- Regulation framework is needed to develop open banking.

- Setting the groundwork to embrace open banking in Africa.

- Open banking has the potential to transform and scale financial services.

Africa is still suffering from lack of access to financial services brought by the high cost of financial products, inaccessible bank branches, and low financial literacy. Open banking is beneficial to improve both access and affordability of financial services.

Open banking is the practice of sharing financial data with third-party using application programming interfaces (APIs) within data privacy rules. The parties involved in open banking practice are API providers such as banks, API consumers, like fintech companies and end-customers. Customers own the data released by API providers to consumers. However, the question is, does Africa leverages the right infrastructure for open banking?

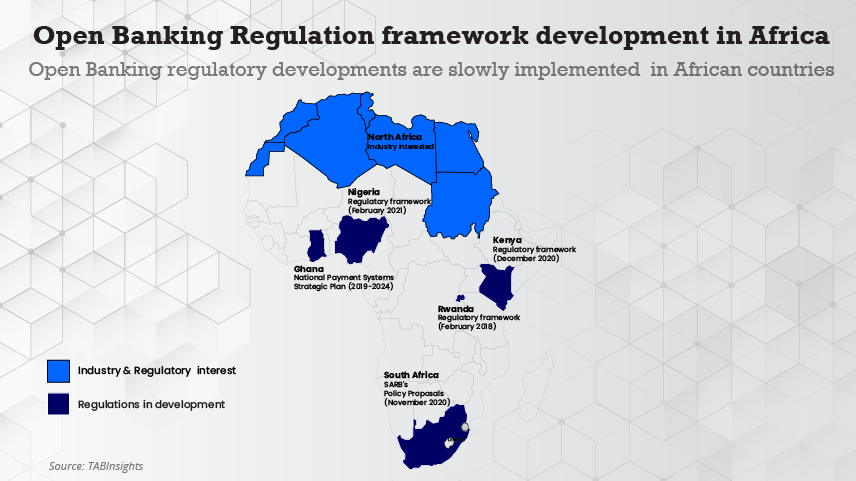

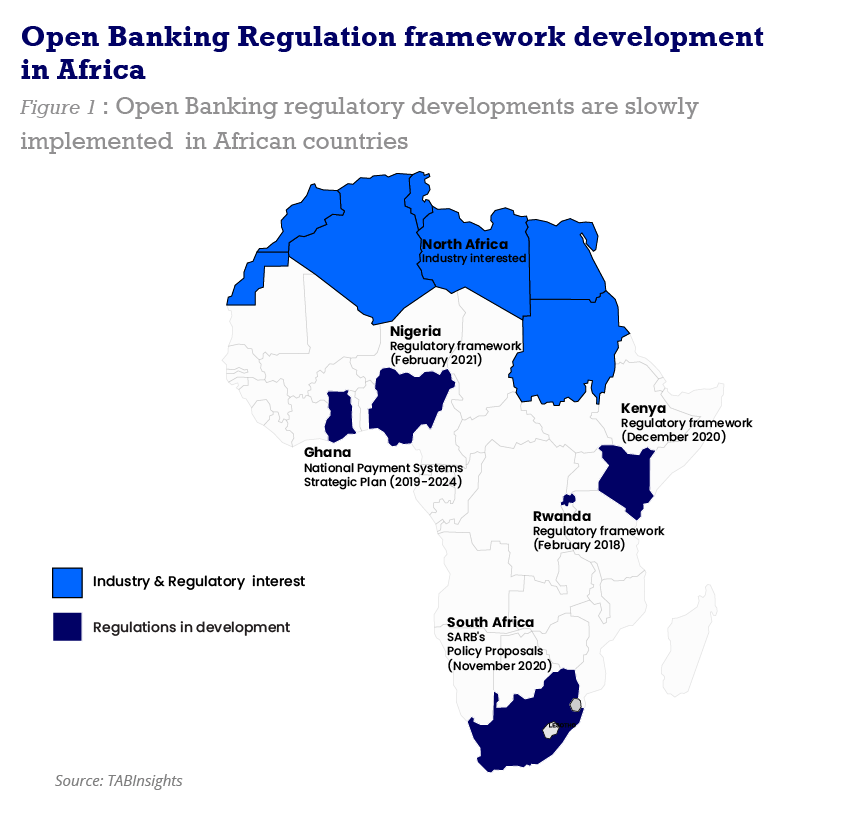

Regulators play a key role in leading the path for financial institutions (FIs) embracing open banking. There is still a lack of regulatory framework to facilitate open banking implementation and to protect customers in Africa. Currently, only few countries, such as Kenya, Nigeria, and South Africa have the data privacy and protection law.

Regulation framework is needed to develop open banking

The Central Bank of Kenya shares its plans to implement open banking, a value espoused in the National Payments System Vision 2025. The regulator has provided guidelines for a seamless experience by operating open banking platforms.

The Central Bank of Nigeria provided guidelines for fintech and FIs on exchanging digital financial data of customers. They emphasised the importance of consumer consent during the data exchange and companies are urged to comply with Nigeria’s data protection regulations.

Setting the groundwork to embrace open banking in Africa

South Africa is one of the pioneers of open banking. In 2019, two banks shared their plans to embrace open banking. Nedbank launched an API marketplace aligned with open banking standards. Its platform has opened the door for third parties to partner with the bank to provide digital solutions. The bank enables clients to give permission to share data with key players they choose.

On the other hand, Investec collaborated with fintech player, Bud to assist in developing an open banking platform.

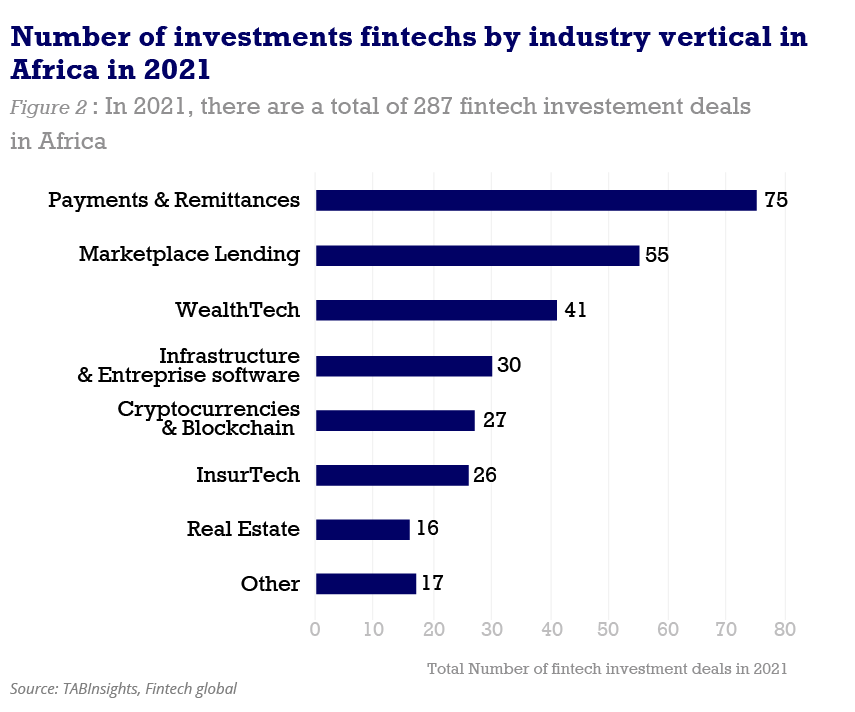

Africa represents a prime ground for open banking projects. In recent years, the region has witnessed a rise in investments driven by fintech players that continue to expand their offerings. Collaborations between fintech players and FIs are expected to deepen in the future to address the low access to financial services.

The COVID-19 pandemic also contributed to the growth of digital adoption in many African countries. Key African countries, such as Benin, Cameroon, the Republic of Congo, Gabon, Ghana, Malawi, Togo, and Zambia saw significant growth in mobile money accounts.

According to World Bank, mobile money adoption increased significantly between 2017 and 2020, from 277 accounts to 645 per 1,000 adults over 30 FIs, including banks, microfinance institutions (MFIs), and e-money institutions.

Despite the fintech boom in Africa in recent years, the continent still has the lowest number of internet connections with only 22%. In addition, the majority of the population still relies on cash. This reality created limitations to fintechs, which pushed them to utilise pre-existing infrastructure, such as physical shops and build their agent networks. A good example is South Africa’s digital bank, Tyme Bank, which allowed customers to open their accounts in its kiosk network across the country.

Open banking has the potential to transform and scale financial services

Open banking involves sharing of customer banking data through APIs with different parties, and as a result, security poised as another challenge. Customers and FIs are exposed to cyberattacks.

The African banking system is considered vulnerable to cyberattacks and many countries are still lacking in expertise and lagging in technology investments to protect customers from fraud.

With the potential growth in the fintech sector, it is expected to have structural improvements, supported by improved policies, technology investments and collaboration between FIs and fintech players. The adoption of open banking will unleash the high potential for financial services in Africa. It will give access to a wider range of products with low costs to customers, including the underbanked customers.