan overtook KB to become the largest in South Korea and Agribank ranks in first position in Vietnam in terms of total assets.

Bangkok Bank placed fourth in Thailand in last year’s evaluation, which was based on the data in FY2018, and now becomes the largest bank in the country, as the bank completed the acquisition of an 89.12% stake in Indonesia’s Bank Permata in May 2020. Siam Commercial Bank, the largest bank in Thailand in 2018, fell to fourth position, which can be attributed to the divestment of SCB Life Assurance and decline in bank lending.

Chinese and Japanese banks continue to dominate the list

Figure 1: Aggregate total assets, net loans, customers deposits and net profits (1H FY2020)

China and Japan dominate

China and Japan continue to lead the region in terms of number of banks on the list. Chinese banks and Japanese banks account for 49.5% and 24.7% of the aggregate total assets of the 500 largest banks in Asia Pacific, respectively, while the share of total assets is less than 0.5% in 10 out of 23 economies. The share of net profit for Chinese banks is 64.9%, much higher than 7.6% for Japanese banks.

Top 10 largest banks in the region comprise six Chinese banks and four Japanese banks. Another six Chinese banks and one Japanese bank are on the list of top 20 largest banks. Sumitomo Mitsui Financial Group moved up one spot to sixth thanks to stronger asset growth than Japan Post Bank, but its total assets was still 54% less than Mitsubishi UFJ Financial Group as at the end of September 2020. Postal Savings Bank of China also improved one place in the ranking, coming in at ninth position, and Bank of Communications fell to tenth position. China Minsheng Banking Corporation surpassed China CITIC Bank to become the tenth largest bank in China.

Top 20 largest banks ranking remains largely unchanged

Figure 2: Top 20 Largest Banks in Asia Pacific

.png)

Balance sheet growth accelerated

When measured on an asset-weighted basis, average asset growth rate of Asia Pacific banks on the list accelerated to 10.3% year-on-year (YoY) at the end of 1H FY2020 from 6.6% YoY at the end of 1H FY2019. These banks also registered a faster loan growth, at 11.3% YoY at the end of 1H FY2020, compared to 8.3% YoY in the prior year. Meanwhile, banks in the region saw their average deposit growth increase from 7.6% YoY at the end of 1H FY2019 to 10.5% YoY.

Banks’ balance sheet growth accelerated the most in Thailand and India, which can be largely attributed to mergers and acquisitions. In Thailand, in addition to Bangkok Bank’s acquisition of Bank Permata, TMB Bank also acquired Thanachart Bank and its total assets was up by 140%. Countries like Japan, Australia, Kazakhstan, New Zealand and Sri Lanka also witnessed much faster balance sheet growth. In Japan, average loan growth improved to 10.2% YoY at the end of September 2020 from 0.7% YoY a year ago. Excluding Japan Post Bank, average loan growth was 5.9% YoY, compared to 4.4% YoY a year ago. The Bank of Japan encouraged banks to boost lending to businesses hit by the coronavirus pandemic. Their average deposit growth accelerated from 1.9% YoY to 7.5% YoY, as Japanese companies deposited more funds at banks as a precaution to meet the funding needs and households held more cash amid uncertain economic prospects.

In contrast, apart from countries with only three banks or less in the ranking, Indonesia, Pakistan, and Philippines saw average bank lending growth decelerate the most. The sluggish loan demand amid the pandemic resulted in a considerable drop in Indonesian banks’ average loan growth to 0.2% YoY at the end of 1H FY2020 from 14.3% YoY, while deposits expanded by an average of 9.1% YoY. Pakistan is the only economy that witnessed a contraction in bank lending, with average loan growth weakening from 13.2% YoY to -0.4% YoY, despite various measures announced by the central bank such as the cuts in interest rate, reduction in the capital conservation buffer from 2.5% to 1.5% and the increase in borrowing limits.

Bank consolidation continues

The number of Indian banks on the list was down from 39 in last year’s evaluation to 29, which is largely driven by the consolidation of public sector banks. Vijaya Bank and Dena Bank were merged with Bank of Baroda with effect from April 1, 2019, and ten public sector banks were merged into four with effect from 1 April, 2020.

The government of India announced the mega merger plan in August 2019. Despite the impact of COVID-19, the government did not defer the consolidation exercise. Oriental Bank of Commerce and United Bank of India merged into Punjab National Bank, Syndicate Bank into Canara Bank; Andhra Bank and Corporation Bank into Union Bank of India; and Allahabad Bank into Indian Bank. The number of public sector banks in the country has been brought down to 12. After the merger, Punjab National Bank is the second-largest public sector bank in the country, followed by Bank of Baroda, Canara Bank and Union Bank of India.

In Indonesia, Bank Central Asia acquired Bank Royal Indonesia in October 2019. Bank BNI Syariah and Bank Syariah Mandiri will merge with Bank BRI Syariah to form Bank Syariah Indonesia, which will be among the top 10 largest banks in the country. The core capital requirement for banks has been increased to IDR 3 trillion ($215 million) by 2022, according to new rules issued by Indonesia’s financial services authority, Otoritas Jasa Keuangan (OJK). Many smaller banks won’t be able to meet the new capital requirements, and thus they will be forced to continue consolidation.

Looking forward, the pandemic is expected to accelerate consolidation. More mergers and acquisitions activity involving troubled smaller banks is expected, especially those in China and Indonesia. Meanwhile, other banks will also consider mergers and acquisitions to achieve scale benefits, improve operational efficiencies, and expand operations in other markets.

Click here to see the 2020 Largest Banks Ranking